Use a supplier receipt template to streamline your transaction process and ensure clarity for both parties. A well-structured template helps record essential details such as product descriptions, quantities, and payment terms, providing transparency for your accounting records. Implementing a consistent format reduces errors and speeds up invoice processing.

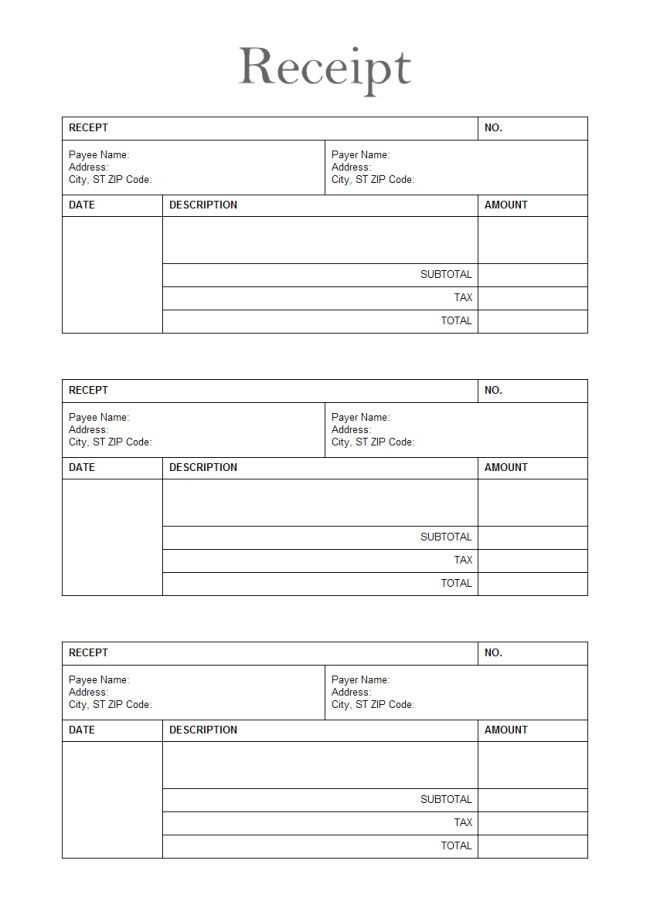

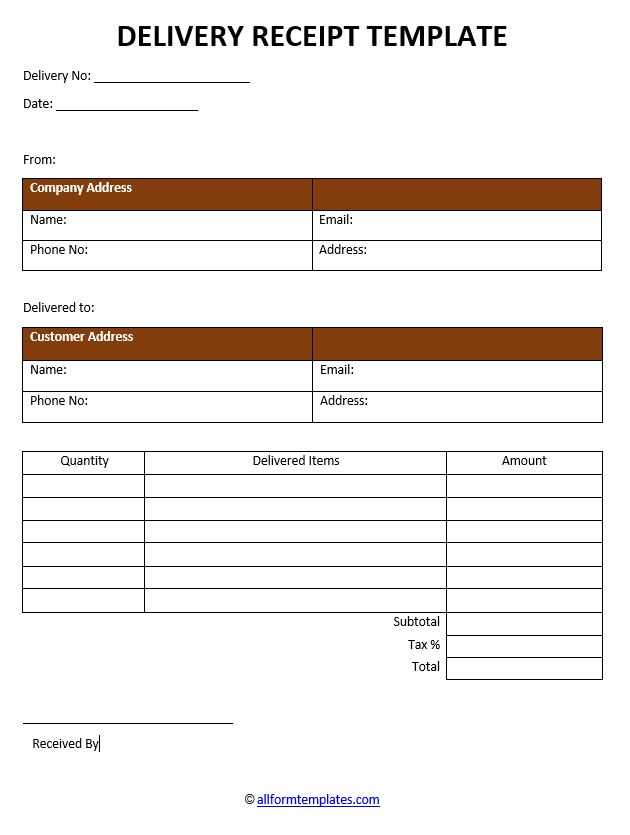

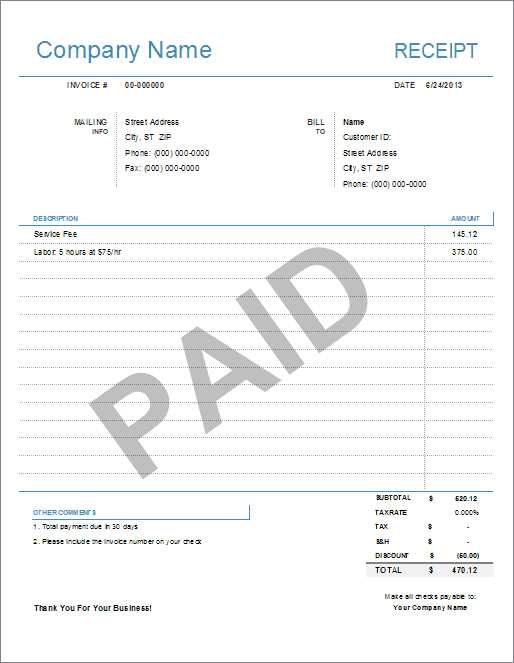

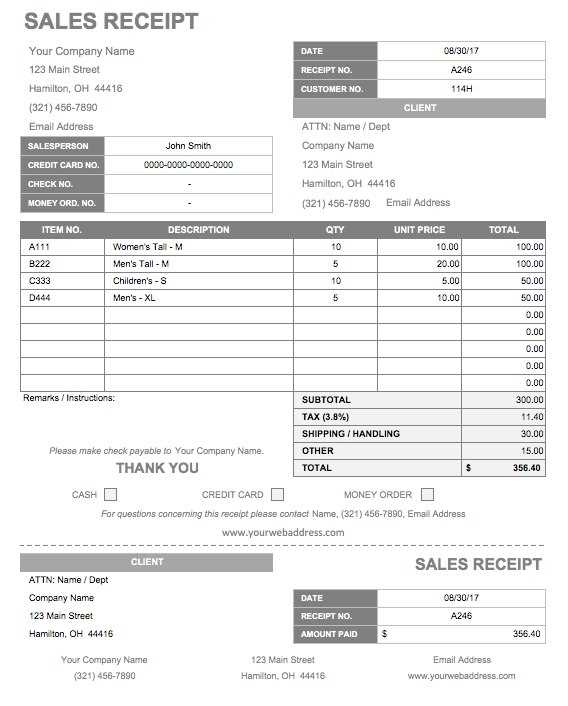

The template should include the supplier’s name, contact information, and the date of the transaction. Make sure to include a clear breakdown of the items purchased, including unit prices and total amounts. A section for payment method and terms allows both parties to stay aligned on how the transaction will be completed.

