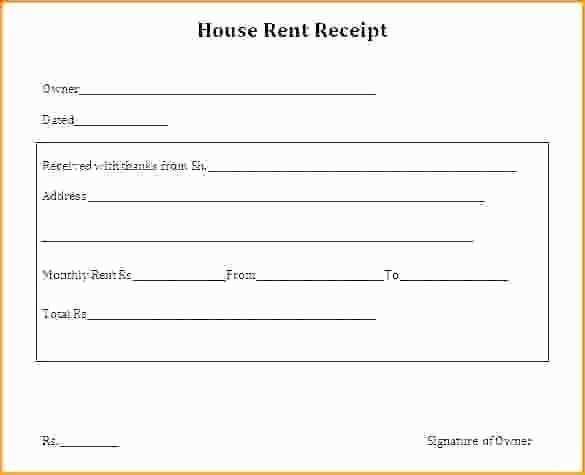

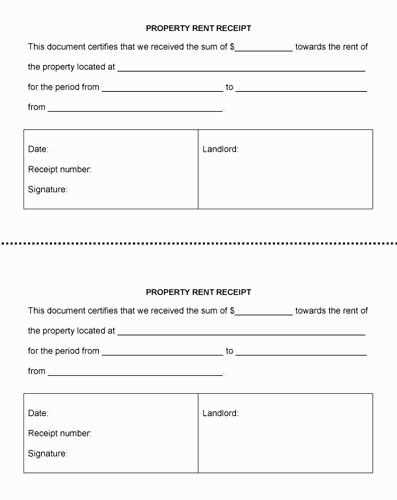

Rent receipts are a straightforward way to document a transaction between landlords and tenants. A well-structured template helps ensure both parties have a clear record of payments made. Start by including the tenant’s name, address of the rental property, and the landlord’s contact details. Clearly state the amount paid, payment date, and the rental period it covers.

To keep things organized, include a unique receipt number for tracking purposes. If applicable, note any additional charges such as late fees, maintenance fees, or deposits. It’s also helpful to provide a space for the landlord’s signature, confirming the payment has been received. This adds credibility to the document and strengthens its legal standing.

Make sure to keep a copy for your records and provide a duplicate to the tenant. This simple step avoids any confusion in case of disputes later on. By using this template, you create a reliable, transparent record of the rental transaction that benefits both parties.

Here’s the revised version with minimal repetition of words:

To create a rental receipt template, focus on clarity and organization. Begin with a header that includes the rental company’s name, address, and contact information. Below that, clearly state the purpose of the receipt, such as “Rental Receipt” or “Lease Payment Acknowledgment.”

Next, include a section for the tenant’s details: full name, address, and phone number. Follow this with the rental agreement details: rental period, property address, and the total rent amount. Include a breakdown of charges if necessary, specifying any additional fees or deposits.

