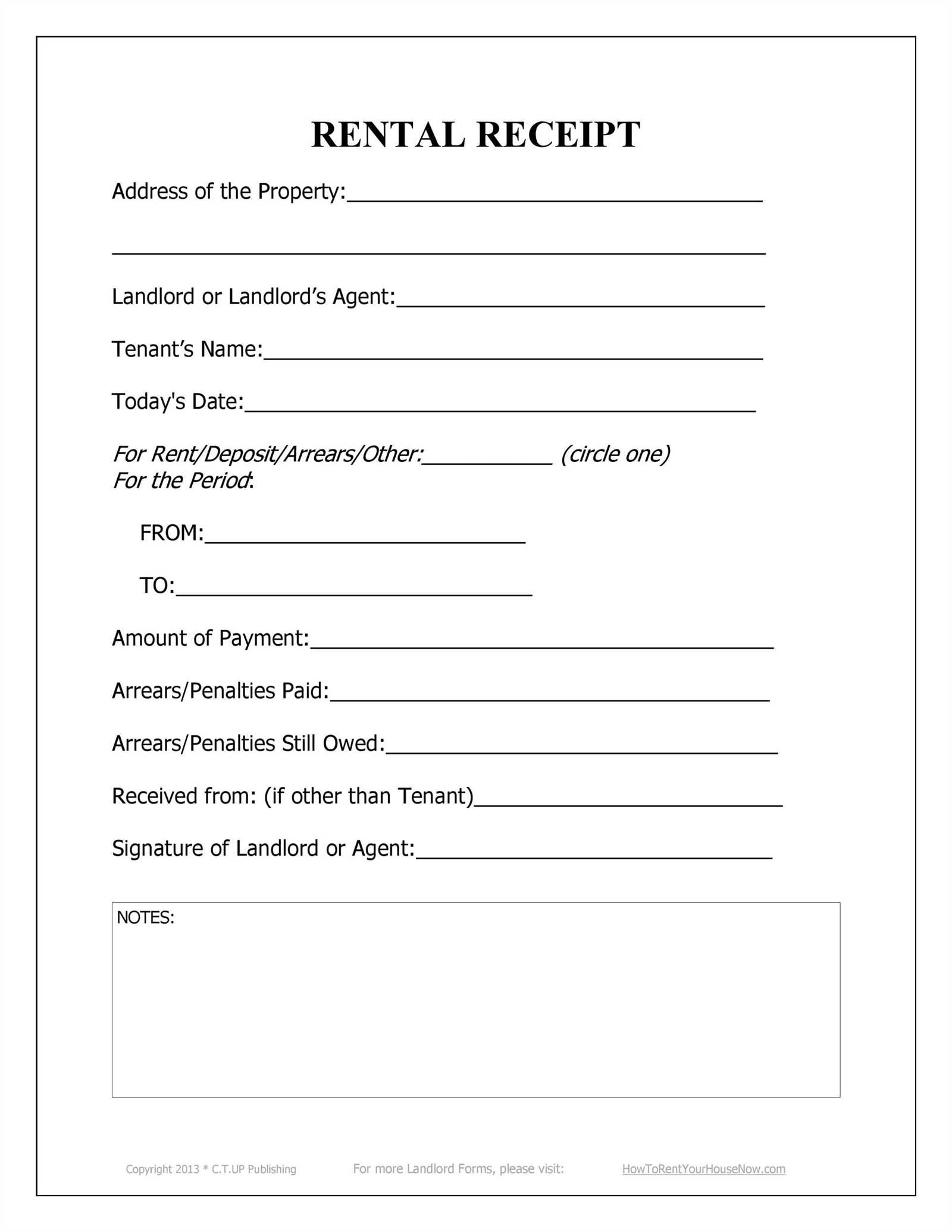

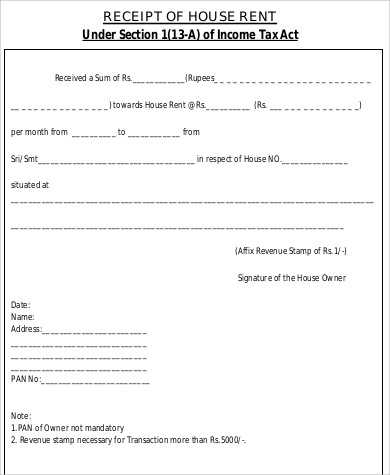

If you’re renting out property, providing a receipt for rent payments is a straightforward way to document financial transactions and keep records clear. A rental income receipt serves as proof of payment and protects both parties involved. It’s important to ensure the receipt includes key details, such as the tenant’s name, rental period, payment amount, and the date received.

