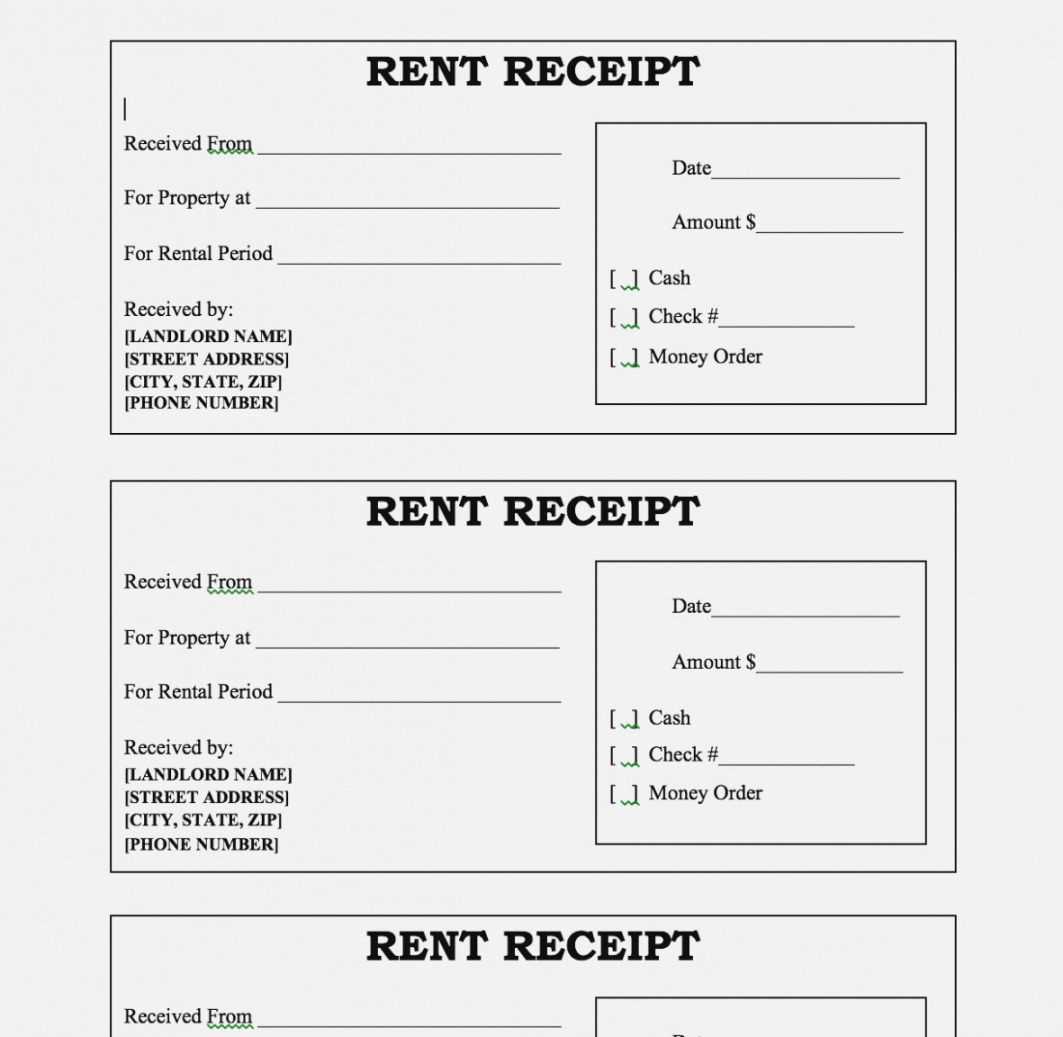

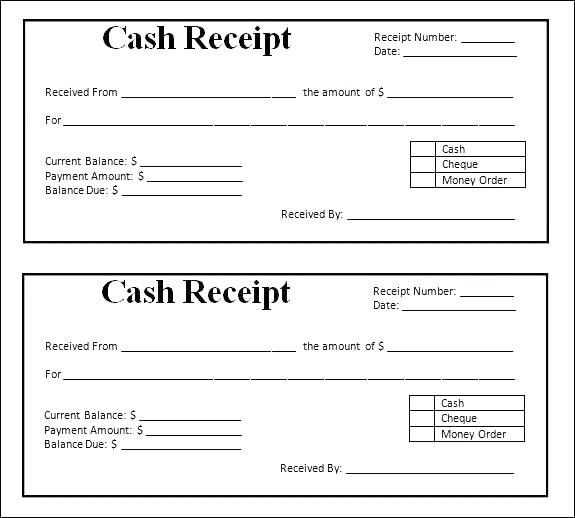

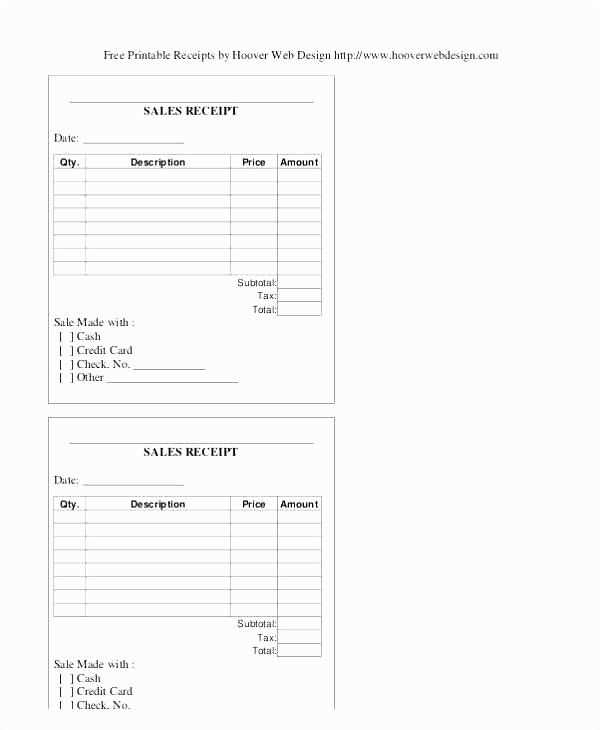

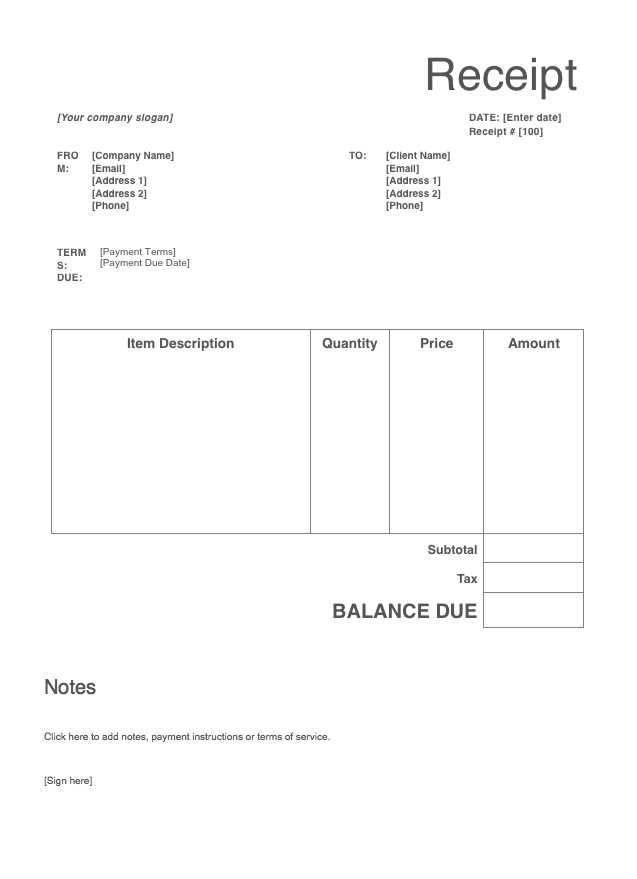

Download a Ready-to-Use Template

Save time by using a pre-formatted receipt template. A structured PDF ensures accurate record-keeping and a professional appearance. Choose a layout that includes:

- Seller and buyer details

- Transaction date

- Itemized list with pricing

- Taxes and total amount

- Payment method

Many free options are available online, or you can create a custom version using document editors.