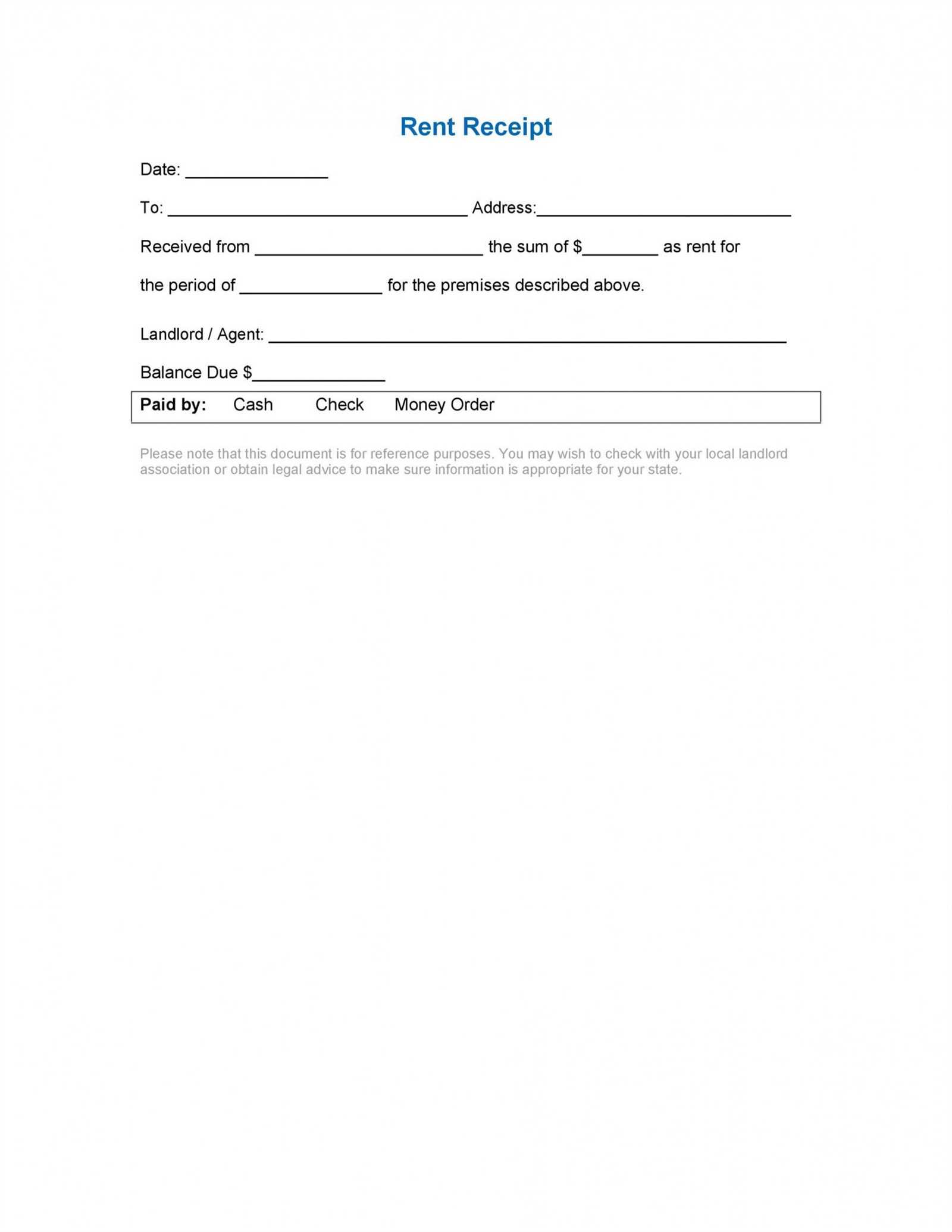

Clearly indicate the payment method used, whether it’s cash, check, or bank transfer. Lastly, provide space for both the landlord and tenant to sign, confirming the transaction. This ensures the receipt serves as proof of payment for both parties.

Finally, place a footer with the company’s legal disclaimers and any relevant terms regarding the rental agreement or payment policy. This keeps the receipt professional and legally sound.

Template for Rent Receipt

Setting Up Receipt Format

Required Information for Rent Payment Acknowledgment

Customizing Receipts for Various Payment Methods

Adding Key Terms and Conditions to the Receipt

Creating a Clear Payment Due Date and Lease Period

Legal Considerations and Tax Information on Receipts

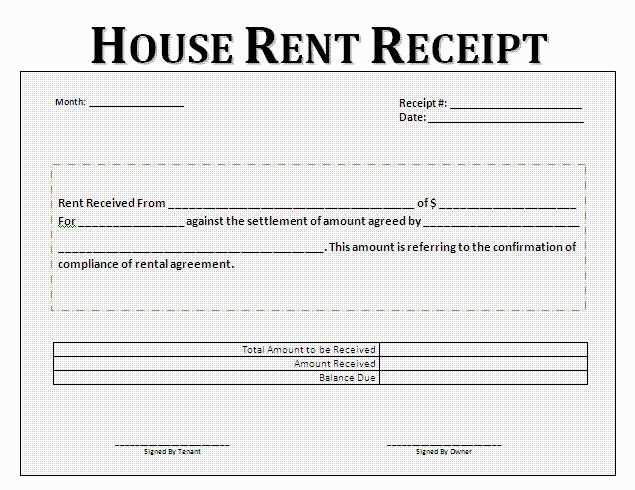

To create a rent receipt template, focus on structuring the document clearly. Include essential details such as the tenant’s name, the property address, payment amount, payment method, and the date of payment. Ensure the format is simple and easy to understand, with a clear title at the top, like “Rent Receipt”.

Required Information for Rent Payment Acknowledgment

Include these details for a complete receipt: tenant name, landlord name, property address, payment amount, payment date, lease period, and payment method (cash, check, electronic transfer). It’s vital to have a unique receipt number to track the transaction, as well as a signature line for the landlord or property manager.

Customizing Receipts for Various Payment Methods

For payments made via check, specify the check number. If the payment is via bank transfer, provide transaction reference numbers. In cases of partial payments, note the amount paid and the balance remaining. Make sure to update the payment method section to accommodate these details clearly.

Next, add any terms and conditions, such as late fees, rent increase schedules, or any clauses relevant to the rental agreement. Mention whether the rent is for a month or another fixed period, and indicate the next due date. This helps the tenant understand their obligations and avoids confusion.

For legal and tax purposes, include a disclaimer noting that the receipt serves as proof of rent payment for tax or legal reasons. You may also state whether taxes are included in the rent or paid separately. Always include the landlord’s tax ID number if required by law.