Always ensure your template aligns with your business’s requirements, adjusting sections like delivery instructions or tax rates as needed. This simple tool not only improves organization but also reduces the chances of disputes by keeping all transaction details in one place.

Sure! Here’s the revised version of your lines:

Begin by clearly specifying the date and time of the receipt at the top of your template. This ensures all transactions are documented accurately for future reference. Next, include the name of the supplier and their contact details. This helps in easily identifying the source and resolving any potential issues swiftly.

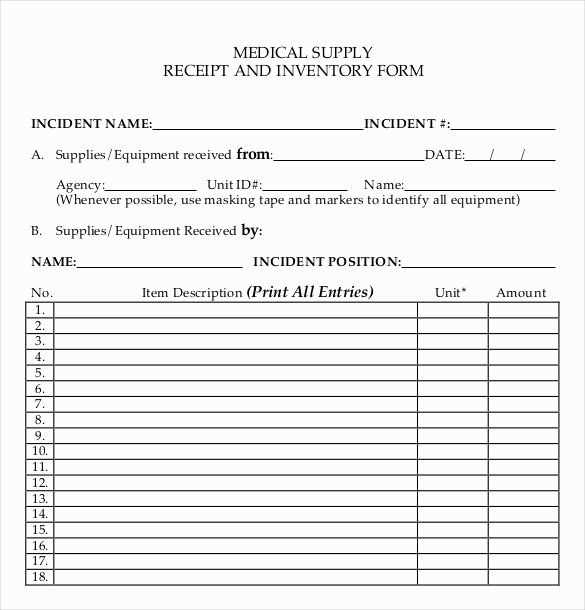

For the items received, list them in a table format with columns for item description, quantity, unit price, and total price. This will streamline the review process and make it easier to cross-check with purchase orders. Don’t forget to include a section for notes to address any special conditions or discrepancies observed during the delivery.

