For non-profits, providing donation receipts is not only a helpful gesture for your donors but also a requirement for tax purposes. A well-designed donation receipt ensures that your organization is compliant with tax laws and builds trust with your supporters.

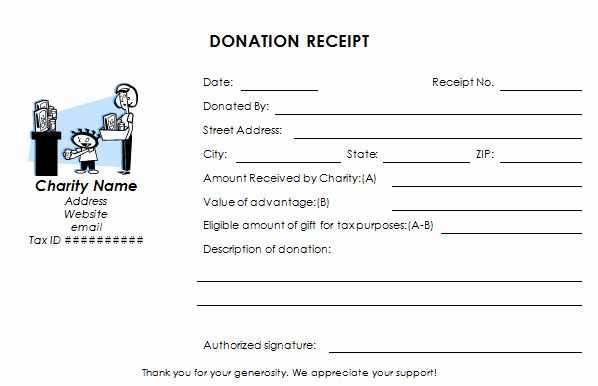

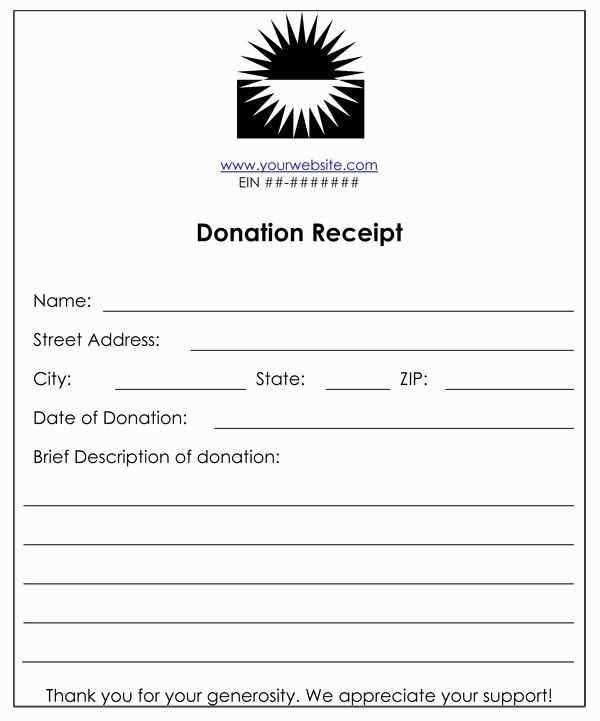

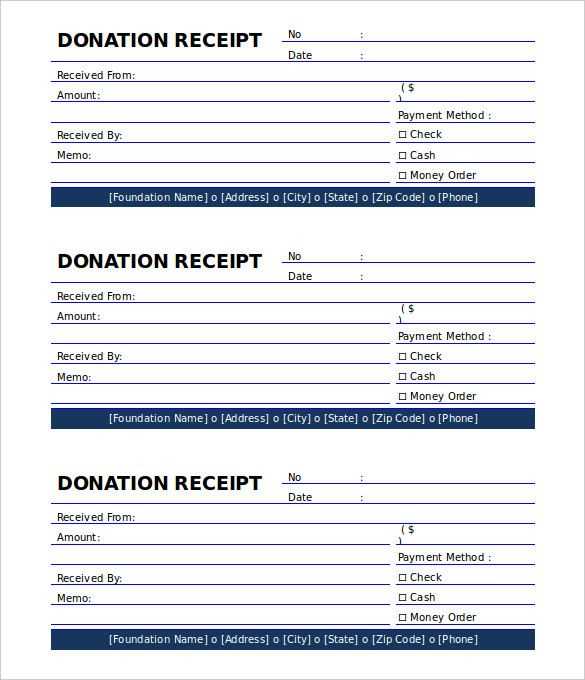

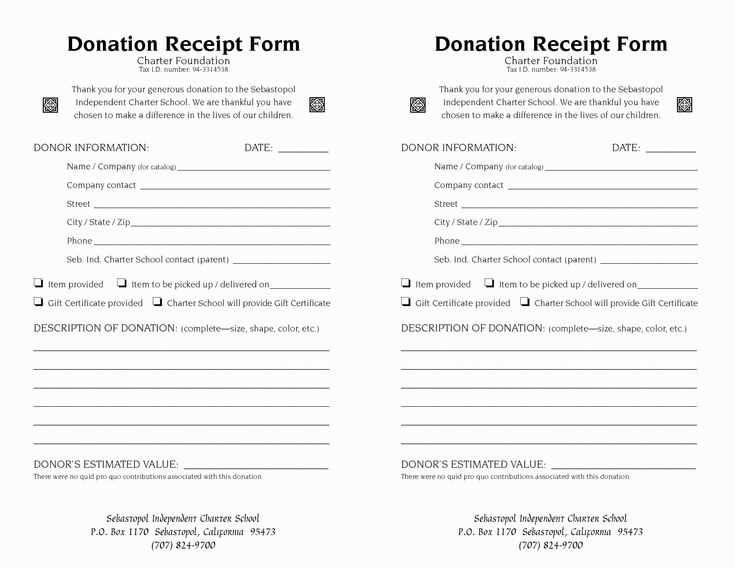

If you’re looking for an easy and free way to create a donation receipt, using a template can save you time and effort. A basic donation receipt includes the donor’s name, donation amount, date of the donation, and a statement about whether the donation is tax-deductible. Some templates even offer customization options, like adding your organization’s logo or a thank you note to make it more personal.

When selecting a free template, look for one that suits your organization’s needs and makes it easy to fill out all necessary information. Many templates are available in formats such as Word or PDF, allowing you to quickly generate receipts and send them out to donors. Be sure to include clear details about the donation, especially if it’s a tax-deductible contribution, to help your donors during tax season.

Using a donation receipt template not only simplifies administrative tasks but also enhances your non-profit’s professionalism. With a few simple steps, you can maintain accurate records and provide donors with the necessary documents for tax purposes.

Here are the corrected lines with minimal word repetition:

Designing a clear and concise donation receipt template is crucial for nonprofits. To improve clarity, avoid overusing terms like “donation” or “receipt.” Streamline sentences by removing unnecessary words.

Example 1:

Incorrect: “This is a receipt for your donation to our nonprofit organization. Your donation receipt is for the amount of $50.”

Corrected: “Thank you for your $50 donation to our nonprofit organization.”

Example 2:

Incorrect: “This receipt confirms that your donation has been made to support our nonprofit organization and its activities.”

Corrected: “Your donation supports our nonprofit’s activities.”

These adjustments reduce redundancy while maintaining clarity, making the document easier to read and more professional.

