Every business that receives payments must provide clear and accurate receipts. A well-structured payment receipt template ensures that customers have proof of payment while helping businesses maintain proper financial records. In the UK, a receipt should include specific details to comply with tax regulations and provide transparency.

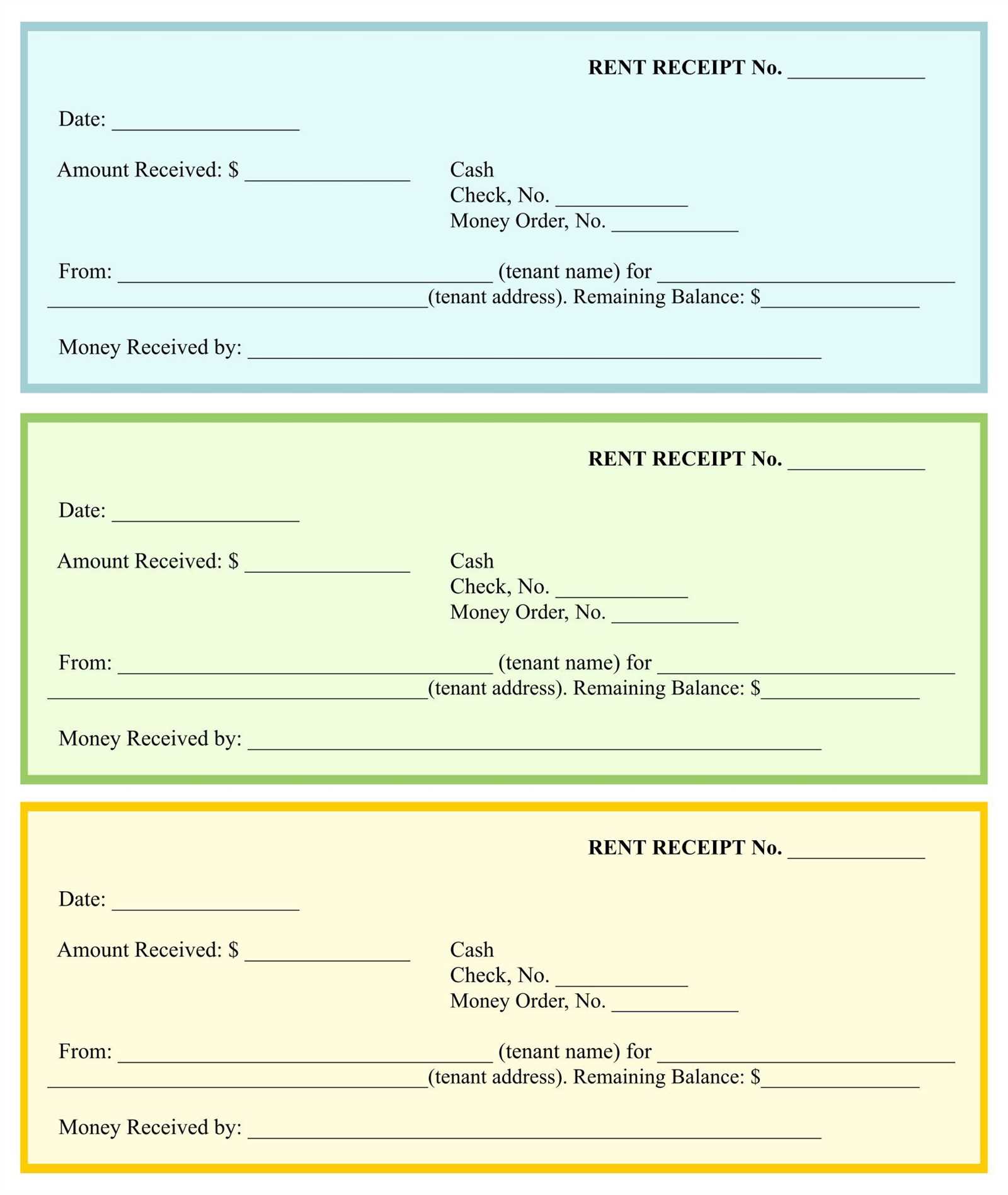

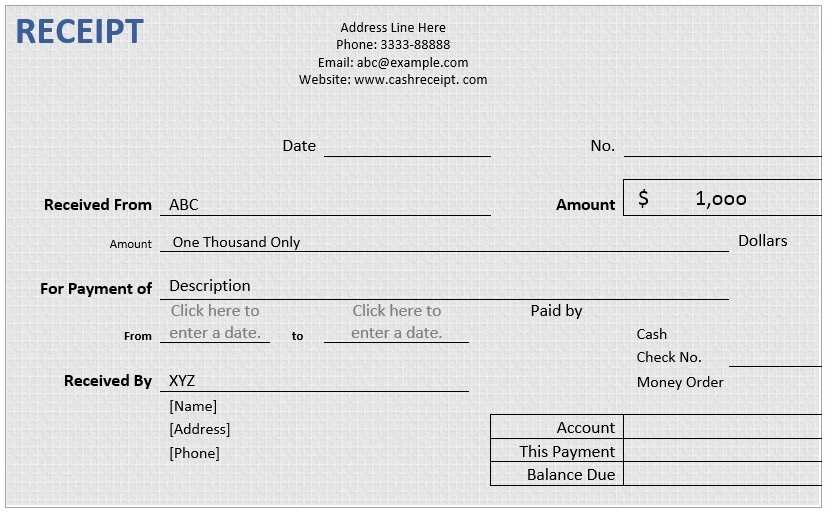

The essential elements of a UK payment receipt include:

- Business Name and Contact Information: Include your company’s name, address, phone number, and email.

- Receipt Number: Assign a unique reference number for easy tracking.

- Date of Payment: Clearly state when the payment was made.

- Payer Details: If applicable, include the customer’s name and contact information.

- Description of Goods or Services: List the items or services provided.

- Amount Paid: Show the total amount, including VAT if applicable.

- Payment Method: Specify whether payment was made by cash, card, bank transfer, or another method.

- Business VAT Number: If your business is VAT-registered, include your VAT registration number.

Using a structured template saves time and ensures consistency. A well-formatted receipt not only builds trust with customers but also simplifies accounting processes. Whether creating receipts manually or using invoicing software, always ensure the details are accurate and easy to read.

Here’s a version with reduced repetition while maintaining meaning:

