A well-structured expense receipt template saves time and ensures accurate financial tracking. The key elements include date of purchase, vendor details, itemized list of expenses, total amount, and payment method. Including these details makes the receipt clear, easy to verify, and legally valid.

For businesses, an expense receipt template helps maintain compliance with tax regulations and simplifies reimbursement processes. Use a structured format with labeled fields, ensuring consistency across all receipts. Adding an auto-calculating section for subtotal, taxes, and the final amount minimizes errors and speeds up processing.

Digital templates in PDF or Excel formats offer flexibility, while online generators provide quick solutions. Choose a format that aligns with your record-keeping needs. If receipts are issued frequently, consider an automated system to generate and store them efficiently.

Clarity is crucial–avoid cluttered designs and unnecessary details. Keep the layout simple, with readable fonts and logical spacing. Whether printed or digital, a well-designed receipt ensures transparency and smooth financial management.

Here’s the revised version with reduced repetitions, retaining the original meaning:

To create a more concise and readable expense receipt template, focus on structuring the information logically. Start with the essential details such as the vendor name, date, and total amount at the top. Keep descriptions short and clear. Use bullet points or tables to organize data like itemized expenses, taxes, and discounts.

For clarity, reduce redundancy in item descriptions. Instead of repeating phrases like “purchased item” for every entry, simply label each product or service with its name and quantity. This minimizes repetition while maintaining the context of each item.

Ensure the total at the bottom of the receipt reflects the sum of the individual entries. Avoid adding unnecessary phrases that don’t add value. Clear headers for each section (e.g., “Items”, “Total”, “Date”) will guide the reader through the document effortlessly.

- Expense Receipt Template: A Practical Guide

Use a clear, concise format for expense receipts to avoid confusion and ensure accuracy. The essential elements for an expense receipt template include:

- Date of the expense: Include the exact date the expense occurred for accurate record-keeping.

- Vendor information: Add the name of the vendor or service provider, along with contact details such as an address or website.

- Expense description: Clearly describe what the purchase was for. This helps distinguish different types of expenses in reports.

- Amount: List the amount spent, including currency symbols and separating decimals correctly.

- Payment method: Indicate how the payment was made–whether by credit card, cash, or other methods.

- Tax details (if applicable): Include any taxes or VAT to provide a full picture of the cost.

- Receipt number: Assign a unique number to each receipt for tracking purposes.

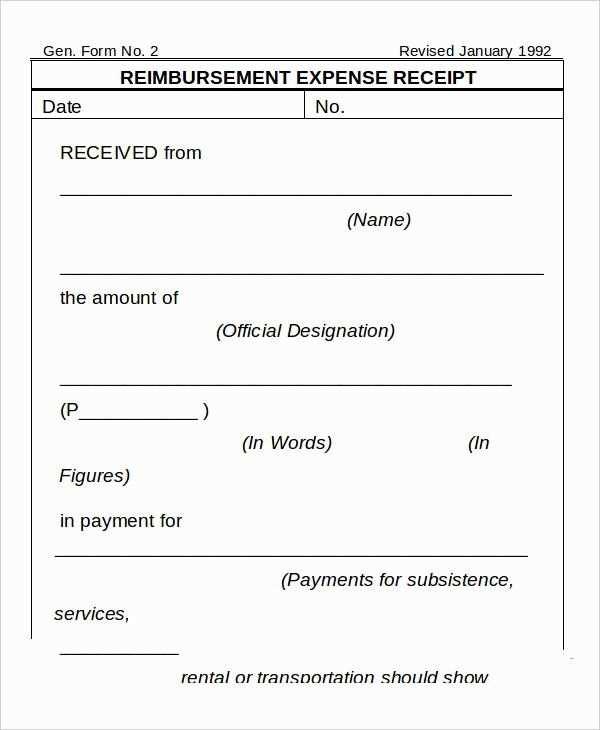

- Approval signatures (if necessary): For company-related expenses, signatures from the person approving the expense can be included.

Tips for Customizing Your Expense Receipt Template

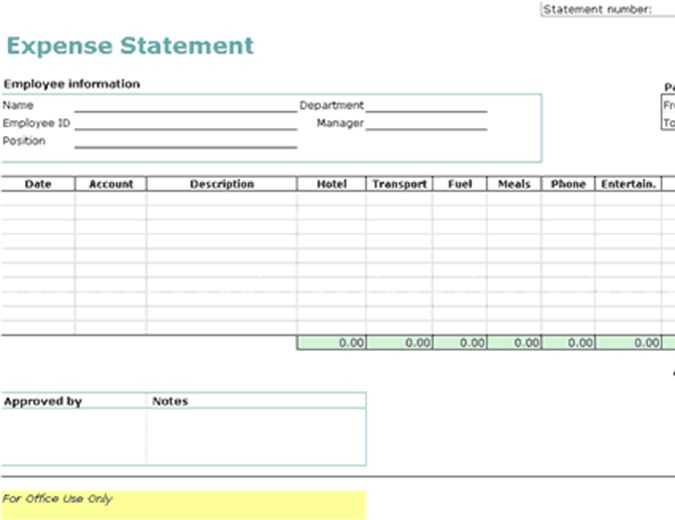

Adapt your template based on the nature of your business or the specific needs of your accounting process. For instance, you can add fields for project codes, department names, or employee IDs if your receipts are used for tracking business-related expenses.

