A well-structured receipt confirms that a payment has been made and provides clear details for both parties. It should include essential elements such as the amount paid, date, payment method, and recipient details. Without these, misunderstandings can arise, making record-keeping difficult.

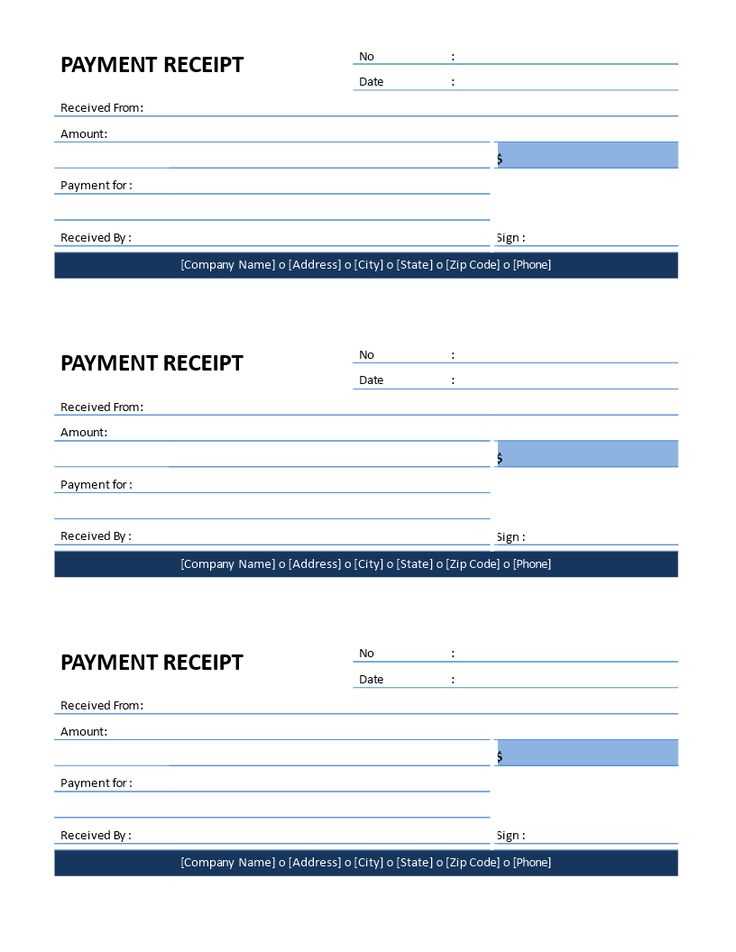

Accuracy and clarity are key when creating a receipt. The format should be easy to read, with structured sections for each piece of information. Adding a unique receipt number helps with tracking, and including the payer’s details ensures proper documentation.