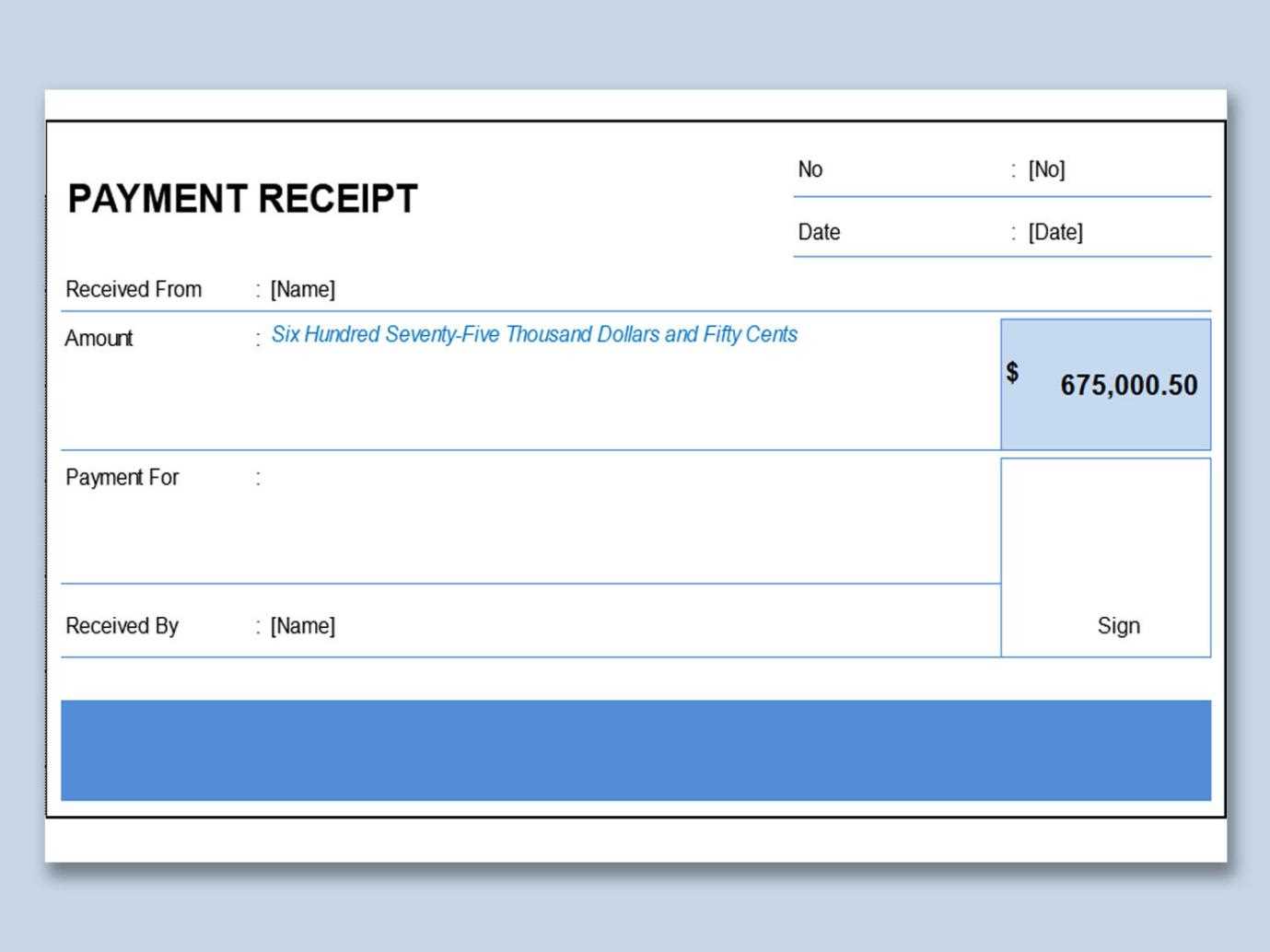

Creating a payment receipt template in the UK requires attention to detail. Include the transaction date, business name, and contact details at the top. Clearly state the amount paid, along with the currency. Make sure to reference the goods or services provided, with a brief description or list for clarity.

Receipt Structure

Organize the information logically: start with the payer’s name and address, followed by the total amount, and the payment method used (e.g., bank transfer, cash). Include a unique receipt number for tracking purposes. Always provide a brief statement confirming that payment has been received in full.

Legal Considerations

For UK receipts, consider adding a disclaimer regarding VAT if applicable. It’s important to comply with tax regulations, ensuring that VAT is correctly reflected where necessary. Include terms of service or return policies at the bottom for transparency.

- Payment Receipt Template UK

A well-designed payment receipt template can simplify transactions and ensure clear communication between buyer and seller. In the UK, creating a receipt that meets both legal and practical needs is key to smooth business operations. Below is a guide to help you structure a basic payment receipt for your transactions.

