When selling personal items in Australia, a well-structured receipt protects both buyer and seller. A private sale receipt should include clear details of the transaction, such as the names of both parties, date of sale, item description, and the amount paid. While not legally required in all cases, a written receipt serves as proof of purchase and can help resolve disputes.

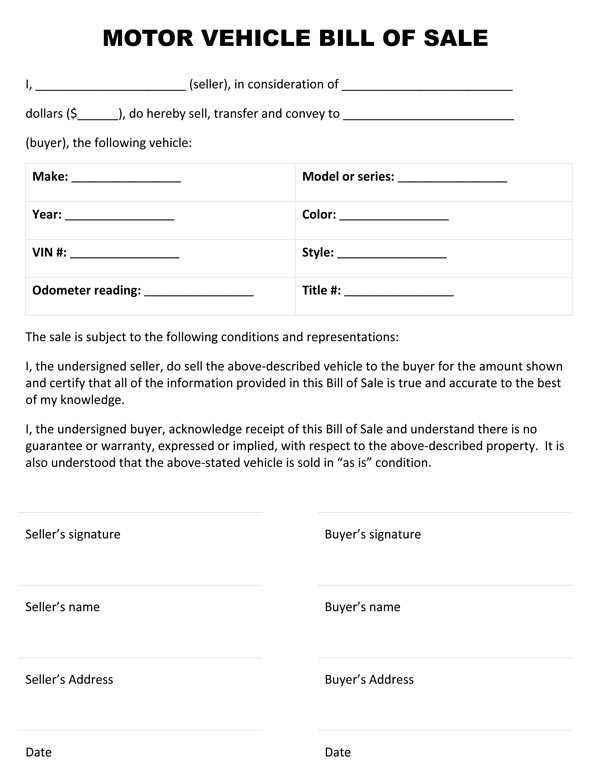

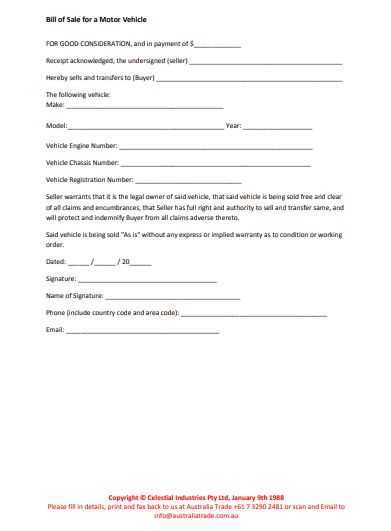

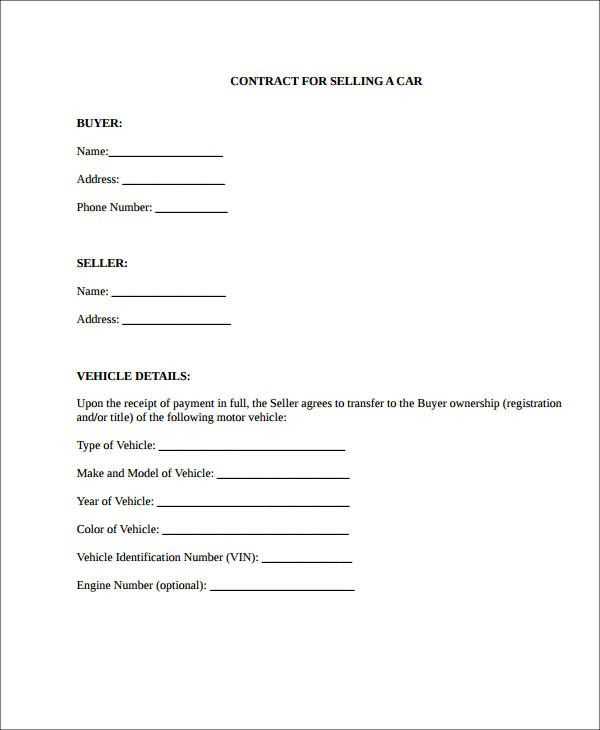

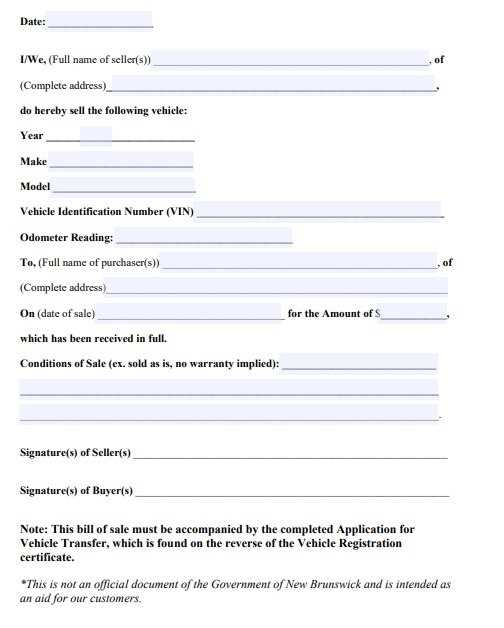

For a legally sound receipt, include the full name and contact details of both parties. If selling a vehicle, add the registration number, VIN, and odometer reading. For high-value items like electronics or jewelry, note the serial number and condition at the time of sale.

