Use a structured farm receipt template to track sales, expenses, and payments without errors. A well-formatted receipt helps maintain financial clarity and ensures compliance with tax regulations. Choose a template that includes key details such as transaction date, buyer and seller information, itemized list of goods or services, total cost, and payment method.

For small-scale farms, a simple printable receipt with predefined fields is ideal. Larger operations may benefit from digital templates that automatically calculate totals and apply taxes. Many free and paid options are available in Excel, Word, and PDF formats, allowing customization to match business needs.

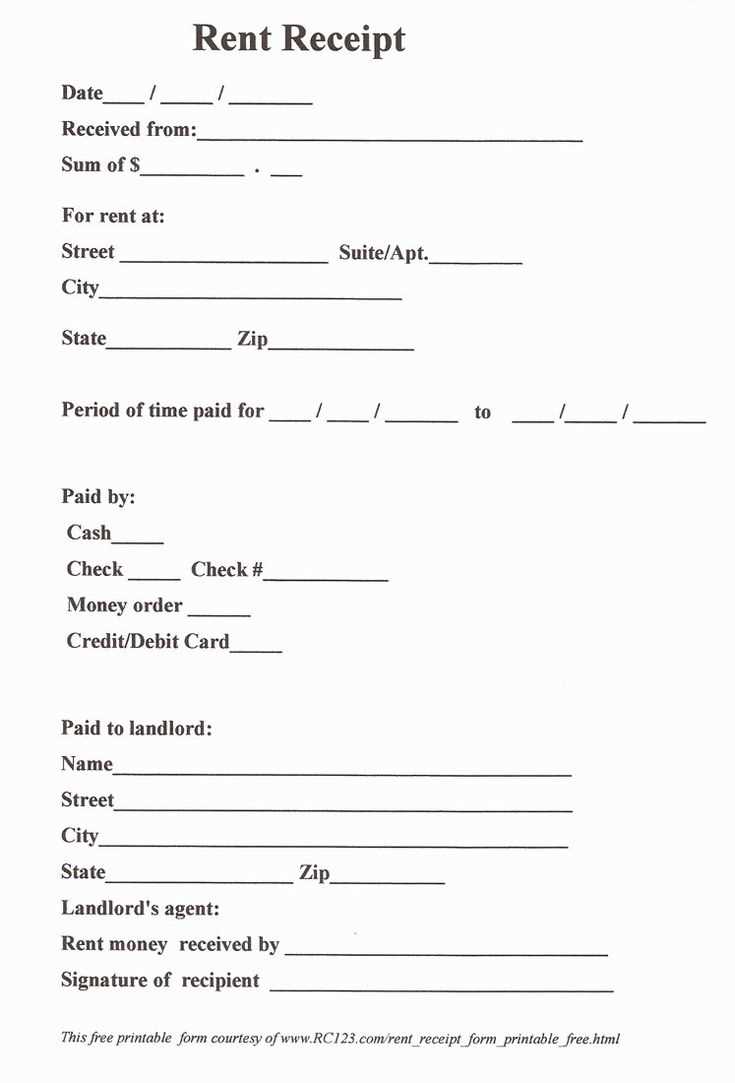

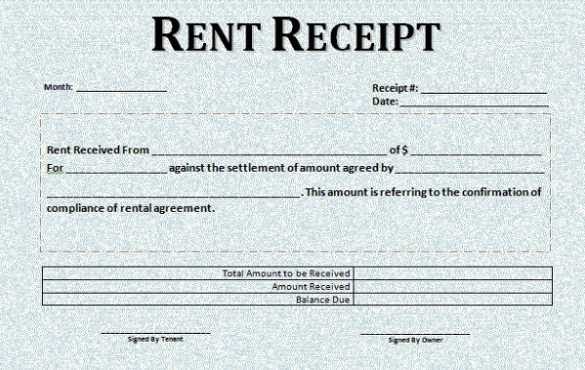

When selecting a template, consider whether you need space for additional details like discounts, delivery fees, or tax identification numbers. Templates with sequential numbering help track receipts efficiently, preventing duplicates and missing records. For added security, include a signature field to confirm transactions.

Consistent record-keeping simplifies financial planning, reduces audit risks, and builds trust with customers. Choose a template that fits your workflow and update it as your business grows.

