When creating a donation receipt letter, ensure it includes all necessary details for both the donor and the organization. Start by clearly stating the donation amount or description of goods provided. Include the date the donation was received and the name of the donor. This not only makes the letter legally compliant but also ensures transparency between both parties.

Be concise and specific. A good donation receipt should avoid vague language. Instead, provide a clear breakdown of what was donated, whether it’s a monetary gift or tangible items. If applicable, add a statement clarifying that the donation was made with no expectation of goods or services in return. This helps protect the nonprofit from any future tax-related issues.

Formatting your letter properly is key. Make sure the letter is well-organized and easy to read. Begin with a formal greeting, followed by the donation details, and close with a sincere thank you. Donors should feel appreciated for their contribution, and a well-crafted letter can leave a positive, lasting impression.

Finally, ensure all required legal language is included, particularly if the donation is tax-deductible. This protects both the donor’s and the organization’s interests. A simple template can be adjusted to suit different situations, but the basics–clarity, respect, and accuracy–should always be present.

What is a Donation Receipt Letter and Why is it Important?

A donation receipt letter serves as an official document confirming a donation made by an individual or organization. It outlines the amount donated, the date, the recipient organization, and whether anything was provided in return, such as goods or services. This letter is important for donors to claim charitable tax deductions, as it provides the necessary documentation required by tax authorities. Without it, donors would not be able to substantiate their donations when filing taxes.

For nonprofits, issuing donation receipts ensures legal compliance with tax laws and establishes transparent financial practices. It helps build credibility with donors, showing that the organization is responsible in handling contributions. This documentation also supports effective financial management by keeping accurate records of all donations received, which is crucial for both reporting and auditing purposes.

A Donation Receipt Letter is an official acknowledgment issued by a charitable organization or nonprofit to a donor, confirming the details of a donation. It provides information about the amount or value of the contribution, the donor’s name, and the date of the gift. This letter serves as a proof of the donation, and is important for both the donor and the organization for several reasons:

The letter ensures transparency in the donation process. For the donor, it acts as official documentation for tax purposes, helping them claim deductions on their taxes. The organization also benefits, as it maintains clear records of all contributions received, which is essential for reporting and future fundraising activities.

Tax Deduction Purposes

A properly issued donation receipt letter is necessary for donors who want to claim charitable deductions on their taxes. It provides the required details, such as the date, amount, and value of the donation. Without this acknowledgment, the donor may face difficulties in claiming their deduction during tax season.

Organizational Record-Keeping

Donation receipts also help the organization keep accurate and up-to-date records of its fundraising activities. They can serve as a reference for auditing and reporting purposes, and they can be included in annual reports or other communications with stakeholders.

- For Donors: It acts as documentation for tax purposes, as charitable contributions can be deductible under tax laws in many jurisdictions.

Make sure to retain the donation receipt from any charitable organization you contribute to. This receipt serves as official proof of your donation and may qualify you for tax deductions. Here’s why it matters:

Tax Benefits

- Most tax authorities allow individuals to deduct charitable donations, lowering their taxable income.

- The receipt should list the donation amount and confirm that no goods or services were exchanged in return for the gift.

- For donations over a certain value, the receipt may also require additional details such as the charity’s registration number.

Best Practices

- Request a receipt immediately after making the donation to ensure it’s available when needed during tax season.

- Double-check that the donation details, such as the date and amount, are correctly listed on the receipt.

- Keep digital or hard copies of all receipts organized for easy access when filing your taxes.

Charitable organizations benefit greatly from donation receipts. These receipts serve as a formal record of each contribution, simplifying bookkeeping and helping ensure all financial transactions are accurately tracked. By documenting each donation, charities can easily reconcile their records and provide a clear financial picture for internal audits, tax purposes, and financial reports.

Improving Transparency

Donation receipts increase transparency by offering a concrete reference for both donors and the organization. This record ensures that both parties have a mutual understanding of the contributions made, which strengthens trust. Additionally, clear documentation can deter potential misunderstandings about donation amounts or the use of funds.

Enhancing Accountability

Receipt issuance helps maintain accountability in charitable operations. By issuing receipts for every donation, organizations demonstrate their commitment to responsible financial management. This transparency supports long-term donor relationships, encourages further contributions, and reassures stakeholders that funds are being used appropriately. Regular, well-maintained records also make it easier to comply with any local tax or legal requirements concerning charitable donations.

How to Structure a Donation Receipt Letter for Clarity and Compliance?

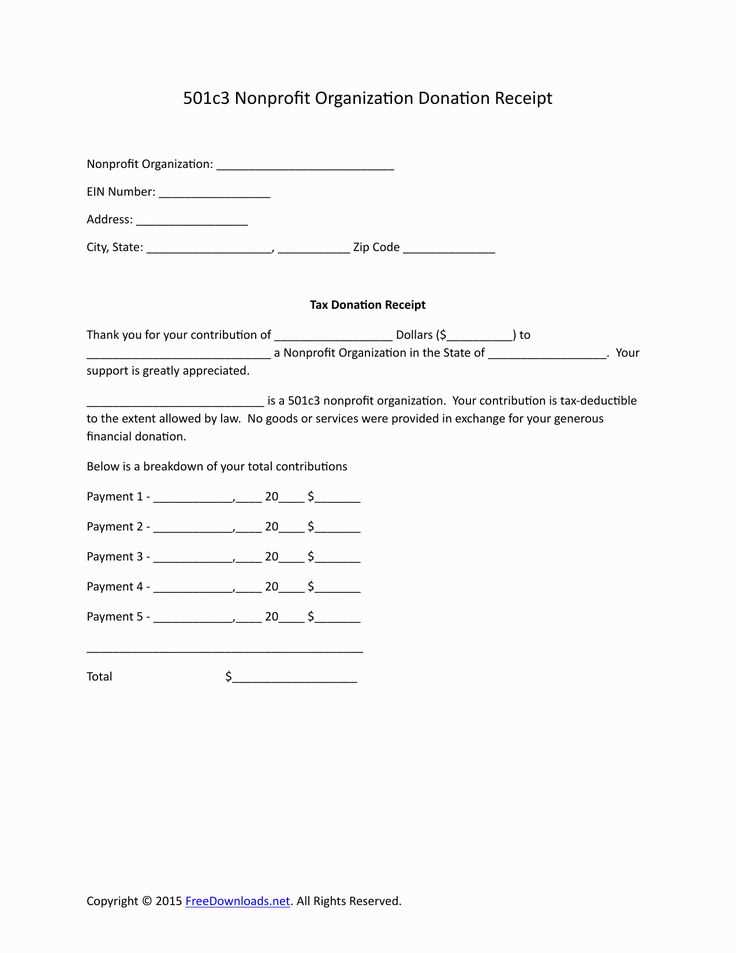

Start with clear and concise details. Each receipt should include specific information that is both legally required and useful for the donor’s record-keeping. Here’s how to organize the content:

- Header Information: Include your organization’s name, address, phone number, and website. It helps recipients verify the source of the donation.

- Donation Details: Clearly state the date of the donation, the amount given (or a description of donated items), and whether it was a cash or non-cash gift. For non-cash donations, provide an estimated value or a description.

- Donor Information: Include the name and address of the donor. This ensures that the donor’s records are accurate.

- Tax-exempt Status: Include a statement of your organization’s tax-exempt status (e.g., “Your donation is tax-deductible under Section 501(c)(3) of the Internal Revenue Code”). This is essential for donor compliance and accurate tax filing.

- Thank You Note: Personalize the letter with a thank-you message that reflects your appreciation. A simple acknowledgment fosters goodwill and encourages future support.

- Non-Compensatory Clause: If applicable, clarify that the donor did not receive any goods or services in exchange for the donation. This can help avoid complications with tax reporting.

- Signature: Include the signature of a responsible party within your organization to authenticate the receipt. This adds credibility to the document.

By structuring your receipt with these elements, you ensure compliance and maintain transparency with your donors. A well-organized donation receipt can strengthen relationships and improve your financial and reporting processes.