Cash transactions should specify the payment method, and if paid via bank transfer, include a reference number. A simple statement confirming that the item is sold “as is” can clarify liability, especially in second-hand sales. Both parties should sign the receipt, and each should keep a copy.

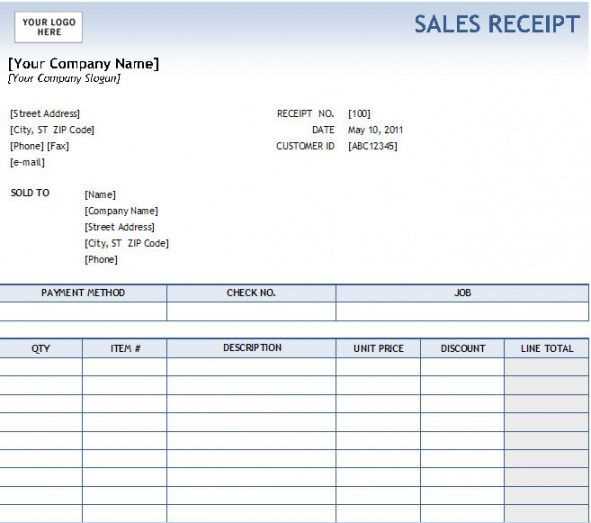

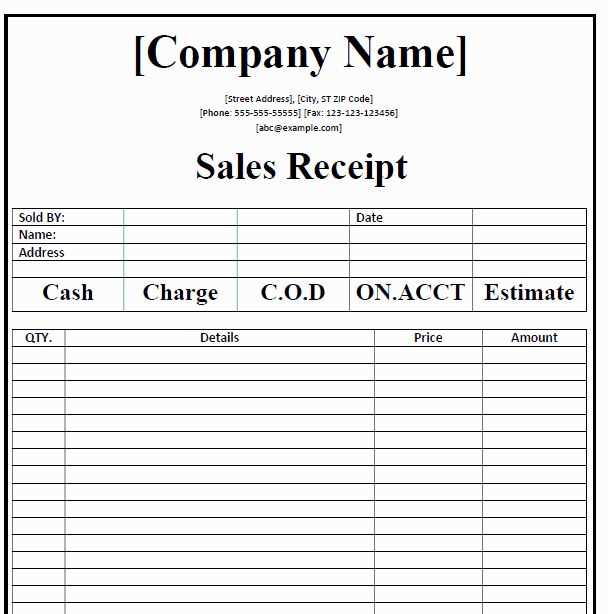

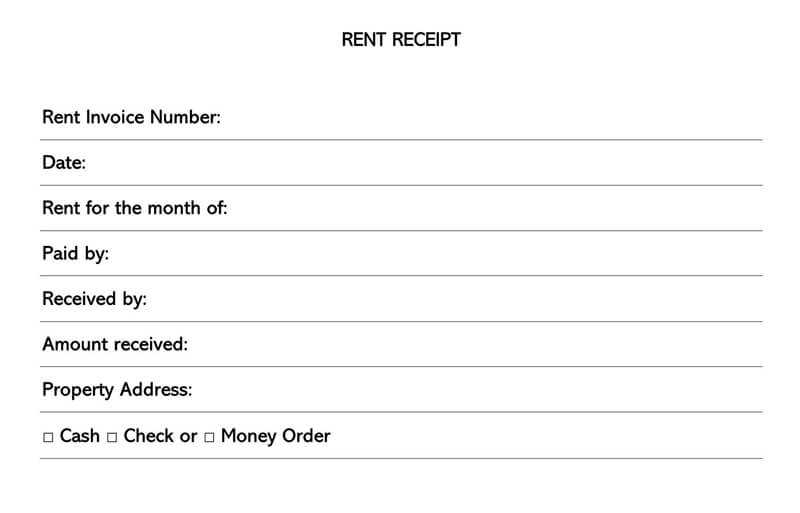

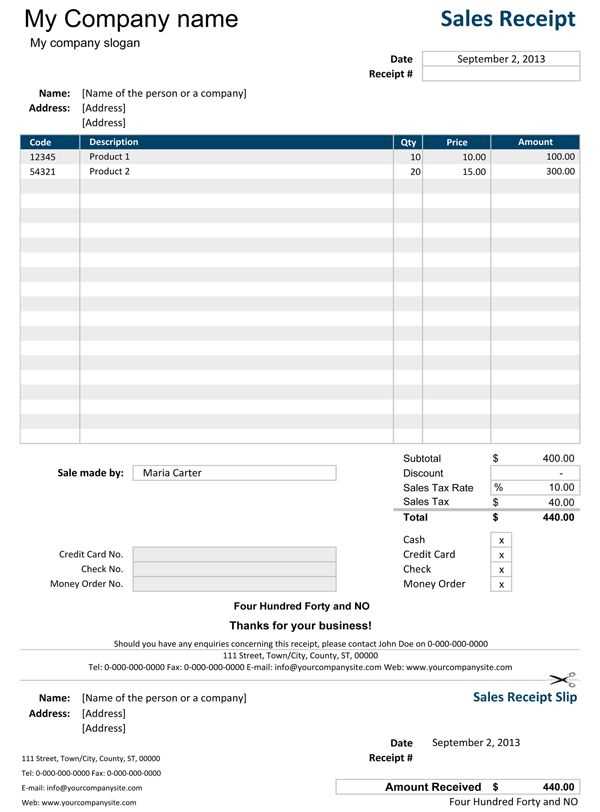

Below is a downloadable template you can customize for your private sale in Australia. Ensuring all necessary details are included can provide peace of mind and legal clarity.

Here’s the corrected version without unnecessary repetition of words:

To create a private sale receipt template in Australia, ensure it covers all required legal aspects. This template should include the seller and buyer’s details, the property or item being sold, the sale price, and the date of the transaction. Here’s a streamlined approach to include the necessary components:

Key Details for a Private Sale Receipt

- Seller’s Information: Name, address, and contact details.

- Buyer’s Information: Name, address, and contact details.

- Description of the Item or Property: Provide a clear description of the property or item sold, including its condition if applicable.

- Sale Price: The agreed price between both parties.

- Date of Transaction: The exact date when the sale occurred.

Other Relevant Information

- Payment Method: Mention how the payment was made (e.g., bank transfer, cash, etc.).

- Signatures: Both the buyer and seller should sign the document to confirm the transaction.

- Witnesses: Optional, but having a witness can add credibility to the transaction.

This streamlined template keeps things simple and ensures you cover all the important points without unnecessary details. Keep the document clear and concise to avoid confusion for both parties involved.

- Private Sale Receipt Template in Australia

When selling a vehicle or item privately in Australia, it is important to provide a clear and accurate receipt. This serves as proof of transaction for both the buyer and the seller. Below are the key components that should be included in your private sale receipt template:

- Seller and Buyer Information: Include full names, addresses, and contact details of both parties.