Here’s a version without frequent repetitions of “Farm” and “Receipt” while maintaining clarity and correctness:

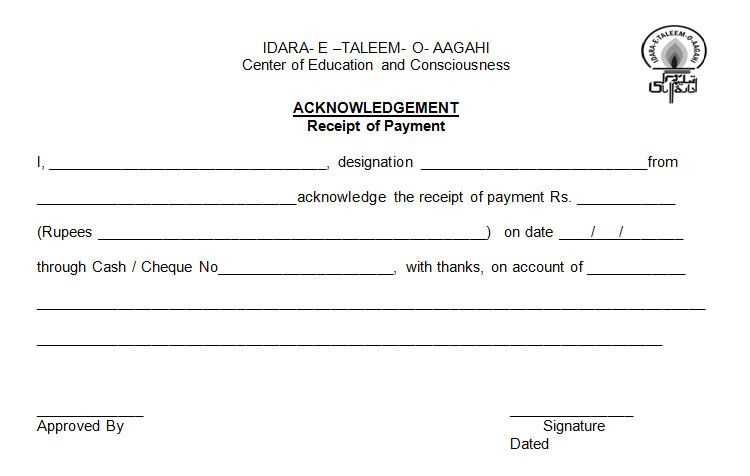

Use a structured template with clearly defined sections for transactions. Include fields for seller and buyer details, date, item descriptions, quantities, unit prices, and total amounts. Specify payment terms and methods to prevent misunderstandings.

Optimize Readability and Accuracy

Ensure all figures align correctly by using tables or aligned columns. Avoid handwritten notes for legibility. Double-check calculations before finalizing the document.

Include Tax and Compliance Details

List applicable taxes separately and reference any legal requirements. If the transaction involves perishable goods, mention relevant storage or transportation conditions. Retain copies for record-keeping and audits.

- Templates for Agricultural Receipts

Choose a template that includes key transaction details, such as product name, quantity, unit price, total cost, payment method, and date. A well-structured format simplifies bookkeeping and tax reporting.

Essential Fields to Include

- Farmer’s Information: Name, address, and contact details.

- Buyer’s Details: Full name and payment method.

- Transaction Summary: Itemized list of goods sold, price per unit, and total amount.

- Payment Confirmation: Cash, credit, or deferred payment status.

- Legal Disclaimer: Return policies or warranty terms, if applicable.

Template Formats

- Printable PDFs: Ideal for handwritten receipts in markets or farm stands.

- Excel Sheets: Customizable for bulk transactions and automated calculations.

- Word Documents: Simple templates for quick edits and printing.

- Mobile Apps: Digital receipts with automatic record-keeping.

Use templates that align with your record-keeping preferences and ensure compliance with tax regulations. Consistent formatting enhances clarity and professionalism.

Every transaction record must provide clear, organized details to ensure accurate financial tracking. Missing or incomplete entries can lead to errors, making it difficult to manage accounts effectively.

Buyer and Seller Details

- Full names and contact information

- Business names (if applicable)

- Addresses for both parties

Transaction Information

- Date of sale

- Invoice or receipt number

- Payment method (cash, check, bank transfer, etc.)

Itemized List of Goods or Services

- Product names or descriptions

- Quantity and unit price

- Total cost per item

Tax and Discounts

- Applicable sales tax percentage and amount

- Any discounts applied

- Final total after tax and discounts

Additional Notes

- Payment terms (due dates, partial payments, etc.)

- Warranty or return policy (if applicable)

- Signature fields for confirmation

Keeping these records structured and complete makes financial reconciliation easier, supports tax reporting, and strengthens business accountability.

PDF ensures a consistent layout across all devices and operating systems. It supports digital signatures, making it a secure choice for finalized payment records.

Excel (.xlsx) allows for easy calculations, automated formulas, and batch processing. It’s ideal for tracking multiple transactions and generating financial reports.

CSV is lightweight and compatible with most accounting software. This format works best for exporting structured data without extra formatting.

Word (.docx) provides flexibility for customized invoices and payment agreements. It’s useful when text formatting and branding elements are needed.

XML standardizes payment data exchange between different financial systems. Banks and enterprise solutions often require this format for automated processing.