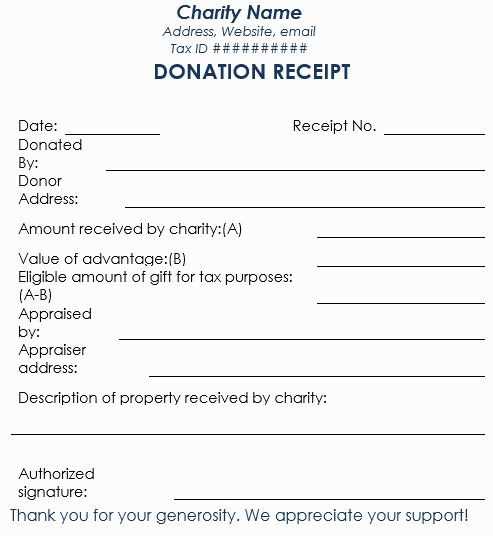

To ensure clarity and compliance, a Donation Receipt Letter should be carefully structured. Here’s a suggested format:

The letter should begin with the name and address of the organization issuing the receipt. This is followed by a clear heading, such as “Donation Receipt,” which immediately identifies the document’s purpose.

Include the donor’s name and address to ensure proper record-keeping and acknowledgment. This helps verify that the right individual or organization is being recognized for the contribution.

State the date of the donation to accurately reflect when the contribution was made. If the donation was received in parts, note each installment separately.

Provide a detailed description of the donation, including the type (cash, goods, services) and the amount or value. If the donation is in the form of goods, list specific items with their fair market value.

If any goods or services were provided in exchange for the donation, describe them clearly and assign their fair market value. This is necessary for tax purposes to differentiate between a charitable contribution and a purchase.

End the letter with a statement that acknowledges the donor’s contribution as a tax-deductible gift under applicable tax laws. Include a reminder that the donor should keep the letter for their tax filing purposes.

Finally, express gratitude for the donation. A simple thank you goes a long way in maintaining a positive relationship with the donor. Sign the letter and include a contact number or email for any follow-up questions.

-

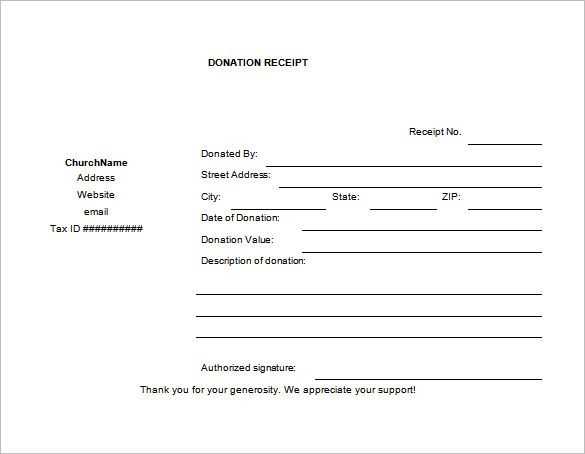

Letterhead and Contact Information:

Letterhead and Contact Information:

The letterhead should be at the top of the donation receipt letter. It represents your organization and should include key details such as the organization’s name, logo, and address. Make sure the contact information is clear and easy to find. This helps donors identify the organization and get in touch if necessary.

Include the Following Information:

- Organization Name: Use the full legal name of your organization.

- Logo: Place the logo in a prominent position if you have one.

- Physical Address: Include a complete address, including street, city, state, and zip code.

- Phone Number: Provide a phone number where someone can reach your organization.

- Email Address: Include an email for general inquiries or specific questions regarding donations.

- Website: Provide your website link if applicable.

Ensure the contact information is up-to-date and accurate. It makes communication easier for your donors and ensures transparency.

- The name and logo of the charitable organization.

Include the full, official name of the charitable organization at the top of the donation receipt. This ensures the donor can easily identify the recipient of their contribution. The name should be clear, matching official registration documents, and appear in an easily readable font.

The logo serves as an important visual identifier. It strengthens brand recognition and adds a professional touch to the receipt. Place the logo near the organization’s name to maintain a cohesive and organized layout. Make sure the logo is of high quality and properly scaled to avoid distortion or pixelation.

Both the name and the logo should be positioned prominently at the beginning of the document. This placement helps establish trust and credibility with donors. It’s also a good idea to use the organization’s official color scheme to create consistency with other materials the donor may have received, such as newsletters or event invitations.

| Recommendation | Details |

|---|---|

| Logo Quality | Ensure the logo is clear and high resolution for professional presentation. |

| Name Format | Use the organization’s full official name for consistency and clarity. |

| Positioning | Place both name and logo at the top of the receipt for easy identification. |

Include all relevant contact details to ensure the donor can easily reach out for any inquiries. Start with the organization’s phone number, email address, and website. Clear and accessible contact information reflects professionalism and fosters transparency in communication.

Contact Information Format

Here’s a format for listing contact details in your donation receipt letter:

| Type | Details |

|---|---|

| Phone Number | +1 555 123 4567 |

| [email protected] | |

| Website | www.organization.org |

Clarity and Accessibility

Make sure the contact details are easy to read and up to date. Double-check the accuracy of the information provided, especially if it’s being used on multiple documents. Keep your contact points consistent across all communication platforms. If the organization has multiple departments, include the relevant contact for donor-related queries to avoid confusion.

How to Format the Closing of a Donation Receipt Letter

Conclude your donation receipt letter with a clear and professional closing. Use the recipient’s full name for a personal touch. Be concise but express genuine gratitude for the support. It’s important that your closing statement acknowledges the donor’s contribution and its impact. The final paragraph should include a call to action, such as an invitation to future involvement or a reminder of the cause’s ongoing needs.

For example:

| Sample Closing Line | Purpose |

|---|---|

| “Thank you once again for your generous donation. Your support helps us [insert impact]. We hope to continue working together to [insert cause].” | Expresses appreciation and reinforces the connection to the cause. |

| “We look forward to keeping you updated on how your contribution is making a difference.” | Encourages ongoing communication and builds long-term donor relationships. |

End with a formal sign-off, such as “Sincerely” or “Warm regards,” followed by the organization’s name and the person responsible for the letter. This will maintain a professional tone while leaving a positive impression.

Date and Salutation:

Begin your donation receipt letter by including the date of the donation. Place the date at the top of the letter, ensuring it reflects the day the donation was received. This helps both parties track the transaction for record-keeping purposes and tax filing.

Date Format:

Use a clear and formal date format, such as “February 4, 2025,” ensuring it is easy to read and understand. Avoid abbreviations or overly casual formats.

Salutation:

Follow the date with a respectful salutation. For a personal touch, address the donor by name, e.g., “Dear [Donor’s Name].” If you don’t know the donor personally, use a general salutation such as “Dear Valued Donor.” Make sure the salutation feels warm but professional.

- Date the receipt is issued.

Include the exact date the receipt is issued. This helps both parties track and verify the donation’s documentation for tax and record-keeping purposes.

Why the date is important:

Providing the date allows the donor to use the receipt for tax deductions in the correct year. It also ensures the receiving organization can confirm when the donation was acknowledged.

How to format the date:

Use a clear and consistent format for the date, such as “Month Day, Year” or “MM/DD/YYYY.” This reduces confusion and ensures accurate record-keeping across different regions.

| Date Format | Example |

|---|---|

| Standard (MM/DD/YYYY) | 02/04/2025 |

| International (DD/MM/YYYY) | 04/02/2025 |

| Full Date (Month Day, Year) | February 4, 2025 |

Properly recording the date helps prevent mistakes in filing and reference. It ensures clarity for both the donor and the organization.

Addressing the donor by name in your donation receipt letter creates a personal connection, making the letter feel more meaningful. Start with a warm greeting that includes the donor’s first and last name, if appropriate. This not only acknowledges their generosity but also shows appreciation for their specific contribution. A personalized greeting helps to establish a more personal tone, making your letter stand out from generic communications.

Example of a Personalized Greeting:

| Generic Greeting | Personalized Greeting |

|---|---|

| Dear Donor, | Dear John Smith, |

| Thank you for your support. | Thank you for your generous support, John! Your contribution means a lot to us. |

By including the donor’s name early in the letter, you ensure they feel recognized as an individual, rather than as just one of many contributors. This small gesture goes a long way in strengthening the relationship between your organization and the donor.

To ensure the clarity and accuracy of your donation receipt letter template, focus on proper formatting and specific details. Include all necessary fields such as the donor’s name, donation amount, and the date of the contribution. The letter should explicitly confirm the tax-exempt status of the organization to provide the donor with the necessary information for tax purposes.

