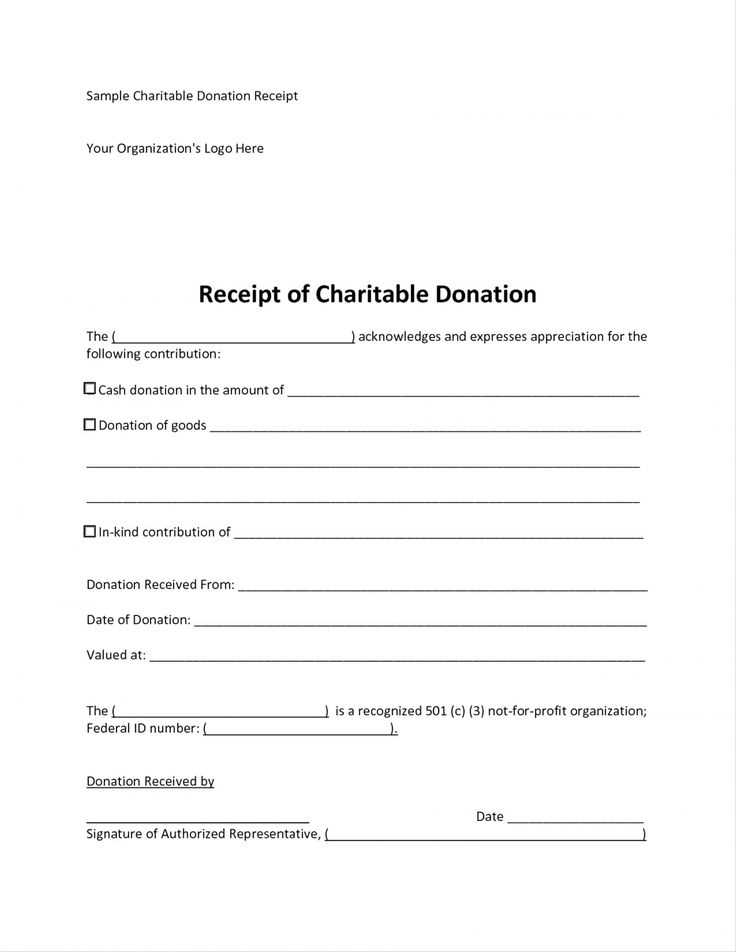

A well-structured not-for-profit receipt template is crucial for ensuring transparency and compliance with tax regulations. To create a professional and legally compliant document, include key elements such as the donor’s information, a description of the donation, and a statement clarifying whether any goods or services were provided in exchange.

Donor Information: Capture the full name and address of the donor. This helps both the organization and the donor maintain accurate records for tax and accounting purposes.