Lastly, make sure to have a designated area for authorized signatures to confirm receipt. This adds an extra layer of accountability and serves as a legal acknowledgment of the transaction. Keep the layout simple, clean, and easy to navigate for quick reference.

- Supplier Receipt Template: A Practical Guide

To create a supplier receipt template, begin with the basics: clearly label the document as “Supplier Receipt.” Include key details such as the supplier’s name, address, and contact information. Next, specify the transaction date, receipt number, and any relevant order or invoice numbers. This ensures clarity and helps track the receipt easily.

Incorporate a section that lists the items received, with a brief description, quantity, and unit price. This breakdown makes it easier to verify the accuracy of the delivery. It is also useful to include a line for the total amount paid or remaining balance if applicable.

For added transparency, include the payment method and any terms regarding payment or return policies. If applicable, a signature field for both parties confirms the receipt of goods and services. Always make sure to keep a copy of the receipt for record-keeping purposes.

The key elements of a supplier receipt ensure accurate tracking of transactions. To make the process smoother, it’s crucial to pay attention to the following details:

1. Supplier Information

The receipt must include clear details about the supplier. This typically includes the supplier’s name, contact details, and business registration number. These identifiers are essential for ensuring that the transaction is properly linked to the correct supplier.

2. Purchase Order Number

Including the purchase order (PO) number ties the receipt to the specific order placed. It helps in tracking and confirming that the correct goods or services were delivered according to the original agreement.

3. Description of Goods or Services

Clearly list the items delivered, including quantities, specifications, and any distinguishing features. This section avoids confusion during the reconciliation of goods received against orders.

4. Date of Receipt

Accurate dates are essential for verifying when goods or services were delivered. The date also plays a role in calculating any applicable warranty periods or payment terms.

5. Price and Total Amount

Break down the price per item or service, including taxes, shipping, and any discounts. This provides a clear understanding of the costs involved in the transaction, aiding in financial planning and accounting.

6. Payment Terms

Define the payment due date and any agreed-upon terms. This helps both parties understand the financial expectations and avoid late payments.

| Element | Description |

|---|---|

| Supplier Information | Supplier’s name, contact details, and registration number. |

| Purchase Order Number | Links the receipt to a specific order. |

| Description of Goods or Services | Details of items delivered, including quantity and specifications. |

| Date of Receipt | Exact date the goods or services were received. |

| Price and Total Amount | Breakdown of cost per item, including taxes and shipping. |

| Payment Terms | Details of the payment due date and terms. |

Begin by including your business name, address, and contact details at the top of the template. This helps the supplier and your team easily identify the transaction’s origin. Ensure that your business logo is clearly visible for branding purposes.

Next, add a unique reference number to each receipt. This will allow you to track and manage receipts effectively, especially when reconciling accounts.

- Choose appropriate fields for transaction details: Include supplier name, product or service description, quantity, unit price, and total amount. These fields should match your typical transactions.

- Set payment terms: If you offer different payment methods or timeframes, reflect this in the template. Include due dates and payment instructions to avoid confusion.

Consider adding customizable fields for discounts, taxes, or additional charges. This flexibility ensures the template works across various supplier agreements and pricing structures.

Ensure your template is clear and easy to read. Use straightforward language and organized sections to enhance readability. Avoid unnecessary information that could clutter the receipt.

Finally, make the template available in multiple formats (PDF, Word, etc.) for easy distribution and record-keeping. This ensures you and the supplier can keep track of transactions in the most convenient format.

Double-check the invoice and delivery details for consistency. Ensure that the quantities, prices, and product descriptions match what was agreed upon. Incorrect details may lead to discrepancies in payment or inventory records.

Don’t forget to verify the supplier’s information. This includes the name, address, and tax identification number. Missing or incorrect data can cause delays in processing and may complicate audits.

Ensure all necessary approval signatures or stamps are present. Missing approvals can halt payment or cause confusion during audits. Always obtain confirmation before proceeding with any transaction.

Avoid entering incorrect dates. Failing to record the accurate receipt date could cause problems with accounting periods and tax reporting.

Check for duplicate receipts. It’s common for suppliers to send multiple copies of the same receipt. Cross-reference your records to avoid paying the same invoice more than once.

Be mindful of tax calculations. Ensure that tax rates are applied correctly, as errors can result in overpayment or underpayment, leading to potential fines or delayed reimbursements.

