Creating a personal trainer receipt is simple and necessary for maintaining clear financial records. A well-structured receipt ensures both you and your clients have proper documentation for each session or package purchased. Use this template to outline the date, session details, and payment information. This helps keep everything organized and transparent.

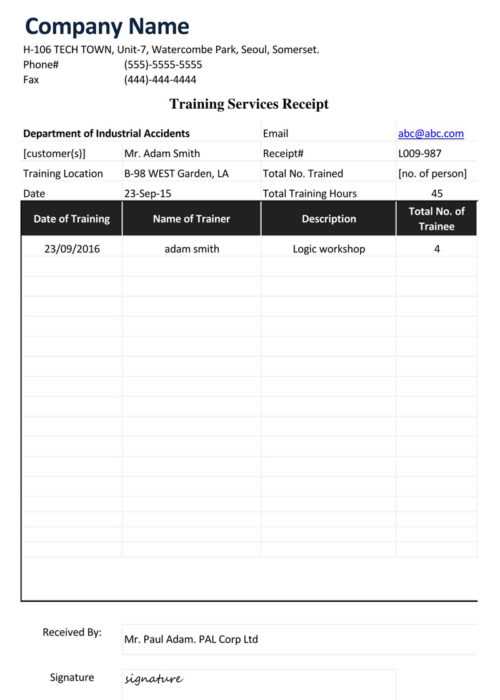

Start with the trainer’s name, business information, and the client’s name at the top of the receipt. Be specific with the services provided–whether it’s a single session or a multi-session package. This clarity prevents confusion and helps both parties track sessions accurately. Include the rate for each session or package, and always specify the total amount paid.

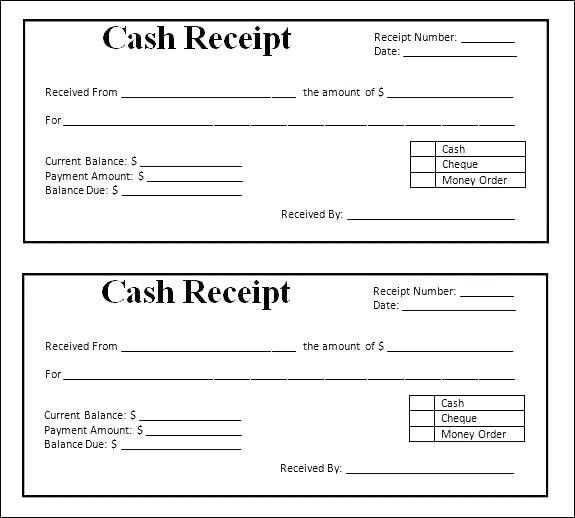

Don’t forget to mention the payment method, whether it’s cash, card, or online transfer. This helps clients remember how they paid and ensures everything is accounted for. For better tracking, add a unique receipt number for each transaction. This small detail can save you time if you need to look up a past transaction later.

Finally, be sure to include any relevant taxes or discounts applied. Clients appreciate a transparent breakdown of costs, and it helps prevent misunderstandings. Keeping receipts simple and professional builds trust and helps with smoother business operations.

Here is the refined version with reduced repetition:

Focus on creating a clear and concise format that is easy to understand. When designing a personal trainer receipt template, include essential details without overloading the layout. Make sure to keep a balance between clarity and thoroughness.

Key Elements of a Personal Trainer Receipt

Start with the trainer’s name and contact information at the top, followed by the client’s name and session details. Each session should include the date, type of service, and duration. If multiple services are provided, list them separately for transparency.

