Use a clear, structured receipt template to keep your workshop transactions organized. A well-designed receipt provides essential details like service descriptions, costs, and payment methods, helping both business owners and customers track expenses and warranties. Whether you’re running a car repair shop, a woodworking studio, or an electronics service center, having a standardized receipt format ensures transparency and professionalism.

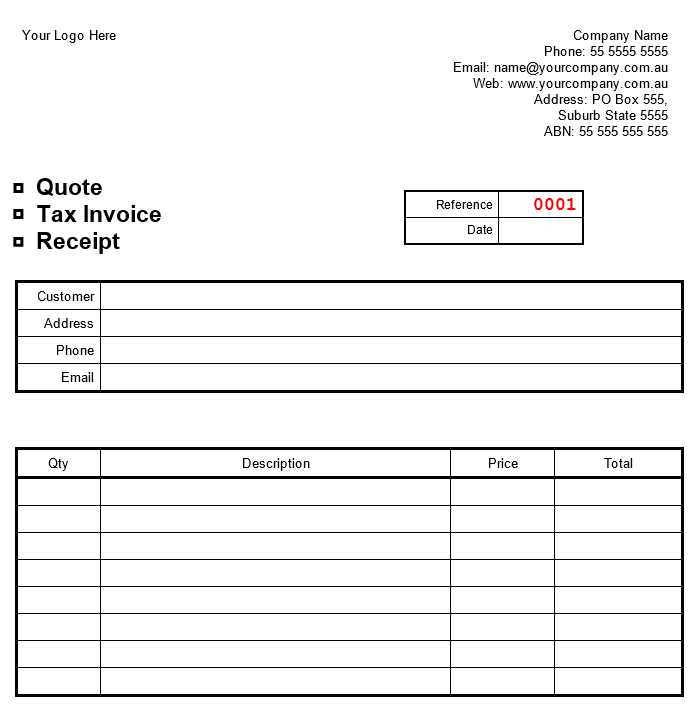

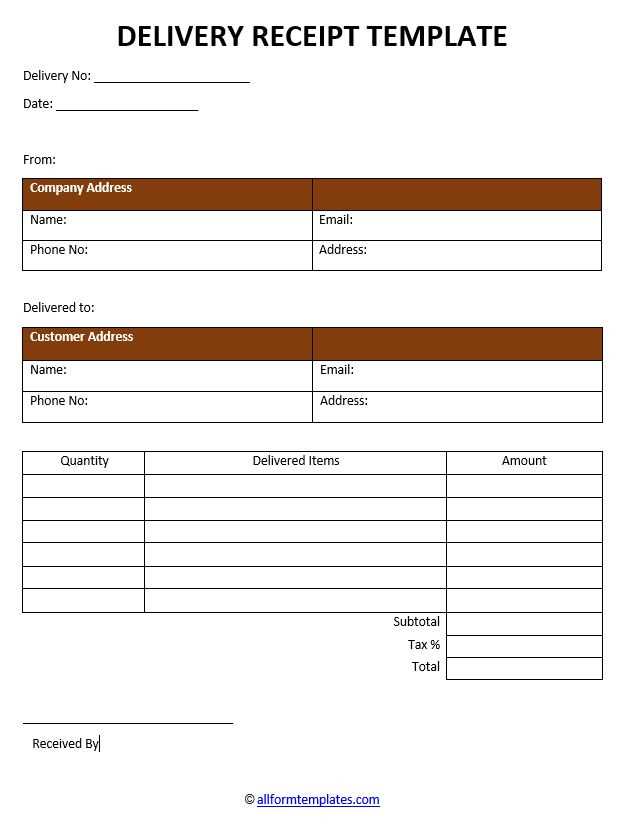

Key elements to include: Business name, contact details, receipt number, date, itemized services, pricing, taxes, total amount, payment method, and terms. A clear layout improves readability and minimizes disputes over charges. Digital templates with auto-calculation features can further simplify the process.

Paper vs. digital receipts: While printed receipts remain useful for in-person transactions, digital receipts reduce paperwork and enhance record-keeping. Many workshop management systems offer integrated receipt generation, streamlining invoicing and financial tracking.

Explore different templates to find one that fits your workshop’s needs. Customizable formats allow you to add branding elements, disclaimers, or warranty terms, making receipts more informative and professional.

Here’s the corrected version with redundancies removed:

When creating workshop receipt templates, clarity and conciseness should be your top priority. Avoid including duplicate fields or information that the customer can easily infer from the context. Keep the layout simple and intuitive for both the customer and your team.