Automating Expense Receipts

If you process a high volume of receipts, consider using software tools that can auto-fill and generate receipts based on input data. This will save time and reduce errors in your expense reporting.

A receipt template for expenses should include the following key components to ensure clarity and accuracy:

- Receipt Title: Clearly label the document as “Receipt” to avoid confusion.

- Vendor Information: Include the name, address, phone number, and email address of the business or service provider issuing the receipt.

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

- Date of Transaction: Clearly state the date the transaction took place, ensuring proper time-stamping for accurate record keeping.

- Itemized List of Purchases: List each item or service purchased, along with their individual costs, quantity, and total cost.

- Tax Information: Specify the tax rate applied and the total tax amount included in the purchase.

- Total Amount Paid: Indicate the overall amount paid, including any discounts or adjustments.

- Payment Method: Note the method used for payment, such as cash, credit card, or bank transfer.

- Additional Notes or Terms: If necessary, provide any additional information or terms related to the purchase, like return policies or warranties.

Including these elements ensures that the receipt is clear, professional, and useful for both parties involved in the transaction.

Start with a clear heading that includes the word “Receipt” and a brief description of the transaction. Make it easy to identify. Below the title, list the seller’s details, including the business name, address, and contact info. This ensures you can easily reach them for any follow-up.

Next, include the transaction date and time. Accurate timestamps are crucial for tracking expenses over time. Add a unique receipt number or reference code for easy identification, especially if you need to make returns or queries later.

For each item purchased, provide a brief description, quantity, unit price, and total cost. If there are discounts, taxes, or extra fees, break them down clearly. This helps you understand the overall price structure at a glance.

Finally, include the payment method used. Whether it’s cash, credit card, or another option, documenting this ensures you have a full record of how the purchase was made.

By following these steps, your receipts will be well-organized, easy to reference, and ready for any necessary audits or reviews.

Tailor your expense receipt template based on the specific needs of each use case. This ensures clarity and accuracy in your records and makes the document easier to understand for both the sender and the recipient. Below are practical tips for customizing the template for various scenarios.