| Service | Date | Duration | Price |

|---|---|---|---|

| Personal Training | 2025-02-09 | 60 minutes | $50 |

| Nutrition Advice | 2025-02-09 | 30 minutes | $30 |

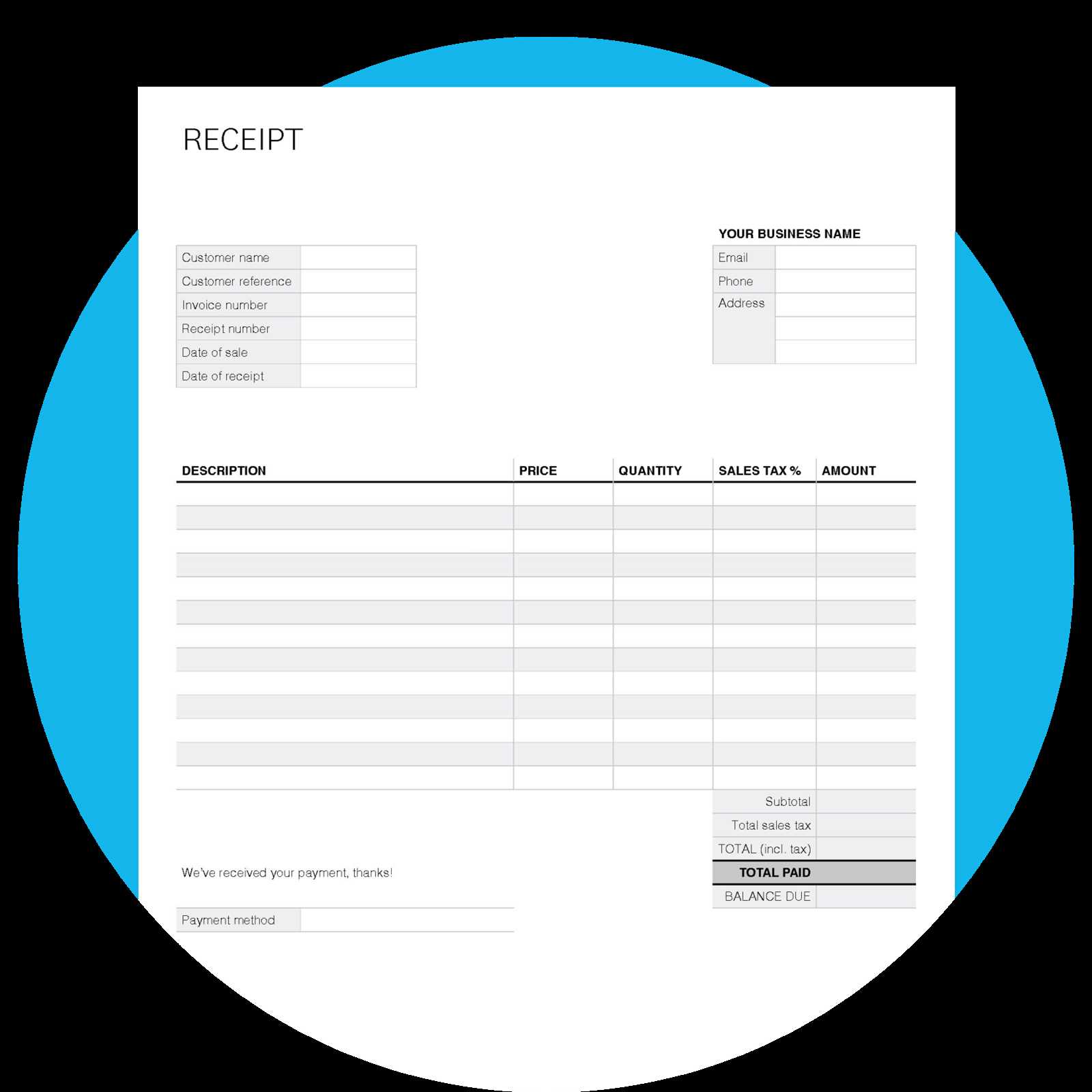

Payment Details

Clearly state the total amount for the services provided and include payment methods, such as credit card or cash. Indicate any taxes or discounts applied, ensuring the client sees a breakdown of the final charge.

- Personal Trainer Receipt Template

Provide clients with clear and organized receipts for training sessions. A well-structured receipt not only ensures smooth record-keeping but also helps in managing finances. Here’s what to include:

Receipt Structure

- Trainer Information: Add the trainer’s full name, contact information, and business name if relevant.

- Client Details: Include the client’s full name and contact information.

- Session Information: List the session date, duration, and type (individual, group, etc.).

- Amount Charged: Include the total cost for the session, including any taxes or discounts.

- Payment Method: State how payment was made (e.g., cash, credit card, online). You can also include the transaction reference number.

- Receipt Number: Assign a unique receipt number for tracking purposes.

Tips for Professionalism

- Use Clear Formatting: A clean, readable format ensures clients can easily review the details.

- Include a Business Logo: If you have a business logo, add it to the receipt for branding.

- Offer Session Packages: If the client has purchased a package, list the remaining sessions on the receipt.

Store a copy for your records and provide a copy to the client after each session. This approach helps maintain clear and professional transaction documentation.

Clearly structure your receipt to ensure clients can easily understand the services rendered and payment details. Start with the name and contact information of your business or personal training service at the top. Follow this by the client’s details, including their name and contact information, to ensure clarity in case of any disputes or inquiries.

Include Specific Service Details

- List the services provided, such as personal training sessions, fitness assessments, or specialized coaching.

- Be specific about the number of sessions, duration (e.g., 1 hour), and the date of each session.

- Use clear descriptions, avoiding jargon, so clients can easily recognize what they’re paying for.

Include Payment Information

- State the total amount paid for the services, broken down if necessary (e.g., per session or package).

- If applicable, list any discounts or promotional offers used during the transaction.

- Note payment methods, such as credit card, cash, or online transfer, and include a payment reference number if relevant.

Finish the receipt with your business’s legal information, such as tax identification or registration number, and include a thank-you note for the client. Make sure the receipt is dated and numbered for organizational purposes.

To make your trainer receipt clear and professional, include these key details:

Client and Trainer Information

Start by listing both the trainer’s and client’s names, addresses, and contact details. This helps both parties identify each other and ensures that the receipt is correctly attributed. If you run a business, include your business name and any relevant registration details.