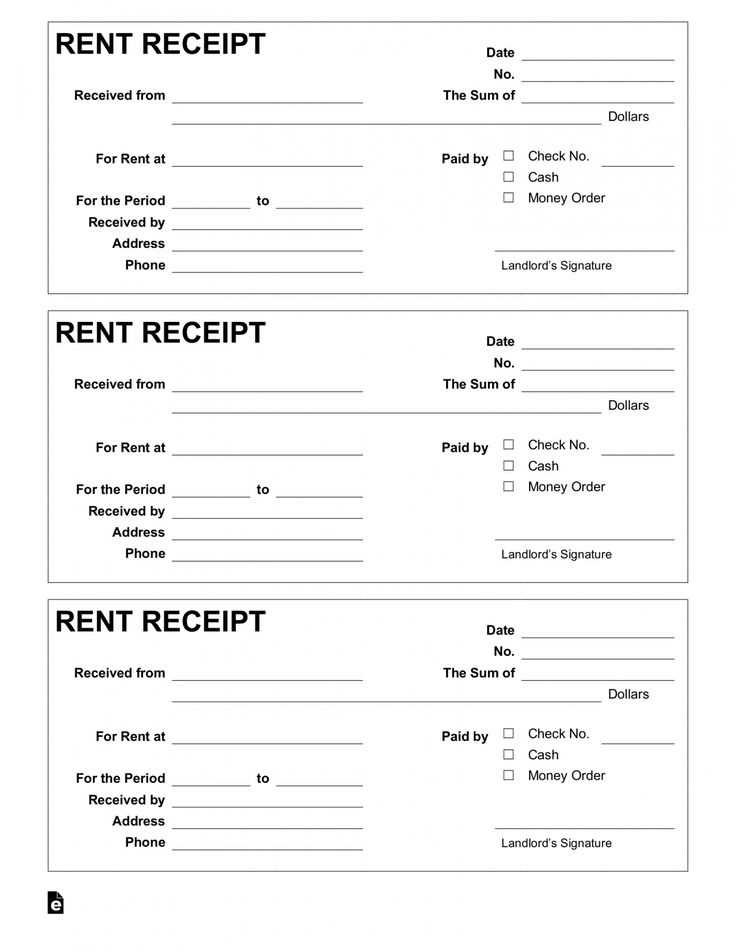

To simplify the process, using a ready-made template saves time and ensures consistency. Whether for business transactions or personal records, a professional receipt builds trust and prevents disputes. Below is a guide to structuring a reliable receipt template.

Here is the revised version with reduced repetition of “Receipt” and “Payment”:

To streamline your payment acknowledgment template, consider simplifying the phrasing and ensuring the terms “Receipt” and “Payment” are used only when necessary. This approach will enhance readability and reduce redundancy.

Key Elements of a Payment Acknowledgment

A well-structured acknowledgment should include the following details:

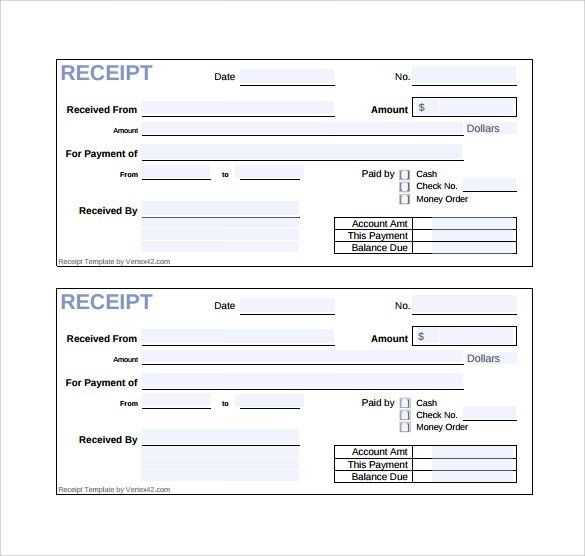

| Element | Description |

|---|---|

| Payment Amount | State the exact amount received, without redundancy. |

| Payment Date | Provide the date the payment was processed. |

| Recipient | Identify who received the payment. |

| Method of Payment | Clarify whether payment was made via cash, card, or transfer. |

| Transaction Reference | Include any relevant reference number for future tracking. |

How to Improve the Template

Instead of repeatedly using “Receipt” or “Payment,” opt for terms like “transaction” or “acknowledgment” where appropriate. This creates a smoother flow and avoids overuse of specific words. For example, instead of repeating “payment received,” simply say “transaction completed.” Be clear and concise, and tailor the template to your audience’s needs.

- Receipt Template for Confirming Payments

Ensure your payment receipt template contains the following key details for accuracy and clarity:

- Receipt Number: A unique identifier for easy reference and tracking.

- Payment Date: Include the exact date the payment was made to avoid confusion.

- Payer’s Information: Include the payer’s full name and contact information for verification.

- Amount Paid: Specify the exact amount received, written in both numbers and words.

- Payment Method: Clearly indicate whether the payment was made via cash, card, check, or other methods.

- Purpose of Payment: Briefly describe the reason for the payment, such as product purchase or service fee.

- Signature: The signature of the person accepting the payment can help validate the transaction.

This template guarantees both parties understand the terms of the payment and can refer back to the details as needed.

Begin with the transaction date and time. This gives clarity on when the payment was made, which is especially helpful for record-keeping. Ensure that this detail is prominent and easy to locate.

