Creating a mortgage payment receipt template can simplify tracking and confirming payments for both homeowners and lenders. A well-structured template ensures clarity and transparency in every transaction.

Start with the basic details: Include the borrower’s name, address, and mortgage account number. This information helps identify both parties involved and avoids any confusion regarding which account the payment is associated with.

Highlight payment specifics: Clearly state the payment amount, date, and method used (check, bank transfer, etc.). These details verify that the transaction was completed as agreed and provide a record for future reference.

Include additional sections: Add a balance after payment, including any outstanding amounts if applicable. This provides a snapshot of the loan’s current standing. Don’t forget to include the due date for the next payment to keep everything organized.

By following this format, you’ll have a mortgage payment receipt that’s both clear and effective for tracking payments and maintaining proper records.

Here’s the updated version with fewer word repetitions:

To create a streamlined mortgage payment receipt template, follow these key steps:

Key Elements of the Receipt

- Borrower’s name and address

- Lender’s name and contact information

- Loan account number

- Payment date and amount

- Outstanding balance after payment

- Payment method (e.g., check, bank transfer)

- Transaction reference number

Formatting Tips

- Use clear, concise language for easy understanding.

- Place all crucial details in a well-organized layout.

- Include a unique receipt number for tracking purposes.

- Ensure the font is readable and professional.

This format helps both parties maintain accurate records, ensuring transparency and ease of reference in future transactions.