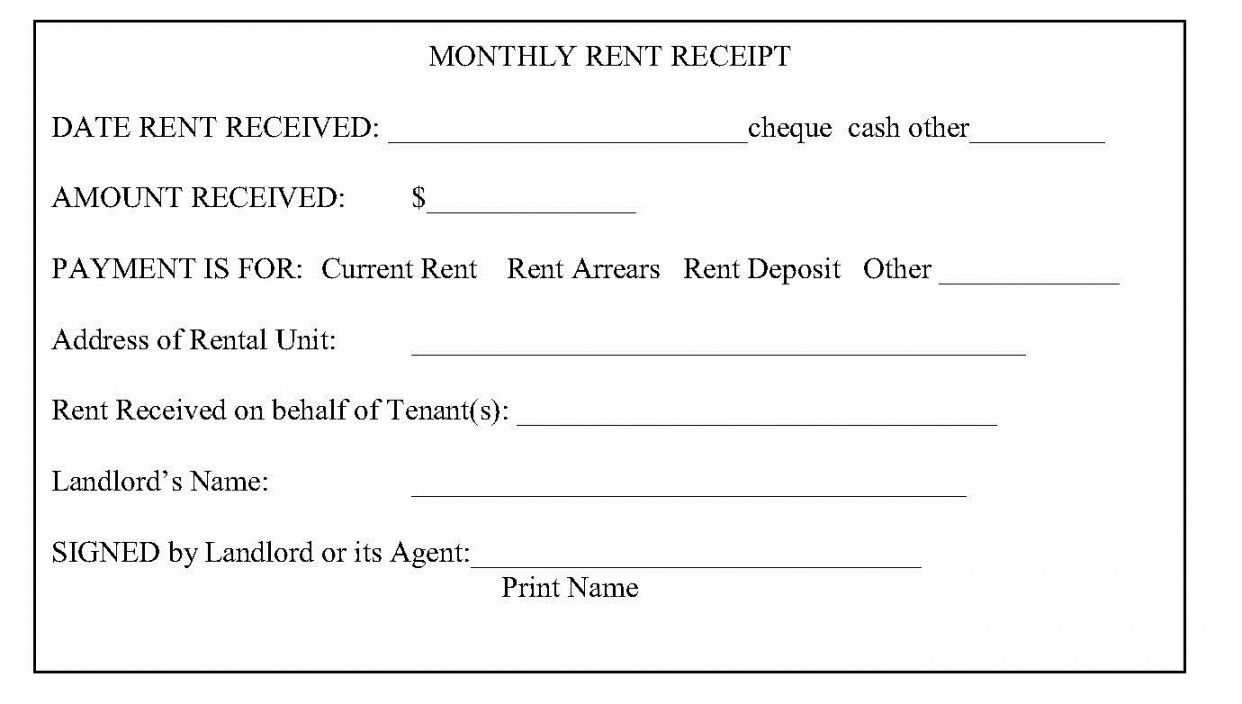

Use a clear and concise format to avoid confusion. A basic rental income receipt should include the tenant’s full name, the amount of rent paid, and the date of payment. You should also include the payment method (e.g., cash, check, or bank transfer) for reference. Adding your name or the name of your property management company and the property address is also a good practice.

For simplicity, create a template that can be reused each month. This way, you won’t miss any important details, and the process will be quick. If you’re handling multiple properties, having a separate template for each one will keep things organized. Consider including a note or disclaimer that the receipt is only valid upon full payment to avoid any disputes later.

Here’s the corrected version:

To create a rental income receipt, follow this clear structure for accuracy and professionalism. It’s important to include all the necessary details in a straightforward format.

Required Information

Each receipt should contain the following elements:

| Element | Description |

|---|---|

| Tenant Name | Include the full name of the tenant who is paying the rent. |

| Property Address | Clearly list the address of the rental property. |

| Payment Amount | State the amount of rent paid for the specified period. |

| Payment Date | Provide the exact date the payment was received. |

| Payment Method | Indicate whether the payment was made by cash, check, bank transfer, or other methods. |

| Landlord’s Details | Include the full name and contact information of the landlord or property manager. |

How to Format the Receipt

Ensure your receipt is clear and easy to understand. Use bold text for key sections like “Tenant Name,” “Payment Amount,” and “Payment Date” to make them stand out. A well-organized receipt helps avoid confusion and provides a solid record for both parties.

By following this template, you can easily create a professional rental income receipt that serves both as a record for the tenant and as proof for the landlord.

- Rental Income Receipt Template

A rental income receipt template should include key details to ensure clarity and transparency. Here’s what to include:

| Item | Description |

|---|---|

| Date of Payment | The exact date the payment was received. |

| Tenant’s Name | The full name of the person making the payment. |

| Property Address | The address of the rental property being paid for. |

| Amount Paid | The total amount received from the tenant. |

| Payment Method | The way the payment was made (e.g., cash, cheque, bank transfer). |

| Rental Period | The time period for which the payment is made (e.g., January 1 – January 31, 2025). |

| Landlord’s Signature | The signature of the landlord confirming the payment was received. |

Ensure that this template is easy to understand and accessible to both the landlord and tenant. It helps avoid confusion and serves as a formal record of transactions.

Begin with clear headers that organize key sections. Include the property details such as address, tenant name, and rental period. This makes it easier to reference specific payments.