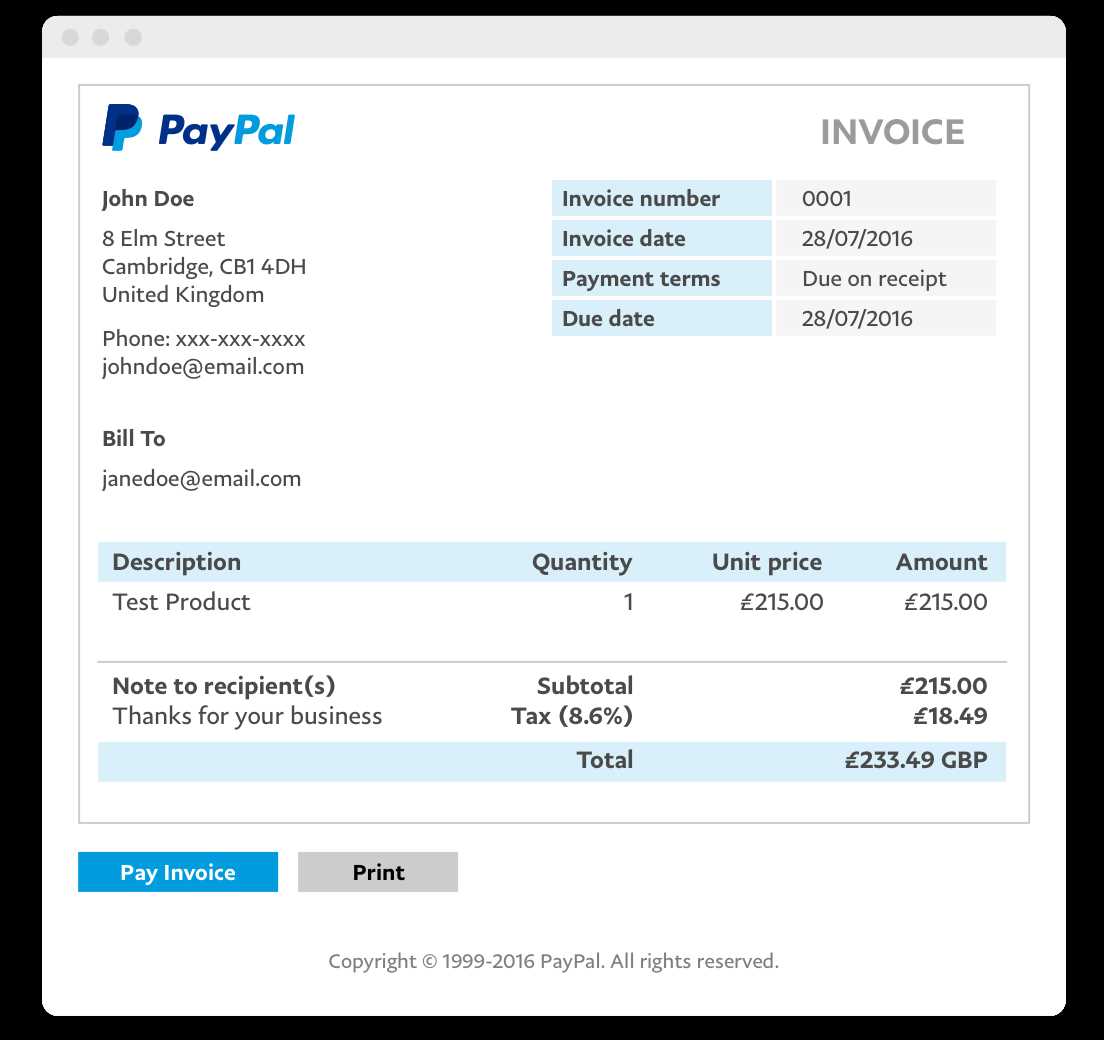

Key Elements of a Payment Receipt

- Receipt Number: Assign a unique number to each receipt for easy reference and tracking.

- Seller’s Details: Include the business name, address, contact information, and VAT number (if applicable).

- Buyer’s Details: Provide the name and address of the customer or client. This helps ensure clarity in case of disputes or returns.

- Date of Payment: The specific date when the transaction took place.

- Amount Paid: Clearly state the total amount paid, broken down if necessary (e.g., item price, VAT, delivery fees).

- Payment Method: Specify how the payment was made–whether by cash, bank transfer, or card.

- Transaction Details: Describe the items or services provided, including quantities and prices, to avoid confusion.

- VAT (if applicable): Include VAT details if your business is VAT-registered, including the rate and amount charged.

Why Use a Template?

- Consistency: A template ensures that each receipt contains all necessary information, reducing errors.

- Time-Saving: Templates speed up the process of creating receipts, freeing up time for other business tasks.

- Professionalism: A well-structured receipt gives your business a polished and reliable image, making customers more likely to trust you.

By including all these elements, your payment receipt template will serve as an effective record of the transaction for both parties. Be sure to adjust the details based on your specific business needs and always keep a copy for your records.

