A well-structured bail bond receipt ensures clarity for both the bail bond agent and the payer. It must include essential details such as the amount paid, payment method, and the parties involved. Without these key elements, disputes or misunderstandings can arise.

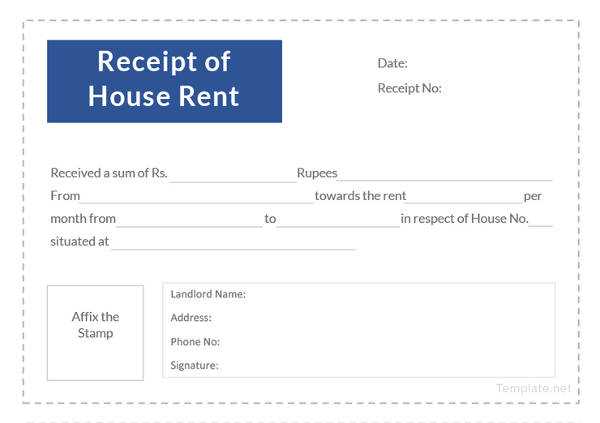

Clearly state the defendant’s name, the case number, and the payment breakdown. Indicate whether the payment is partial or covers the full bond amount. If applicable, include any fees or collateral provided.

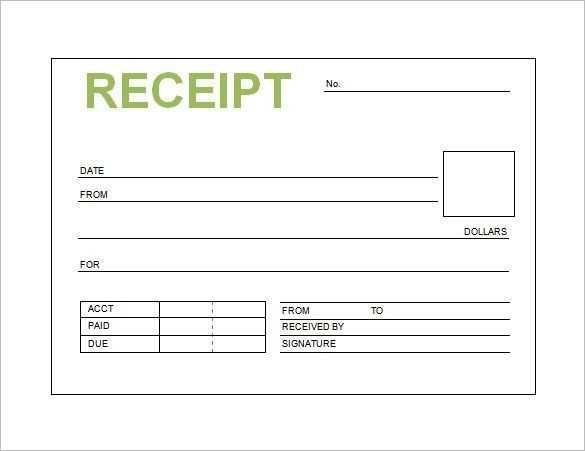

Use a standard format that includes the date of issuance, the bond agent’s information, and a signature section. A professional layout makes it easier for all parties to reference the document when needed.

Providing a detailed and organized receipt not only enhances transparency but also serves as a critical record for future reference. Accuracy in documenting payments protects both the agency and the client.

Here’s the revised version with repetitions removed while preserving meaning:

Use a clear and structured bail bond receipt template to ensure transparency and accuracy. Below is a detailed format with essential fields:

| Payer Name | Bond Amount | Payment Method | Date Issued | Receipt Number |

|---|---|---|---|---|

| John Doe | $5,000 | Credit Card | 07/15/2025 | BBR-20250715-001 |

Key Information

- Defendant Name: Include the full legal name.

- Case Number: Reference for tracking purposes.

- Bail Agent Details: Business name, license number, and contact.

- Payment Confirmation: Clearly state the amount received and any outstanding balance.

Final Steps

Verify all details before issuing the receipt. Provide copies to the payer and retain records for compliance.

- Bail Bond Receipt Template

A well-structured bail bond receipt ensures transparency and legal clarity. The document must include the defendant’s full name, case number, bond amount, payment method, and issuing agent’s details. Without these elements, disputes may arise.

Key Components

- Receipt Number: A unique identifier for tracking.

- Defendant Information: Full name and case reference.

- Bond Details: Amount paid, outstanding balance, and due dates.

- Payment Method: Cash, credit, or collateral details.

- Issuer’s Signature: Verification by the bondsman or agency.

Best Practices

Use a standardized format to prevent errors. Ensure all parties receive copies and store digital backups for security. Double-check legal requirements in your jurisdiction to maintain compliance.

Ensure the receipt covers all necessary details to prevent disputes and provide clear records. Each section should be precise and well-structured.

Payer and Payee Information

- Full Names: Clearly list both parties involved.

- Contact Details: Include phone numbers and addresses for verification.

- Identification Numbers: Add relevant license or bond numbers.

Payment Details

- Amount Paid: Specify the exact sum received.

- Payment Method: Indicate whether the transaction was in cash, card, or check.

- Transaction Date: Record the exact date and time of payment.

Include a unique receipt number to track transactions efficiently. Ensure the document is signed by both parties for validation.