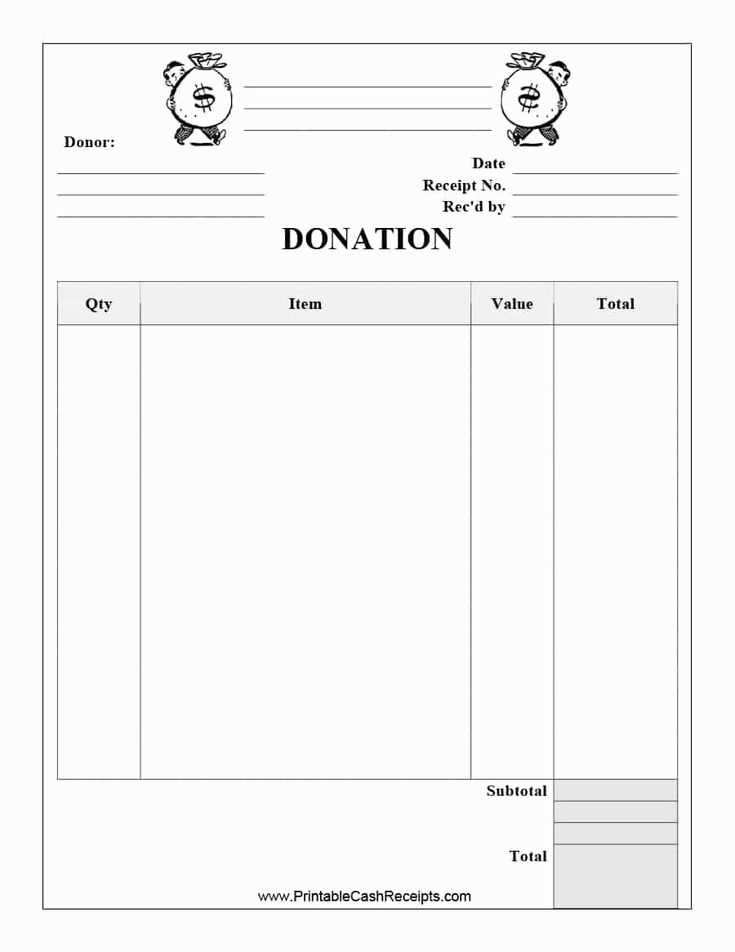

Donation Description: Clearly describe the nature of the donation, whether it’s a monetary contribution, goods, or services. For physical items, include a brief description but avoid assigning a specific value unless required by your organization’s policy.

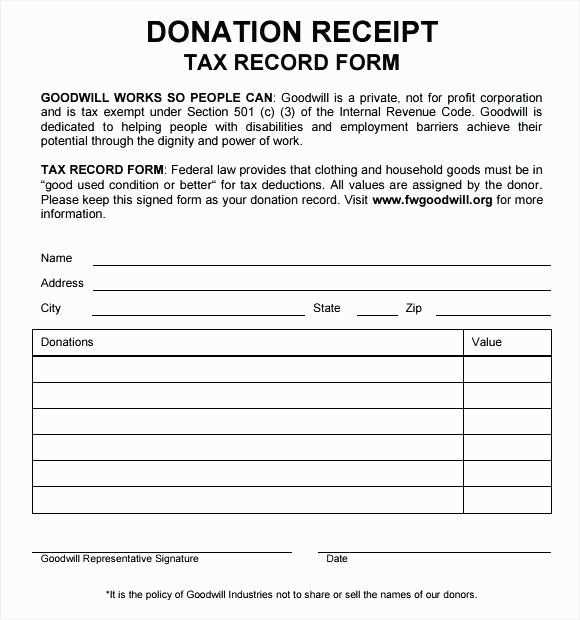

Tax Statement: Include a specific statement indicating whether the donor received any goods or services in return for their contribution. If none were provided, mention that the donation qualifies as a fully tax-deductible gift. In cases where services or goods were provided, specify their fair market value.

Standardizing your receipt template ensures consistency and simplifies your administrative processes. Regularly reviewing and updating the template based on legal guidelines can save time and enhance trust with your donors.

Here’s an optimized version of the text with redundant repetitions removed:

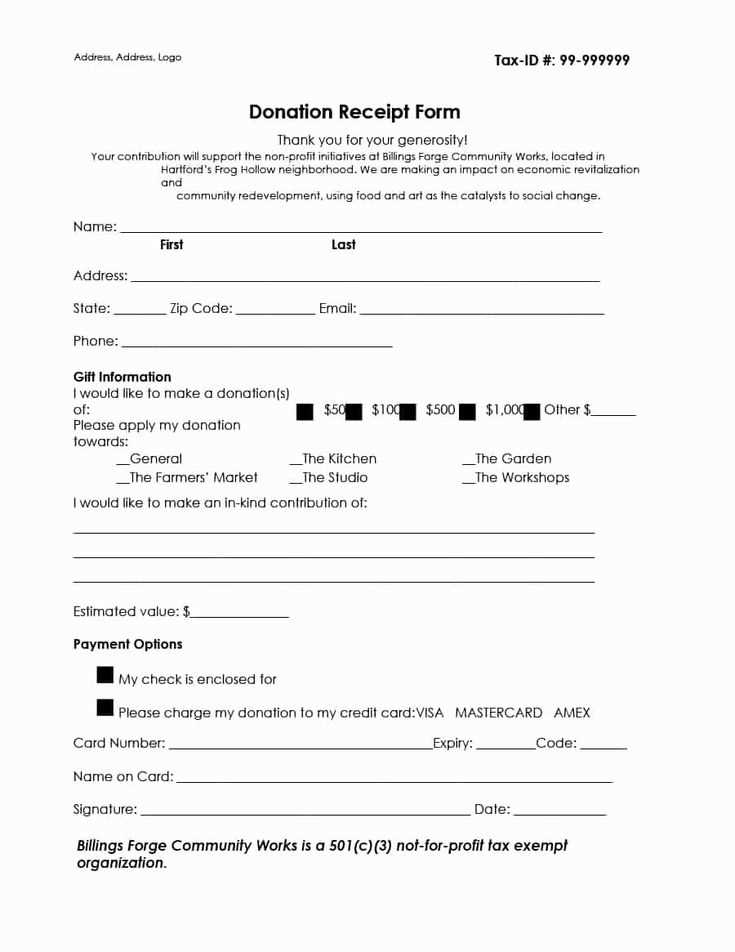

To create a clear and professional not-for-profit receipt template, ensure it contains essential elements such as the organization’s name, address, and registration number. Include the donor’s name, contribution amount, and the donation date. Specify whether the contribution is monetary or in-kind and provide a brief description for non-monetary gifts.

