Ensure every donation is properly recorded with a structured church receipt template. A well-designed receipt provides clarity for donors, simplifies bookkeeping, and ensures compliance with financial regulations. Whether collecting tithes, special offerings, or event contributions, an organized template streamlines the process and minimizes errors.

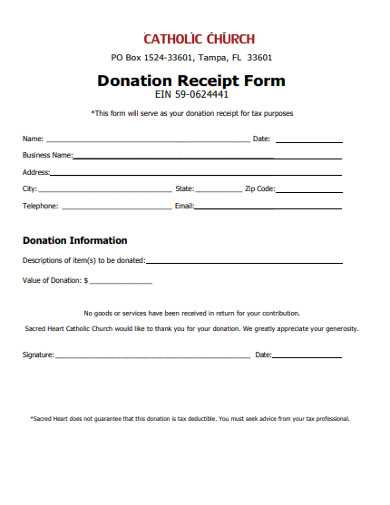

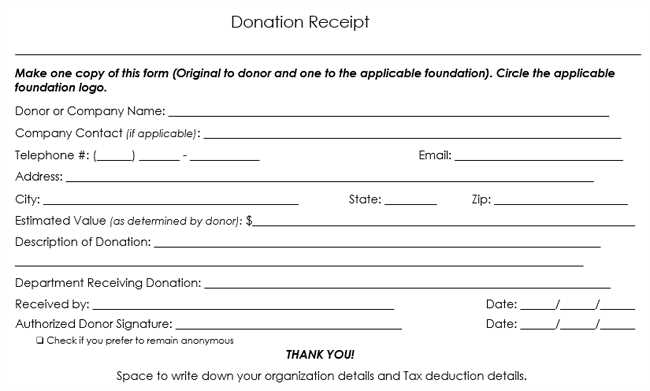

Include key details such as the donor’s name, date of contribution, amount given, and purpose of the donation. Adding a unique receipt number improves tracking, while a brief acknowledgment message strengthens transparency and donor trust. If applicable, include tax-exempt status information to help contributors with their financial records.

Digital and printed receipts both serve valuable roles. A printable version is useful for in-person donations, while an email-friendly format allows for quick electronic distribution. Consider integrating templates into accounting software or church management systems to automate record-keeping and reduce administrative workload.

Using a structured receipt template not only ensures compliance but also reinforces donor confidence. By maintaining clear and consistent documentation, churches demonstrate accountability and strengthen relationships with their communities.

Here’s the revised version, reducing the repetition of “Church Receipt” while maintaining clarity:

To create a receipt for church donations, include the donor’s name, address, donation date, and amount. For clarity, specify the purpose of the donation–whether it’s for general funds, a specific project, or a special event. Additionally, it’s helpful to list the church’s name and address for tax purposes. To avoid confusion, mention the donation method, such as cash or check, and indicate if the donation is recurring. Conclude with a statement confirming that no goods or services were exchanged for the donation. This ensures the receipt is clear, accurate, and usable for tax filing.

- Church Receipt Template: A Practical Guide

Creating a church receipt template requires clear and concise details to ensure transparency in financial transactions. Start by including the name and address of the church at the top for identification.

