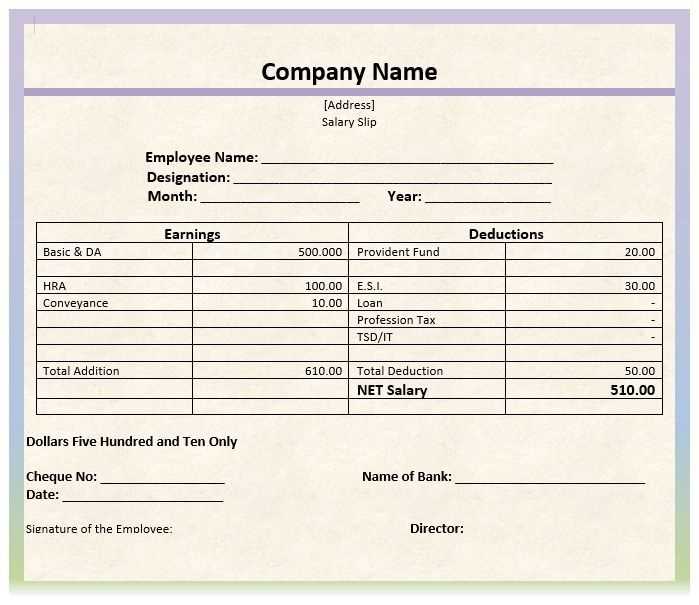

When paying a nanny, it’s crucial to provide a clear and detailed salary receipt. A salary receipt helps both the employer and the nanny keep accurate records of payments made, ensuring transparency and trust. It also serves as proof of income, which may be necessary for tax purposes or financial planning.

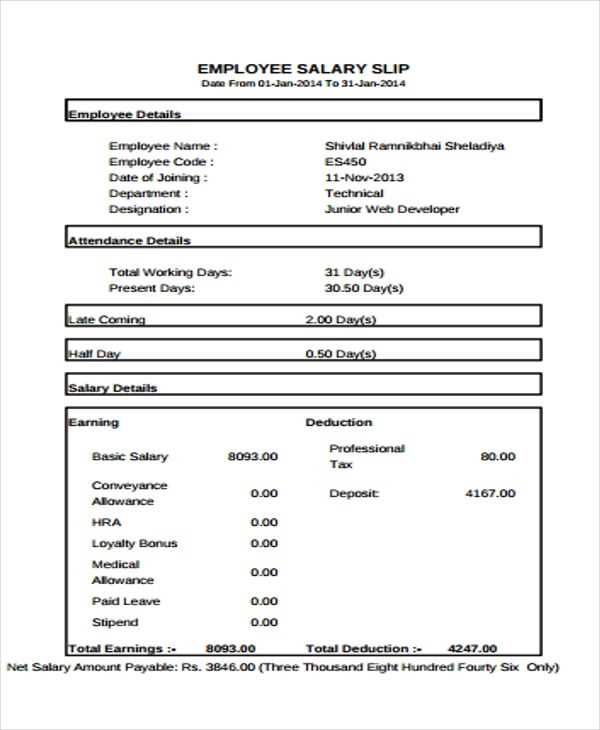

Start by including the nanny’s full name, the period covered by the payment, and the total amount paid. Specify the breakdown of the salary, such as hourly wage, weekly or monthly rate, overtime (if applicable), and deductions, like taxes or insurance. Make sure to note the payment method, whether cash, bank transfer, or check, and include any bonuses or additional compensation.

It’s also helpful to have a space for both parties to sign the receipt. This acknowledges that the payment details are correct and both the employer and the nanny are in agreement. A well-organized and professional template can make this process quick and easy for everyone involved.