Key Elements to Include

- Donor’s Name and Address: Clearly state the name and address of the donor to avoid any confusion.

- Donation Amount: Specify the exact amount donated. If the donation was in kind, provide a description of the item(s) donated.

- Date of Donation: Include the date the donation was made, which is crucial for tax records.

- Organization’s Details: State your organization’s full name, address, and tax identification number.

- Tax-Exempt Status: Clearly state that your organization is a 501(c)(3) or equivalent entity, qualifying the donation for tax deductions.

Formatting Tips

- Professional Tone: Use a formal yet friendly tone to maintain professionalism without sounding too rigid.

- Clear Structure: Break the letter into sections for easy reading. Start with a greeting, followed by the details, and close with a warm thank-you note.

- Simple Language: Avoid legal jargon. The letter should be easy to understand and free from unnecessary complexity.

Clear Acknowledgment of Donation:

Ensure the donation receipt clearly confirms the donor’s contribution. State the exact amount, date, and method of donation. This acknowledgment must be specific, avoiding any ambiguity. For example, “We confirm a donation of $500 made on January 15, 2025, via credit card.” Include any relevant details, such as whether the donation is restricted for a specific purpose or unrestricted. This will help the donor understand how their contribution will be used.

It’s important to specify that no goods or services were provided in exchange for the donation, especially if applicable. For example, “No goods or services were received in exchange for this donation.” If any goods or services were provided, mention their fair market value so that the donor can accurately report their tax deductions.

By being clear and detailed, you show respect for the donor’s generosity while also helping them track their contributions for personal records or tax purposes. Always make sure to issue this acknowledgment promptly after receiving the donation. This step builds trust and reinforces the relationship between your organization and the donor.

- A statement confirming the donor’s gift, including the date of the donation and the amount (or description of in-kind donations).

When preparing a donation receipt letter, clearly stating the details of the donor’s contribution is a must. This statement should include the date of the donation, the exact amount donated (for cash donations), or a detailed description of in-kind donations. A well-written statement ensures transparency and confirms the donor’s generosity for tax or record-keeping purposes.

Date of Donation

Always include the exact date of the donation. This helps both the donor and the organization keep accurate records for tax filing and auditing. If the donation was made over multiple dates, note each individual date to avoid confusion.

Amount or Description of In-Kind Donations

For monetary donations, clearly state the amount given. If the donation is in-kind (e.g., goods, services, or items), provide a detailed description of the items donated, including quantities or condition if relevant. While an appraisal or valuation is not mandatory, the description should be precise enough to reflect the contribution accurately.

How to Properly Close a Donation Receipt Letter

Ensure the conclusion of your donation receipt letter is clear and professional. A thoughtful closing reinforces gratitude and provides necessary information for the donor’s tax records.

- Start by thanking the donor once more. This can be done in a simple sentence like, “We are deeply grateful for your contribution.” A second expression of appreciation solidifies the positive relationship.

- Include any next steps if relevant. For example, let the donor know about future communications, events, or additional ways they can stay involved.

- Reconfirm the donation amount and its intended use. This serves as a reminder for the donor and provides confirmation of the charitable purpose.

- Close the letter with a formal but warm sign-off. Phrases like “Sincerely,” or “Best regards,” followed by the name and title of the organization’s representative, add a personal touch.

Adding Final Touches

If you’re including tax details, state them clearly. Confirm that the donor’s contribution is tax-deductible under applicable law. If applicable, mention your nonprofit’s tax ID number, and ensure all legal language is properly formatted.

Finally, always double-check for spelling or grammar errors. A polished letter enhances your organization’s credibility and professionalism.

Legal and Tax Information:

Ensure that your donation receipt includes the proper legal and tax-related details to guarantee its validity for tax deductions. Mention the full name of the donor, the amount donated, and the date of the contribution. If the donation is a non-cash gift, provide a description of the item along with an estimate of its value.

Tax-exempt Status

Clearly state your organization’s tax-exempt status. For U.S.-based organizations, this means indicating that your charity is recognized as a 501(c)(3) entity by the IRS. This allows donors to claim deductions on their tax returns. Failure to mention your tax-exempt status could lead to complications for the donor when claiming their deduction.

Non-cash Donations

If your organization accepts non-cash donations, specify that the donor is responsible for valuing the donated property, unless an appraisal was provided. Include a statement that the receipt does not include any goods or services in exchange for the donation, which is a requirement for tax-deductible gifts.

- A declaration that no goods or services were provided in exchange for the donation (if applicable).

Include a clear statement confirming that no goods or services were provided in exchange for the donation. This ensures proper tax documentation and helps the donor understand the full value of their contribution. If no exchange took place, the IRS requires this declaration for the donor to claim a charitable deduction.

Example:

“No goods or services were provided in exchange for this donation.”

In cases where a donation involved goods or services, list them and their estimated value. However, if no such exchange happened, this statement is sufficient.

If goods or services were provided, state their estimated value.

Clearly indicate the value of any goods or services you provided in exchange for a donation. This ensures transparency and helps the donor properly assess the tax deduction they may claim. To estimate the value, refer to the market price for similar items or services. You can also use professional appraisals if necessary for more specialized goods or services.

How to Estimate the Value

For tangible goods, check the current selling price or market rate for similar items. If the goods are used, subtract a reasonable depreciation amount based on condition and age. For services, base the value on the average hourly rate for that service in your area. For example, if you provided event tickets, use the ticket price or resale value. For professional services like consulting, refer to the standard hourly rate for that service.

Why the Value Matters

Stating the value of goods or services helps the donor receive an accurate tax deduction. It also ensures the donation letter is compliant with IRS requirements. Always document the method used to determine the value in case verification is needed later.

To create a clear and efficient donation receipt letter template, follow these key steps:

- Include the Date: Always start by adding the date the donation was received. This ensures proper documentation for both the donor and the organization.

- Donor Information: Provide the donor’s full name and address. This helps to personalize the receipt and also ensures accuracy for tax reporting.

- Donation Amount: Clearly state the amount of the donation. If it is monetary, write the full dollar amount. For non-cash gifts, describe the items donated with an estimated value.

- Statement of No Goods or Services Provided: Include a brief statement confirming that the donation was made without any goods or services being exchanged, unless that’s not the case. If something was exchanged, include a description of the items or services provided and their value.

- Tax Identification Number (TIN): Include your organization’s TIN for the donor’s tax records.

- Gratitude Statement: End the letter with a thank you message. Let the donor know their contribution is appreciated and will make a difference.

Additional Tips

- Be Clear: Ensure that all details are easy to understand and unambiguous. This will prevent confusion for both the donor and the organization.

- Use Proper Formatting: Organize the letter clearly with bullet points, appropriate headings, and sections to ensure all important details are highlighted.

- Follow-up: After sending the receipt, follow up with the donor to confirm they received it and to express your ongoing appreciation.

Tax Information (if applicable):

Include any tax-related details in your donation receipt. If the donation is tax-deductible, mention the organization’s IRS tax-exempt status and provide the IRS tax identification number. Clearly state whether the donation was made in cash, goods, or services, as the type of donation may impact the tax deduction amount. If the donor received goods or services in exchange for the donation, estimate the value of those items and subtract it from the total donation amount to determine the deductible portion. Ensure that the letter contains language such as, “No goods or services were provided in exchange for this donation” if that applies.

Make sure to include the donation date, amount, and any other relevant details that support the donor’s claim for tax purposes. If the donor’s contribution is over a certain threshold, such as $250, provide a clear statement regarding the donor’s eligibility for tax deductions and remind them to keep the receipt for their records.

- Reference to the nonprofit’s tax-exempt status.

Include a clear statement confirming the nonprofit’s tax-exempt status to reassure donors that their contributions are deductible. Here’s what to include:

- Indicate the nonprofit’s 501(c)(3) status to show it qualifies for tax-exempt status.

- Provide the nonprofit’s Employer Identification Number (EIN) for IRS verification.

- Clearly state that donations are tax-deductible as allowed by law.

Sample Statement

- “[Organization Name] is a 501(c)(3) nonprofit organization. Donations are tax-deductible as permitted by IRS regulations.”

- “EIN: [Insert EIN]. Please retain this receipt for your tax records.”

Why Include This Information?

