Key Elements of a 501c3 Donation Receipt

A donation receipt for a 501c3 nonprofit organization should clearly outline the details of the donation to meet IRS standards. It should include specific elements to ensure compliance and transparency. Here’s what to include:

- Organization’s Name and Address: The name, address, and tax identification number (EIN) of the organization.

- Donor’s Name: Full name of the donor or the organization making the donation.

- Date of Donation: Exact date the donation was made.

- Donation Description: A clear description of the donation (e.g., cash, property, services) and, if applicable, the fair market value of donated items.

- Statement of No Goods or Services: A statement confirming that no goods or services were provided in exchange for the donation, or if they were, a description of those goods or services and their value.

- Amount of Donation: The monetary value of the donation, if applicable, or an estimate of the fair market value for non-cash donations.

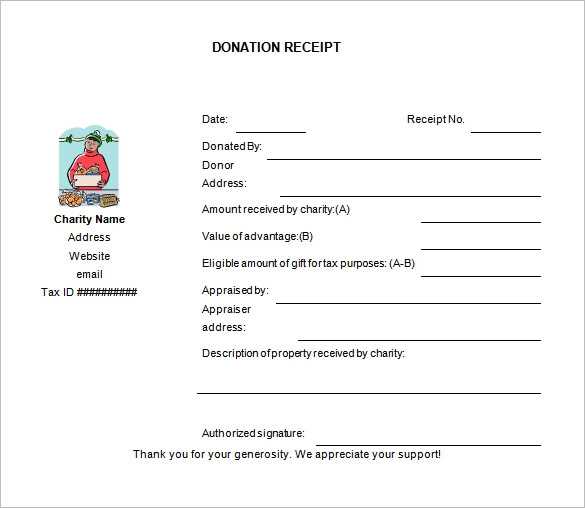

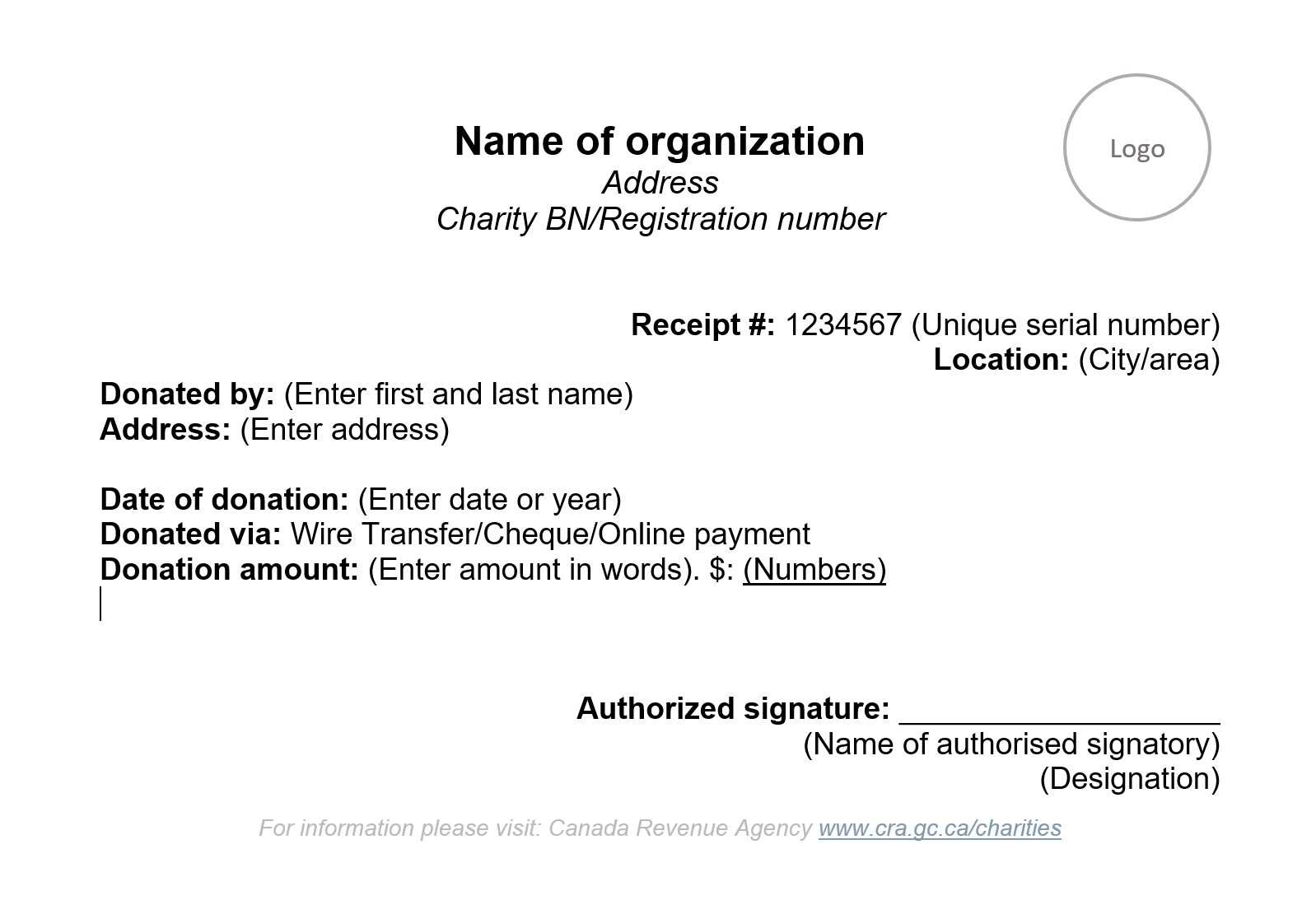

Donation Receipt Template Example

This simple template can be used to create a donation receipt:

Donation Receipt [Organization Name] [Organization Address] EIN: [Tax ID Number] Date of Donation: [Date] Donor Name: [Donor Name] Donor Address: [Donor Address] Description of Donation: - Cash: $[Amount] - Non-cash items: [Description of donated items with fair market value] No goods or services were provided in exchange for this donation. Thank you for your generous contribution to [Organization Name]. Signature: ___________________________ Date: ___________________________

Important Notes for Donors

Donors should keep a copy of the receipt for tax purposes. Donations made to 501c3 organizations are generally tax-deductible, but it’s advisable to consult a tax professional to understand the full implications based on the donation amount and type.