Here’s the revised version with no excessive repetition:

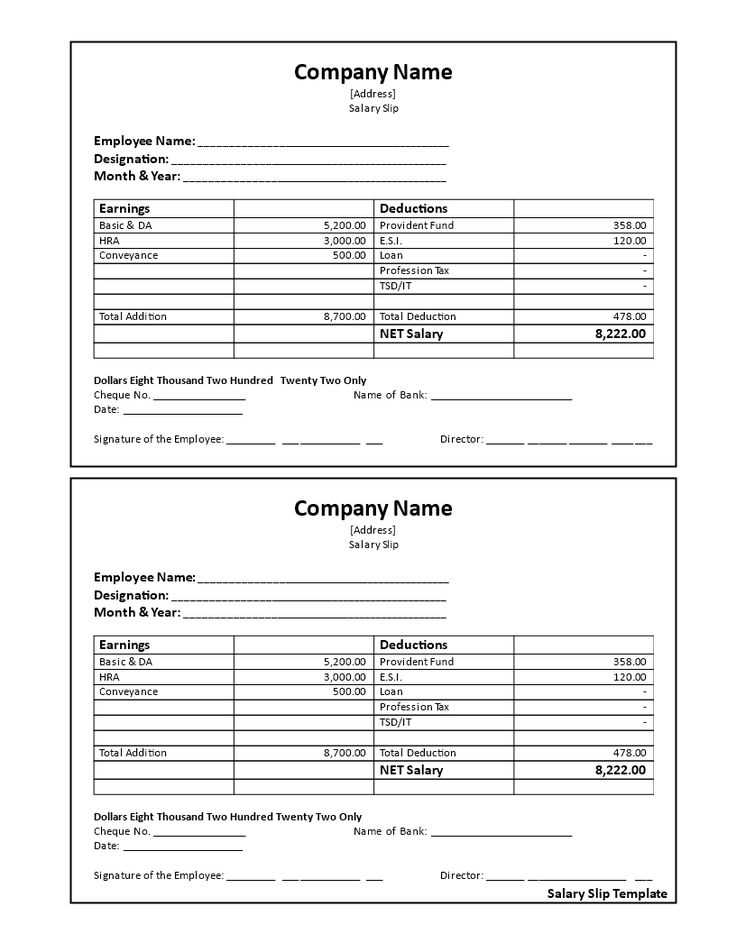

When creating a salary receipt for a nanny, keep the format clear and concise. Focus on including all necessary details without adding unnecessary information. A well-organized receipt includes the nanny’s full name, payment period, total earnings, deductions, and the net amount paid. This ensures transparency and clarity for both the employer and the nanny.

Key Information to Include:

List the following components to make the receipt comprehensive:

- Employer’s Information: Name and contact details.

- Nanny’s Information: Name and role.

- Payment Period: Start and end dates of the payment period.

- Gross Salary: The total amount before deductions.

- Deductions: Any tax, insurance, or other deductions made from the salary.

- Net Salary: The amount after deductions, which is the actual payment received.

- Payment Method: Specify whether it’s paid via bank transfer, cheque, or cash.

- Date of Payment: The date on which the payment was made.

Tips for Clarity:

Keep the language simple and the structure easy to follow. Avoid unnecessary details that don’t pertain directly to the payment process. A professional yet straightforward template helps build trust and ensures that all financial transactions are documented accurately.

- Salary Receipt Template for a Nanny

Creating a salary receipt template for a nanny helps ensure transparency and avoids misunderstandings. A clear salary receipt outlines the payment details, benefits, and deductions for both the nanny and the employer. Below is an example template that can be easily customized to meet specific needs.

Key Information to Include

- Employer Details: Include the employer’s name, address, and contact information.

- Nanny’s Details: The nanny’s full name, address, and contact number should be mentioned clearly.

- Payment Period: Specify the start and end date of the pay period (e.g., “01/01/2025 to 31/01/2025”).

- Gross Salary: State the total salary earned before any deductions (e.g., “Gross Salary: $2,000”).

- Deductions: List any applicable deductions such as taxes, health insurance, or pension contributions (e.g., “Tax Deduction: $200”).

- Net Salary: Mention the total amount to be paid after deductions (e.g., “Net Salary: $1,800”).

Additional Information

- Bonus or Overtime: If applicable, note any additional payments (e.g., “Overtime Pay: $100”).