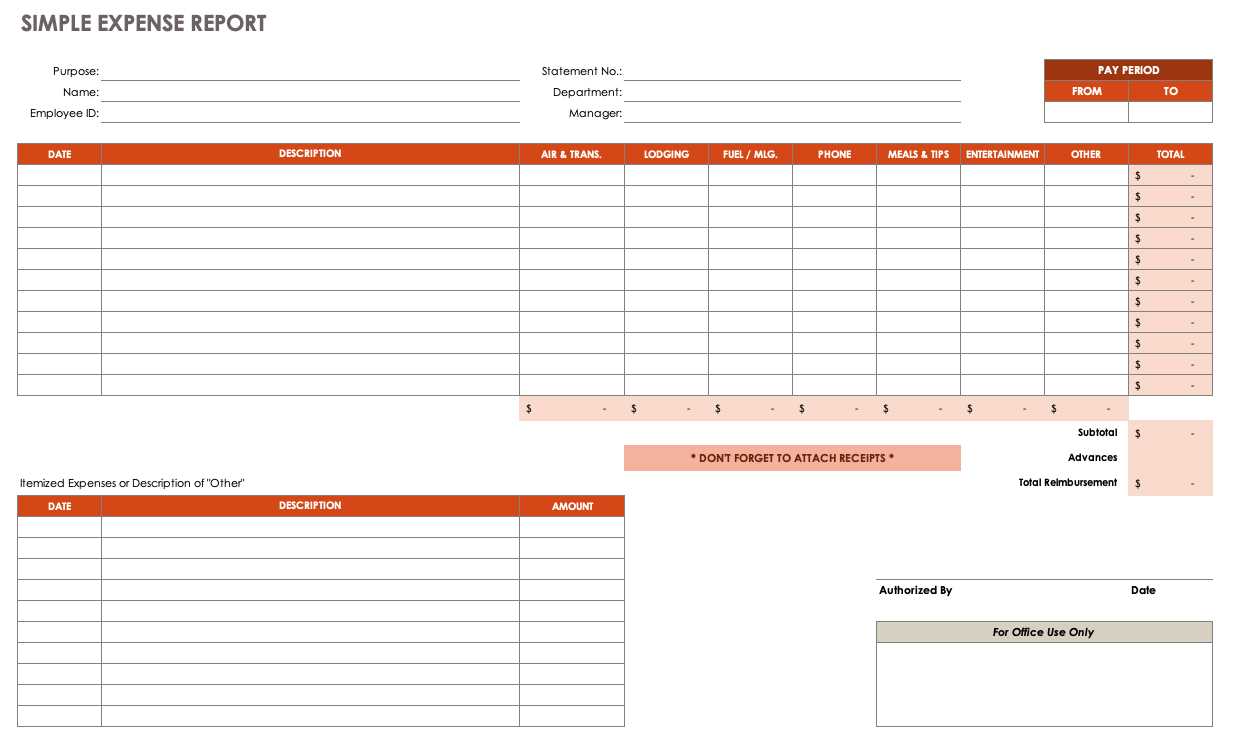

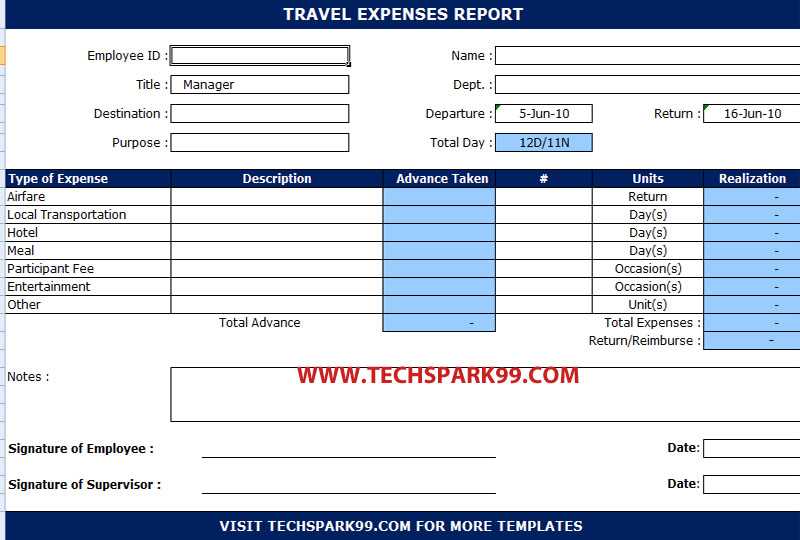

Business Travel Expenses

- Include fields for transportation, accommodation, meals, and incidental expenses. These are the core categories for business travel receipts.

- Use a breakdown by date to track daily expenditures and enhance transparency.

- Consider adding a “project code” or “client reference” section to link expenses to specific business projects or clients.

- Use itemized lists for meals or travel upgrades to meet corporate compliance and audit standards.

Client Entertainment Expenses

- Provide a section for the type of event (e.g., business dinner, conference) and the purpose behind the expense.

- Ensure there is space to list attendee names, positions, and company affiliations to justify the expense.

- Add a checkbox or drop-down menu for different types of entertainment (e.g., lunch, dinner, tickets) to simplify categorization.

Office Supplies and Equipment

- Include a field for the quantity, unit price, and total cost of each item purchased. This is especially helpful for bulk orders.

- Add an item description field to clarify what each purchase is for (e.g., “Laptop charger for office use”).

- For recurring purchases, include a “subscription or contract” field to link receipts to longer-term agreements.

Employee Reimbursements

- Include a “staff name” and “department” field to assign responsibility for each expense.

- List whether the expense is part of a reimbursement policy (e.g., travel allowance, meal per diem).

- Offer a simple breakdown of the total claim (e.g., total meals, travel expenses, miscellaneous costs) to avoid confusion.

By customizing your template for each specific use case, you ensure accurate reporting and compliance, which ultimately reduces errors and speeds up the approval process.

Digital receipts are convenient and eco-friendly. They reduce paper waste, allow quick storage, and simplify searching for past transactions. With digital formats, you can easily store receipts in cloud storage or apps, making them accessible anywhere and reducing physical clutter. However, digital receipts depend on internet access and technology, which can be a problem if devices malfunction or networks fail. Additionally, some businesses might not offer digital receipts, leaving you with no choice but to accept paper.

Paper receipts, while more traditional, provide a tangible proof of purchase. You can keep them in a physical folder or binder for easy access without worrying about losing internet connection or device compatibility. However, paper receipts can fade over time, making them less reliable for long-term storage. They also occupy space and contribute to waste, which can be a concern for environmentally conscious individuals. Carrying multiple paper receipts can clutter your wallet or bag, and tracking them manually can be time-consuming.