- Mortgage Payment Receipt Template

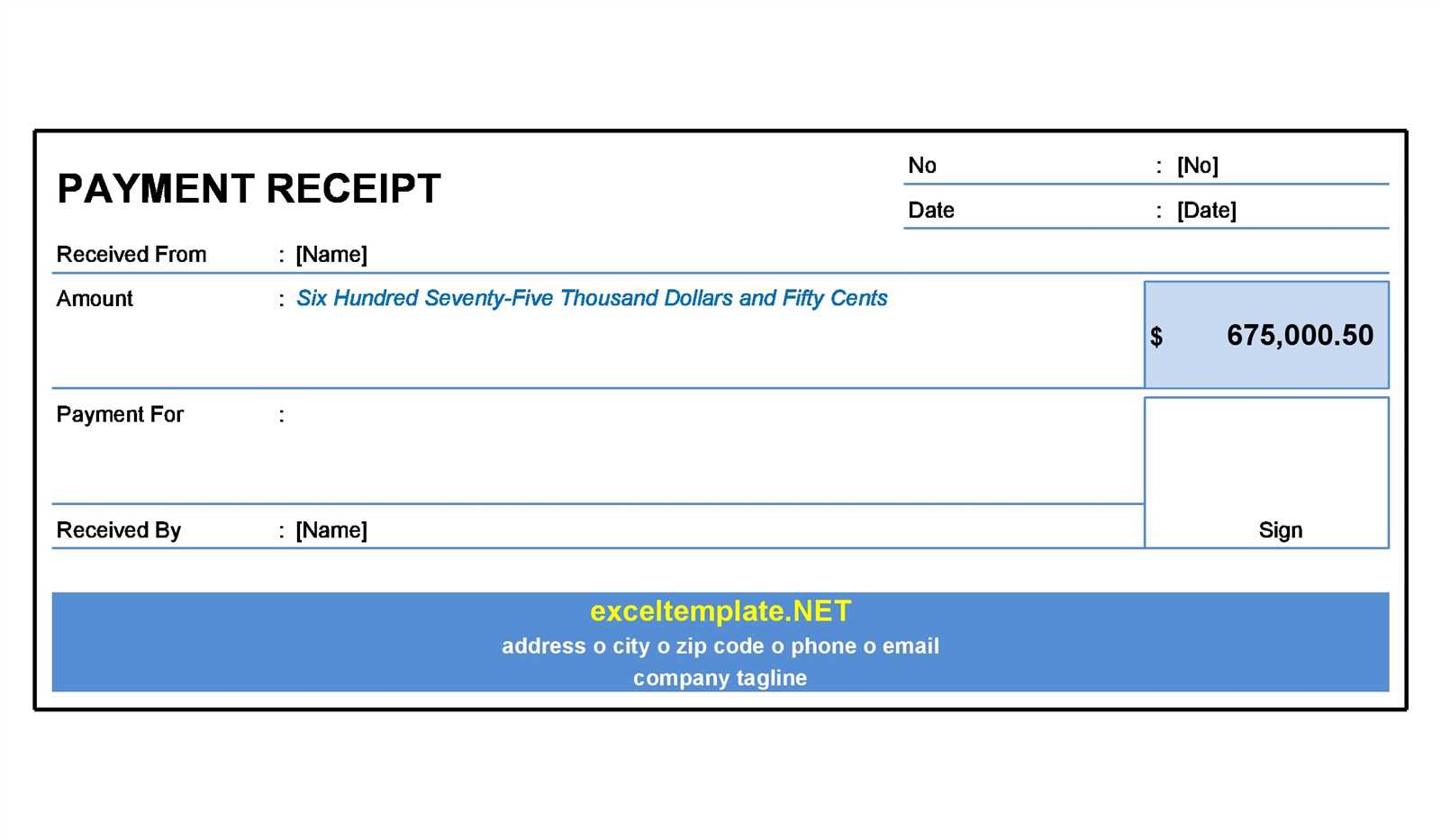

When creating a mortgage payment receipt, ensure it includes all critical details to maintain clarity for both the payer and the recipient. At a minimum, the receipt should include the following elements:

1. Borrower and Lender Information

Include the full names, addresses, and contact details of both the borrower and the lender. This helps verify the identity of the parties involved.

2. Payment Details

Clearly state the amount paid, the date of payment, and the payment method (e.g., bank transfer, check). This information provides a concrete record of the transaction.

3. Loan Information

Specify the mortgage loan number or reference to ensure the payment is correctly applied to the right loan. Also, indicate the remaining balance after the payment is processed.

4. Payment Breakdown

Provide a breakdown of how the payment is allocated–whether it is applied to the principal, interest, escrow, or other charges. This adds transparency to the transaction.

5. Signature Line

A signature line for the lender or their representative adds legitimacy to the document and confirms that the payment has been received and processed correctly.

These components ensure that the mortgage payment receipt is both accurate and informative, creating a clear record of the payment made.