Key Changes:

- Streamlined Information: Ensure the receipt contains only essential details such as services provided, parts used, and total cost. Remove any repetitive sections like redundant service descriptions.

- Improved Structure: Organize sections logically, with clear headings for each part of the service–e.g., parts, labor, taxes, and total amount due.

- Clear Formatting: Make use of bold text for important figures like total cost, ensuring they stand out immediately for easy reference.

Final Tips:

- Use bullet points or numbered lists for easier readability.

- Avoid technical jargon that may confuse customers; use simple language.

- Make sure to leave space for custom notes or additional charges if necessary.

- Workshop Receipt Templates: Practical Guide

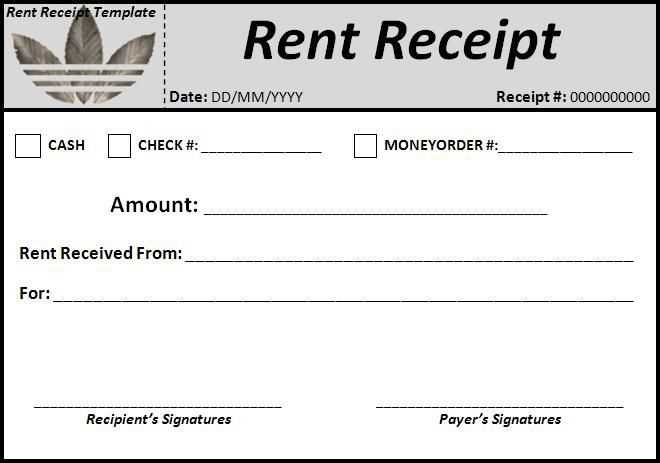

Choose a template that suits your workshop’s needs. Keep it simple and clear, ensuring all necessary details are included. A basic template should contain the workshop’s name, address, and contact information, along with the customer’s name, the date of service, and an itemized list of work performed.

Make sure to include the cost of labor and parts, and clearly indicate any taxes or discounts applied. A breakdown of these elements ensures transparency and avoids confusion. You can also include a warranty section for parts and services to help manage customer expectations.

Consider incorporating a payment section where the total amount due is clearly stated. This section should specify the payment method and due date to prevent misunderstandings.

If your workshop provides a repeat service, add a reminder for the next scheduled appointment or follow-up, making the receipt more functional. Customizing the design with your workshop’s logo and brand colors can also improve the professional look and feel of the receipt.

Lastly, keep a digital copy of the receipt for record-keeping and future reference. Many templates allow you to store receipts electronically, which is helpful for tracking payments and managing accounting.

Include the business name, address, and contact details at the top of the receipt. This ensures customers know where the transaction took place and how to reach the company if needed.

Next, add a clear and unique receipt or transaction number for reference. This allows both parties to easily track and confirm the transaction in the future.

List the date and time of the transaction to establish a clear timeline of when the purchase occurred. This helps avoid confusion and serves as proof of purchase.

Provide a detailed breakdown of products or services sold, including quantities, descriptions, and prices. This helps customers understand exactly what they are paying for.

Clearly display the total amount paid, including applicable taxes or fees. This eliminates any ambiguity about the final cost.

If applicable, include payment method details, such as credit card type or cash payment, along with the transaction’s authorization code if available.

For warranty or return purposes, include relevant information about return policies or service agreements to ensure transparency and clarity for the customer.

Use a clear and straightforward format for your receipt to avoid confusion and make it easy to read. Start with the most important details, such as the date, transaction number, and service provided. This ensures quick reference when needed.

Consider Space and Layout

Organize the information logically. Keep it concise by aligning key sections like items, prices, and taxes in a neat, easy-to-follow order. A cluttered layout makes details harder to find, while a clean structure helps customers quickly understand their purchases.