- Free Non-Profit Donation Receipt Template

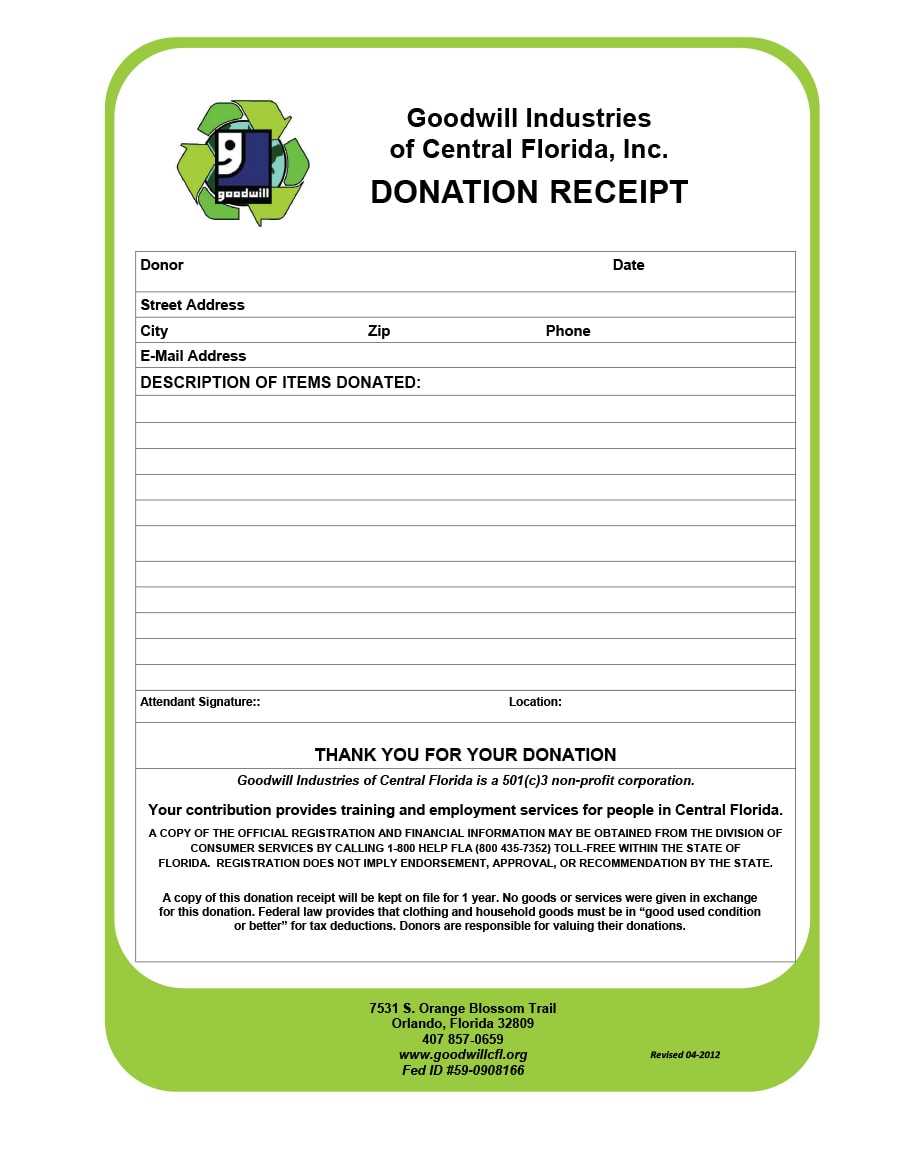

A donation receipt template helps non-profits provide clear and accurate records of contributions. This template should include essential information like the donor’s name, donation date, and donation amount. It also needs to state whether the donation is monetary or in-kind. The template should be customizable to accommodate different types of donations and allow for easy insertion of the organization’s details, including tax-exempt status.

Key Elements to Include

- Donor’s full name

- Organization’s name and tax-exempt status (if applicable)

- Donation date

- Detailed description of donated items (for non-monetary donations)

- Estimated value of non-cash donations

- Confirmation of no goods or services received in exchange for the donation

- Signature or representative of the organization

Customization Tips

Ensure the template is clear, concise, and legally compliant with your country’s tax regulations. Including a thank you note is a good practice for maintaining positive relationships with donors. Consider adding space for additional comments, special instructions, or follow-up details if needed.

Adjusting a donation receipt template to fit your non-profit’s specific needs ensures clarity and compliance. Here’s a straightforward approach to make your template truly your own:

1. Include Your Non-Profit’s Branding

- Insert your organization’s logo at the top of the receipt.

- Choose colors and fonts that reflect your branding for consistency.

- Add your mission statement or a short message to reinforce your cause.

2. Customize the Donation Information

- Clearly display the donor’s name and contact details for easy reference.

- List the donation amount, date, and method (e.g., credit card, check, or cash).

- If applicable, include details about recurring donations, including frequency and amounts.

3. Tax Information and Acknowledgment

- Ensure you include a statement confirming that the donation is tax-deductible (if applicable) and reference your tax-exempt status (e.g., 501(c)(3) in the US).

- Provide a clear acknowledgment that no goods or services were exchanged for the donation, or list them if applicable.

4. Personalize for Donor Relations

- Add a personal thank you message to show appreciation for the donor’s support.

- Consider adding a follow-up option for future donations or engagement opportunities.

5. Make the Receipt Easy to Read

- Use a clean, easy-to-read layout with clear headings and bullet points.

- Ensure that important details, such as the donation amount and date, are highlighted.