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

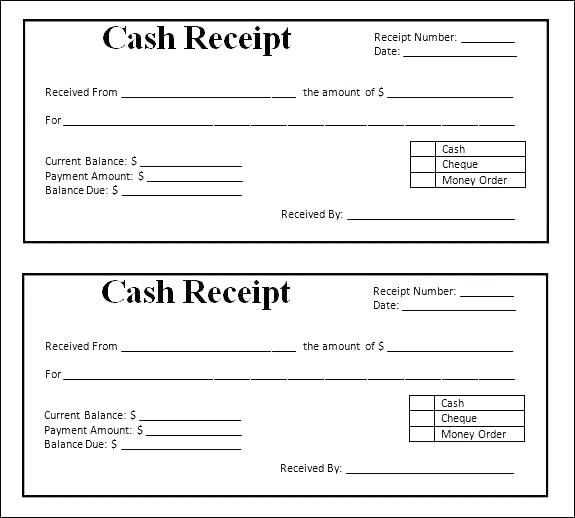

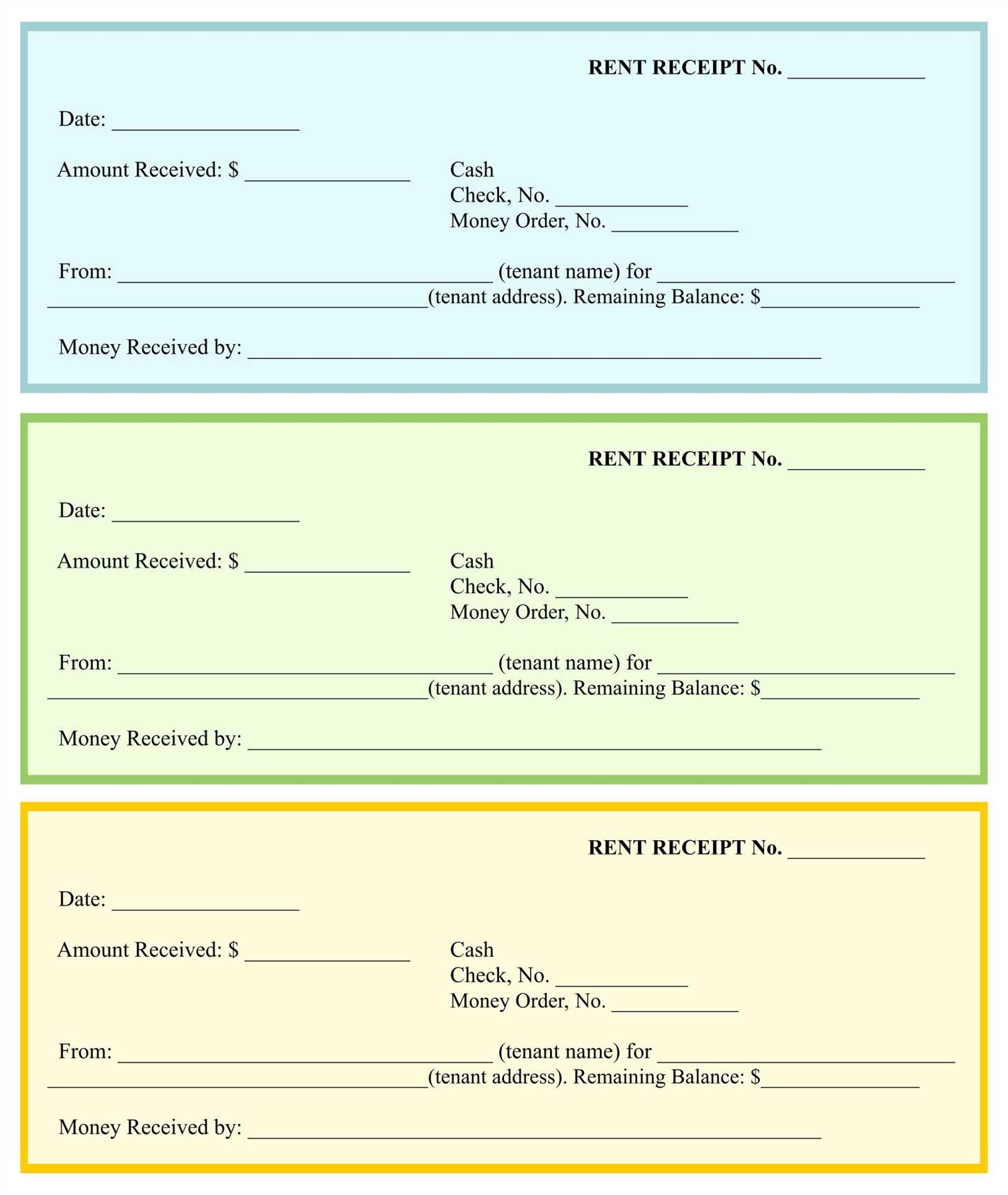

- Date: Include the date of the donation or payment to keep accurate records.

- Donor Information: Clearly list the donor’s name, address, and contact details if applicable.

- Donation Amount: Specify the exact amount donated or paid. If applicable, break it down into categories (e.g., tithing, building fund, etc.).

- Payment Method: Note whether the donation was made via cash, check, or electronic transfer for complete documentation.

- Purpose of Donation: Briefly describe the intended use of the funds (e.g., general donation, special event, etc.).

It’s crucial to include a statement that no goods or services were exchanged in return for the donation, as this ensures compliance with tax-exemption regulations.

- Tax Exemption Statement: Clearly state that the donation is tax-deductible, as long as the donor did not receive anything in exchange.

- Authorized Signature: Include a space for an authorized signature from the church’s treasurer or other responsible party.

- Thank You Message: A brief expression of gratitude adds a personal touch and encourages future contributions.

Ensure the receipt is formatted neatly and professionally for easy readability. This template can be adapted for different types of contributions, from regular tithes to special event donations, by modifying the categories accordingly.

Include the donor’s full name and address. This is necessary for tax purposes and ensures accuracy in record-keeping. Make sure the information matches the donor’s records with your church.

Date of Donation

Clearly state the date of the donation. This helps both the church and the donor to track contributions within the correct tax year. This also supports transparency in your financial records.

Amount or Description of the Donation

For cash donations, specify the exact amount given. For in-kind donations, provide a description and, if possible, an estimated value. This provides clarity and helps the donor claim proper deductions.

Include a statement confirming that no goods or services were exchanged for the donation, unless applicable. This ensures the donation qualifies for tax benefits. If goods or services were provided, mention their fair value to avoid confusion.

End with a statement of gratitude, reinforcing the donor’s positive impact. This shows appreciation and encourages continued support.

Ensure your church receipt template complies with local tax laws and regulations. Incorporating specific legal details, such as the tax-exempt status of your church and the type of donations received, is crucial. Many regions require receipts to include certain information to maintain transparency and ensure that contributions qualify for tax deductions.