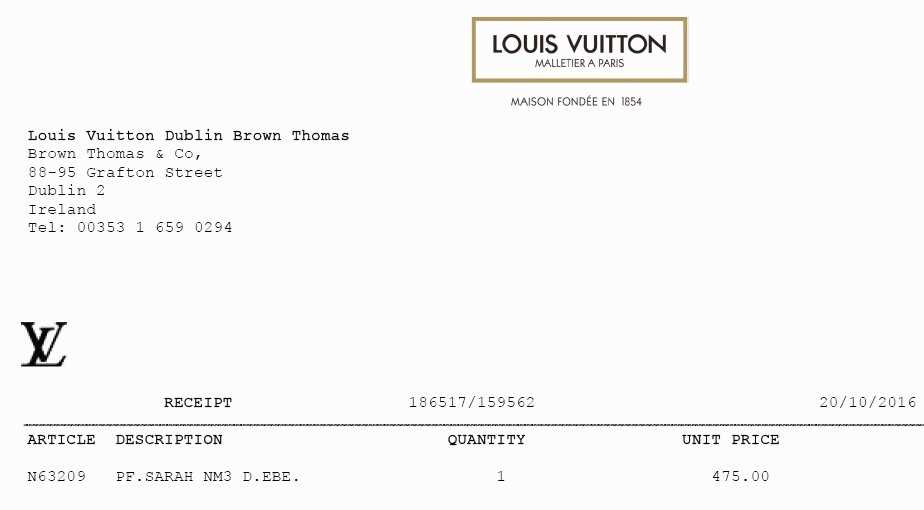

Customize for Your Business

Modify the template to match branding and legal requirements. Include a business logo, specific disclaimers, or additional fields for tracking purposes. Editing tools like Adobe Acrobat, Word, or Google Docs allow for quick adjustments.

Adding Digital Signatures

For added security, integrate a digital signature field. This confirms authenticity and prevents unauthorized modifications.

Automating Receipt Generation

Use invoicing software or apps that automatically generate PDF receipts based on sales data. This eliminates manual input and reduces errors.

Ensuring Compliance

Check local tax regulations to include necessary details, such as VAT or sales tax numbers. A well-structured receipt protects both the seller and buyer in case of disputes.

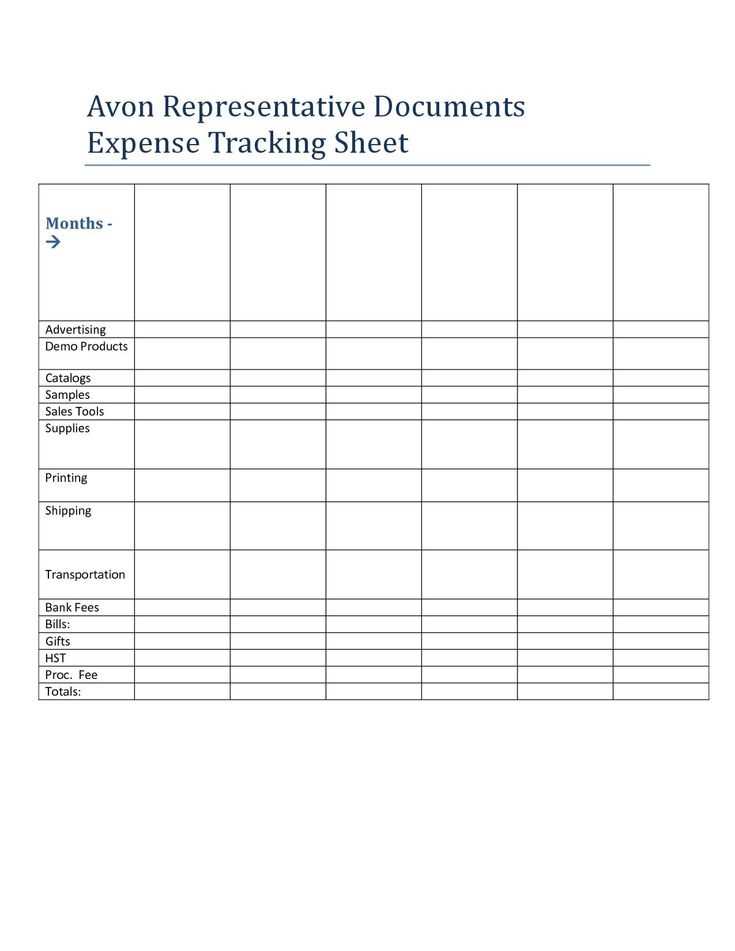

Avon Receipt Template PDF

Find a ready-to-use Avon receipt form in PDF format on official websites, business resource platforms, or invoice template libraries. Many online tools offer free and paid options, allowing customization to match specific business needs.

Modify an invoice to suit your brand by adjusting the layout, adding a logo, and including relevant details like tax information, payment terms, and product descriptions. Use PDF editing software or online services for quick modifications.

Ensure receipts are saved properly by selecting “Print to PDF” or using accounting software that exports transaction records. Organizing digital copies helps track sales and simplifies tax reporting.

Include key sections such as date, transaction ID, customer details, purchased items, subtotal, taxes, and total amount. Clear formatting enhances readability and prevents misunderstandings.

Resolve common receipt issues like missing data, incorrect calculations, or formatting errors by double-checking inputs before saving. Automated tools help reduce mistakes and improve accuracy.

Follow legal guidelines by verifying that receipt templates comply with tax laws and business regulations. Consulting a financial expert ensures correct record-keeping and prevents potential disputes.