By applying these customizations, you not only provide a professional document to your donors but also strengthen your relationship with them. Every small change adds value to the donor’s experience.

Ensure your donation receipt includes the donor’s full name and address. This information is critical for both record-keeping and tax purposes. Clearly state the donation amount and the date it was received. For non-cash donations, describe the donated items or services, including their condition if applicable.

Donation Description

Provide a detailed description of the donation. For monetary contributions, specify the exact amount donated. If the donation is non-cash, describe the item, such as “used laptop” or “box of clothing.” If the donation was in-kind, include the estimated value, if known, and any appraisals if relevant.

Non-Profit’s Information

Clearly display the non-profit’s name, address, and tax-exempt status. Include your tax-exempt number or the IRS determination letter that verifies the organization’s 501(c)(3) status. This helps ensure donors can claim tax deductions accurately.

Provide a statement confirming that no goods or services were provided in exchange for the donation, unless applicable. If a good or service was provided, list the fair market value of what was received. This clarifies the portion of the donation that is tax-deductible.

Always make sure that the receipt is signed by an authorized representative from your organization to add credibility. Lastly, include contact information in case the donor has questions or requires further documentation.

Non-profit organizations must provide donation receipts for tax purposes that meet specific legal criteria. For donations over $250, it is mandatory to include the donor’s name, donation amount, and a statement confirming that no goods or services were provided in exchange for the donation, or if something was provided, its value.

Basic Information to Include

Receipts should clearly state the name of the organization, its tax-exempt status (typically indicated by a 501(c)(3) designation in the United States), the donor’s name, and the exact date of the donation. For donations over $75, it is necessary to describe the goods or services the donor received in return for their contribution, along with their fair market value.

Special Rules for Non-Cash Donations

When receiving non-cash donations, such as goods or securities, the receipt must include a description of the donated items. However, the organization is not required to assign a value to non-cash gifts. Donors must appraise these items themselves for tax reporting purposes. If the donation is over $5,000, a qualified appraisal may be required.

