Key Components of a Donation Receipt

A donation receipt should include the following elements to be valid and useful for both the donor and the organization:

- Organization Information: Name, address, and tax-exempt status of the charity.

- Donor Details: Name and address of the donor.

- Donation Description: A brief description of the items donated or the amount given, including any specific restrictions.

- Date of Donation: The date when the donation was made.

- Amount Donated: For monetary donations, the amount should be listed clearly. For non-monetary items, provide an approximate value.

- Statement of Goods or Services: If any goods or services were provided in exchange for the donation, mention the value.

- Tax-Exempt Status: Include a statement that the organization is a 501(c)(3) tax-exempt entity, or the equivalent in your country, and no goods or services were provided in exchange for the donation (if applicable).

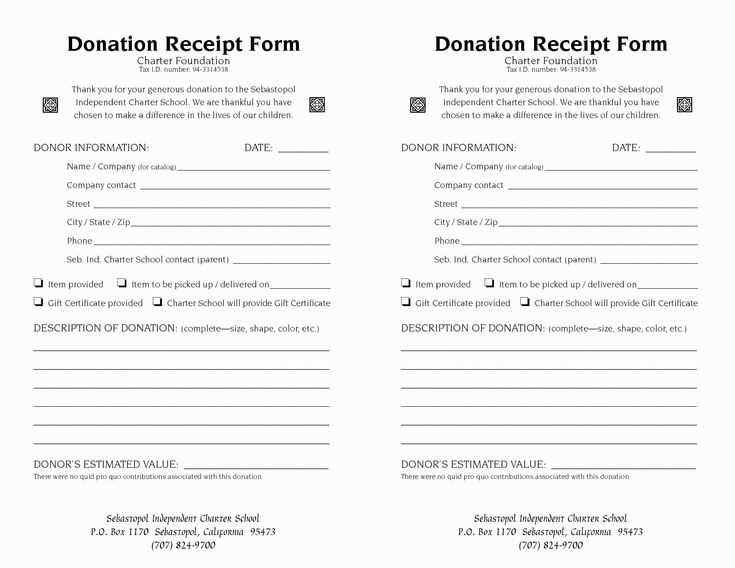

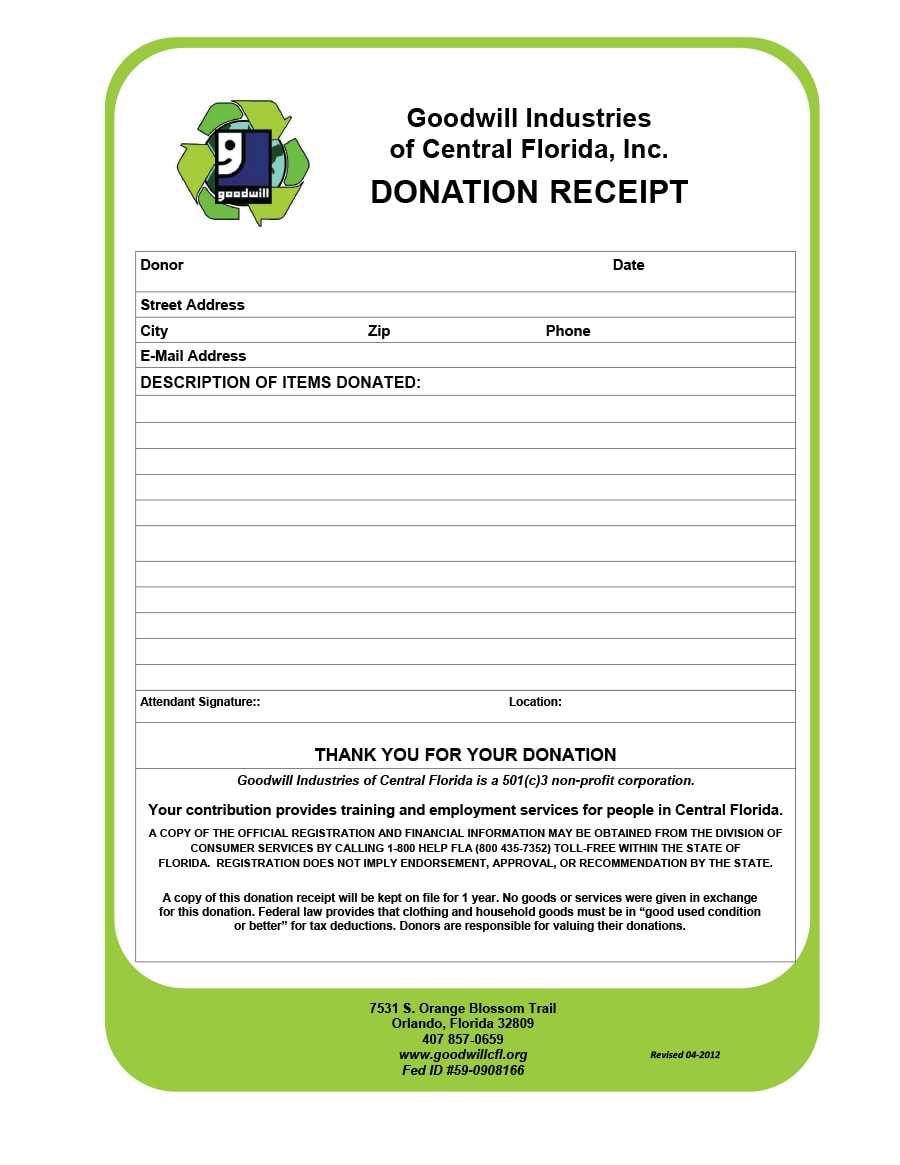

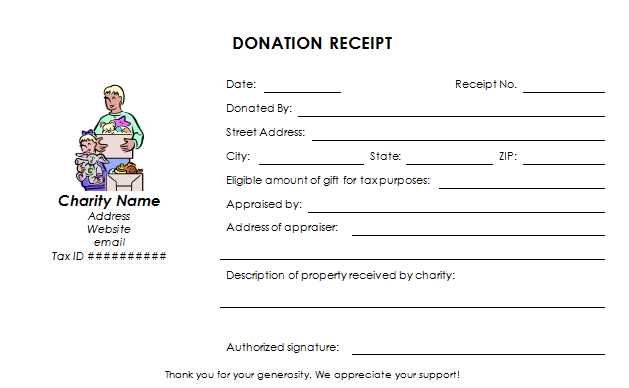

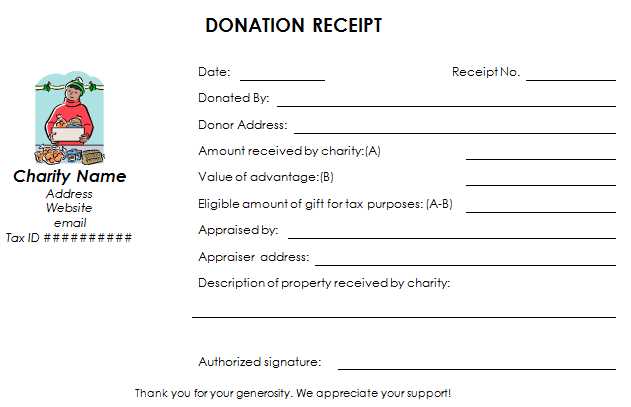

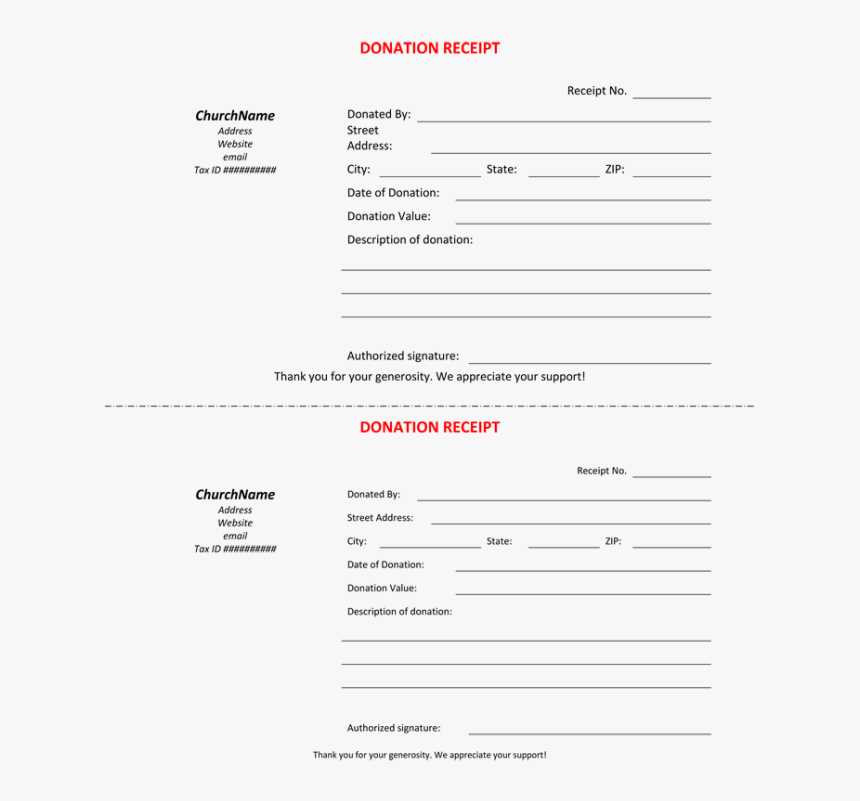

Sample Template

This simple template can be used for documenting charitable donations:

Donation Receipt Organization Name: [Charity Name] Organization Address: [Charity Address] Tax-Exempt Status: 501(c)(3) [or equivalent] Donor Name: [Donor Name] Donor Address: [Donor Address] Donation Description: [Description of Donated Item(s) or Monetary Amount] Donation Date: [Date of Donation] Amount Donated: $[Amount] or [Item Description] (Value: $[Estimated Value]) No goods or services were provided in exchange for this donation. Thank you for your generous support! Signature of Authorized Person: _____________________ Date: [Date]