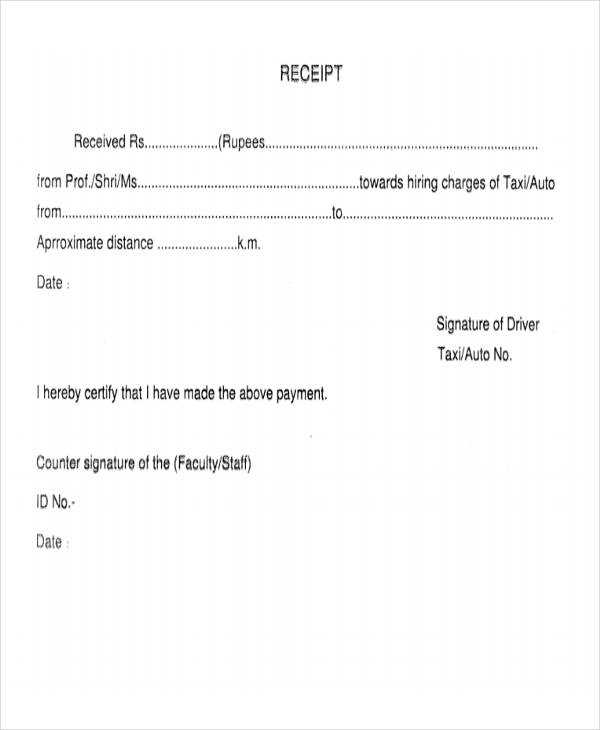

- Payment Method: Specify how the payment was made, whether via bank transfer, check, or cash.

- Signature: Both the employer and nanny should sign the receipt to acknowledge the transaction.

This template helps provide a clear, structured record for both the nanny and the employer. It helps avoid confusion and ensures all payments are documented appropriately.

Ensure the payment details are clear and accurate to avoid any confusion. Include the following components:

- Gross Salary: Clearly mention the total amount before deductions.

- Deductions: List any deductions such as taxes, insurance, or pension contributions, showing each amount separately.

- Net Salary: Display the final amount after all deductions have been subtracted from the gross salary.

- Payment Date: Indicate the date when the payment was made to the nanny.

- Payment Method: Specify the method used for payment (e.g., bank transfer, cash, cheque).

- Pay Period: State the period for which the salary is being paid, such as weekly, bi-weekly, or monthly.

By including these details, both parties can verify the payment information quickly and efficiently, ensuring transparency and avoiding misunderstandings.

Accurately tracking hours worked is critical when calculating a nanny’s salary, particularly if overtime applies. Clearly outline the start and end times for each workday, including any breaks. Specify whether the nanny works weekends, holidays, or during unusual hours, as this impacts the pay rate.

Tracking Regular Hours

Regular hours are those that fall within the standard work schedule, typically from 9 AM to 5 PM. Ensure that these hours are recorded precisely to avoid confusion and errors. If there’s flexibility in work hours, clarify the exact shift timings on the receipt.

Overtime Pay Calculation

Overtime pay applies to any hours worked beyond the standard schedule. In most cases, overtime is compensated at 1.5 times the regular hourly rate. To avoid disputes, define what constitutes overtime, and clearly state the applicable rate in the salary receipt.

To ensure transparency, include both regular and overtime hours on the salary receipt. This allows both the nanny and the employer to easily verify the total hours worked and the correct pay rate applied.

Including deductions and taxes in a nanny’s salary slip is crucial for transparency and accuracy. Taxes are typically withheld according to local regulations, and other deductions might include social security, health insurance, or retirement contributions. Here’s how to structure these elements on the salary slip:

1. Tax Deductions

Include the total amount of taxes withheld from the nanny’s gross salary. These deductions might be for income tax, social security, and Medicare, depending on the jurisdiction. Ensure the correct tax rate is applied, as this can vary based on income levels and local tax laws.