JSON is widely used for API-based payment integrations. It simplifies data exchange between online payment platforms and accounting tools.

Choosing the right format depends on the specific needs of your payment workflow. Combining formats can improve accuracy, security, and compatibility.

Match the form layout to the type of transaction. For produce sales, include fields for weight, unit price, and total cost. For livestock deals, add sections for breed, age, health status, and vaccination records. Lease agreements should specify land area, rental terms, and maintenance responsibilities.

Use drop-down menus and checkboxes for common items to speed up data entry. Pre-fill recurring details like farm name and contact information to reduce manual input. Leave space for handwritten notes if negotiations require adjustments.

Ensure legal compliance by integrating state-specific tax details and required signatures. If working with multiple buyers, customize invoice numbering to track transactions separately. Digital forms should support easy export to spreadsheets for bookkeeping.

Use written agreements to define payment terms, delivery conditions, and dispute resolution methods. A signed contract prevents misunderstandings and provides legal protection.

Verify local regulations on agricultural sales, including tax obligations and licensing. Some regions require specific documentation for farm product transactions.

Keep accurate records of all transactions, including receipts, invoices, and contracts. These documents serve as evidence in case of disputes or audits.

Ensure compliance with food safety and labeling laws when selling perishable goods. Mislabeling or failing to meet standards can result in fines or legal action.

Consult a legal expert for complex deals, such as land leases or equipment financing. Proper legal guidance minimizes risks and ensures compliance with applicable laws.

Farmers seeking better record management should consider digital tools for automation, backups, and quick access. Spreadsheets, cloud storage, and farm management apps simplify calculations, reduce errors, and integrate with financial software. Automated reports improve decision-making, and digital receipts ensure compliance with tax regulations.

Paper records provide a tangible backup, require no internet access, and eliminate cybersecurity risks. However, they demand storage space, are prone to damage, and make searching for past transactions time-consuming.

| Factor | Digital | Paper |

|---|---|---|

| Accessibility | Instant, searchable, cloud-based | Physical access required, manual search |

| Security | Encryption, backups, password protection | Loss risk due to fire, water, or misplacement |

| Cost | Subscription fees, device investment | Printing, filing, physical storage |

| Environmental Impact | Less paper waste, lower carbon footprint | Ink, paper, storage materials needed |

For a balanced approach, farmers can scan and archive paper receipts while using digital tools for analysis and planning. Hybrid solutions ensure accessibility and security without full reliance on either method.

Start with platforms that specialize in financial documents, such as Template.net and Invoice Home. These websites offer a variety of pre-designed farm receipt templates in multiple formats, including PDF, Word, and Excel.

Government websites often provide free templates tailored for agricultural businesses. Check the official website of your country’s agriculture department or small business administration for downloadable forms that meet legal standards.

Accounting software like QuickBooks and FreshBooks includes built-in receipt templates designed for farm-related transactions. Users can customize these templates to match their branding and compliance needs.

Online marketplaces such as Etsy and Creative Market feature unique farm receipt templates created by independent designers. These options allow for greater personalization while maintaining a professional look.

Google Docs and Microsoft Office offer free receipt templates accessible through their template galleries. Search for “farm receipt” within these platforms to find customizable options that integrate with cloud storage.

Explore industry-specific forums and agricultural associations, as they often provide downloadable templates tailored for farmers. Members frequently share practical resources that align with farming operations.

Minimizing Repetitions for Clarity and Precision

To maintain clarity and precision in farm receipt templates, streamline the language by eliminating unnecessary repetitions. Use concise terms that directly convey the intended meaning, avoiding redundancy while preserving accuracy. This can be achieved by combining similar statements into one, ensuring that each point is made with the fewest words possible.

Use Clear and Simple Phrasing

Avoid over-complicating sentences. For example, instead of repeating the same idea in different ways, try consolidating it into one statement that covers all aspects effectively. This approach makes the template easier to understand and reduces confusion for both the sender and the recipient.

Provide Precise Information

Focus on specific details. For instance, instead of saying “Quantity of items sold” and “Number of products sold,” simply state “Items sold” with the correct quantity mentioned immediately next to it. Clear, direct language enhances the readability and accuracy of the receipt.