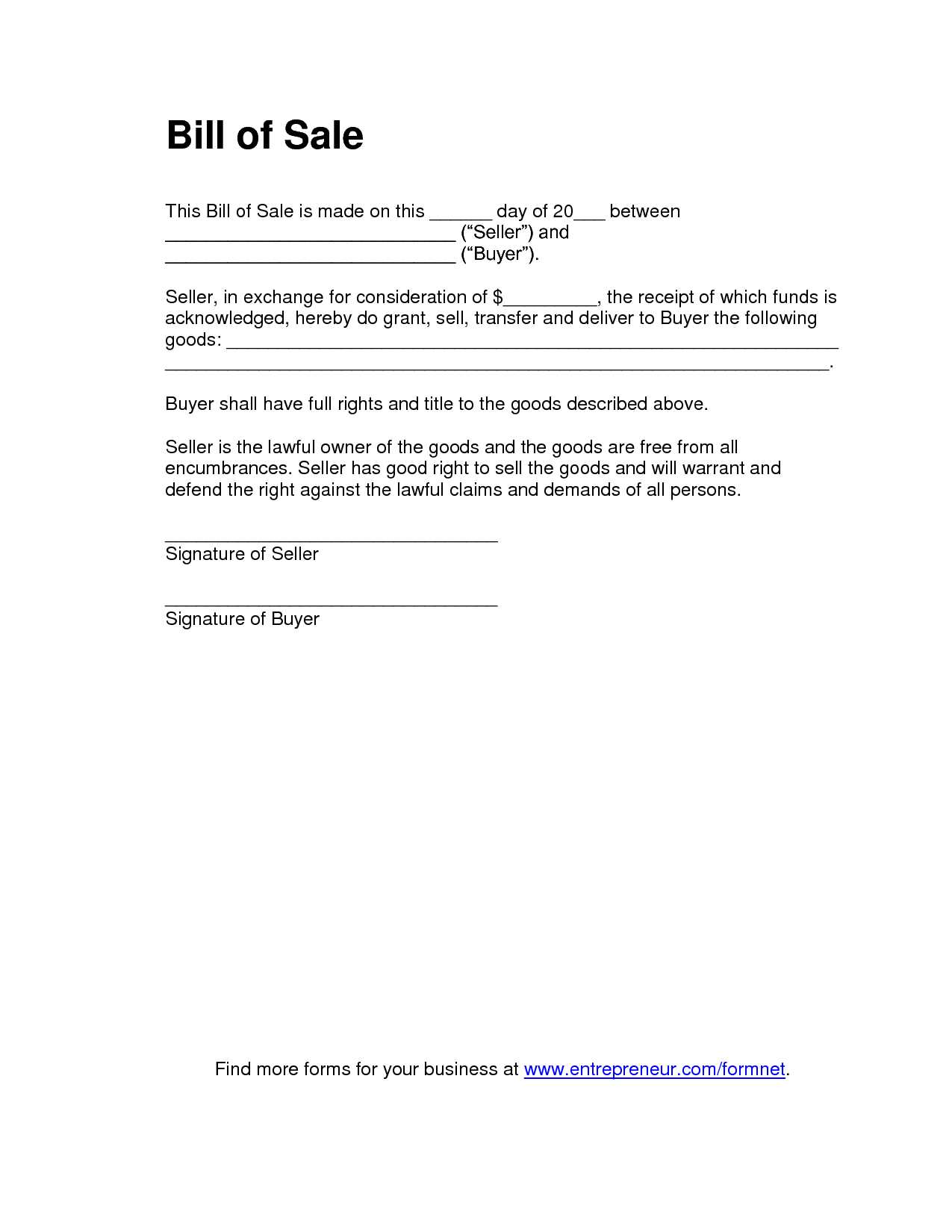

Include a clear statement of cancellation when drafting a bill of sale receipt. This ensures that both parties are aware of the transaction’s termination, preventing any future confusion. If you need to cancel a sale, explicitly state the terms in the document to make sure both sides are in agreement about the reversal.

Use language that removes ambiguity. For example, write: “This bill of sale is hereby cancelled as of [date], and both buyer and seller acknowledge the cancellation of the transaction.” This simple, direct phrase confirms the agreement between the parties and marks the official end of the sale.

Ensure that the cancellation is signed by both parties to make the document legally binding. This step protects both buyer and seller in case of disputes, as it shows mutual consent to the cancellation.