Finally, verify the payment terms. If you receive an invoice with different terms than previously agreed upon, clarify with the supplier to prevent confusion in future transactions.

To enhance the security and authenticity of supplier receipts, include digital signatures directly within your template. This guarantees both parties’ agreement and reduces potential fraud. Digital signatures are legally binding and ensure that the document has not been altered after signing.

Follow these steps to seamlessly integrate digital signatures into your receipt template:

| Step | Action |

|---|---|

| 1. Select a Digital Signature Provider | Choose a trusted provider that offers digital signatures with encryption standards, such as DocuSign, Adobe Sign, or a blockchain-based solution. |

| 2. Add Signature Fields | Within the template, add a placeholder for the signature field. Ensure that the area for signing is clearly marked for both the supplier and recipient. |

| 3. Integrate with Your Template Tool | Use your chosen provider’s API or integration tools to embed the signature functionality into your receipt template. Many document management systems offer simple integration options. |

| 4. Implement Authentication Measures | Set up authentication procedures like email verification or two-factor authentication to ensure that only authorized personnel can sign the document. |

| 5. Verify and Store Signed Documents | Once signed, the system will automatically verify the signature and store the document securely. Ensure that the digital signature is protected and cannot be tampered with after signing. |

By incorporating a digital signature, you not only improve the reliability of your supplier receipt but also streamline the entire process, ensuring that both parties maintain a clear, unaltered record of the transaction.

Use clearly labeled folders or digital files for each supplier, ensuring you can locate receipts quickly. Group receipts by vendor or transaction type for quicker retrieval. Organize receipts chronologically, making it easier to track purchases over time.

Digital Solutions for Quick Search

Scanning receipts and storing them in cloud storage or a dedicated document management system allows you to access them from anywhere. Use searchable file names and tags to streamline finding specific documents. Implement software that automatically categorizes receipts based on pre-set criteria, reducing manual sorting.

Regular Maintenance and Review

Schedule periodic checks to remove outdated or irrelevant receipts. Archiving older receipts that no longer require immediate access keeps your active files organized without clutter. This practice ensures that only current and necessary records are easily available when needed.

To comply with legal standards, always include the following key elements in your supplier receipt templates:

- Business Identification Details: Include the full name, address, and tax identification number of both the supplier and the purchaser. This ensures traceability and establishes the legal identity of both parties.

- Date and Time of Transaction: Clearly state the transaction date. This helps prevent disputes over delivery timelines and payment terms.

- Description of Goods or Services: Provide detailed descriptions of the items or services provided, including quantities, unit prices, and any applicable discounts. This minimizes ambiguity and aligns with consumer protection laws.

- Payment Terms: Specify payment methods, due dates, and any applicable late fees. Having clear terms protects both parties from confusion or legal action regarding payment expectations.

- Compliance with Local Tax Laws: Ensure the template includes any required sales tax or VAT information. Check local regulations to avoid fines related to tax noncompliance.

- Return and Warranty Information: Include a section that outlines the return policy and warranty conditions, if applicable. This protects both the supplier and customer by clarifying how disputes over defective goods will be handled.

Ensure Transparency in Terms

Clearly state any terms or conditions that might affect the transaction, such as special delivery charges or conditions for service cancellations. This transparency will help avoid misunderstandings and potential legal issues.

Review and Update Regularly

Regularly review the supplier receipt template to ensure it meets the latest legal requirements. This includes staying informed about changes in tax laws, consumer rights, and any other regulatory updates.

This way, no word is repeated more than 2-3 times, while preserving the original meaning.

Start with a clean layout for your supplier receipt template to ensure clarity. Structure your document logically with distinct sections for itemized details, supplier information, and payment terms. This makes it easier for both parties to review and track transactions.

Section 1: Supplier Information

- Name of Supplier

- Business Address

- Contact Details (Phone, Email)

- Tax Identification Number (if applicable)

Section 2: Receipt Details

- Receipt Number

- Date of Transaction

- Purchased Items (with Quantity, Unit Price, Total Price)

- Subtotal and Taxes Applied

- Total Amount Due

Ensure that each section is well-defined, making it simple for both parties to confirm transaction accuracy. Consistent formatting adds professionalism and minimizes the chance of errors during review.