Referencing the nonprofit’s tax-exempt status ensures compliance with tax laws. It also provides clarity for donors who wish to claim deductions on their taxes. Be transparent about your status to build trust and avoid any confusion regarding the tax-deductibility of donations.

Include a clear statement indicating whether the donation qualifies for tax deductions. Mention that the donation is eligible for tax benefits, if applicable, and provide specific details, such as the charity’s tax-exempt status (e.g., 501(c)(3) in the U.S.). This helps the donor understand the potential financial benefits of their contribution. Be sure to specify the nature of the deduction, such as whether it is for federal or state taxes, to avoid any confusion. If necessary, recommend that the donor consult a tax advisor for personalized guidance on claiming deductions. This statement reassures the donor about the legitimacy of their gift and supports their recordkeeping for tax purposes.

Creating a Donation Receipt Letter Template

Ensure your donation receipt letter is clear and concise. Begin with a thank-you statement that acknowledges the donor’s generosity. Be specific about the donation amount and its intended use. Include details such as the donor’s name, the donation date, and the amount or description of the items donated. If the donation includes goods, list them with brief descriptions for clarity.

Key Elements of the Donation Receipt

Provide a clear breakdown of the donation, including the donor’s name, address, and contact information. Be transparent about whether the donation is monetary or in-kind. If applicable, mention the tax-deductible status of the donation, and always refer to the IRS guidelines on tax deductions. Include your organization’s name, contact details, and tax-exempt number if relevant.

Finalizing the Letter

Before closing the letter, offer further thanks for the donor’s support. Sign the letter with a personal note or your signature to make it more genuine. If possible, send the letter promptly to show appreciation and ensure it aligns with financial reporting timelines. This simple gesture strengthens the relationship with the donor and encourages future support.

Closing Remarks and Gratitude:

Conclude your donation receipt letter with a sincere expression of appreciation. Acknowledge the donor’s generosity and the impact of their contribution. Ensure the message feels personal and genuine. You want the donor to know their support is truly valued.

Steps to Craft Meaningful Closing Remarks:

- Express specific thanks for the donation amount and its intended use.

- Reaffirm the positive difference the donor’s support makes to your cause.

- Provide reassurance that their donation is being used responsibly and effectively.

- Invite the donor to stay involved with your organization through updates or future events.

A simple, heartfelt note can turn a standard donation receipt into a meaningful expression of gratitude. Keep it warm, specific, and impactful to strengthen the relationship with the donor.

- A thank you message for the donor’s generosity.

Your support means more than just a financial contribution; it shows a deep commitment to making a positive difference. Thanks to your generosity, we are able to continue our mission and help those who need it most. Your kindness is creating real change, and we are truly grateful for your involvement.

Your donation is making a tangible difference. With your support, we are able to bring about real change for those in need. The funds you contributed will directly benefit the people, projects, or initiatives you care about. Below are some key ways your generosity is creating impact:

- Improved Resources: Your donation helps supply necessary tools, materials, and services that strengthen our mission and goals.

- Community Support: The funds directly support programs that provide immediate relief to individuals, improving their lives today.

- Long-Term Change: With your contribution, we can invest in sustainable solutions that address the root causes of challenges faced by our community.

- Increased Outreach: Your support allows us to extend our reach and provide assistance to more people in need, creating a wider ripple effect.

Every donation makes a difference

By donating, you are joining a collective effort to solve pressing issues. Your contribution may seem small, but it adds up and strengthens our shared vision. We are grateful for your role in creating this positive change, and we will continue to ensure that every dollar is put to good use.

Formatting a Template Donation Receipt Letter

When creating a template for a donation receipt letter, keep it clear, concise, and organized. A well-structured letter ensures your donors feel acknowledged and provides them with necessary details for their tax purposes. Below is a recommended structure for the letter:

- Header Section: Include the organization’s name, logo, address, and contact information at the top. Add the date of the letter.

- Donor’s Information: Provide a space for the donor’s full name, address, and email. Ensure it is placed directly below the header, aligned to the left.

- Salutation: Use a formal greeting, such as “Dear [Donor’s Name],” ensuring the tone is respectful.

- Donation Details: Clearly state the amount donated, the date received, and the donation method. If the donation was in kind, list the item(s) donated with a brief description.

- Tax-Exempt Status: Mention the organization’s tax-exempt status (e.g., 501(c)(3)) and confirm that no goods or services were provided in exchange for the donation, if applicable.

- Closing: Express appreciation for the donor’s generosity and commitment. Use a phrase like “Thank you for your support!” to close.

The following table illustrates how this template can be laid out:

| Section | Details |

|---|---|

| Header | Organization’s name, logo, contact info |

| Donor Info | Donor’s full name, address, email |

| Salutation | Dear [Donor’s Name] |

| Donation Info | Amount donated, date, method, or items in kind |

| Tax Status | Tax-exempt status, no goods/services received |

| Closing | Thank you message |

Customize each section based on the specifics of the donation, ensuring clarity and accuracy in every detail provided. This layout simplifies the process of sending receipts while keeping it professional and donor-friendly.

Signature:

Ensure the signature section includes the authorized signatory’s name, title, and date of signing. This validates the donation receipt.

-

Signatory: The donation receipt must be signed by a person with the proper authority within your organization, such as the Executive Director or Treasurer.

-

Printed Name: Beneath the signature, include the full name of the signatory to confirm their identity.

-

Title: List the signatory’s job title, such as “Executive Director” or “Finance Officer,” to establish their role within the organization.

-

Date: Include the date the receipt is signed. This provides a clear record of the donation acknowledgment.

With this information in place, the donation receipt is officially complete and can be used for the donor’s records.

- Signature of the authorized person at the organization (typically a representative or manager).

The signature of an authorized person on a donation receipt letter confirms the legitimacy of the document and the donation process. The person signing the letter must hold the authority to represent the organization–usually a manager, director, or other official with signing privileges. Their name and position should be clearly stated below the signature to provide context and ensure the letter is properly validated.

Who should sign?

Typically, this would be someone in a leadership role such as a CEO, executive director, or finance officer. The signature ensures that the donation was processed by the organization and signifies acknowledgment of the donor’s contribution.

Why is the signature necessary?

Including the authorized person’s signature lends credibility and assures the donor that the receipt is valid for tax purposes. This small yet crucial detail can prevent any potential issues with tax authorities or the donor’s records.

Make sure your donation receipt letter is clear and precise, especially when formatting the list of items or details related to the donation. A well-structured letter will build trust and ensure tax deduction eligibility. To properly close your list, use the correct HTML tags to maintain organization. For example, ensure that your list items end with the appropriate closing tags such as

. This guarantees the items are properly listed and visually aligned in the letter’s format.

How to Close Lists in HTML

When you are adding a list of items related to a donation, use the <ul> tag for unordered lists and <ol> for ordered lists. Each item inside the list should be wrapped in a <li> tag. Make sure that every opening <ul> has a matching closing tag </ul>, and the same applies to <li> tags–always close them with </li>. This ensures the list is presented correctly and the receipt is professionally formatted.

Example of a Simple Donation Receipt

Below is a simple example of a donation receipt in HTML format:

- Donation Date: January 25, 2025

- Donor Name: John Doe

- Amount: $500.00

- Purpose: General Fund

By using the correct HTML tags, your receipt will appear organized and easy to read. This can also help ensure that all the necessary details are present and properly formatted for tax purposes.

Key Components to Include in a Donation Receipt Letter

A donation receipt letter should clearly reflect specific information that confirms the contribution and meets tax requirements. Here’s what to include:

1. Donor’s Information

Start by listing the donor’s full name and contact details. This allows for easy identification of the donor and future correspondence. If the donation was made by an organization, include the organization’s name and its contact information.

2. Date of Donation

Record the exact date the donation was received. This is crucial for both your organization’s records and the donor’s tax filing purposes.

3. Donation Amount or Description

If the donation is monetary, specify the exact amount. For non-cash donations, provide a description of the items received. Avoid appraising the value of non-cash donations–this is the donor’s responsibility, but provide enough detail to support the valuation.

4. Statement of No Goods or Services Provided

If applicable, include a statement confirming that no goods or services were provided in exchange for the donation. This is required for tax purposes and simplifies the donor’s deduction process.