Why It Matters

Providing clear and detailed receipts helps maintain accurate records for both the charity and the donor. It ensures the donor has the necessary information for tax purposes and allows the charity to comply with legal requirements for reporting charitable donations. Regularly updating the receipt format is key to maintaining transparency and trust in your organization.

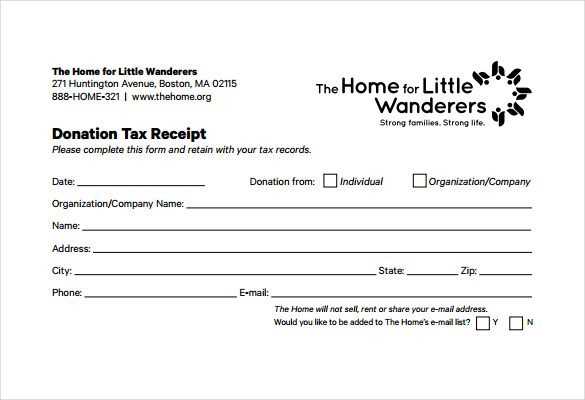

Non-profit Charitable Donation Receipt Template

Key Elements to Include in a Donation Receipt

How to Format Date and Contribution Details Properly

Legal Obligations for Charitable Donations Documentation

Customizing the Template for Various Donation Types

How to Provide Donors with Tax Information on Receipts

Best Practices for Storing and Distributing Receipts

Ensure the donation receipt includes the following key elements: name and contact information of the organization, donor’s details, description of the donation (cash, goods, or services), and the date of the donation. For non-cash contributions, provide a brief description of the item(s) donated. Always include a statement confirming whether any goods or services were provided in exchange for the donation, and, if so, their value.

Format the date clearly to prevent any confusion. It should follow the standard format (MM/DD/YYYY) to ensure consistency. For contributions, clearly state the amount or item value along with the donation type. When a donor makes a contribution of goods or services, a detailed list or description is essential for accuracy in tax filings.

Non-profit organizations are legally obligated to provide receipts for donations, especially for tax purposes. The IRS requires that all cash donations over $250 be acknowledged with a receipt, including the amount and a statement regarding any goods or services received in return. Ensure the receipt meets the necessary documentation requirements for tax deductions.

Customize the template depending on the type of donation. For cash donations, simply list the amount donated. For in-kind donations, include a description of the goods and their estimated market value. If donations are related to an event or program, clarify how the contribution aligns with the organization’s mission.

Donors often rely on receipts for tax purposes. Make sure to include a statement indicating that the organization is tax-exempt under the applicable IRS section, and confirm the donor did not receive any goods or services in exchange for their donation, if that’s the case. If a donor receives goods or services, include a breakdown of their value to ensure the donor is aware of the non-deductible portion.

Store receipts in a secure digital or physical format for easy retrieval. Use a numbering system for receipts to maintain consistency and ensure proper record-keeping. Distribute receipts promptly after donations are made. You can either mail them to the donor or provide them electronically, but ensure they are received in a timely manner to help donors claim their deductions for the relevant tax year.