Service Details

Clearly state the type of session or service provided, such as personal training, group classes, or fitness assessments. Include the date of the session and the duration. If multiple sessions were purchased, list each session’s date and time separately.

Payment Breakdown

Include the cost of each session or package. If there were any discounts applied, mention them. Also, specify the total amount paid, including any taxes or extra fees. Make sure to indicate the payment method (e.g., cash, credit card, bank transfer).

Terms and Conditions

If there are any cancellation policies or other important terms, they should be briefly noted on the receipt. This ensures both parties are aware of the expectations and policies surrounding the service.

Select a payment method that suits both you and your clients. Credit or debit card payments are widely accepted, providing convenience and immediate transactions. Mobile payment apps like Venmo or PayPal are becoming more popular, especially for clients who prefer digital transactions over cash. These platforms also offer built-in receipt features, which can save time and reduce errors in tracking payments.

If you work with clients on a more personal level, consider options like checks or bank transfers. While these methods can take longer to process, they offer a straightforward approach for clients who may not want to use online platforms. Always confirm the method in advance to avoid any payment delays.

Finally, ensure that your receipts include the payment method used. This transparency builds trust and makes record-keeping easier, particularly when managing multiple clients. Include a clear note of the transaction type, the amount paid, and the date for a complete and professional receipt.

To create tailored receipts for various services, start by adjusting the service description field to reflect specific offerings. Whether it’s personal training sessions, diet plans, or fitness assessments, clearly describe each service rendered to avoid confusion.

- Service Name and Description: Modify the text to fit the service type. For instance, “One-on-One Personal Training” or “Custom Fitness Program.” This ensures clients understand exactly what they paid for.

- Pricing Structure: Adapt the pricing to the service model. If offering packages or subscriptions, include options like “Monthly Subscription” or “5-Session Package,” with prices for each individual session as well as the overall package.

- Additional Charges: Include any extra charges that apply. For personal training, you might have a travel fee or premium service charge. Make sure these are listed separately for transparency.

- Date and Time: Adjust the receipt’s date format depending on the service type. For example, fitness sessions may require a specific time, while packages might list a start and end date instead.

- Discounts or Promotions: If applicable, incorporate any discounts or promotional codes that were used. This shows a clear breakdown of the pricing adjustments applied to the service.

Always ensure that your receipts include payment method details and any relevant tax information. Customizing the layout to fit the particular service ensures both professionalism and clarity for your clients.

Ensure that your receipts include all required information to comply with local tax and business regulations. This includes listing the full name and address of both the trainer and the client, the date of the transaction, the service provided, and the total amount paid. Keep your receipts clear and accurate to avoid legal complications in the future.

Include Proper Tax Information

If you’re registered for sales tax or other applicable taxes, make sure the receipt reflects the correct tax rate. This helps both you and your clients stay in line with government regulations. In some areas, failing to include tax information may result in fines or penalties for you as a trainer.

Keep Records for Audit Purposes

Always store copies of your receipts for a set period–usually between 3 and 7 years–depending on your local laws. If you’re ever audited, having organized and accurate records will save time and ensure your business stays compliant.

Organize your receipts by category, such as travel expenses, equipment, or client-related costs. This helps track business-related spending more effectively and simplifies tax reporting.

Use Digital Tools

Switch to digital storage by scanning or taking photos of receipts. Store them in cloud services like Google Drive, Dropbox, or specialized apps such as Expensify. This not only reduces physical clutter but also makes retrieval fast and secure.

Maintain Clear Naming Conventions

Develop a consistent file naming system. For example, use the format: “Date_Description_Amount” (e.g., 2025-02-09_Travel_50). This enables easy searching and helps keep receipts organized in folders or subfolders for each month or category.

Review and Reconcile Regularly to ensure receipts match your financial records. Schedule a monthly check to verify that all expenses are recorded accurately, avoiding surprises at tax time.

Set Reminders for Expiry Dates. If some receipts have expiration dates, such as warranties or returns, set reminders in your calendar to avoid missing important deadlines.

Secure your data by using strong passwords for your digital storage and considering encryption for sensitive information. This prevents unauthorized access to your financial records.

Meaning is preserved, and repetition is minimized.

Use clear, concise labels for each section in your receipt template. This helps clients quickly understand the details of their payment. Include categories such as session date, duration, service type, and price. Avoid clutter by focusing only on relevant information. Organize data in a way that clients can easily follow, such as using bullet points or a clean table layout.

Keep a consistent format. If you use bold for headings, apply it uniformly throughout the document. This will create a uniform structure and make it easier for clients to read the receipt without distractions. Avoid unnecessary words and focus solely on the details that matter most.

Finally, ensure the template is customizable. Each client may have different needs or preferences, so allow flexibility for adjusting content while maintaining the same professional presentation.