5. Acknowledgment of Tax-Exempt Status

If your organization is a registered tax-exempt entity, reference this status by including the organization’s tax-exempt number. This assures donors that their contributions are eligible for tax deductions.

6. A Personal Thank-You

Acknowledge the donor’s generosity with a personalized thank-you message. This fosters positive relations and makes the donor feel valued.

7. Organization’s Information

End the letter with your organization’s name, address, and contact information. Include your website if available. This helps the donor reach out for any further queries or follow-ups.

-

Donor Information:

Donor Information:

Accurate donor details are crucial for a transparent and legally compliant receipt. Ensure that you include the full name, address, and contact details of the donor. The donor’s information should be presented clearly at the top of the letter for easy reference.

Required Details

The following donor information must be provided:

| Donor’s Full Name | Enter the full legal name of the donor as it appears on their records or account. |

|---|---|

| Mailing Address | Include the donor’s address, with details such as street name, city, state, and ZIP code. |

| Contact Information | Phone number and email address should be listed for follow-up if needed. |

| Donation Date | Specify the date the donation was received. |

These details help verify the donation and maintain clear records for both the donor and the organization. Additionally, they support tax deduction claims for the donor.

Why Accurate Donor Information Matters

Having the donor’s correct information ensures smooth communication and allows the donor to receive the necessary documentation for their tax returns. This also builds trust and assures that your organization remains transparent in its operations.

- Donor’s full name and address.

Always include the donor’s full name and complete address. This helps to properly identify the individual and ensures that the donation receipt is valid for tax purposes. Make sure the address is accurate, as it will be used for future communication or mailings related to the donation. Double-check the spelling of the donor’s name and address to avoid any errors that might cause confusion. If the donor prefers to remain anonymous, you can list their name as “Anonymous” but still include an accurate address for record-keeping.

When creating a donation receipt letter template, ensure the structure is simple, clear, and easy for donors to understand. Organize the details logically and include all necessary information to comply with tax regulations.

Begin with a proper greeting and thank the donor for their contribution. Include the donation amount, type of gift (cash, check, property), and the date of the donation. Make sure to specify whether any goods or services were provided in exchange for the donation, as this will affect tax deductions.

Provide a clear breakdown of the donation in the receipt section, listing the total value and any specific instructions on how to report it for tax purposes. If applicable, include your nonprofit’s tax-exempt status number.

| Item | Description |

|---|---|

| Donor Name | Full name of the donor |

| Donation Amount | Amount donated (in dollars or other currency) |

| Donation Type | Cash, check, or in-kind donation (e.g., goods or services) |

| Donation Date | Date the donation was received |

| Nonprofit Tax ID | Tax-exempt identification number of the nonprofit |

Conclude the letter by thanking the donor once again and providing a contact number or email for any questions regarding the receipt or further assistance. A signature, whether digital or hand-signed, adds a personal touch to the receipt.

Organization Information:

Include your organization’s full name, mailing address, and tax identification number. This information should be prominently displayed at the top of the donation receipt to ensure clarity and professionalism.

Consider adding a brief description of the organization’s mission and purpose. This helps donors understand the impact of their contribution, and it creates a connection between them and your cause.

-

Full Organization Name: Clearly state the official name of your organization to avoid any confusion.

-

Mailing Address: Include a complete address where receipts can be sent or where your organization can be contacted. Make sure the address is up to date.

-

Tax Identification Number (TIN): Provide this number for tax purposes. It assures donors that the donation is eligible for tax deductions and makes the receipt valid for their records.

-

Website (optional): If your organization has a website, include the URL. This offers donors easy access to more information about your activities.

By clearly presenting this information, you demonstrate transparency and build trust with your supporters. This also streamlines the donation receipt process for future reference, whether for donors’ tax filings or your own administrative purposes.

- Name, address, and contact info of the organization.

Include your organization’s full name, address, and contact details at the top of the donation receipt. This provides transparency and ensures the donor can easily verify the organization they contributed to.

Organization Name

Use the official, registered name of the organization. This avoids any confusion and establishes your legal identity. Don’t abbreviate the name unless it’s widely recognized.

Organization Address

Provide the full address of your organization, including street, city, state, and ZIP code. This confirms your location and reassures donors of your legitimacy.

Contact Information

Make sure to list both phone and email contact details. This gives donors a way to get in touch if they have any follow-up questions or need clarification regarding their donation.

| Information | Example |

|---|---|

| Organization Name | Bright Future Foundation |

| Address | 456 Hope Street, Suite 200, Springfield, IL 62701 |

| Phone Number | (555) 987-6543 |

| Email Address | [email protected] |

Keep this information accurate and current. Providing clear and reliable contact info strengthens the relationship between the donor and your organization.

If your organization has tax-exempt status, include a clear statement in the donation receipt. This confirms to donors that their contributions may be eligible for tax deductions under applicable laws. Specify the tax-exempt status of the organization by citing the relevant section of the tax code, such as Section 501(c)(3) for U.S. charities, if applicable.

Provide the Tax-Exempt Identification Number

Include your organization’s tax-exempt identification number (EIN or similar), so donors can reference it when filing their taxes. This helps substantiate the claim that the donation is made to a qualified, tax-exempt organization.

Clarify the Nature of the Donation

Ensure the receipt specifies whether the donation was a monetary gift, in-kind contribution, or other type. This detail supports the donor’s ability to apply the correct tax treatment when claiming deductions.

Formatting Your Donation Receipt Letter:

Structure your donation receipt letter in a way that is both clear and concise. Here’s a simple guide on how to organize key information:

- Donor’s Information: Start by addressing the donor directly with their full name or organization name.

- Date of Donation: Clearly state the date on which the donation was received. This helps with record keeping for tax purposes.

- Amount or Description of Donation: Include the exact amount of the donation if it’s monetary or a description of donated goods or services. Specify if any goods or services were provided in exchange for the donation.

- Tax-Exempt Status: If applicable, remind the donor of the nonprofit’s tax-exempt status with the relevant IRS number for their records.

- Thank You Statement: Express appreciation for the donor’s contribution and its positive impact on your mission. Be sincere but succinct.

- Contact Information: Include your nonprofit’s contact information for any follow-up questions or clarifications.

By organizing your receipt clearly, donors can easily verify their contributions and maintain accurate tax records.

Donation Details:

Clearly outline the donation’s specifics, including the date, amount, and method of contribution. This helps both you and the donor keep accurate records. For cash donations, include the exact amount. For in-kind contributions, specify the items or services donated along with their approximate value.

Also, mention any recurring donations, such as monthly or yearly pledges. If applicable, indicate the frequency and duration of these contributions. Always note if the donation was made in honor or memory of someone to personalize the receipt and reflect the donor’s intent.

In case of corporate donations, include the company name and the person who made the contribution. If matching gifts were involved, document the matching amount and the organization involved.

- Donation date.

Clearly stating the donation date ensures both transparency and clarity for the donor and the receiving organization. Always specify the exact date when the donation was made. This helps track the timing of contributions and aligns with financial reporting standards for tax purposes.

Why is the Donation Date Important?

The donation date is required for accurate record-keeping. It determines the tax year for which the donation can be claimed and can also influence whether the donor receives credit for that year’s giving. This date establishes a clear and verifiable record for both parties.

How to Format the Donation Date

For consistency and accuracy, include the full date in the format “Month Day, Year” (e.g., January 15, 2025). Avoid abbreviating the month or using just the year, as it may cause confusion.

| Donation Date Format | Example |

|---|---|

| Month Day, Year | January 15, 2025 |

For cash donations, include the exact amount donated. If it’s an online donation, ensure that the transaction reference or confirmation number is also provided for verification purposes.

For non-cash donations, provide a detailed description of the items donated. This can include the type, condition, and purpose of the items. Be as specific as possible to give clarity about what was donated. Along with the description, include an estimated value for the items. This can be based on the fair market value at the time of the donation or a reasonable estimate. For example:

- Clothing: Gently used winter jackets, estimated value $150

- Electronics: Laptop, in working condition, estimated value $300

- Furniture: Wooden dining table, well-maintained, estimated value $200

If you’re uncertain about the value, consider consulting a professional appraiser, or refer to resources like online valuation tools or guides. It’s important that the estimated value reflects what an average buyer would pay for the item. This ensures that the receipt meets both your and the donor’s needs for accurate record-keeping and tax purposes.