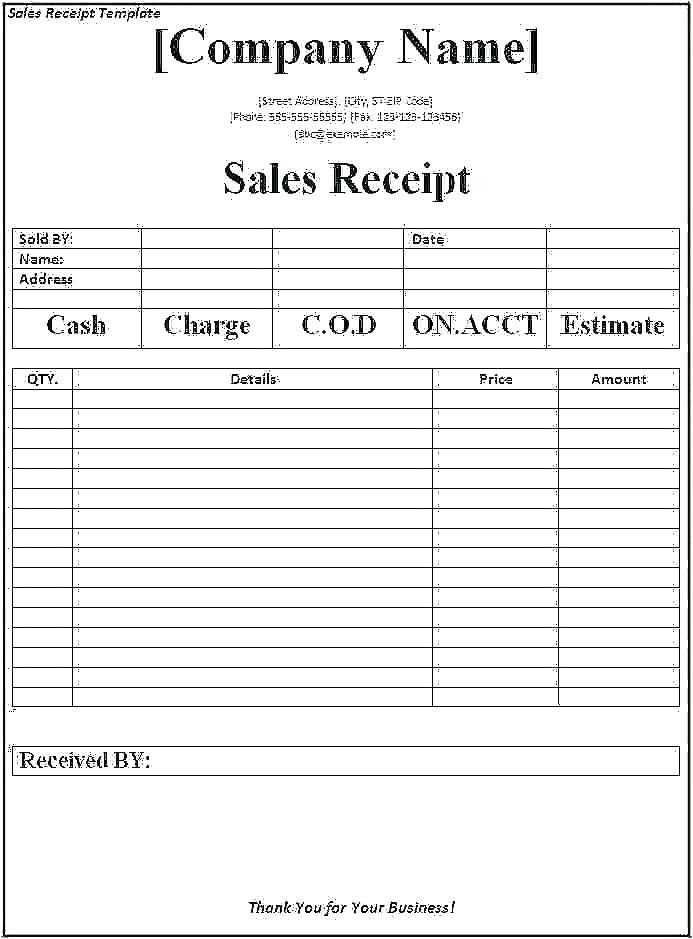

Tailor Your Format for Your Business Type

Adjust the receipt’s structure based on the nature of your business. For example, a mechanic’s shop might include labor charges and parts separately, while a coffee shop receipt should focus more on product names and quantities. Customizing the format ensures that customers see the most relevant information first.

Choosing the right format can improve your receipt’s clarity, avoid confusion, and enhance the customer experience. A good receipt format saves time for both you and your clients.

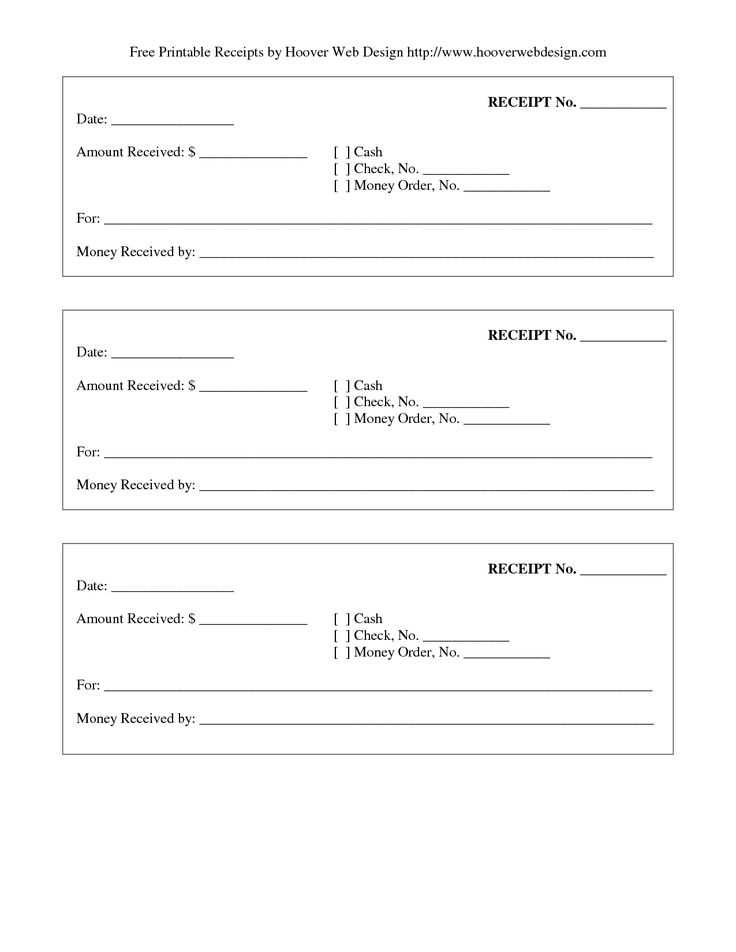

Printable templates offer the advantage of a physical copy that can be handed to customers or kept in a file for future reference. They are ideal when a signature or handwritten note is required. Simply print and fill out the necessary information, making it easy to have a tangible record. However, you’ll need to ensure you have a reliable printer and paper stock, which could add costs over time.

Digital templates are more versatile and convenient. They can be filled out and sent via email or stored digitally for easy access. Digital templates can be easily edited or updated, which eliminates the need for reprints. Many software tools allow you to create or customize templates with automatic calculations, reducing manual work. While digital templates can be used on any device, they do require some form of software or app for editing, which could be a barrier for those less tech-savvy.