Next, list all sources of income. Include monthly rent, any additional fees (maintenance, utilities, parking, etc.), and any other income from the rental property.

- Rental income – Include the monthly rent amount.

- Other income – Add any other payments from tenants, such as late fees or parking charges.

Record the payment dates. For each income entry, note the date the payment was received. This helps track payment history and shows when payments were made.

Deduct expenses to show net income. List operational costs, like property management fees, repairs, utilities (if applicable), and insurance. Deduct these from the total income to calculate the final amount.

- Expenses – List all recurring and non-recurring costs related to property upkeep.

- Net income – Subtract total expenses from total income.

Lastly, add a signature or date section to confirm the accuracy of the statement. This ensures it’s complete and legally recognized.

A rental income receipt should include key details that make it clear and legally valid. The first element is the landlord’s full name and contact information. This ensures the tenant knows exactly who received the payment. Include an address or phone number for clarity.

Next, specify the tenant’s name and contact information. This shows who made the payment and provides accountability. It’s also helpful for identifying the tenant in case of disputes.

Date of payment is another critical detail. The receipt must clearly indicate when the payment was made. This is necessary for record-keeping and for resolving any discrepancies that may arise later.

The payment amount must be stated precisely, including the currency. Break down the payment into any specific rent, late fees, or other charges, if applicable. This avoids confusion and helps clarify exactly what was paid.

It’s important to include the payment method, whether it was cash, cheque, bank transfer, or any other form. This helps both parties keep a clear financial record.

Lastly, ensure you provide a receipt number or reference code for tracking purposes. This provides a clear audit trail and makes it easier to manage future transactions.

Opt for a clear, professional layout that includes all key details without overwhelming the recipient. A well-structured receipt should be easy to read and understand at a glance.

- Start with clear labels: Use headings like “Tenant Name,” “Rental Period,” “Amount Paid,” and “Date Paid” to quickly identify the most important information.

- Consider a digital or printed option: Decide whether you want to offer receipts in a digital format (PDF or email) or as a printed document. Digital receipts are often easier for both parties to store and access later.

- Be concise but thorough: Only include the necessary details. Overloading the receipt with extraneous information can distract from the main points. Keep it to the basics while ensuring clarity.

- Use a consistent design: Stick to one style for all receipts to maintain professionalism. This includes the font, color scheme, and layout, making sure it’s consistent and easy to follow.

Clearly specify payment methods accepted, such as bank transfers, checks, or digital payment platforms. Include the payment due date and any penalties for late payments. If partial payments are allowed, outline the schedule and terms for these. Mention any required deposits or advance payments, along with their conditions for refunds or deductions. It’s also helpful to add a section for payment instructions, especially if there are specific steps for wire transfers or online transactions. Make sure terms for additional charges, like late fees or service fees, are stated upfront to avoid misunderstandings.

Ensure your rent receipts are clear, accurate, and compliant with local laws. A well-structured receipt prevents disputes and simplifies tax reporting. Always include the following information:

- Tenant’s name – Identify the person paying the rent.

- Property address – Specify the rental property.

- Payment date – Include the exact date the rent was paid.

- Amount paid – List the payment amount and the payment method (e.g., cash, bank transfer).

- Rental period – Indicate the start and end dates of the rental period for which the payment covers.

- Landlord’s details – Include the landlord’s name and contact information.

- Signature – Both landlord and tenant signatures add validity.

Check Local Rent Receipt Laws

Different regions may have specific requirements. Research your jurisdiction’s rental laws to ensure you’re following the correct procedures. For example, some places may require landlords to provide receipts for payments over a certain amount or within a set timeframe.

Digital Receipts vs. Paper Receipts

If you choose to issue digital receipts, ensure they are secure and easily accessible. Digital receipts must contain the same details as paper receipts to comply with legal standards.

Provide a receipt to tenants immediately after they make a payment. This ensures transparency and avoids potential disputes. Always give a receipt for any cash, check, or electronic payment received. It acts as proof of payment for both the tenant and landlord.

Timing

Deliver the receipt right after the payment is made, ideally on the same day. For regular payments, ensure that receipts are issued at the beginning of the next payment cycle to maintain accurate records.

Method of Delivery

Provide receipts in writing, either physically or electronically, based on the tenant’s preference. Ensure all necessary details are included: the date of payment, the amount, the payment method, and a description of the rent or service being paid for.

List the rental details clearly. Include the tenant’s name, rental property address, and rental period. Mention the start and end dates for clarity.

State the rental amount. Clearly show the rent amount being paid. Break it down into smaller details if there are multiple charges involved (e.g., utilities, parking). Be specific and list the amounts for each category separately.

Include payment terms. Specify the due date for the rent and any late fees that apply. If the payment method is specified, include that as well.

Indicate the security deposit. If applicable, include the amount of the security deposit. Clearly state the terms regarding its return and deductions (if any).

Provide contact information. List both the tenant’s and landlord’s contact details for quick communication in case of issues or clarification.

Sign the document. Both the tenant and landlord should sign and date the receipt. This formalizes the agreement and makes it legally binding.