Key Elements of a Rent Receipt

A well-structured rent receipt ensures clarity for both landlords and tenants. Include these essential details:

- Date: The exact date the payment was received.

- Tenant’s Name: The full name of the person making the payment.

- Rental Address: The complete address of the rented property.

- Payment Amount: The total sum paid, written in numbers and words.

- Payment Method: Cash, check, bank transfer, or another method.

- Payment Period: The specific rental period covered (e.g., March 1–March 31, 2024).

- Landlord’s Name and Signature: Confirmation that the payment has been received.

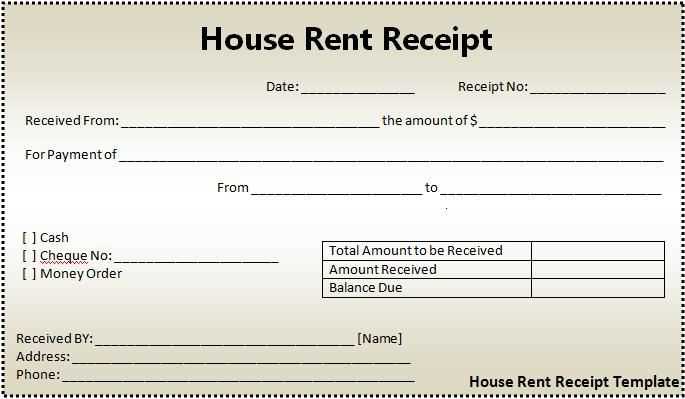

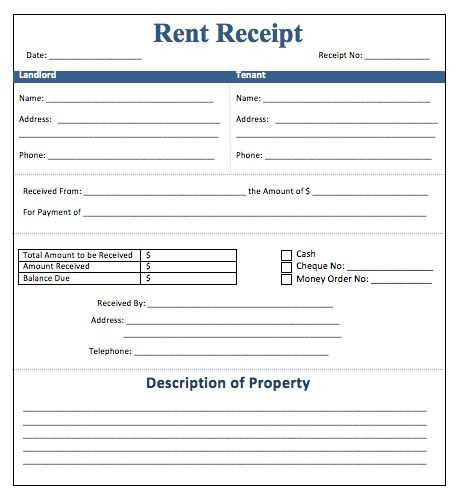

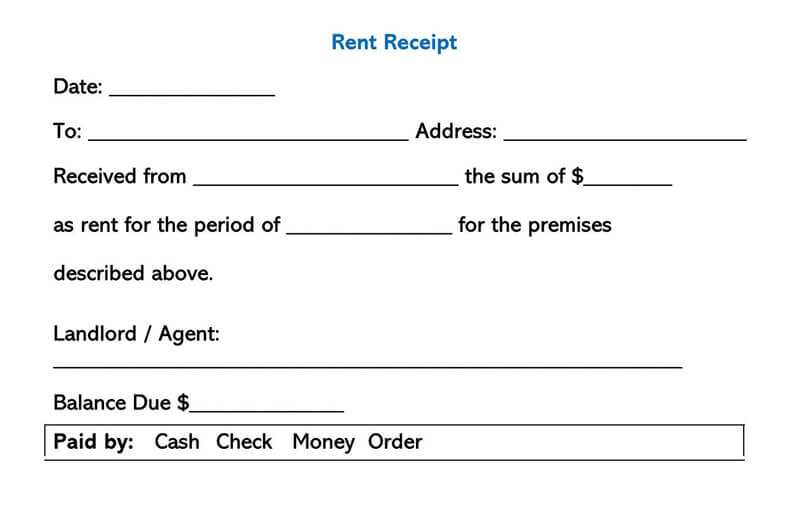

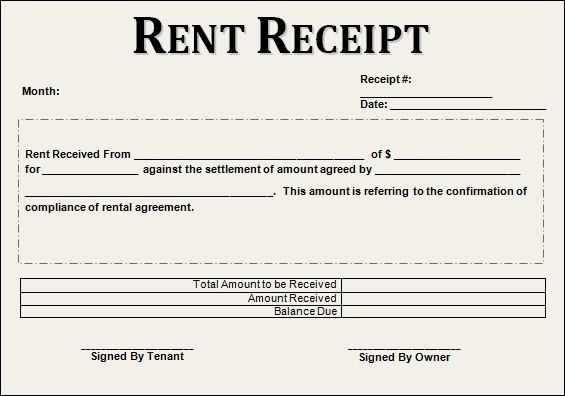

Simple Rent Receipt Template

Use this template to create a professional receipt:

Rent Receipt

- Date: [Insert Date]

- Received From: [Tenant’s Name]

- Rental Property Address: [Full Address]

- Amount Paid: $[Amount] ([Amount in Words])

- Payment Method: [Cash/Check/Bank Transfer]

- Rental Period: [Start Date] – [End Date]

- Received By: [Landlord’s Name]

- Signature: __________________________

Best Practices for Rent Receipts

For accurate record-keeping, always issue receipts immediately upon payment. Keep digital or physical copies for reference. If payments are made online, consider using automated receipts to maintain consistency.