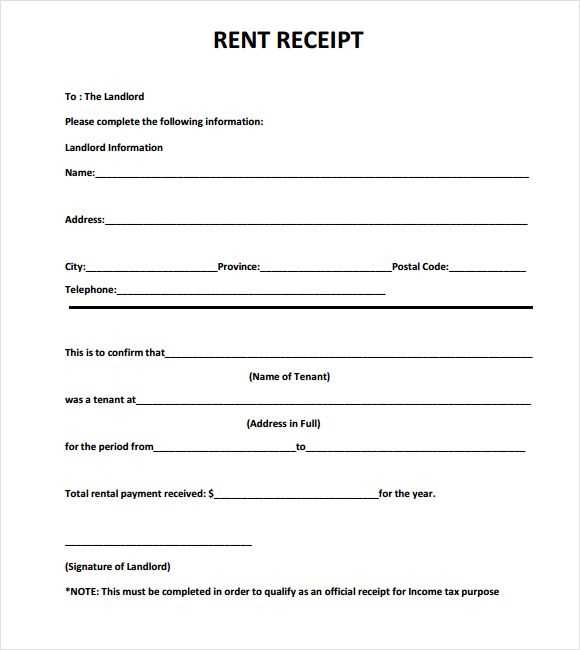

Receipts in the UK must meet specific requirements to be legally compliant, particularly for VAT-registered businesses. These regulations ensure transparency and protect both consumers and businesses. Here’s what needs to be included on a receipt:

Key Information for Receipts

- Business Details: The name, address, and contact information of the business must be clearly stated.

- Receipt Date: The date the transaction took place is necessary for record-keeping.

- Description of Goods or Services: The receipt should list what was purchased, including any relevant item codes or descriptions.

- Price Details: The price of each item or service, along with any applicable taxes, should be shown.

- VAT Information: If the business is VAT-registered, the VAT number must be included. Additionally, the VAT rate and the amount charged must be visible.

Electronic Receipts and Paper Receipts

- Both electronic and paper receipts are acceptable as long as they contain the required information. However, businesses must ensure that electronic receipts are as accessible and clear as paper versions.

- For VAT-registered businesses, it’s crucial to retain receipts for a minimum of six years for tax purposes.

Following these guidelines helps businesses avoid penalties and ensures consumer rights are upheld. Always ensure receipts are clear, accurate, and meet all legal obligations.

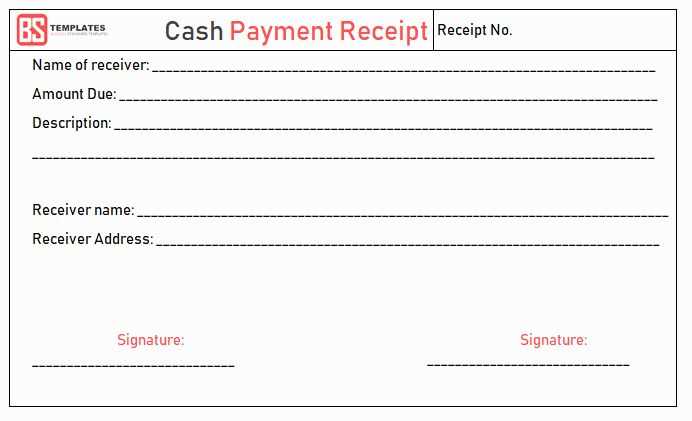

A UK receipt must include a few key elements to ensure clarity and compliance. The date of the transaction should always be displayed clearly, helping both the buyer and seller track the purchase.

Next, include the seller’s full name or business name along with the registered business address. If VAT is applicable, the seller’s VAT number should be visible.

Provide a detailed description of the items or services purchased, listing the quantity, price, and any applicable VAT rates. This ensures transparency regarding the charges applied to the transaction.

The total amount paid should be listed clearly, including any taxes or additional fees. Make sure to specify the payment method used, whether it’s cash, card, or another form of payment.

If applicable, include a unique transaction reference number or invoice number for tracking and verification purposes. This helps with record-keeping and addressing any potential disputes.

Lastly, always include the terms and conditions of the sale if relevant, particularly for refunds, exchanges, or warranties. This gives customers a complete overview of their purchase and your policies.

Choose digital receipts for convenience and accessibility. They are easy to store, search, and retrieve when needed, without worrying about paper clutter. Digital formats are also environmentally friendly, helping to reduce paper waste. If you run a small business, digital receipts can streamline your record-keeping and save on printing costs.

Benefits of Digital Receipts

With digital receipts, you can easily share them with customers via email or other platforms. This makes it simpler for both you and your customers to track transactions. Additionally, digital formats are secure, as they can be stored in encrypted files, reducing the risk of losing important receipts.

When Paper Receipts Make Sense

Paper receipts are still valuable in situations where digital devices are not accessible. For in-person transactions at remote locations or when dealing with customers who prefer physical proof of purchase, paper receipts provide a tangible option. Keep in mind that paper receipts can sometimes fade over time, so make sure to store them in a safe, dry place for long-term reference.