Non-profits should also keep detailed records of donations to ensure compliance with IRS regulations, as failure to provide accurate receipts could result in penalties for both the donor and the organization.

To use donation receipts for tax deductions, make sure they include specific details: the organization’s name, date, description of the donation, and its fair market value. If you donate items, the receipt must state whether you received any goods or services in exchange, as this affects the deductible amount.

Keep copies of your receipts and store them in an organized way. For donations totaling over $250, you’ll need a written acknowledgment from the charity that includes the amount and a statement of whether you received anything in return.

If you donate cash or check, the receipt should reflect the exact amount. For non-cash donations, like clothing or household items, ensure the receipt provides a detailed description of what was given. An estimated value for these donations can help you calculate your deduction, but it’s best to keep records of how you arrived at that estimate.

Consult IRS guidelines to verify how to claim the deduction and what documentation is needed based on the amount donated. Be thorough to avoid any issues with your tax filing.

For simplicity and accessibility, PDF is the best format for donation receipts. It’s easy to share via email, preserves formatting across devices, and looks professional. PDFs are universally accessible and ensure your donor receives the document exactly as you intend.

Word files are suitable for internal use or when quick edits are needed. However, they can cause formatting issues when viewed on different devices or programs, making them less reliable for final receipts. They also require the recipient to have Microsoft Word or compatible software to view the document correctly.

Excel, while excellent for tracking multiple donations and creating reports, isn’t ideal for formal donation receipts. It can be cumbersome to format, and the recipient might not find it as polished as a PDF. Excel is better suited for behind-the-scenes record keeping rather than for providing receipts to donors.

In summary, use PDF for your donation receipts to maintain consistency and professionalism, with Word and Excel reserved for administrative purposes. This ensures your receipts are accessible, easily printable, and meet donor expectations for a smooth giving experience.

Non-profits can easily access free donation receipt templates from several trustworthy sources. These templates provide clear, standardized formats that meet IRS guidelines for tax-deductible contributions. Below are the best places to find reliable templates:

1. Non-Profit Websites

Many non-profit organizations share donation receipt templates for free to help other similar groups streamline their donation processes. Websites like Charity Navigator and Guidestar offer templates that align with donation reporting standards.

2. Template Providers and Tools

Websites like Canva and Vertex42 offer free templates for various needs, including donation receipts. These sites allow for customization to match your non-profit’s branding and specific requirements.

3. Google Docs and Microsoft Word Templates

Both Google Docs and Microsoft Word provide free, ready-made donation receipt templates through their template galleries. These templates are easily customizable and available to anyone with a Google or Microsoft account.

4. IRS Website

The IRS offers detailed guidance on what should be included in a donation receipt for tax purposes. While they don’t provide templates directly, they give clear instructions which you can use to create your own receipt.

5. Non-Profit Software Providers

Some non-profit management software providers offer free tools and templates to assist with donation tracking. Websites like Network for Good offer free templates to accompany their fundraising tools.

6. Template Marketplaces

Several online marketplaces like TemplateMonster and Templatify have free templates available. Some may require you to sign up for an account or offer a freemium model, but many templates are available at no cost.

Example Donation Receipt Template

| Donation Information | Organization Details |

|---|---|

| Donor Name: John Doe | Non-Profit Organization: XYZ Charity |

| Donation Amount: $100 | Tax ID: 12-3456789 |

| Date: 02/05/2025 | Address: 123 Charity Lane, City, State, Zip |

| Payment Method: Credit Card | Contact: [email protected] |

| Donation Type: Monetary | Phone: (555) 123-4567 |

By using these resources, non-profits can easily generate donation receipts that are compliant with tax regulations and efficient for donor record-keeping.

Make sure to include the donor’s name, donation date, and the exact amount donated in your receipt template. This creates a clear record for both the donor and your organization. You should also state your non-profit’s legal status and provide contact information for any questions regarding the donation.

Use specific language when acknowledging donations. Avoid vague statements like “general donation” and instead specify if the gift is for a particular cause or project. This helps the donor understand exactly how their money is being used and adds transparency to your operations.

Include a thank you note that reflects appreciation and emphasizes the impact of the donation. Personalized messages are ideal, but a general “Thank you for your generous contribution” will still convey gratitude effectively.

It’s helpful to incorporate a unique receipt number for tracking purposes. This makes it easier for donors to reference their donation, especially if they need it for tax purposes.

End the receipt with a reminder about your organization’s tax-exempt status, and advise the donor to keep the receipt for their records. A brief disclaimer explaining that no goods or services were exchanged for the donation will solidify the receipt’s legitimacy.