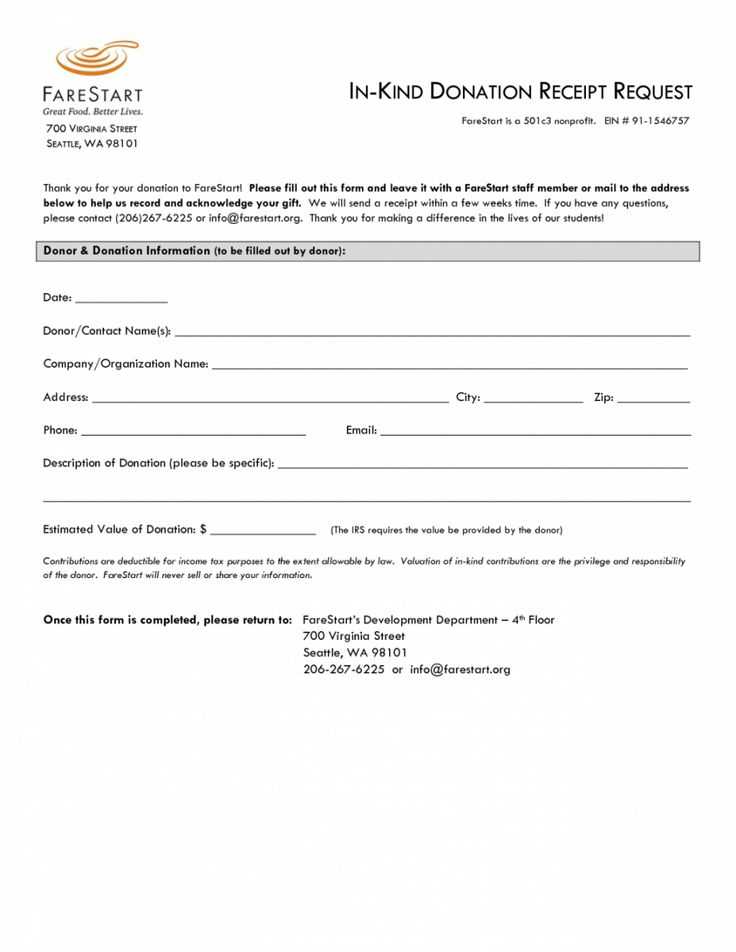

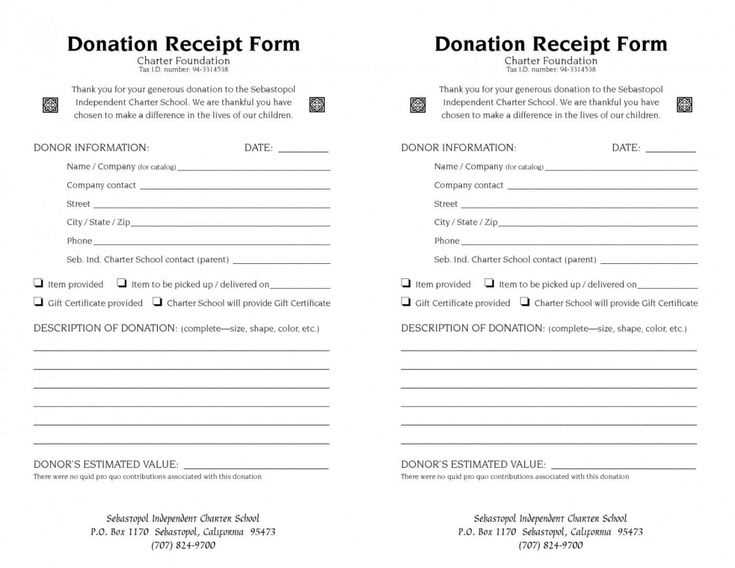

Non-Cash Donations

If the donation includes non-cash items, ensure that the description is detailed and includes a reasonable estimate of the fair market value. It’s helpful to attach an appraisal if the value exceeds certain thresholds.

501c3 Donation Receipt Template: A Practical Guide

How to Structure a 501c3 Receipt Template

Key Legal Information to Include in Your Donation Receipt

How to Acknowledge Contributions Properly

Creating a Template for Various Types of Donations

Customizing Receipts for Different Donor Needs

Common Mistakes to Avoid When Issuing 501c3 Receipts

Start by including the name, address, and tax identification number (TIN) of your organization. The IRS requires that these details appear on every donation receipt. Make sure the donation date and the donor’s information are accurate. Specify the donation amount, whether cash or property, and if the donor received anything in exchange, such as goods or services. If goods or services were provided, their fair market value should also be included. This ensures transparency and aligns with IRS regulations.

Key Legal Information to Include

Legal compliance is crucial when issuing 501c3 donation receipts. The IRS requires nonprofits to provide receipts for any donations of $250 or more. These receipts must include a statement clarifying whether the donor received any goods or services in return for the donation. If the donor received benefits, the receipt must include the estimated value of those benefits to ensure proper tax reporting.

Customizing Receipts for Different Donor Needs

Tailor your receipts to accommodate both small and large contributions. For smaller donations, a basic receipt may suffice, while larger donations may require a more detailed statement, especially for in-kind contributions. When donors give goods, a description of the items (without value) should be provided. For recurring donations, you might want to issue a yearly summary receipt.

Avoid mistakes like failing to include the necessary legal statements or using generic templates that don’t address specific types of donations. Each receipt should reflect the exact nature of the contribution to maintain compliance and provide donors with the information they need for tax purposes.