Here’s the revised version with reduced repetition:

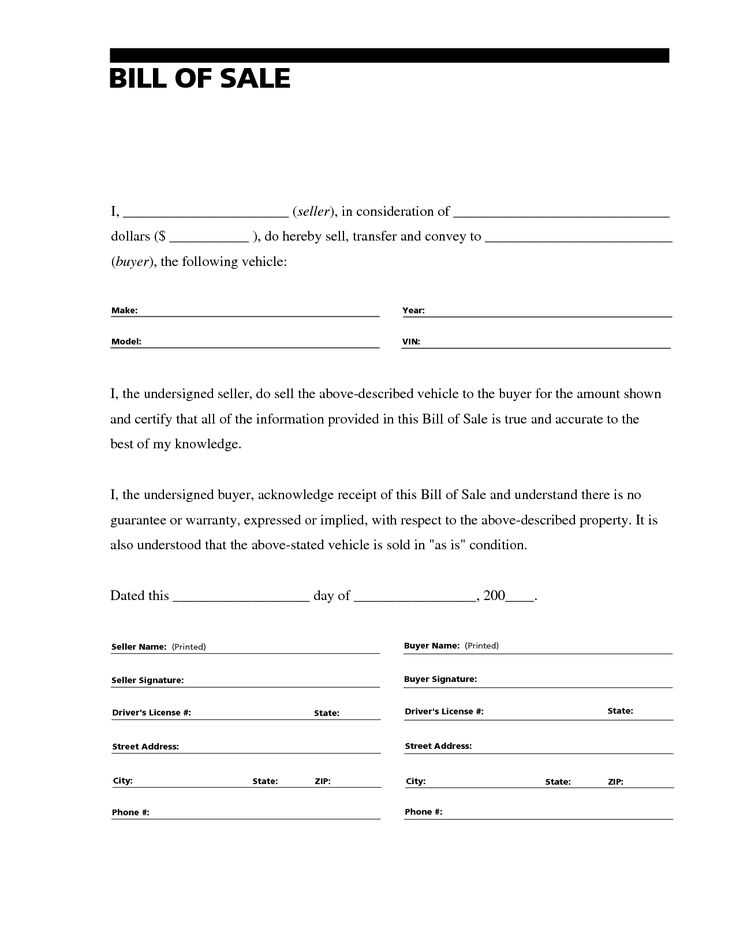

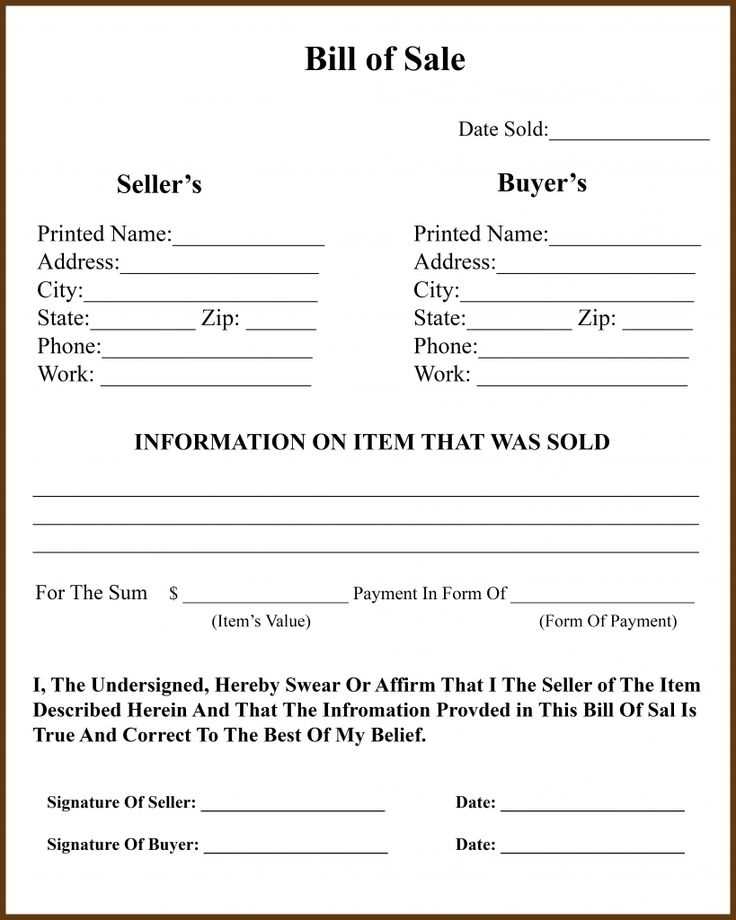

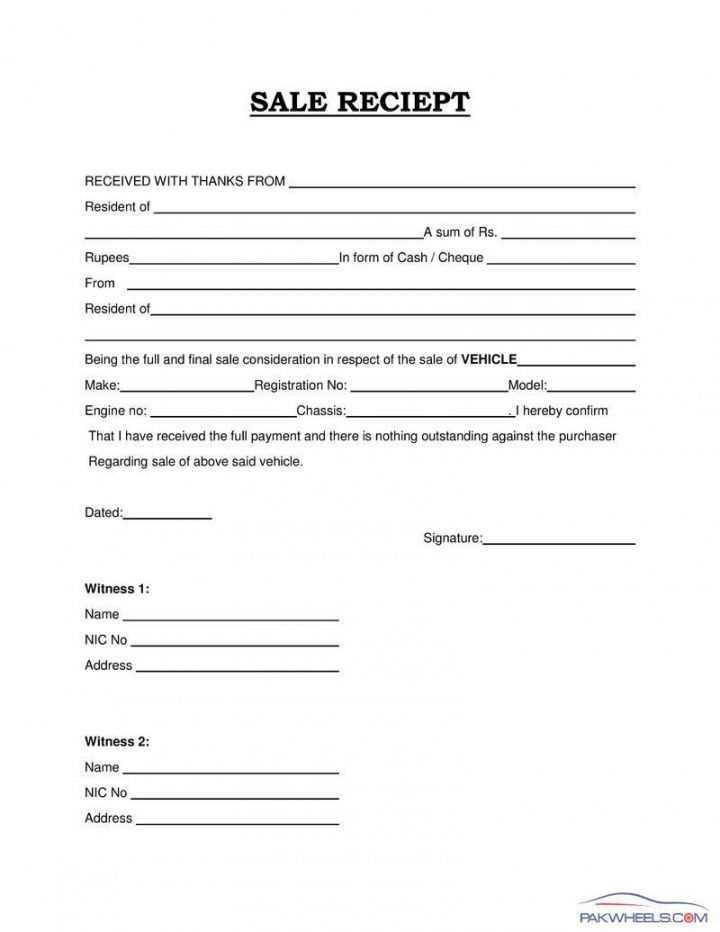

In a bill of sale receipt cancellation template, start with a clear statement that the receipt is being voided. Include the original transaction details, such as the date, amount, and parties involved. Reference the specific receipt number to avoid any confusion. Ensure both buyer and seller confirm the cancellation by including spaces for signatures.

Key Elements of a Cancellation Notice

The cancellation notice should directly state the reason for the voiding of the transaction, if applicable. Use simple language to ensure both parties understand the purpose of the document. Clearly outline any conditions, if present, under which the cancellation is being processed.

Final Steps for Agreement

Once the template is filled out, both parties should sign it, acknowledging the cancellation. It’s also advisable to provide a copy for each party’s records, ensuring transparency and avoiding future disputes.

- Cancellation for a Bill of Sale Receipt Template

If you need to cancel a bill of sale receipt, it’s important to document the cancellation clearly. Begin by drafting a cancellation notice that includes the date of cancellation, the names of the buyer and seller, and the details of the transaction being voided. Make sure to reference the original bill of sale receipt number for clarity.

Key Information to Include

Include the following in your cancellation notice:

- The original bill of sale receipt number

- The full names and contact information of both parties involved