Always include the donor’s name, the date of the donation, the amount given, and a clear statement confirming whether the donation is tax-deductible. For non-cash donations, list the description of the items donated and their estimated value. Avoid overestimating or underreporting the value of donations.

The following table provides a checklist of the necessary legal elements for a compliant donation receipt:

| Element | Description |

|---|---|

| Donor Information | Full name of the donor or organization |

| Donation Amount | Exact value of monetary donations, or description and estimated value for non-cash donations |

| Date of Donation | Specific date the donation was received |

| Tax-Exempt Status | Statement of the church’s tax-exempt status, including the tax ID number |

| Non-Cash Donation Details | Detailed description of non-cash donations with an estimated value |

| Statement of No Goods or Services Provided | Confirmation that no goods or services were provided in exchange for the donation (for gifts of $250 or more) |

Consult a tax professional to ensure your receipts meet all legal requirements in your area. Periodically review your templates to stay compliant with any changes in tax laws or IRS guidelines. This will help maintain the integrity of your church’s financial records and support your donors in receiving accurate tax deductions for their contributions.

Organize files into clear categories. Separate church receipts by date or event type, using folders or digital directories. Consistently naming files helps you locate them easily later.

For paper records, use sturdy file folders or a filing cabinet to keep everything in order. Label folders clearly and maintain a consistent system. Consider scanning paper receipts for backup storage, ensuring they’re legible and searchable.

Digital Records Management

Store digital receipts in cloud storage services. This reduces the risk of losing data in case of technical issues. Ensure the digital files are encrypted for added security, especially when handling sensitive information.

Establish a routine for uploading new receipts and categorizing them as soon as they’re received. Set reminders to maintain this habit regularly to avoid accumulation.

Paper Records Management

For paper receipts that need to be preserved, keep them in a cool, dry environment. Use acid-free folders to prevent damage over time. Periodically review and shred any outdated or unnecessary documents.

Adjust your church receipt template to fit various activities by considering the specifics of each event. Begin by adding or removing fields based on the type of activity, ensuring the form captures all relevant details.

- For Donations: Include donor names, donation amounts, dates, and a note about the purpose (e.g., general fund or special event). Add a section for recurring donations if applicable.

- For Fundraisers: Focus on ticket sales or auction proceeds, specifying the number of tickets purchased or items won. Include a breakdown of the funds raised and expenses incurred for transparency.

- For Church Events: Customize with event details like date, time, location, and special instructions. Provide a space for attendees’ contributions, whether monetary or in-kind, along with volunteer information.

Make sure that each template version maintains clarity and is easy to update for future activities. Consistently check that the fields match the specific requirements of your event for accurate record-keeping.

Ensure accurate donation amounts by double-checking figures before finalizing receipts. Avoid errors by verifying the total and individual item values one last time before issuing the receipt. This helps prevent discrepancies between what was given and what is recorded.

Incorrectly formatted dates can confuse both church staff and donors. Always use a consistent date format, ensuring it aligns with your region’s standard. If possible, automate the insertion of the current date to eliminate manual entry mistakes.

Inconsistent donor names can lead to miscommunication. Double-check the spelling of each donor’s name. For churches with a large number of donors, maintaining a database that can auto-fill name fields will save time and minimize errors.

| Common Error | How to Avoid It |

|---|---|

| Incorrect Donation Amounts | Double-check the total and individual values before issuing the receipt. |

| Formatting Issues with Dates | Stick to a standard date format and automate insertion when possible. |

| Donor Name Errors | Verify the correct spelling of donor names, use an auto-fill feature where available. |

Be cautious about missing signatures. If your template requires one, ensure the field is always included and clearly visible. This avoids confusion or the need for follow-up communication.

Lastly, remember to review the tax-deductible status and proper categorization of donations. Using preset categories for each type of contribution will help keep records consistent and accurate, preventing mistakes when filing for taxes.

For free templates, check out sites like Canva and Google Docs. Canva offers an easy-to-use interface with multiple church receipt templates you can customize. Google Docs provides basic templates that you can download and adapt without any cost.

If you’re looking for more premium options, Envato Elements has a wide range of high-quality templates, including detailed church receipt formats. Membership gives you access to a vast library of designs with regular updates. Template.net is another paid resource offering various professionally crafted templates, perfect for churches needing polished receipts quickly.

For a more tailored approach, consider visiting church-specific resources like Church Templates or Church Helper, where you’ll find templates designed specifically for religious organizations. These platforms offer both free and paid options that suit different needs.

Now the term “Church Receipt” is used less frequently, while the text remains clear and accurate.

To simplify the use of “Church Receipt” in documents, focus on specific details relevant to the transaction, avoiding unnecessary repetition. This helps maintain clarity and prevents redundancy. Ensure the receipt clearly outlines:

- Donor’s name and contact details

- Donation amount and date

- Church’s name and address

- Reason for the donation

This structured approach allows you to convey all necessary information without overusing the term “Church Receipt.” By prioritizing clarity, you ensure recipients easily understand the document while keeping it concise and professional.