Where to Find Lowe’s Receipt Templates

Need a Lowe’s receipt template? The best approach is to generate an official receipt through Lowe’s online order history. If that’s not an option, various tools can help you create a professional-looking receipt.

- Lowe’s Online Account: Log in, access past purchases, and reprint receipts.

- Email Confirmations: If the purchase was online, check your inbox for a digital copy.

- Receipt Generators: Websites like Invoice Home and ExpressExpense offer editable templates.

- Spreadsheet Software: Google Sheets and Excel have free invoice and receipt templates.

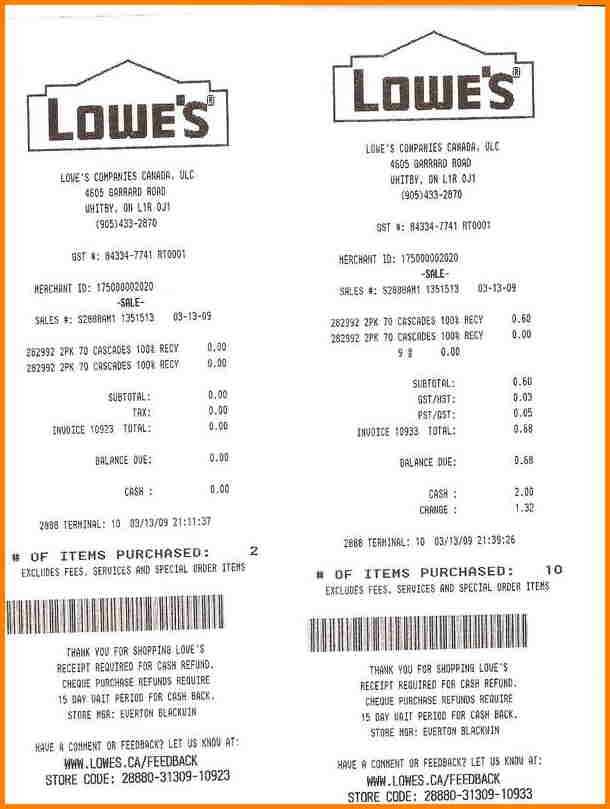

Key Elements of a Lowe’s-Style Receipt

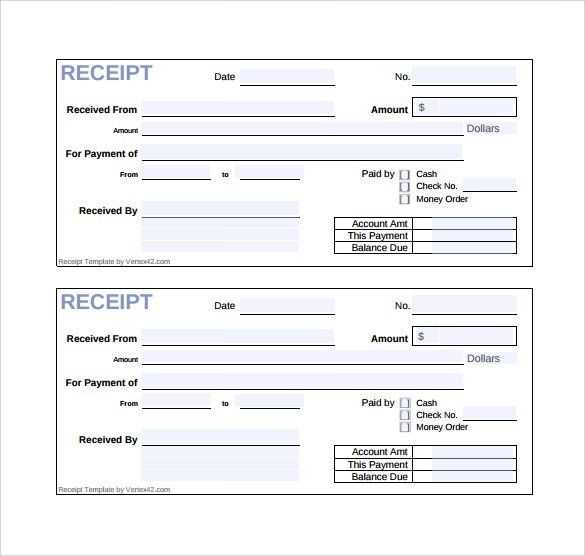

A Lowe’s receipt follows a standard format. To ensure accuracy, include:

- Store Details: Name, address, and phone number.

- Receipt Number: A unique identifier.

- Date & Time: When the purchase was made.

- Itemized List: Product names, SKUs, prices, and quantities.

- Subtotal, Tax, and Total: Clear breakdown of costs.

- Payment Method: Cash, credit, or gift card.

Customizing a Lowe’s Receipt Template

Using a blank template? Adjust details to match Lowe’s format. Ensure fonts, layout, and spacing resemble a genuine receipt. Tools like Photoshop or Canva can refine the design.

Legal and Ethical Considerations

Receipts should reflect actual purchases. Using fake receipts for returns or reimbursements may lead to legal consequences. Always keep original copies for reference.

Whether you need a duplicate for records or a simple invoice, a well-formatted receipt saves time and ensures accuracy.

Receipt Templates for Lowe’s: A Practical Guide

To create an accurate Lowe’s receipt template, ensure it includes essential details such as the store’s name, address, transaction date, itemized purchases, subtotal, taxes, total amount, and payment method. Including a barcode or transaction ID enhances authenticity and simplifies record-keeping.

For official Lowe’s receipts, retrieve them through the Lowe’s online portal or request a copy from customer service using the original payment details. Business purchases linked to a Lowe’s Pro account provide access to digital receipts for easy tracking.

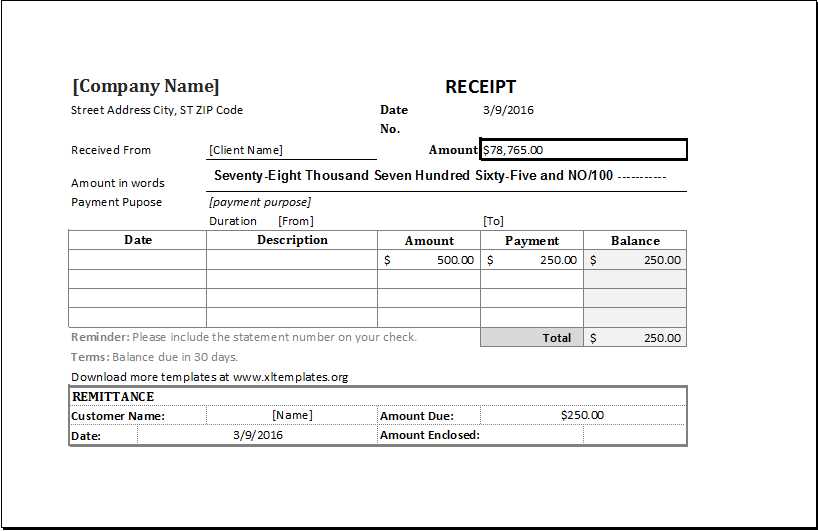

When designing a custom receipt, use Excel for editable spreadsheets, PDFs for fixed layouts, or Word templates for easy modifications. Each format suits different needs–Excel for calculations, PDF for standardization, and Word for flexibility.

To verify a receipt’s authenticity, compare it with an original Lowe’s receipt, checking font style, transaction structure, and barcode format. Altered or missing details, such as incorrect tax calculations or non-standard fonts, may indicate forgery.

Avoid errors like incorrect tax rates, missing store details, or formatting inconsistencies. Ensure the receipt reflects real transactions, and double-check calculations to prevent discrepancies.