- The description of the item or property being sold

- The original date of the sale

- A statement clearly indicating the cancellation of the transaction

- The signature of both parties to confirm the cancellation

Next Steps After Cancellation

Once the cancellation is finalized, ensure both parties receive a copy of the cancellation document. Keep a copy for your records. If any payment was made, outline the refund process and the date by which the refund will be completed. This will help avoid any confusion in the future.

Including a cancellation clause in a bill of sale receipt ensures that both parties are clear on how to handle the situation if the transaction needs to be reversed. This clause defines the conditions under which a sale can be canceled, providing a legal framework for refunds or exchanges. It helps prevent misunderstandings or disputes by specifying the exact terms of cancellation.

Why a Cancellation Clause is Necessary

- It protects both the buyer and the seller by clearly stating the grounds for cancellation.

- It establishes a clear process for returning goods or issuing refunds.

- It reduces the risk of legal complications in case of disagreements.

Key Elements of a Cancellation Clause

- Conditions under which cancellation is allowed, such as defects in the product or services not rendered as agreed.

- Time limits for requesting a cancellation, often tied to a certain period after purchase.

- Any associated fees or penalties for canceling the sale.

- Specific instructions for returning the goods, if applicable.

Begin by clearly stating the intent to cancel the bill of sale receipt. Use a heading such as “Cancellation of Bill of Sale Receipt” for clarity.