- Item Description: Clearly list the item being sold, including make, model, year, and serial numbers if applicable.

- Sale Date: Specify the exact date of the transaction.

- Price: Indicate the agreed-upon sale price and the payment method (cash, bank transfer, etc.).

- Warranty Details: If applicable, outline any warranty or guarantees that apply to the item sold.

- Signatures: Both parties should sign the receipt to validate the transaction.

By incorporating these details, your private sale receipt will be a clear record of the transaction, offering protection for both parties involved.

In Australia, a private sale receipt must meet specific legal criteria to be valid. The receipt should include essential details such as the seller’s name, the buyer’s name, the transaction date, and a description of the item sold. Additionally, the sale amount should be clearly stated, along with any GST (if applicable). The receipt must also reflect that the transaction was a private sale, distinguishing it from business-related sales.

Seller and Buyer Information

The receipt must list the full names of both the seller and the buyer. This ensures that both parties are identifiable and helps in case of disputes. Including addresses is not mandatory but can offer added clarity in case of future legal requirements.

Transaction Details

Clearly outlining the transaction date and the item(s) sold is necessary for record-keeping. The receipt should specify the sale amount, breaking down any applicable taxes, such as GST if the seller is registered for GST purposes. Without these details, the receipt could be considered incomplete or invalid for tax reporting purposes.

Include the full names and addresses of both the buyer and seller. Add the contact details like phone numbers or emails for easier communication. Specify the exact date of the transaction. Provide a clear description of the item, including make, model, year, and serial or VIN numbers if applicable.

State the sale price and note the payment method. If the buyer made a deposit, mention the amount and any remaining balance. If there are any warranties, guarantees, or terms of the sale, they should be stated clearly in the receipt.

Conclude with both parties’ signatures, confirming the validity of the transaction. This protects both sides and serves as proof of the sale.