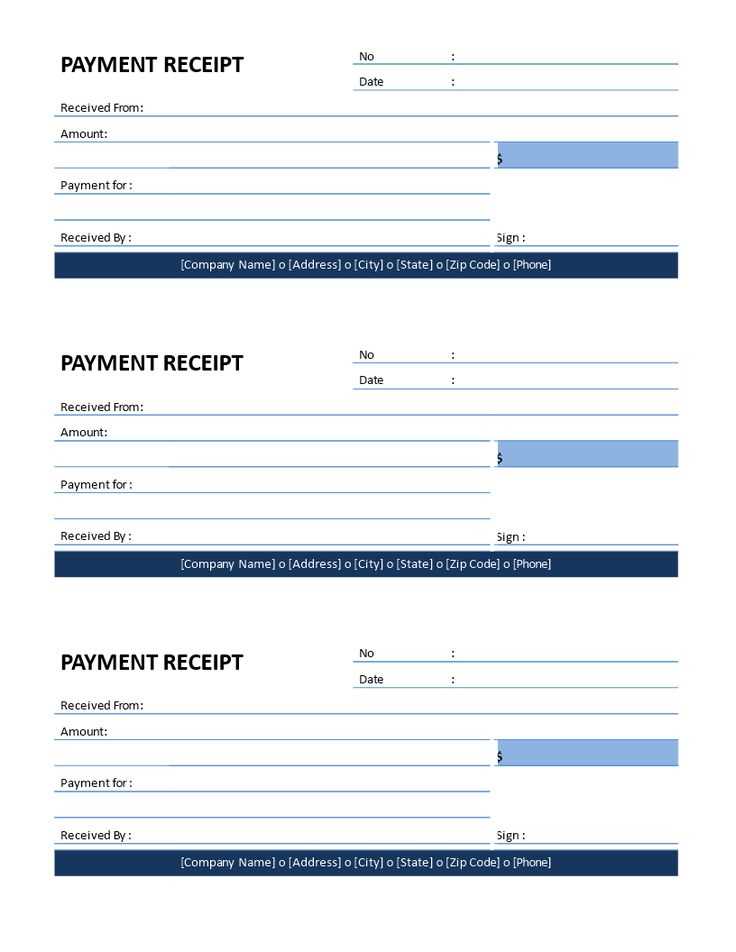

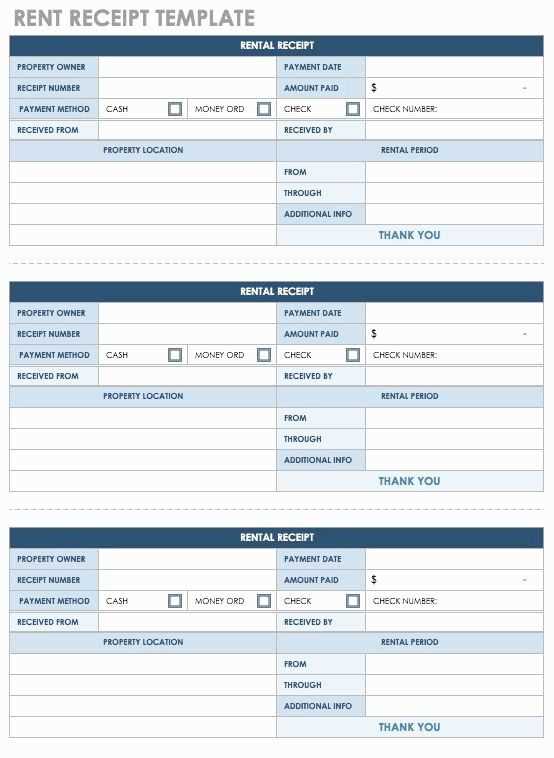

To create a payment receipt with customizable fields, begin by designing a template that covers all necessary details such as payment amount, payer, recipient, and date. Customizable fields allow flexibility in adjusting to different payment types, methods, and any additional information specific to the transaction.

Step-by-Step Guide to Building a Customizable Payment Receipt

Start by creating a basic receipt structure with the following fields:

- Receipt Number

- Payer Information

- Recipient Information

- Amount Paid

- Payment Method

- Payment Date

- Description of Payment

For customization, you can make each of these fields editable, allowing for adjustments based on individual transactions. Add dropdowns for payment methods, text boxes for specific descriptions, and date pickers for payment dates. This way, users can quickly update the receipt without altering the format.

Custom Fields Example in Table Format

| Field | Description | Customization Options |

|---|---|---|

| Receipt Number | A unique identifier for each payment | Editable text field, auto-generate sequential numbers |

| Payer Information | Details of the person making the payment | Text field for name, address, and contact |

| Amount Paid | Total payment made | Numeric input, currency selection |

| Payment Method | Method used for payment (e.g., Credit Card, Cash) | Dropdown selection |

| Payment Date | Date the payment was made | Date picker |

| Description of Payment | Additional details about the payment | Text area for custom descriptions |

Using these customizable fields, you ensure that each receipt is adaptable to varying scenarios while maintaining a clean and professional look. Whether you need to update a payment method or add a detailed description, this approach ensures both flexibility and accuracy in documenting payments.

Include the payment date at the top of the receipt. This helps both the payer and the recipient track when the transaction occurred. It is helpful to use a clear, readable format like “Month, Day, Year” (e.g., February 9, 2025).

List the payer’s name and contact details. This ensures that both parties have accurate information about who made the payment, reducing confusion in case of future inquiries.

Clearly state the amount paid, and specify the currency. It’s important to break down the total into any applicable fees, principal, or interest, especially for mortgage payments, so both parties are clear on how the payment is allocated.