Both options have their place. For workshops needing a fast, simple, and paperless solution, digital templates are often the way to go. On the other hand, if a more traditional or formal approach is needed, especially for legal or personal documents, printed templates may be the better choice.

One common mistake is failing to include all necessary details. Every receipt must have a clear breakdown of products or services provided, including quantity, description, price, and applicable taxes. Missing any of these details can lead to confusion and disputes later.

Another issue is incorrect or inconsistent formatting. Ensure that the layout is clean and easy to read, with each section clearly separated. Inconsistent fonts, sizes, or poorly aligned data can make the receipt harder to interpret and less professional.

Key Elements to Include:

| Element | Description |

|---|---|

| Business Information | Company name, address, and contact info |

| Receipt Number | A unique identifier for tracking purposes |

| Transaction Date | When the purchase or service occurred |

| Itemized List | Descriptions of the items or services purchased, with prices |

| Taxes | Applicable tax rates and amounts |

| Total Amount | The final sum to be paid, including tax |

Inaccurate Tax Calculations

Calculating taxes correctly is crucial. Incorrect tax rates or failing to apply the right tax percentage can lead to financial discrepancies. Double-check the tax laws applicable to your business location to avoid this mistake.

Lastly, don’t forget to include a clear payment method. Whether the customer paid by credit card, cash, or another method, this detail can resolve any potential questions about the transaction later on. Not specifying this might lead to confusion if a refund or dispute arises.

Workshops specializing in auto repair, electronics, or woodwork each have unique needs when it comes to receipt templates. Tailoring the format and content of receipts to match these specialties helps improve clarity and accuracy for both customers and business owners.

For auto repair shops, include fields for part numbers, labor costs, vehicle details, and warranty information. Customizing templates to list common services such as oil changes, tire rotations, or diagnostics will speed up the process and ensure all necessary details are captured. Make sure the template supports integrating invoicing software, allowing for seamless record keeping.

In electronics repair workshops, focus on detailing the specific model and serial number of devices, along with an itemized list of parts replaced. Providing a clear breakdown of service charges versus parts costs helps build trust with customers. Optionally, add space for repair notes, expected lifespan of repairs, or maintenance recommendations for future reference.

For woodworking or craft workshops, receipts should feature detailed descriptions of materials used (such as wood type, dimensions, and finish) along with labor hours. A customizable option for noting special requests or custom orders is valuable for personalized projects. Keep the design clear and simple, with a focus on the type of wood and any finishing work done.

All receipt templates should offer customization for adding company branding, contact information, and payment details. Offering digital or printed receipts gives customers flexibility in how they manage their purchases. Additionally, ensure that templates support multiple languages if needed to accommodate diverse customer bases.

Ensure your receipts meet legal and tax requirements by including specific information. First, make sure to provide your business’s name, address, and contact details. This data is necessary for tax reporting and legal verification. Next, include the date of the transaction and the itemized list of services or products provided. This breakdown allows for accurate financial records and supports tax deductions.

Tax Reporting Requirements

Receipts play a significant role in tax audits. The IRS or local tax authorities may request receipts to verify business expenses and income. For businesses, it’s important to keep records for a minimum of 3 to 7 years, depending on your jurisdiction. The receipt should clearly display the amount paid, applicable taxes, and the total cost of the transaction.

Local Legal Compliance

Some regions may require additional details on receipts, such as a business license number or VAT registration number. Familiarize yourself with your local tax laws to ensure your receipts are compliant. For example, in the EU, including VAT information is mandatory for all business transactions. In the U.S., sales tax must be shown for taxable items or services.

- Include business name, address, and contact info.

- Provide transaction date and itemized services/products.

- Ensure sales tax or VAT is clearly listed.

- Follow local regulations for specific details required.

Lastly, always use clear, readable fonts and proper formatting for receipts. Misleading or unclear receipts can lead to disputes or tax penalties. Keeping a professional, consistent format is not only helpful for tax filings but also builds trust with your customers.

Streamline Workshop Receipt Templates

Reduce repetition of the terms Workshop and Receipt while keeping the meaning clear. This can be done by varying phrasing and removing redundancies. For example, use “workshop invoice” or simply “invoice” where context allows, and substitute “receipt” with “proof of payment” when relevant. By incorporating synonyms and restructuring sentences, the text becomes more concise without losing its intent.

Key Tips for Compact Templates

For maximum clarity and efficiency, break down the essential information in a straightforward format. Include workshop details, service descriptions, payment method, and date in a simple, easy-to-read structure. Avoid unnecessary filler text, and focus on clear headings for each section. Keep it all organized with bullet points or numbered lists for better readability.