Key Compliance Notes

Always state whether any goods or services were provided in exchange for the donation. If none, use clear wording such as “No goods or services were provided in return for this donation.” This detail is often required by tax authorities to maintain compliance.

To enhance donor experience, include a heartfelt note of appreciation. A well-crafted message strengthens donor relationships and encourages future contributions.

- Not for Profit Receipt Template Guide

A well-structured not-for-profit receipt template should include all essential details to ensure transparency and compliance with tax regulations. Below is a simple and actionable guide to help you create an effective receipt.

Key Elements to Include

- Organization Details: Include the name, address, and contact information of the not-for-profit organization.

- Donor Information: Capture the donor’s full name and address to ensure accurate record-keeping.

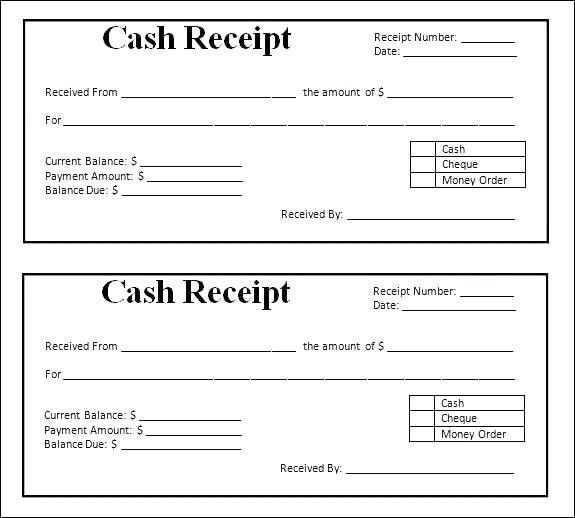

- Date of Donation: Specify the date when the donation was received to provide clear transaction details.

- Donation Amount: Clearly state the amount received or the fair market value of any in-kind contributions.

- Description of Donation: If the donation is non-monetary, provide a detailed description.

- Statement of No Goods or Services: Indicate whether any goods or services were provided in exchange for the donation. If not, include a statement such as, “No goods or services were provided in exchange for this contribution.”

- Tax Deductibility Disclaimer: Add a note that the donation may be tax-deductible to the extent permitted by law.

- Signature (Optional): Include a signature line for the authorized representative of the organization.

Formatting Tips

- Use a clear and professional layout to make the receipt easy to read.

- Consider including a receipt number for better tracking.

- Ensure all text is legible and formatted consistently.

Following these recommendations will help your organization issue compliant and professional donation receipts, strengthening donor trust and ensuring accurate record-keeping.

Ensure your nonprofit receipt contains the following essential elements to maintain transparency and meet tax requirements:

1. Donor Information

- Full name of the donor

- Mailing address (optional but recommended)

2. Nonprofit Details

- Organization’s full legal name

- Tax identification number (TIN/EIN)

- Contact information for any queries

3. Contribution Details

- Donation amount (if monetary)

- Description of non-cash contributions, if applicable

- Clear statement that the donor received no goods or services, or a description of any benefits provided with their estimated value

4. Receipt Date

- The date when the donation was received

- If different, the date when the receipt was issued

5. Statement for Tax Purposes

Include this essential phrase: “No goods or services were provided in exchange for this donation.” This ensures compliance with tax regulations.

Include the full legal name and address of the non-profit organization issuing the receipt. This ensures clarity for both donors and tax authorities.

Clearly state the date when the donation was received. Tax authorities require this information to verify the donation period.

Provide the donor’s full name and address, as this is essential for tax documentation and accurate record-keeping.

Specify the amount donated. If the contribution was non-monetary, describe the item and provide its fair market value.

Include a statement confirming whether the donor received any goods or services in exchange for the donation. If so, list the value of these goods or services separately.