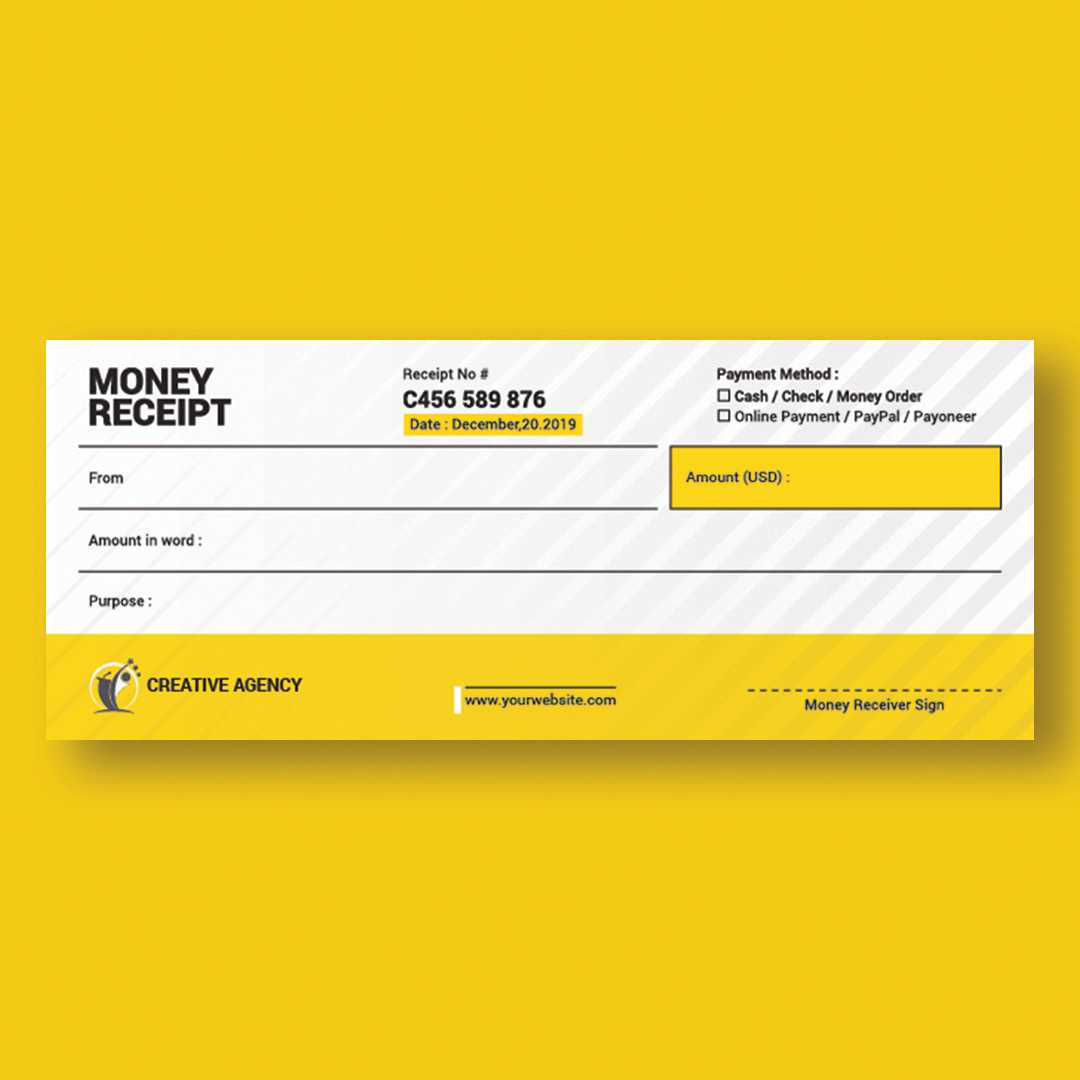

Include Payment Method

Indicate the method of payment, such as bank transfer, check, or credit card. This adds transparency, especially in case of disputes or errors, and helps verify the payment process.

Provide Payment Reference Number

Always include a unique reference number or invoice number. This helps track the payment in your system and can be referenced in any future correspondence.

Finally, ensure that both the payer and the recipient sign or acknowledge the receipt electronically, if possible. This adds a layer of security and confirms that both parties agree on the transaction details.

Keep your receipt clear and easy to read. Use a simple, legible font like Arial or Times New Roman, and avoid overly stylized text. Ensure all details are spaced out with consistent margins, making each section distinct.

1. Organize Information Logically

Start with the company name, address, and contact details at the top. Follow with the recipient’s name and payment details, such as the amount paid and the payment method. Close with the date and any additional remarks. Make sure these sections are clearly separated with headings or spacing.

2. Include a Unique Reference Number

A reference number helps track payments efficiently. It should be positioned near the top of the receipt, allowing easy identification for both parties. This can be a combination of letters and numbers that align with your accounting system.

Lastly, consider including a footer with your company’s logo or a thank-you note, if appropriate. This adds a personal touch without cluttering the design.