Both options have their place depending on your needs. If you prefer convenience and less environmental impact, go for digital receipts. But if you need a physical copy for personal reasons or prefer the reliability of paper, that might be the better option. Consider a mix of both depending on the situation to balance accessibility and long-term storage.

Always keep clear, detailed records of all business expenses. Receipts should be legible and include essential information like the vendor’s name, date, and total amount spent. These elements ensure compliance with tax laws and avoid potential audits.

For tax purposes, receipts serve as the primary proof of expenses. Without them, your claims may be rejected. Ensure receipts clearly itemize the products or services purchased. If a receipt is lost, you can still prove the expense with bank statements or credit card records, but be aware that these are less effective than an original receipt.

Companies should establish a consistent process for expense documentation. A well-organized system minimizes errors and simplifies tax reporting. Categorize expenses to match tax filing categories, ensuring each receipt is filed correctly according to business use–whether it’s for office supplies, travel, or meals.

For legal purposes, only business-related expenses should be documented. Personal expenditures mixed with business expenses can create complications in case of an audit. Ensure that your business documentation clearly distinguishes between the two types.

If your business operates internationally, you may need to comply with different tax laws regarding expense documentation. Consult a tax professional familiar with international taxation to avoid issues with cross-border expenses.

| Expense Type | Required Documentation | Retention Period |

|---|---|---|

| Travel | Ticket receipts, hotel bills, meal receipts | At least 5 years |

| Supplies | Itemized invoices, receipts | At least 3 years |

| Meals and Entertainment | Detailed receipts, purpose of meeting | At least 3 years |

Tax laws can vary significantly depending on location. Always verify the specific retention periods and documentation requirements for your jurisdiction. Incorrect or incomplete documentation can lead to fines, penalties, or issues with tax authorities.

Be mindful of electronic receipts. These are valid in most cases, but ensure they are backed up and stored securely. Digital formats must be clear and readable in case of an audit. Some countries may also have specific requirements regarding digital records, so check local guidelines to stay compliant.

One of the most common mistakes is neglecting to include clear and accurate dates. A receipt without a date can cause confusion and lead to potential disputes. Always ensure that the date of transaction is prominently displayed and in a readable format.

1. Missing Important Information

Always include key details like the buyer and seller’s name, item descriptions, prices, tax rates, and the total amount. Skipping any of these components can make your receipt incomplete and unreliable for both parties.

2. Using Unclear Formatting

A cluttered or overly complex layout can make your receipt hard to read. Avoid cramming information into small spaces. Use enough spacing, legible fonts, and clear headings to help users quickly locate essential details like total cost and payment method.

3. Incorrect or Inconsistent Tax Calculation

Miscalculating taxes or applying inconsistent rates across different items can invalidate a receipt. Double-check the tax percentage and ensure it is applied correctly for each item or service listed on the receipt.

4. Omitting Contact Information

If there’s an issue with the transaction, customers need to know how to reach you. Always include contact details, like phone numbers or email addresses, to address potential concerns.

5. Failing to Use Unique Identifiers

A receipt should have a unique identifier or number. This helps with tracking and future references. Without this, it could be difficult to differentiate receipts in case of a dispute or audit.

By avoiding these common mistakes, you’ll ensure that your receipt templates are both professional and legally valid.

Now the word “Expense” is used less frequently, but its meaning remains clear.

When creating expense receipt templates, it’s important to understand that while the term “expense” may not be as commonly used in everyday language, its function within financial documentation is still crucial. Whether it’s for a business or personal use, an expense receipt serves as evidence of a transaction where money was spent. This document plays a vital role in tracking and organizing expenditures, especially for reporting or tax purposes.

Understanding the Expense Receipt Template

Although the term might be less emphasized, the purpose of an expense receipt template hasn’t changed. It allows individuals or organizations to itemize and categorize the money spent. Creating an effective template involves including the following key elements:

| Element | Description |

|---|---|

| Date | The date when the expense was incurred. |

| Vendor | The name of the business or individual providing the goods or services. |

| Description | A brief explanation of the purchase made. |

| Amount | The total cost of the item or service. |

| Payment Method | How the payment was made (credit card, cash, etc.). |

| Tax | If applicable, the amount of tax paid on the purchase. |

| Signature | A place for the authorizing signature (if needed). |

Adapting the Template to Current Needs

In today’s context, the term “expense” may be referred to as “cost” or “payment,” but it serves the same purpose. A receipt remains a critical tool for accurate financial record-keeping. Whether you’re documenting personal spending or business expenses, organizing them in a structured, clear template ensures that all necessary details are captured for accountability and transparency.