Add a declaration indicating the organization’s tax-exempt status, referencing the relevant legal provisions (such as Section 501(c)(3) for U.S.-based non-profits).

Ensure the receipt is signed by an authorized representative of the organization to validate its authenticity.

Nonprofit organizations must comply with specific legal requirements regarding donation receipts, which vary by jurisdiction. Below is a summary of the key requirements in major regions:

| Jurisdiction | Required Information | Minimum Donation for Receipts | Tax-Exempt Status Acknowledgment |

|---|---|---|---|

| United States (IRS) | Donor’s name, donation amount, organization’s name, tax-exempt status, date of donation | Donations over $250 must include a written acknowledgment | Required for all donations over $250 |

| Canada (CRA) | Donor’s name, amount donated, organization’s name, tax-exempt status, receipt number | Receipts are mandatory for all donations regardless of amount | Required for tax purposes on all donations |

| United Kingdom (HMRC) | Donor’s name, amount donated, organization’s name, charity number, date of donation | Receipts not required for donations under £10, but recommended | Required for all donations over £10 |

| Australia (ATO) | Donor’s name, amount donated, organization’s ABN, date of donation | Receipts required for donations over $2 | Tax acknowledgment required for donations over $2 |

In most jurisdictions, nonprofits are expected to provide a formal receipt for any donations over a certain amount. The receipt must include specific details to ensure it serves as proof of donation for tax purposes. These details typically include the donor’s name, the donation amount, and the nonprofit’s tax-exempt status. In many regions, organizations are also required to provide a receipt number or unique identifier to prevent fraud and maintain records.

Ensure compliance with local laws to avoid penalties and to offer donors the proper documentation for tax deductions. Each jurisdiction may have additional stipulations depending on the nature of the donation or the nonprofit’s activities, so it’s important to stay updated on local regulations.

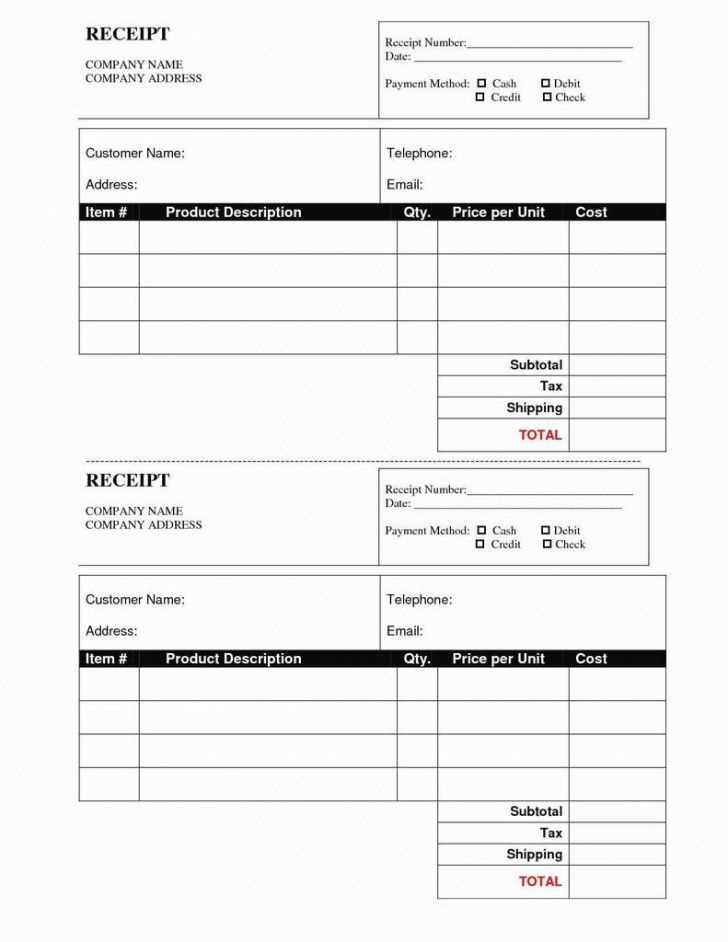

Use a clear and consistent layout. Make sure to organize the receipt in a way that guides the reader’s eye naturally. Group related information like transaction details, payment methods, and contact info. Keep the fonts simple and legible–avoid fancy styles that can make the text hard to read.