Include details of the original transaction. This includes the names of both parties, the date of the sale, and a brief description of the item or service involved.

Provide a reference to the original bill of sale receipt. This should include the receipt number or other unique identifier.

Specify the reason for cancellation. Be clear and concise about why the cancellation is necessary, such as mutual agreement or failure to meet conditions of the sale.

State that the seller and buyer both agree to cancel the receipt and nullify the transaction. This section should include a statement of mutual consent.

Include spaces for both parties’ signatures and the date of signing. This helps confirm that the cancellation is authorized by both the buyer and seller.

Ensure that the document is properly dated and filed. Keep a copy of the cancellation for future reference in case of disputes.

Include the date of cancellation, the reason for cancellation, and any relevant transaction details. Make sure the notice is clear and concise, so there is no room for misunderstanding.

Transaction Details

State the bill of sale receipt number, the date of the transaction, and the names of both the buyer and seller. This helps link the cancellation to the specific agreement and avoids confusion.

Refund or Return Process

Specify the steps for returning goods or processing a refund, if applicable. Clearly outline who is responsible for shipping costs or other fees associated with the cancellation.

| Information | Description |

|---|---|

| Receipt Number | The unique number assigned to the bill of sale receipt. |

| Transaction Date | The date when the sale took place. |

| Buyer and Seller Names | Names of both parties involved in the transaction. |

| Reason for Cancellation | State the specific reason for the cancellation. |

| Return or Refund Process | Outline how returns or refunds should be handled. |

Ensure you accurately reference the receipt number or details before cancelling it. Missing or incorrect information can lead to confusion or disputes later.

1. Not Including the Reason for Cancellation

Always provide a clear reason for cancelling the receipt. This prevents misunderstandings and serves as a record for future reference. Include specific details about why the cancellation was necessary.

2. Cancelling Without Confirmation

Don’t cancel the receipt without confirming with the involved parties. It’s important to ensure that both the buyer and seller are informed and agree with the action to avoid conflicts.

3. Forgetting to Update Financial Records

Updating financial or transaction records is vital after cancellation. Failure to reflect the cancellation in your records can cause discrepancies in your accounting system.

4. Overlooking the Deadline for Cancellation

Check for any specific timeframes when a receipt can be cancelled. Cancelling a receipt after a set period may not be allowed or could lead to complications.

5. Not Keeping a Copy of the Cancellation

Always keep a copy of the cancelled receipt for your records. This document is crucial in case of future inquiries or disputes related to the transaction.

To cancel a bill of sale, both parties must agree to void the transaction, usually through a written agreement. This ensures that the legal transfer of ownership is reversed, and the asset is returned to the seller. Without mutual consent, the buyer may face difficulty reclaiming payments or assets.

The cancellation must be properly documented to avoid future disputes. A signed agreement or amendment to the original bill of sale should clearly state that the transaction is nullified, including the return of goods and refund of money, if applicable.

Failure to document the cancellation correctly can result in the buyer or seller being bound to the original terms of the sale. It may also lead to potential legal challenges, especially if either party claims the cancellation was not authorized.

Depending on jurisdiction, there may be specific forms or procedures required to complete the cancellation. Consulting with a legal expert is recommended to ensure compliance with local laws and avoid complications down the line.

If you suspect that the bill of sale receipt may be invalid or fraudulent, seek legal advice immediately. A legal expert can guide you through the process of assessing whether cancellation is warranted and provide steps to protect your rights.

Complex Transaction Disputes

If the receipt cancellation involves a dispute over the terms or conditions of the sale, consult a lawyer. Complex issues such as misrepresentation, contract breaches, or unclear terms can require professional legal intervention to resolve appropriately.

Uncertainty About Legal Rights

If you’re unsure about the consequences of canceling a bill of sale receipt, it’s wise to consult a lawyer. They can explain the legal implications and advise you on how to proceed without risking future legal complications.

Cancellation for a Bill of Sale Receipt Template

To cancel a bill of sale receipt, clearly state the cancellation in writing. A concise statement, such as “This bill of sale is void,” must be included, followed by both parties’ signatures and the date. This ensures there is a formal record of the cancellation.

Steps to Follow

1. Locate the original bill of sale receipt.

2. Add a section at the top stating the cancellation clearly, e.g., “This receipt is canceled as of [date].”

3. Include the signatures of both parties and date the cancellation.

4. Keep a copy of the canceled receipt for your records.

Additional Information

For added clarity, include a brief explanation of the reason for cancellation, if necessary. It is also important to ensure that both parties agree to the cancellation and are aware of any associated consequences or refunds.