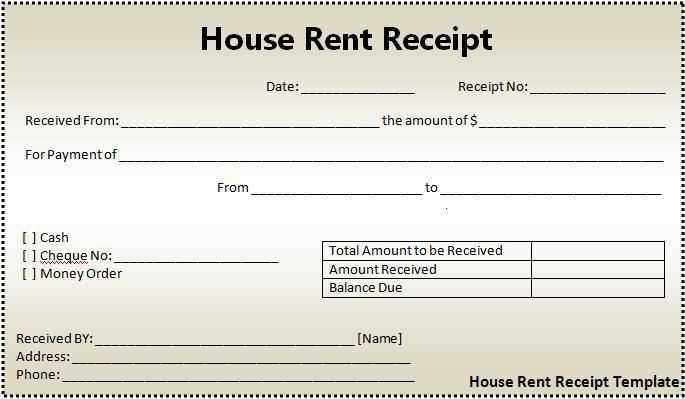

To effectively include the breakdown of principal, interest, and fees in your mortgage payment receipt template, structure the information clearly under separate categories. Start with a section that lists the total payment and itemizes each part of the payment. This allows the recipient to easily understand how the payment is distributed.

Principal

Label the portion of the payment applied to the principal as “Principal.” This amount reduces the outstanding loan balance. It is important to display the principal as a separate line item, showing the exact amount paid toward the loan principal. A clear breakdown of the remaining balance is also helpful, giving the borrower an understanding of how the payment impacts the overall loan.

Interest

For the interest portion, label it as “Interest” and display the amount charged for that period. Interest is calculated based on the loan balance and the interest rate. Ensure that the interest amount reflects the agreed-upon terms, and display it alongside the total payment for clarity. This helps the borrower see how much they are paying in interest versus the principal.

Fees

If there are any additional fees, such as late fees or service charges, include them under a “Fees” section. Clearly list the type of fee and the amount charged. Each fee should be explained, so the borrower knows exactly what they are being charged for. Avoid combining fees with other payments to maintain transparency.

Use tables or bullet points to keep the breakdown organized. A clean, easy-to-read format will make the receipt clear and professional.

Digital vs. Physical Receipts: Which is Better?

Choose digital receipts for better organization and convenience. With digital records, you can easily store and access receipts on your phone or computer. This eliminates the risk of losing paper receipts and offers a searchable archive for future reference.

Physical receipts, however, can still be useful in certain situations, like for proof of purchase when technology isn’t available or when businesses don’t offer digital alternatives. Keep in mind that paper receipts are often prone to fading or damage over time, making them less reliable in the long run.

- Storage and Organization: Digital receipts can be categorized and stored in cloud storage, allowing you to organize them by date, vendor, or expense type. Physical receipts require manual filing or keeping them in envelopes, which can become disorganized.

- Environmental Impact: Digital receipts reduce paper waste and are more eco-friendly. Physical receipts contribute to unnecessary paper usage, particularly with the overproduction of thermal paper, which often can’t be recycled.

- Security: Digital receipts are more secure if stored properly, protected by passwords or encryption. However, physical receipts may be easier to access by others if lost, and they may contain sensitive information that could be mishandled.

- Legal Validity: Both types of receipts are legally valid, but it’s essential to verify whether a specific organization or entity requires one over the other, particularly for tax purposes.

In summary, digital receipts offer superior organization, storage, and environmental benefits. However, physical receipts may still be preferred in specific scenarios. Consider your personal needs and convenience when making the decision.

Keep receipts in one place, whether physical or digital. For physical receipts, use a folder or filing cabinet with labeled sections, categorized by date or type of payment. For digital receipts, create a folder on your computer or cloud service where you can organize files by year and month.

Organizing Digital Receipts

For easier retrieval, save receipts in PDF or image format with clear filenames, such as the date and transaction amount. If you receive digital receipts via email, set up a specific email folder to store them. Use cloud storage services like Google Drive or Dropbox for added security and easy access across devices.

Regular Backup and Maintenance

Back up digital receipts regularly to avoid losing important documents. Make a habit of reviewing and organizing your receipts every month to ensure everything is up-to-date and properly stored. Shred physical receipts after scanning them if space is an issue.

Include a clear payment date. It helps both parties track when the payment was made and ensures there are no disputes regarding payment timelines.

Provide a unique payment reference number. This identifier will make it easier for the lender to track the payment against the borrower’s account.

Specify the total amount paid. It is necessary to include the exact sum of the mortgage payment, breaking it down into principal and interest if applicable.

Indicate the remaining loan balance. This keeps the borrower informed of the remaining mortgage debt after each payment, which is key for long-term financial planning.

Include a payment method description. Whether the payment was made by check, bank transfer, or another method, this adds clarity for future references.

Ensure there’s a signature or an authorization mark. It provides additional verification of the transaction’s validity.

Don’t forget the lender’s contact information. Should there be any questions about the payment, having the lender’s phone number or email address listed is important for quick resolution.