Donation Receipt Letter Template

Provide a clear and accurate donation receipt to ensure proper acknowledgment and record-keeping for both parties. A well-structured donation receipt includes the following key elements:

- Donor’s Information: Include the donor’s full name, address, and contact details.

- Donation Details: State the amount of the donation, whether it’s cash or goods. If the donation involves goods, describe the items clearly.

- Organization’s Information: Include the nonprofit’s name, address, and tax identification number (TIN).

- Purpose of Donation: If relevant, specify the cause or project the donation supports.

- Date of Donation: Clearly list the exact date the donation was made.

- Non-Refundable Statement: Mention that the donation is non-refundable.

- Signature: Ensure the letter is signed by an authorized representative of the organization.

- Tax Deduction Statement: For donations eligible for tax deductions, add a statement confirming no goods or services were provided in exchange for the donation.

This concise format allows the donor to use the receipt for tax purposes while also acknowledging their contribution. Make sure to provide the letter promptly to maintain a positive relationship with supporters.

Statement of No Goods or Services Received:

Clearly state in your receipt if no goods or services were provided in exchange for the donation. This ensures transparency and compliance with tax regulations. For example, you can include a sentence like: “No goods or services were received in exchange for this donation.” This statement confirms that the donor is eligible to claim the full amount of their contribution as a charitable deduction. Keep this section simple and direct, avoiding any unnecessary details.

By providing a clear declaration of “no goods or services received,” you help the donor understand their tax benefits and maintain proper documentation for both parties. This also minimizes confusion during tax filing. Ensure that the wording is easy to read and unambiguous, as clarity is key for both compliance and donor understanding.

- A statement affirming the donor didn’t receive anything in return for the donation, which is essential for tax deduction purposes.

For tax deduction purposes, the donation receipt must clearly state that the donor received no goods or services in exchange for their contribution. This ensures the donor can claim the full value of the donation when filing taxes.

How to Phrase the Statement

- Use clear, direct language to explain that the donor’s contribution was entirely voluntary and without compensation.

- A simple example: “No goods or services were provided in exchange for this donation.”

- Ensure that the statement is placed prominently on the receipt to avoid confusion.

Why It Matters for Tax Deductions

- Without this affirmation, the IRS may consider the donation a payment for goods or services, disqualifying the donor from tax deductions.

- The donor must be able to prove that their gift was a charitable donation without any reciprocal benefit to maximize tax benefits.

Ensure the clarity of your donation receipt letter by structuring it logically. A well-organized letter provides the donor with all necessary details in an easily digestible format.

- Begin with the donor’s name, followed by a thank you message that is specific to their donation.

- Clearly state the donation amount or the item donated. Include the date of the donation for reference.

- Incorporate your organization’s name and contact information to ensure transparency and make it easy for the donor to follow up if needed.

- Provide a statement confirming that no goods or services were exchanged for the donation, or detail any benefits the donor might have received.

- Conclude with a message of appreciation that reflects the donor’s impact on your mission.

By following this structure, the donation receipt will be both informative and professional, offering a positive experience for the donor.

Tax Information:

Ensure accurate reporting of your donation for tax purposes. The donation receipt must include specific details to help donors claim deductions. This includes the charity’s name, address, and tax-exempt status number, along with a clear description of the donated items or monetary value.

For cash donations: The receipt should indicate the exact amount donated. If the donor receives any goods or services in exchange for their contribution, the value of those must be clearly stated. You should also note the fair market value of any benefits received.

For non-cash donations: Provide a description of the items, and, if possible, their estimated value. Donors should be aware that they are responsible for appraising the value of the non-cash donation, especially if it exceeds a certain threshold.

For donations exceeding $250: A written acknowledgment is required. This acknowledgment should state that no goods or services were provided in exchange for the donation or, if they were, their value.

Ensure clarity: Double-check that all information on the receipt is legible and precise to prevent any confusion when the donor files their taxes. This way, donors can confidently claim their deductions without facing issues during tax filing.

- The donor’s eligibility to deduct the contribution on their taxes (if applicable).

Donors may be eligible to deduct their contributions from taxable income if the receiving organization qualifies as a tax-exempt entity under IRS guidelines. To confirm eligibility, the donor should verify that the nonprofit has a 501(c)(3) status or equivalent, which allows donations to be tax-deductible. The donation receipt should specify the amount of the donation, the organization’s name, and their tax-exempt status.

If the donor receives any goods or services in exchange for their contribution, the amount eligible for deduction is reduced by the fair market value of the benefits received. The donor must retain this receipt for tax filing purposes, along with any other supporting documentation if the donation exceeds certain thresholds, such as $250. This threshold often requires a written acknowledgment from the nonprofit, which details the donation’s value and confirms no goods or services were exchanged.

For non-cash contributions, including property or goods, donors must be able to determine the fair market value of the item(s) donated. Special rules apply for donations of items worth over $500, requiring a detailed form (IRS Form 8283) to be submitted along with the tax return. Donations exceeding $5,000 in value generally require an independent appraisal to substantiate the claimed value.

Provide the organization’s EIN (Employer Identification Number) or tax ID number when issuing a donation receipt. This number is required for tax-exempt organizations in the United States to identify the organization for IRS reporting purposes.

Why is the EIN necessary?

The EIN allows both donors and organizations to track donations accurately and ensures proper documentation for tax deduction purposes. It links the donation to the correct organization, confirming its nonprofit status with the IRS. Donors can use this number when filing taxes to substantiate their charitable contributions.

Where to find the EIN?

- The EIN can usually be found on the organization’s official IRS letter of determination or IRS Form 990 filings.

- If not on the receipt, the EIN can also be located on the organization’s website or request it directly from the nonprofit.

Ensure that the EIN is clearly included in all donation receipts for transparency and compliance with IRS guidelines.

Best Practices for Crafting a Template Donation Receipt Letter

Make your donation receipt letter clear and straightforward. Focus on accuracy and brevity. Here’s how:

- Begin with a clear subject line: The donor should immediately recognize the purpose of the letter. Use something like “Donation Receipt for [Donor Name]” or “Thank You for Your Generous Donation.” This lets the reader know the letter’s purpose at a glance.

- Include the donation date: Clearly state when the donation was made, along with any relevant transaction number. This helps the donor for tax purposes and for their personal records.

- Detail the donation amount: Mention the exact value of the donation. If it’s a monetary contribution, specify the exact dollar amount. If it’s an in-kind donation, include a description of the item and an estimated value.

- State that the donation is tax-deductible: Let the donor know that their contribution is tax-deductible. This adds value to the receipt, especially for those who are seeking tax benefits.

- Include your nonprofit’s information: Provide the name of your nonprofit organization, its official address, and tax ID number. This ensures the donor can easily identify the organization for tax or legal purposes.

- Personalize the letter: While it’s a template, add a personal touch. Mention the donor’s name and acknowledge their specific contribution, showing that you truly appreciate their support.

- Clarify any non-cash donations: If the donor gave goods or services, provide a brief description of the items and estimate their value. Avoid providing specific values for services, as this could conflict with tax rules.

- Sign the letter: Make sure to include a personal signature from a representative of the nonprofit. This reinforces the authenticity of the receipt and demonstrates the organization’s gratitude.

- Double-check details: Before sending, review the letter for accuracy. Ensure all donation details and your nonprofit’s information are correct.

Examples of Donation Receipt Letter Templates for Different Donation Types

Examples of Donation Receipt Letter Templates for Different Donation Types

Here are specific donation receipt templates tailored to different types of contributions. Customize them to match your organization’s needs and provide accurate documentation for your donors.

Monetary Donations

- General Monetary Donation

- Donor’s Name: [Donor’s Name]

- Donation Amount: $[Amount]

- Date of Donation: [Date]

- Thank you for your generous donation. Your support helps fund [Specific Project or Cause].

- Recurring Monthly Donation

- Donor’s Name: [Donor’s Name]

- Monthly Donation Amount: $[Amount]

- Donation Start Date: [Start Date]

- Next Payment: [Date]

- We appreciate your continued support and commitment to [Cause]. Your contribution is making a difference.

In-Kind Donations

- Goods or Property Donation

- Donor’s Name: [Donor’s Name]

- Item(s) Donated: [Description of Items]

- Estimated Value: $[Value]

- Date of Donation: [Date]

- We are grateful for your donation of [Item(s)]. Your generosity supports [Cause].