Highlight key information. Key details such as the amount, date, and receipt number should stand out. Use bold text or larger font sizes for these critical elements. This makes it easier for recipients to locate important information at a glance.

Include necessary legal information. Depending on the jurisdiction, receipts may require specific wording or disclaimers, such as tax identification numbers or refund policies. Ensure this information is included in a way that doesn’t clutter the receipt but remains easy to find.

Align the text properly. Proper alignment enhances readability. For example, right-align the amount to keep financial figures consistent. Align dates and names to the left or center as needed for a uniform, professional look.

Provide clear item descriptions. For product or service receipts, provide clear, concise descriptions of each item. Avoid abbreviations unless they are commonly understood, and make sure quantity, price, and total are easy to distinguish.

Ensure legible contact information. Your contact information, including your name, address, and phone number, should be easy to read but not overpower the receipt. Place this information at the top or bottom for easy access.

Include a thank-you note. A simple, polite note expressing gratitude to the recipient can enhance the professional image of your receipt. This small touch adds a human element without overwhelming the design.

Begin by selecting a software tool that suits your needs. Whether it’s a word processor, spreadsheet software, or specialized receipt template builder, ensure it provides customization options.

1. Define the Information

Determine what information will appear on the receipt. At a minimum, include the following:

- Business name and contact details

- Date and time of transaction

- Itemized list of goods or services

- Total amount paid

- Payment method

2. Customize the Layout

Use a grid or table to structure the information clearly. Organize items in rows and separate sections with lines or spaces to enhance readability. Ensure that the total stands out by increasing the font size or using bold text.

3. Add Branding Elements

Incorporate your logo and brand colors to make the receipt look professional. This adds a personal touch and ensures the receipt aligns with your business identity.

4. Use Dynamic Fields

If possible, use dynamic fields for information such as date, transaction ID, or customer name. This will allow for automatic updates, reducing manual input errors.

5. Review and Save

Double-check the template for any missing or incorrect details. Save the receipt template in an editable format to make future changes easier.

By following these steps, you can create a receipt template that’s both functional and professional, tailored to the specific needs of your business or nonprofit organization.

Ensure the receipt includes the correct donation amount. Many nonprofit organizations mistakenly issue receipts without clearly indicating the exact value of the contribution, especially when donations involve non-cash items. Always state the value or an estimate of the donation provided.

Do not forget the date of the donation. A receipt without the donation date is incomplete and can cause confusion for both the donor and the organization. Make it a standard practice to include the exact date the contribution was made.

Failing to specify the tax-exempt status of your organization can lead to issues when donors try to claim deductions. Always include a clear statement of your nonprofit’s tax-exempt status, typically under section 501(c)(3) of the IRS code, if applicable.

Avoid vague descriptions. Providing unclear or generic descriptions of the donation, especially for in-kind contributions, can make it difficult for donors to substantiate their claims. Be specific about the items received, including quantity and condition, if relevant.

Do not overlook donor information. Missing details such as the donor’s name and address can create issues during tax filing. Always ensure that the donor’s full name and address are accurately included on the receipt.

Double-check that you haven’t left out any required legal disclaimers. Some regions have specific laws about what must be included in nonprofit receipts, such as language about goods and services provided in exchange for a donation or limits on deductions for certain types of donations. Be familiar with your local legal requirements.

Last, make sure the receipt is legible and well-organized. A poorly formatted receipt can confuse donors and might even lead to audit issues. Organize the information clearly, and ensure that it is easy to read for both the donor and tax authorities.

When creating a receipt template for a non-profit organization, clarity is key. Start by including the organization’s name, address, and contact information at the top. Make sure to clearly label the document as a receipt and specify the donation type (e.g., cash, check, or goods). Include the date and the amount received. It’s also helpful to add a brief description of the donated items, if applicable. Include a section for the donor’s information–name, address, and contact details. Finish by providing a statement indicating that no goods or services were provided in exchange for the donation, if that applies. This ensures compliance with tax laws for both the donor and the organization.

Additionally, ensure that each receipt is numbered for reference and tracking purposes. This can be useful for both your records and for any donor queries. Including the tax-exempt status number of the organization can also enhance transparency and trust. Keep the template simple, easy to read, and free of unnecessary clutter.

For non-monetary donations, ensure that the value of the donation is either estimated by the donor or determined by the organization, but make it clear that the non-profit is not responsible for appraising the donated items. Provide space for signatures from both the donor and a representative of the organization. This can help authenticate the receipt.