Use clear headings to divide sections of the receipt. For example, separate the buyer and seller details, transaction information, and payment summary into distinct areas for easy reference. This helps readers quickly locate the information they need.

Organize with Tables

Structure itemized lists using tables. Include columns for item name, description, quantity, and price. This improves readability and helps the buyer or seller review the details at a glance.

| Item | Description | Quantity | Price |

|---|---|---|---|

| Smartphone | 64GB, Black | 1 | $499 |

| Phone Case | Leather, Black | 1 | $29 |

Ensure Consistent and Simple Layout

Keep fonts simple, such as Arial or Times New Roman, and maintain a readable size between 10 and 12pt. Align text to the left, and avoid using too many colors or fonts that may distract from the content. Provide enough space between sections to maintain a clean and professional look.

Highlight key figures, like the total price, by making them bold or increasing their size slightly. A clear, organized receipt helps build trust between buyer and seller.

Choosing between printable and digital private sale receipts depends on your business needs and preferences. Both options offer distinct advantages and some limitations.

Printable Receipts

- Pros:

- Physical copies provide a tangible proof of transaction, often preferred for legal or archival purposes.

- Can be stored manually, offering easy access during audits or customer disputes.

- Useful for customers who prefer paper records or do not use digital devices.

- Cons:

- Requires paper, ink, and a printer, which incur ongoing costs.

- Physical storage space is needed for keeping receipts over time.

- Printing errors or poor quality can compromise legibility.

Digital Receipts

- Pros:

- Eco-friendly, reducing paper waste and costs.

- Convenient for both businesses and customers, allowing easy sharing and storage.

- Can be integrated with accounting software for automated record-keeping.

- Cons:

- May not be suitable for customers who do not have email or smartphones.

- Dependent on technology, so issues like email delivery failures or file corruption can cause problems.

- Privacy and security concerns related to storing digital records online.

Ensure that all required fields are clearly included. Leaving out critical information like the buyer’s name, the item description, or the transaction date can create confusion or lead to disputes later. Double-check the numbers to avoid discrepancies, especially when it comes to the amount paid and the applicable tax rates. A simple miscalculation can cause significant issues.

Don’t neglect to use a professional format. Even for private sales, a well-organized, easy-to-read receipt helps avoid misunderstandings. Clearly label each section (e.g., “Item Description”, “Amount Paid”, “Date of Sale”) for better clarity.

Another common mistake is failing to provide proof of payment. Be sure to mention the method of payment, whether it’s cash, bank transfer, or any other form. This adds legitimacy to the transaction and provides reference material in case of future inquiries.

Keep records of all receipts. Without a backup copy, it may be difficult to prove that a transaction took place, especially for large sales. Make sure both parties retain a copy for their records.

If you’re looking for private sale receipt templates in Australia, several reliable sources offer both free and paid options. Here’s where you can find them:

1. Government Websites

The Australian government’s official sites, such as the business.gov.au portal, offer downloadable templates for various business documents, including private sale receipts. These are typically free and tailored to Australian legal standards.

2. Template Providers and Marketplaces

Websites like TemplateLab and Etsy provide both free and paid templates. TemplateLab offers customizable free options, while Etsy hosts professionally designed paid templates. Prices vary depending on the complexity and features of the template.

Both platforms allow you to browse specific categories like invoicing and receipts, so you can quickly find templates that suit your needs.

3. Accounting Software Platforms

Many accounting software tools like Xero and QuickBooks offer built-in templates for receipts and invoices. These tools typically require a subscription but provide advanced features such as integration with bank accounts and automatic calculations, making them ideal for business owners who need a more comprehensive solution.

4. Freelance Designers and Custom Solutions

If you need a personalized design or specific features, hiring a freelance graphic designer or using platforms like Fiverr can help. Freelancers can create custom templates to match your branding and business needs. Expect to pay based on the designer’s experience and project scope.

Whether you’re after a quick, free solution or a professionally designed paid template, these resources provide a range of options to suit any budget and requirement.

Thus, the meaning is preserved, but unnecessary repetitions are removed.

Use clear and concise language when drafting private sale receipts. Focus on the key details, like the item or property being sold, the price, and the buyer and seller’s contact information. Avoid repeating information already listed elsewhere in the document. For instance, once you’ve mentioned the item description, there’s no need to repeat it multiple times.

To maintain clarity, use bullet points for itemized lists. This approach helps convey essential details without overloading the reader with redundant phrasing. Ensure that each section of the receipt is straightforward and direct, without unnecessary elaboration. By doing so, you maintain a professional and streamlined document.

When referencing the transaction details, consider summarizing the total payment once at the end, rather than repeatedly highlighting it throughout the document. This keeps the content organized and readable, with no superfluous information distracting from the key points.