- Volunteer Time Donation

- Donor’s Name: [Donor’s Name]

- Service Provided: [Description of Volunteer Work]

- Hours Donated: [Number of Hours]

- Date of Service: [Date]

- Thank you for contributing [X] hours of your time to help [Organization/Cause]. Your efforts are truly valued.

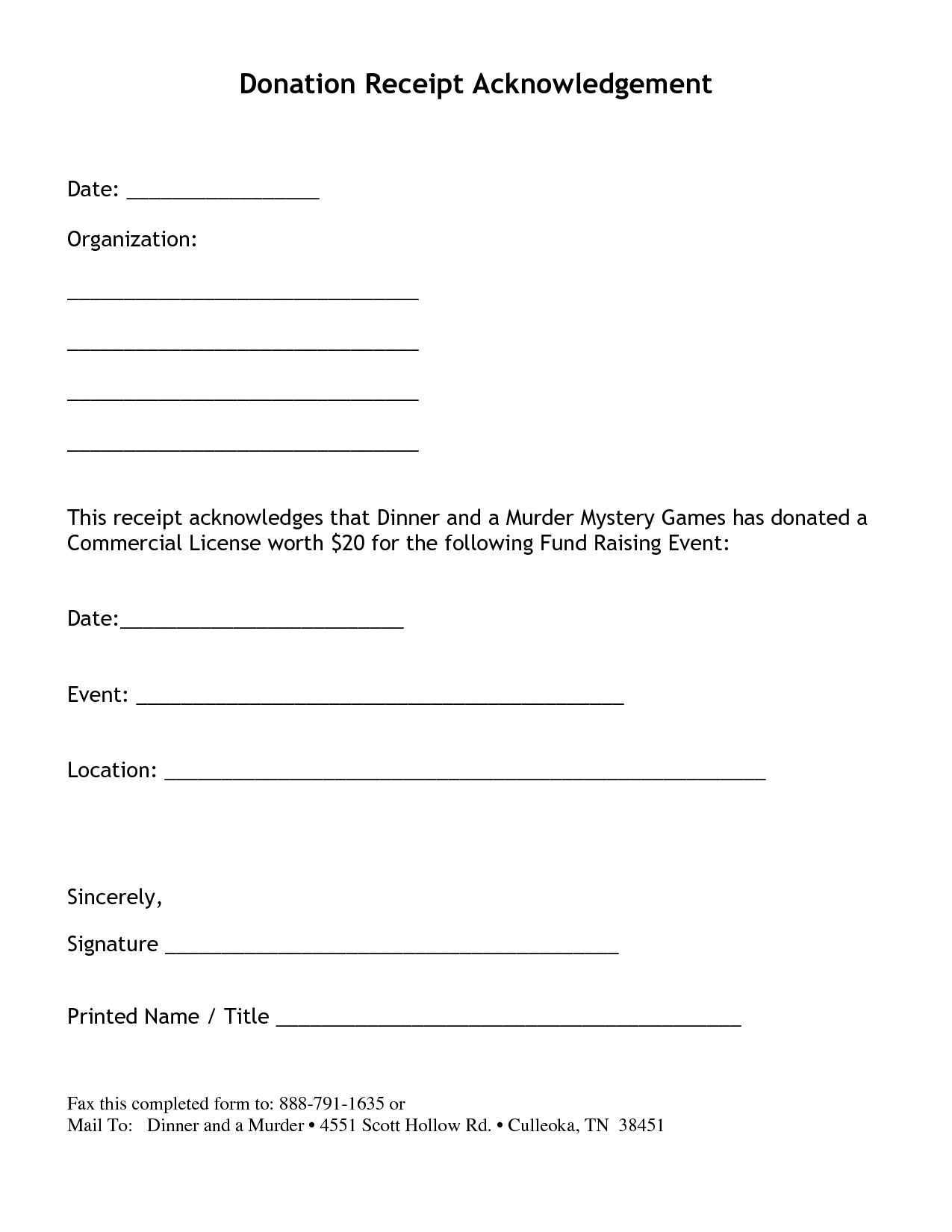

Event-Specific Donations

- Fundraising Event Contribution

- Donor’s Name: [Donor’s Name]

- Event Name: [Event Name]

- Donation Amount: $[Amount]

- Date of Event: [Date]

- Thank you for supporting [Event Name]. Your donation is making an impact on [Cause/Project].

- Ticket or Auction Item Donation

- Donor’s Name: [Donor’s Name]

- Item Donated: [Item or Service Donated]

- Estimated Value: $[Value]

- Event Date: [Date]

- Your contribution to [Event Name] is invaluable. We appreciate your generosity in supporting [Cause].

These templates serve as a guide for structuring your donation receipts. They help ensure accuracy, provide transparency, and maintain good relationships with your donors.

-

Cash Donation Template:

Cash Donation Template:

For a smooth and clear acknowledgment of a cash donation, use this template to ensure all necessary details are included. Keep it straightforward and polite to maintain transparency and build trust with the donor.

Template Example:

[Your Organization's Name] [Address] [City, State, ZIP] [Phone Number] [Email Address] [Date][Donor's Name][Donor's Address][City, State, ZIP]Dear [Donor's Name],Thank you for your generous donation of [$Amount] made on [Date]. Your support enables us to [mention the impact of the donation or the specific project supported]. We are grateful for your contribution, and it will go a long way in [briefly explain the use of the donation].This letter serves as a formal receipt for your cash donation. No goods or services were provided in exchange for this gift.Please keep this letter for your tax records. We appreciate your continued support!Warm regards,[Your Name][Your Title][Organization's Name]

Key Elements to Include:

- Organization Details: Always include your organization’s name, address, and contact information for easy reference.

- Donor’s Information: Make sure to address the donor properly and include their full name and address.

- Donation Amount and Date: Specify the exact cash amount donated and the date it was received.

- Purpose of Donation: Briefly mention what the donation will support, whether it’s a specific project or general funds.

- Tax Information: State that no goods or services were exchanged for the donation to clarify its tax-deductible status.

- Signature: Have a responsible person sign the receipt to give it official recognition.

[Organization Name]

[Organization Address]

[City, State, ZIP Code]

[Date]

Include the organization’s name, complete address, and the specific date on your donation receipt letter. This information provides a clear reference for both the organization and the donor. Make sure the address is current and accurate to avoid any confusion when processing or filing the receipt for tax purposes.

How to Format the Information

For clarity and professionalism, format your organization’s name and address in a straightforward way. The organization’s name should be in italics for a polished look. Ensure the address includes the full street name, city, state, and ZIP code, with no abbreviations. The date should reflect when the donation was received.

Example:

Sample Charity

123 Charity Lane

Big City, NY 10001

February 4, 2025

Keep this section clear and readable, especially for future reference or audits. It should be easy for the donor to find this key information quickly.

Dear [Donor’s Name],

We greatly appreciate your generous contribution to our cause. Your donation will make a significant difference and directly impact the success of our efforts. We want to acknowledge your support and express our deepest thanks.

Donation Details

Your contribution of $[amount] has been received on [date]. This donation will help us [specific purpose or project] and support our mission to [briefly describe the impact of the donation].

Next Steps

We will keep you updated on the progress and outcomes made possible by your support. Please feel free to reach out if you have any questions or would like more information about how your gift is being used. Your involvement is truly appreciated, and we look forward to keeping you engaged with our work.

Thank you once again for your generosity. Together, we are making a real impact.

Sincerely,

[Your Organization’s Name]

On behalf of [Organization Name], I would like to thank you for your generous donation of $[Amount], received on [Date]. We deeply appreciate your support in furthering our mission to [Mission Statement or Cause].

Your contribution plays a key role in helping us achieve our goals. With your support, we can make a meaningful difference in [specific area or community impact]. Your donation will be directed toward [specific program or initiative], allowing us to [specific action or outcome].

Please find below a summary of your donation for your records:

| Donation Date | Amount Donated | Purpose |

|---|---|---|

| [Date] | $[Amount] | [Program or Initiative] |

If you have any questions or need further information, don’t hesitate to reach out. We’re here to assist you in any way possible.

Once again, thank you for your generous support. We look forward to keeping you updated on the impact of your donation and the progress we are making together.