When a Rent Receipt Is Necessary

Providing a receipt is crucial when handling cash payments, resolving disputes, or applying for rental-related benefits. Some jurisdictions legally require landlords to issue receipts, so check local regulations to ensure compliance.

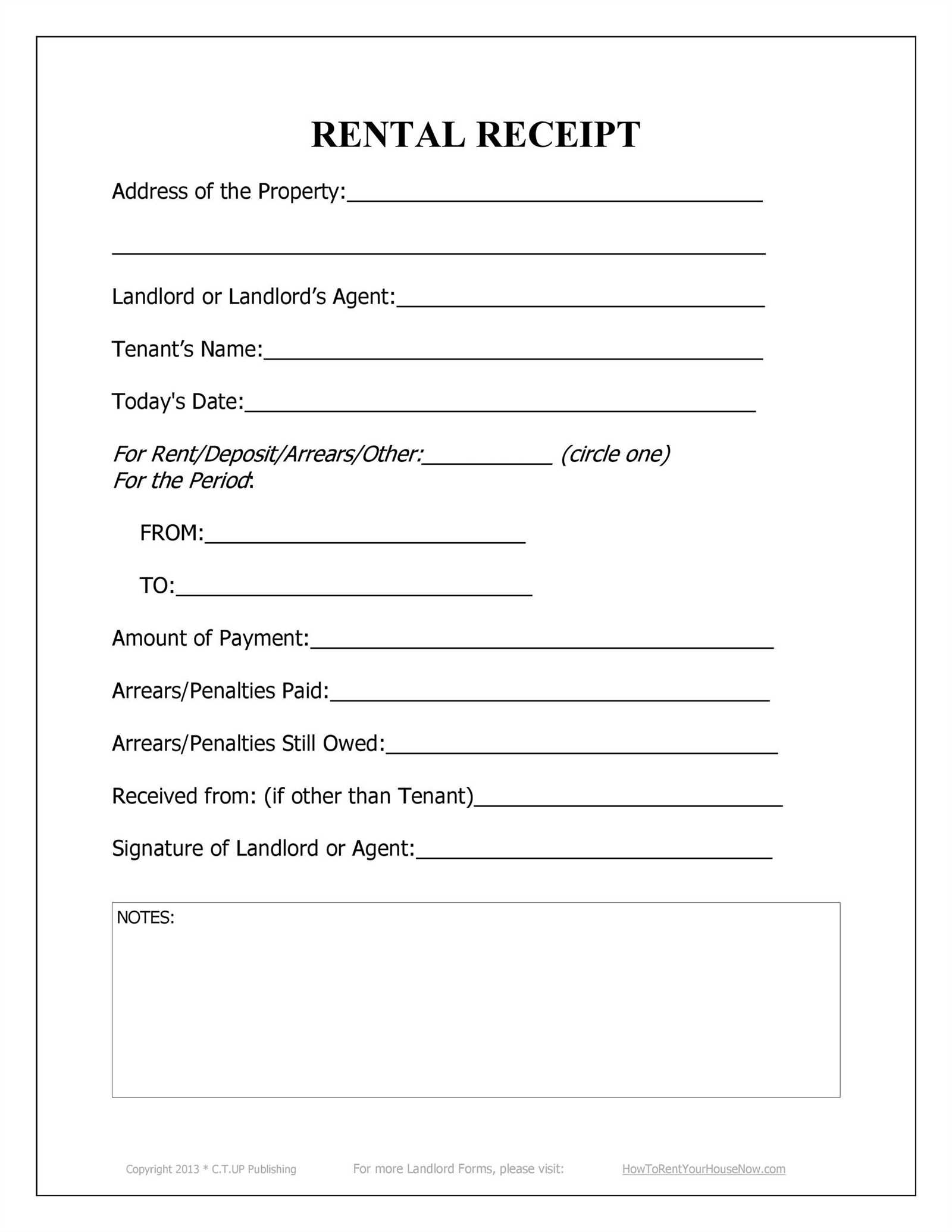

Rent Receipt Template

A proper rent receipt should include the date of payment, tenant’s name, rental period, amount paid, payment method, and landlord’s signature. Missing any of these elements can lead to disputes or compliance issues.

Key Elements to Include in a Rental Acknowledgment

Ensure every receipt contains:

- Date: The exact day the payment was received.

- Tenant Information: Full name and address of the payer.

- Rental Period: Specify whether the payment covers a month, quarter, or other term.

- Amount Paid: Clearly state the total sum and any partial payments.

- Payment Method: Indicate whether the payment was made in cash, check, or electronically.

- Landlord’s Signature: Validates the transaction and confirms receipt.

Legal Requirements for Payment Receipts

Some states require landlords to issue receipts for cash payments or all rental transactions. Check local laws to ensure compliance. If a receipt is mandatory, failure to provide one can result in fines or legal disputes.

For tax purposes, maintain organized records of all receipts. Digital copies can serve as backup documentation in case of audits or legal claims.