2. Other Deductions

List any other deductions that apply, such as contributions for health insurance, retirement plans, or uniform costs. Be sure to specify each deduction clearly and separately to avoid confusion.

| Description | Amount |

|---|---|

| Gross Salary | $2000 |

| Tax Deduction | $200 |

| Health Insurance | $50 |

| Net Salary | $1750 |

Clearly outlining all deductions helps avoid confusion and ensures the nanny knows exactly how their salary is calculated. Regularly review these deductions to ensure they are up-to-date and in line with any changes in tax laws or benefit plans.

Include a clear section for bonuses or additional payments in the salary receipt template to ensure transparency and avoid confusion. This section should specify any extra earnings outside of the regular salary, such as performance bonuses, overtime, or special incentives.

- Label the section clearly as “Bonuses” or “Additional Payments” to separate it from the base salary.

- Provide detailed descriptions of each bonus or payment type, including the reason for the extra payment (e.g., “Holiday Bonus”, “Overtime Pay”).

- Indicate the calculation method for each bonus. For example, “10% of monthly salary” or “Hourly rate x 1.5 for overtime hours”.

- Include the date the bonus or additional payment was earned to clarify when it was applicable.

- Ensure that the total bonus amount is clearly visible at the end of this section.

This clear breakdown helps both the nanny and the employer track additional earnings separately from the regular salary, ensuring all payments are understood and documented. Be specific about any eligibility criteria for bonuses, such as performance goals or seasonal adjustments, to prevent misunderstandings.

Make sure to include clear headings and organize the information logically. Start by listing the key details such as the nanny’s name, address, and the date the payment is made. This gives a clear snapshot of the transaction.

Key Sections to Include

| Section | Description |

|---|---|

| Employee Information | Name, address, and contact details of the nanny. |

| Employer Information | Details of the person or family employing the nanny. |

| Payment Details | Amount paid, breakdown of hours worked (if applicable), and hourly/daily rates. |

| Payment Method | State if payment was made via check, bank transfer, or cash. |

| Deduction Information | If any deductions (tax, insurance) are made, list them here. |

| Employer’s Signature | Provide space for the employer’s signature for verification. |

Formatting Tips

Use bullet points or short paragraphs to separate key information. Avoid lengthy sentences, and keep the layout neat. A well-organized receipt makes it easier for both parties to review the payment details. Consider adding a header with the term “Salary Receipt” to make it immediately identifiable.

A nanny’s pay stub should clearly display key information to ensure compliance with labor laws and tax regulations. Include the following details:

- Employee’s name and address – This identifies the nanny and provides a clear record of employment.

- Employer’s name and address – Similarly, this identifies the employer and ensures proper documentation of the relationship.

- Pay period – Specify the start and end dates of the pay period to avoid confusion over compensation timing.

- Gross wages – This is the total earnings before deductions, covering regular hours and any overtime, bonuses, or other payments.

- Hours worked – Break down regular and overtime hours to reflect the actual work done.

- Hourly rate or salary – Include the agreed-upon hourly rate or salary for transparency on compensation calculations.

- Tax withholdings – List federal, state, and local tax withholdings, including Social Security and Medicare, to ensure proper deductions.

- Other deductions – If applicable, show deductions for benefits, insurance, or retirement plans.

- Net pay – The amount the nanny will actually receive after all deductions are subtracted from the gross wages.

- Employer’s tax contributions – Employers should also outline their contributions for Social Security, Medicare, and any other applicable taxes.

Including these components ensures clear, accurate, and lawful documentation for both the employer and employee. Pay stubs also serve as a useful reference in case of disputes or audits.

Make the salary receipt template clear and concise. Include key details such as the employee’s full name, the payment period, and the total amount paid. Always specify the date of the payment and the method used (cash, bank transfer, etc.). A straightforward layout makes the document easy to read and understand.

Details to Include

Include the breakdown of hours worked, pay rate, and any deductions or bonuses. For example, if the nanny worked extra hours, indicate the number of overtime hours and their corresponding rate. If there were any deductions (like taxes or insurance), list those clearly.

Formatting Tips

Use a clean and simple format. Keep sections separated for better readability. For example, group the pay period, employee details, and payment breakdown in distinct blocks. Use bullet points or lists for clarity when breaking down deductions or additional payments.