Please note that no goods or services were provided in exchange for this donation, and as such, it is fully deductible for tax purposes.

Donations made without receiving goods or services in return can be fully deducted when filing taxes. For accurate reporting, ensure you keep a record of the donation and this statement, as it confirms that no exchanges took place. This documentation serves as proof of your charitable contribution, which can be used during tax season.

Tax Deduction Details

The full value of your donation is eligible for a tax deduction. To claim this, ensure that the donation was made to a qualified organization. The IRS requires proof that no goods or services were provided in return for the gift. This ensures the full amount is deductible.

What You Should Keep

- A receipt or letter from the recipient organization confirming your donation.

- The value of the donation, including any details about the charitable organization.

- Clear indication that no goods or services were exchanged for the donation.

When preparing your taxes, include these details with your other charitable deductions to maximize your eligible deductions. Check with a tax professional if you have specific questions regarding your donation.

Thank you once again for your generous support.

Your contribution makes a significant impact on our ability to fulfill our mission and reach our goals. With your help, we are able to continue our work and provide essential resources to those who need them most.

Your donation is already at work, directly supporting our projects and initiatives. We are committed to using every dollar responsibly to maximize its benefit. You are part of a community dedicated to creating positive change, and we are excited to continue this work together.

If you would like to learn more about how your support is being utilized, please don’t hesitate to reach out. We are always happy to share updates and answer any questions you may have.

Your generosity does more than just provide funding; it sends a powerful message of hope and solidarity. Together, we are making a real difference, and we cannot thank you enough for your ongoing support.

Sincerely,

[Authorized Person’s Name]

[Title]

When closing a donation receipt letter, use a professional yet approachable sign-off. Clearly include the name and title of the authorized person who can validate the receipt. This adds legitimacy and personal accountability to the acknowledgment. Make sure the name is spelled correctly and the title is precise to avoid any confusion about the sender’s role or authority.

Why Include the Authorized Person’s Title?

Including the title adds clarity and shows the person’s role within the organization. This helps the donor understand who they are dealing with and assures them that their contribution is recognized by someone in a position of authority. This step enhances trust and transparency.

Best Practices for the Signature Line

Keep the sign-off short and professional. The authorized person’s name should be followed by their title to ensure proper identification. Avoid excessive titles or embellishments. If the letter is being sent electronically, a scanned signature is a nice touch to make it feel more personal and authentic.

Non-Cash Donation Template:

For non-cash donations, it’s crucial to provide detailed information on the items donated. This helps both the donor and the receiving organization maintain clear records. Below is a simple and direct template that can be used for this purpose:

Non-Cash Donation Receipt Example

Dear [Donor’s Name],

Thank you for your generous donation of non-cash items to [Organization’s Name]. Your contribution is greatly appreciated. Below is the list of items you donated:

- Item 1: [Description of the item] – Estimated Value: $[Amount]

- Item 2: [Description of the item] – Estimated Value: $[Amount]

- Item 3: [Description of the item] – Estimated Value: $[Amount]

Please note, the total estimated value of your donation is $[Total Amount]. This estimate is based on the fair market value of the items at the time of donation.

This receipt is being provided for tax purposes and should be kept for your records. We do not provide appraisals of non-cash items, but we recommend consulting a professional for accurate valuation if necessary.

Thank you again for your support. Your contribution helps us continue our work in [mention the organization’s cause or mission].

Sincerely,

[Your Name]

[Your Position]

[Organization’s Name]

[Organization’s Address]

[Organization Name]

[Organization Address]

[City, State, ZIP Code]

[Date]

Include the name and full address of your organization at the top of the donation receipt letter. This should be placed clearly to the left or centered at the top for easy identification. Using a clean and professional format helps the recipient quickly recognize the origin of the letter.

Example:

- [Organization Name]

- [Organization Address]

- [City, State, ZIP Code]

- [Date]

After providing the organization’s information, include the date of the donation receipt. This serves as a reference for both the donor and your organization for any future tax purposes. It’s critical to ensure this is up-to-date, as it directly correlates with the donation for record-keeping.

Ensure that both the name and address of the organization are written clearly. Any contact information, such as phone numbers or websites, can be added in a separate section, making it easy for the donor to reach out with any inquiries. This creates a simple and effective receipt that fulfills legal and organizational requirements.

Dear [Donor’s Name],

We are truly grateful for your generous contribution. Your donation of $[Amount] will directly support [specific program or project]. This support allows us to continue [specific activity or mission].

We have attached a receipt for your records. Below is a summary of your donation:

| Donor Name | Donation Amount | Date of Donation |

|---|---|---|

| [Donor’s Name] | $[Amount] | [Date] |

If you have any questions or require further information, please don’t hesitate to contact us at [contact details]. Thank you again for your incredible support.

Warm regards,

[Your Organization’s Name]

Thank you for your generous in-kind donation of [Description of Item(s)] received on [Date]. The estimated value of the donation is $[Value]. Your contribution will support our work in [Area or Program of Impact].

Your donation plays a significant role in helping us deliver [specific service, product, or support] to those in need. With your items, we can [describe the immediate impact or usage]. This is crucial for [specific program or purpose] and will directly contribute to [specific outcome].

Below is a summary of your donation:

| Item(s) | Estimated Value | Date Received |

|---|---|---|

| [Description of Item(s)] | $[Value] | [Date] |

We appreciate your support and trust in our mission. Please keep this letter for your records, as it serves as proof of your donation for tax purposes.

Should you have any questions or need further information, feel free to contact us at [Contact Information]. We look forward to continuing our work together.

No goods or services were provided in exchange for this gift, and it is tax-deductible as permitted by law.

Make it clear that the donation was made without the expectation of receiving anything in return. This statement is crucial for the donor to claim a tax deduction. Ensure that the donor understands the nature of their contribution and how it qualifies under the law. Specify that the gift is purely charitable, with no goods or services provided as part of the transaction.

Use this language to clarify that the donation is eligible for tax deduction, as allowed by the IRS or local tax regulations. This helps donors confidently report their gifts when filing taxes. Always include the relevant tax details to ensure compliance and offer clear guidance for future reference.

If the donation qualifies for tax deductions, include the necessary supporting details, such as the date of donation and the total amount, to facilitate accurate tax filing. Donors should keep a copy of the receipt for their records, and it’s helpful to outline any further instructions regarding how they can benefit from the deduction.

We are grateful for your support.

Your donation plays a critical role in our mission. It directly impacts the lives of those we serve, allowing us to continue our programs and reach more people in need. The time and effort you’ve dedicated to this cause do not go unnoticed, and we want you to know that your contribution is making a real difference.

We invite you to keep track of the results your donation helps achieve. Below is a breakdown of how the funds are being used to maximize impact:

| Program | Amount Allocated | Impact |

|---|---|---|

| Community Outreach | $500 | Supporting local initiatives that provide education and resources. |

| Health and Wellness | $300 | Providing healthcare services and medical supplies to underserved communities. |

| Research and Development | $200 | Funding new projects aimed at addressing pressing community challenges. |

With your generous support, we can continue to expand our reach and make meaningful improvements. We encourage you to stay connected with us and witness the ongoing progress. Your involvement is invaluable, and we are thankful to have you as part of our mission.

Sincerely,

[Authorized Person’s Name]

[Title]

Make sure that the closing section of your donation receipt letter is concise and professional. The sign-off conveys the organization’s gratitude and confirms the credibility of the document. Here’s how you can structure it:

1. Clear and Professional Signature

Conclude with a formal sign-off using the name and title of the authorized person. This ensures transparency and provides the recipient with contact information in case they have any follow-up questions. Use a polite, respectful tone that reinforces the professionalism of the letter.

2. Title Accuracy

Include the full title of the authorized person, whether they are a director, manager, or coordinator. This highlights their responsibility within the organization and emphasizes that the letter is official.

The closing line, “Sincerely,” is widely recognized for formal letters, making it a reliable choice for ending the document. It’s essential to use the exact name and title as listed in your organization’s records to maintain consistency and accuracy.

Donation Receipt Letter Template

Make the receipt clear and simple. Include the donor’s full name, the donation amount, and the date of the donation. This helps the donor quickly locate the important information. Add your organization’s name, address, and tax ID number for legitimacy. If the donation is in kind (goods or services), describe the items or services donated, along with their estimated value.