Next, include the payment method used. Whether it’s a credit card, bank transfer, or cash, specifying the method confirms how the payment was processed and provides transparency for both parties.

Buyer and Seller Information

Clearly state the name and contact details of both the buyer and the seller. This allows both parties to verify the transaction details and serves as a reference point for future communications or disputes.

Transaction Amount

Clearly mention the exact amount paid. Be sure to specify the currency if applicable, as this prevents any confusion. If the transaction involved multiple items, list the items with individual prices and then the total amount.

Use a clean, easy-to-read font such as Arial, Calibri, or Times New Roman, ensuring that the text is legible in both printed and digital formats. Set the font size to 11 or 12 points for the body text and slightly larger (14-16 points) for headings.

Clear Headings and Subheadings

Organize the content with distinct headings and subheadings to break up the text. Ensure that each section is clearly labeled to allow for easy navigation. Use bold formatting for headings to make them stand out, and maintain consistency in the heading style throughout the document.

Consistent Alignment and Spacing

Align all text to the left, as this ensures a clean and uniform appearance. Use proper line spacing (1.5 or double-spaced) to avoid crowding the content, allowing it to breathe. Add extra spacing between paragraphs and sections to improve readability.

Always leave sufficient margins (1 inch on all sides) to provide a neat border and prevent text from being cut off when printed. If using a digital template, ensure that all text is legible on a standard screen size without the need for excessive scrolling or zooming.

Ensure the payment confirmation includes clear details about the transaction. The payment amount, date, method, and any reference numbers should be specified. This prevents any misunderstandings or disputes regarding the payment. Always include both the payer’s and recipient’s full legal names and addresses to identify the parties involved.

Verify the accuracy of the payment terms mentioned in the agreement before issuing the confirmation. If payment terms or deadlines are outlined in a contract, make sure they align with the details in the confirmation. Failure to do so can lead to legal complications later on.

If the payment involves any taxes or fees, clearly state how they are calculated and whether they were included in the total payment. This transparency is crucial for both parties to understand their financial obligations.

In some jurisdictions, providing a payment confirmation can establish a legal record of the transaction. Therefore, it’s essential to ensure that all details are accurate and that the confirmation is issued in a timely manner to avoid potential legal consequences. Double-check that the document complies with local laws related to financial transactions and receipts.

Ensure clarity in the template by avoiding unnecessary jargon. Stick to simple language so all users understand the information at a glance. Overly complex terminology can confuse rather than clarify details.

- Inaccurate Payment Amounts: Double-check amounts before finalizing templates. A small mistake in numbers can lead to confusion and disputes.

- Missing or Incorrect Transaction Dates: Always include accurate transaction dates. Missing dates or incorrect entries can cause delays in record-keeping and auditing.

- Omitting Payment Method Details: Specify the payment method used (e.g., credit card, bank transfer). Lack of this information may lead to questions about the transaction’s legitimacy.

- Unclear Recipient Information: Include full details of the recipient, including their name and contact information, to avoid misunderstandings.

- Excessive Detail: Keep the template straightforward. Overloading it with irrelevant information can distract from the key transaction details.

- Not Using Consistent Formatting: Use a consistent format for all transaction entries. Inconsistent styles can make templates look unprofessional and harder to read.

By avoiding these mistakes, your transaction templates will be clearer, more professional, and easier to manage. Always prioritize accuracy and simplicity to ensure smooth transactions.

Choose digital receipts when speed, storage, and environmental impact matter most. Digital receipts are easy to store, access, and share without taking up physical space. They’re often automatically sent via email or text, eliminating the need for manual input. Plus, they’re more eco-friendly, reducing paper waste.

Paper receipts remain valuable in specific situations, such as for those who prefer physical copies for record-keeping or when digital options are unavailable. They can also serve as a more tangible proof of purchase in certain contexts, like returns or warranty claims, where a physical document might be required.

When to Choose Digital Receipts

- For quick access and easy sharing.

- If you need to reduce paper waste.

- If you want to store receipts electronically for tax purposes or expense tracking.

When to Choose Paper Receipts

- If a digital receipt isn’t offered.

- If you require a physical document for returns or warranties.