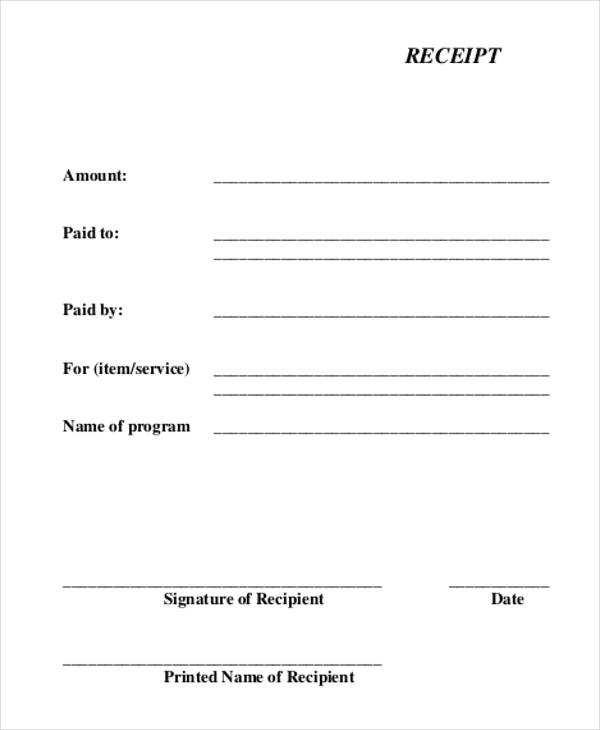

Ensure that every receipt includes the full name of the individual making the payment, the exact amount paid, and the method of payment. Missing any of these details can lead to disputes and legal issues.

Mandatory Information

Include the date and time of the transaction, the case or reference number, and the name of the issuing agency. Each document must also specify whether the payment is refundable or non-refundable, preventing confusion in future proceedings.

Compliance and Verification

Use legally recognized formatting, including official letterhead and authorized signatures. Retain copies for record-keeping, as regulatory bodies may require verification. Always verify state-specific requirements, as regulations vary.

Use a clear, legible font like Arial or Times New Roman at 12-14 pt for readability. Align text to the left and maintain consistent spacing between sections to improve structure.

Key Sections

Organize information into logical sections, ensuring all relevant details are easy to locate. Below is a recommended format:

| Section | Details |

|---|---|

| Receipt Number | Unique identifier for tracking |

| Date | Issued date in MM/DD/YYYY format |

| Payer Information | Full name and contact details |

| Payment Amount | Exact amount received, written numerically and in words |

| Authorized Signature | Signature of issuing agent |

Spacing and Alignment

Ensure sufficient white space between sections to avoid clutter. Use bold text for headers and labels to improve clarity. Keep margins uniform for a balanced layout.

Ensure all required fields are filled accurately. Missing or incorrect details, like names, dates, or amounts, can lead to delays or complications. Double-check the bond amount to match what’s listed in the receipt. Even small discrepancies can cause issues with processing.

Inaccurate Dates

Verify that all dates, including arrest and bond dates, are correct. Incorrect dates may raise questions about the bond’s validity. Always cross-check the information with official documents to avoid confusion.

Unclear Payment Methods

Clearly specify the payment method used for the bond transaction. Ambiguous payment details, like cash or card, may not provide enough evidence of the transaction. If possible, include a receipt or confirmation for added clarity.

Digital receipts offer instant access and easy sharing, which is highly convenient for those who need to track payments remotely. These can be stored securely on devices or cloud storage, reducing the risk of physical damage or loss. However, digital versions require internet access and may face compatibility issues with certain devices or file formats.

On the other hand, paper receipts are tangible and do not rely on technology. For some, having a physical copy makes tracking expenses and providing proof of payment more straightforward. However, paper receipts can easily be lost, damaged, or misplaced. Storing paper copies takes up physical space, and the environmental impact of printing can add up.

Advantages of Digital Receipts

Digital receipts are convenient for on-the-go tracking and organizing. They can be easily searched and categorized in file systems, making it faster to find specific documents. Many online platforms or apps allow you to automatically receive these receipts, reducing the need for manual entry or storage.

Benefits of Paper Receipts

Paper receipts offer reliability without depending on devices or networks. This can be especially useful in situations where digital access might be unavailable, such as during travel or in areas with poor connectivity. For those less comfortable with technology, paper receipts can feel more tangible and manageable.

Adjusting a bail bond receipt for specific jurisdictions ensures compliance with local laws and regulations. Each jurisdiction has unique requirements regarding bail procedures, fees, and documentation. Customize your receipt by including the appropriate details based on local guidelines.

Include Jurisdiction-Specific Information

Local courts may require specific wording, such as case number formats, jurisdictional identifiers, or relevant statutes. Ensure the receipt includes these details for proper recognition and legitimacy.

Adjust Payment Terms and Fees

- Include any local taxes or fees specific to the area.

- Verify if there are any differences in payment methods accepted or any additional charges for processing bail.

By tailoring your receipt, you minimize the risk of errors or challenges to the bail bond’s validity. Ensure you stay updated on any changes to local laws to maintain compliance at all times.

When creating a bail bond receipt template, it’s important to structure it clearly. Ensure all necessary details are included for both the payer and the agency. Here’s a recommended layout for an effective receipt:

- Date: Include the exact date of the transaction.

- Receipt Number: A unique identifier for easy reference.

- Payer’s Information: Name and contact details of the person paying the bail.

- Bond Amount: Clearly state the total amount paid for the bail.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, etc.).

- Agency Details: Include the name, address, and contact information of the agency issuing the receipt.

- Signature: A space for both the payer and agency representative’s signatures.

- Additional Notes: Any relevant notes or terms regarding the bond.

Using this structure will ensure the receipt is both professional and easy to understand, minimizing confusion for both parties involved.