Tailor your receipt template to match the specific requirements of your business. This ensures clarity for both you and your customers. For example, service-based businesses may need a section for labor hours, while product-based businesses will require a detailed list of items sold.

Consider including different sections based on what your customers expect. A food delivery business, for instance, may benefit from adding delivery details like time, address, and delivery charges, while a retail shop may focus on SKU numbers, item descriptions, and discounts offered.

Be mindful of the layout and the amount of information displayed. A small business might only need the basic elements, such as the company name, purchase date, items sold, and total. However, larger companies may include additional fields like tax breakdowns, serial numbers, or even loyalty points for repeat customers.

Here is an example of how you could structure your receipt depending on your business model:

| Business Type | Recommended Customizations |

|---|---|

| Retail | Item descriptions, SKUs, discounts, taxes, and total price. |

| Restaurant | Menu items, table number, server name, taxes, service charges. |

| Service | Labor hours, service description, hourly rate, taxes, and total amount. |

| Online Store | Shipping details, order number, discount codes, and tax information. |

Adapt the content to meet your specific needs, ensuring that each element adds value for the customer and enhances your business’s transparency.

Finding the right payment receipt template is straightforward whether you want a free or premium version. Many websites offer both options, depending on your needs and the level of customization required. Free templates often suit basic needs, while paid options provide more advanced features and design flexibility.

Free Templates

Free payment receipt templates are widely available across various platforms. Websites like Template.net and Smartsheet offer several options you can download instantly. These templates typically come in standard formats like Word or PDF and are easy to modify to fit your requirements. Additionally, some accounting software, such as Wave, includes free receipt templates built into the platform for quick and easy use.

Paid Templates

If you need more customization, a paid template might be a better choice. Premium templates are available on platforms like Envato Market and Creative Bloq, where you can find designs tailored to specific industries or needs. These templates often come with advanced features like automated calculations or integration with invoicing systems. They typically cost between £5 and £20, but the extra functionality may be worth the investment for businesses that require a more polished presentation or complex features.

Follow these clear steps to issue a receipt correctly and professionally:

- Choose Your Format – Select a paper or electronic receipt format. If using paper, ensure it is printed on a receipt book or blank document. For digital receipts, use a template or receipt generator tool.

- Include Business Details – Add your business name, address, and contact details at the top. If applicable, include your VAT number or registration number for tax purposes.

- Detail the Transaction – Provide a breakdown of what was purchased, including item descriptions, quantities, prices, and any applicable taxes. Include the date and time of the transaction.

- Payment Information – Specify the payment method used, whether cash, card, or bank transfer. If a card was used, include the last four digits of the card number (for security reasons).

- Issue a Unique Receipt Number – Generate a unique number for each receipt to help with future reference and tracking. This is essential for accounting and customer service purposes.

- Amount Paid – Clearly state the total amount paid, breaking down any additional fees or discounts. If applicable, note any remaining balance.

- Sign and Date – Sign the receipt to validate the transaction and include the date for accurate record-keeping.

- Provide a Copy – Hand the original receipt to the customer, and keep a copy for your records. Digital receipts can be sent via email or downloaded by the customer.

Issuing a clear, accurate receipt builds trust and ensures smooth transaction tracking for both you and your customers.

For clear and organized payment receipts in the UK, include all the necessary details without clutter. A well-structured receipt ensures clarity for both parties. Here’s how to set it up effectively:

| Field | Description |

|---|---|

| Receipt Number | A unique reference for each transaction. |

| Date of Payment | The date when the payment was received. |

| Payee Name | The person or company receiving the payment. |

| Payer Name | The person or company making the payment. |

| Amount Paid | Clearly state the total amount paid, including the currency. |

| Payment Method | Specify whether the payment was made by bank transfer, card, cheque, or cash. |

| Transaction Reference | Provide any reference number or identifier related to the transaction. |

| Service or Product Description | Briefly describe the goods or services paid for. |

| VAT (if applicable) | Include the VAT amount if the transaction is VAT-inclusive. |

Once the receipt is filled with all the required details, you can issue it to your client or customer, ensuring the information is transparent and easy to track. Always retain a copy for your records for future reference.