- If you don’t have easy access to digital storage solutions.

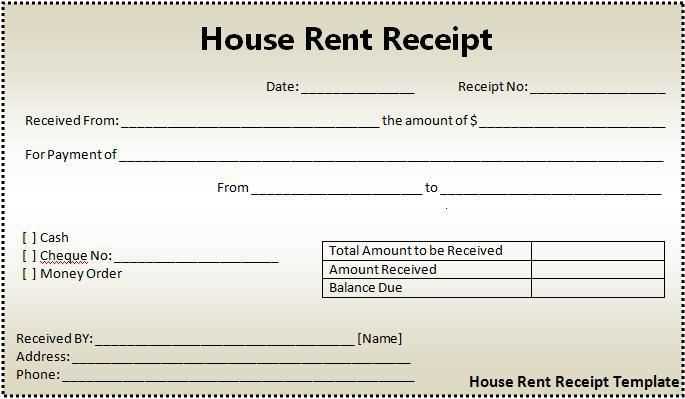

Adjust your payment receipt template based on the type of transaction. For product sales, include the item details, quantities, and pricing breakdown. For services, list the service description and any applicable hourly rates or fixed charges. Customization should also account for discounts, taxes, or shipping fees, where relevant. Ensure the payment method (credit card, cash, or bank transfer) is clearly stated, along with any reference numbers or authorization codes to maintain transparency.

If the transaction involves multiple payments or installments, break them down in a clear manner, highlighting due dates and outstanding amounts. For subscription-based services, include recurring payment information and renewal dates. Tailor the template’s design by keeping it simple yet professional, ensuring that the relevant details are easy to read and follow for both the customer and your accounting team.

Consider adding a section for notes, allowing space for any custom messages or thank-you notes. The template should align with your brand’s tone, whether it’s formal or more casual, making the experience more personal for the customer. Always make sure to test the template for clarity and ease of use before finalizing it for regular transactions.

Meaning preserved, repetitions reduced, text remains natural and readable.

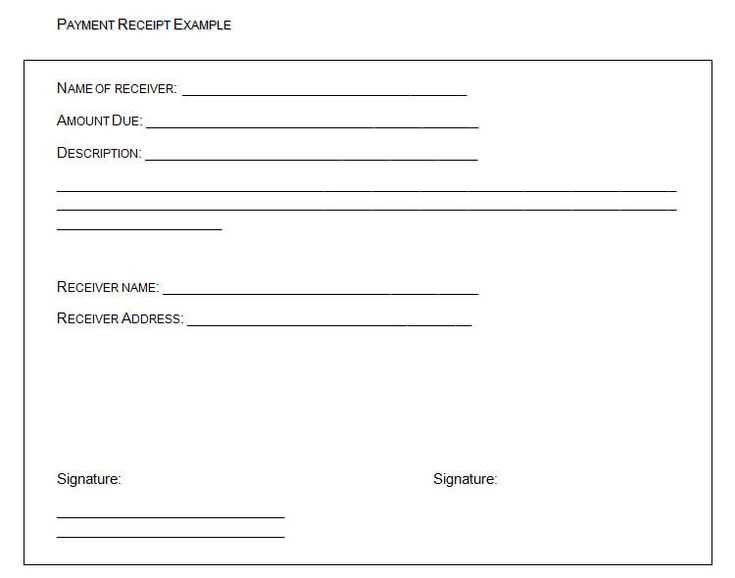

To ensure clarity in a receipt template, it’s key to focus on straightforward details: payment amount, date, payer’s name, and transaction method. A clean layout enhances readability, so avoid unnecessary text or complicated wording.

Keep the information concise: Limit each section to only what’s needed for the transaction. The payment method, whether credit card, bank transfer, or cash, should be clearly stated with no ambiguity. This way, both parties understand the transaction without needing further clarification.

Structure is key: Use bullet points or short paragraphs to separate key data points. For example, list the payer’s details, payment amount, and the date of payment. This will ensure important details stand out at a glance.

Use clear, direct language: Avoid vague terms. If the payment was for a service or product, mention that explicitly. This removes the need for follow-up questions and makes the receipt universally understandable.