Every electrician needs a clear and structured receipt template to provide customers with a professional record of services rendered. A well-organized receipt ensures transparency, simplifies bookkeeping, and helps avoid disputes. To create a functional template, include essential details such as service descriptions, costs, and payment methods.

Key elements of an electrician receipt:

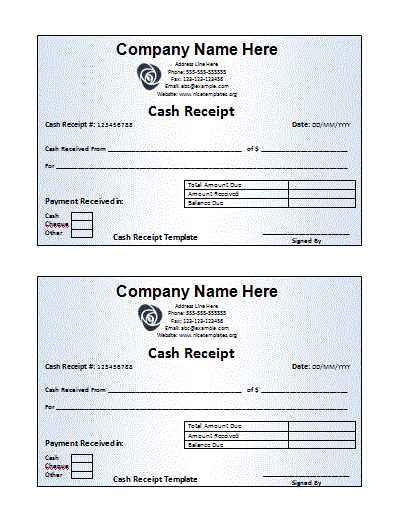

1. Business Information: List the electrician’s name, business name (if applicable), contact details, and license number. This establishes credibility and allows customers to reach out if needed.

2. Customer Details: Include the client’s name, address, and phone number. This helps with future reference and warranty claims.

3. Service Breakdown: Clearly describe each task performed, including materials used and labor charges. Providing itemized details ensures the customer understands what they are paying for.

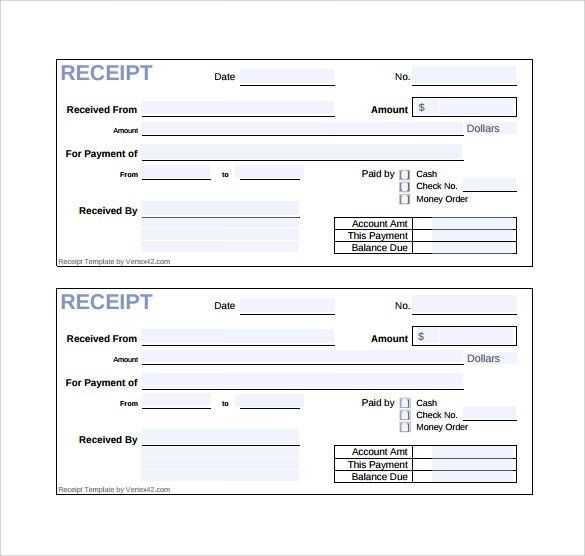

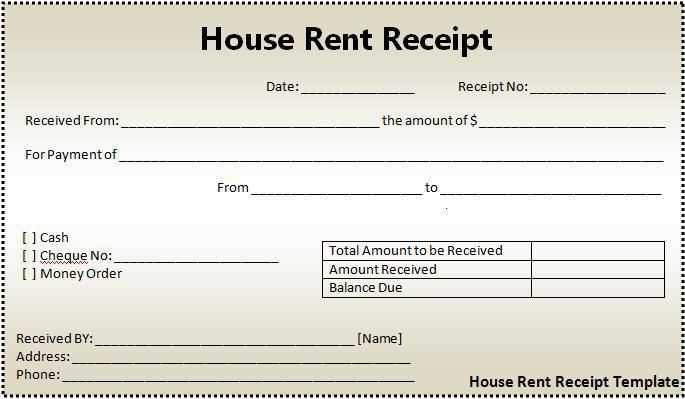

4. Payment Information: State the total amount due, accepted payment methods, and any applicable taxes. If the payment has been received, mark the receipt as “Paid” with the date of transaction.

5. Terms and Notes: Add any relevant terms, such as warranty conditions or late payment policies. A brief thank-you message can enhance customer relations.

Using a standardized template saves time and maintains consistency in documentation. Whether printed or digital, a well-structured receipt ensures smooth transactions and professional service delivery.

Electrician Receipt Template

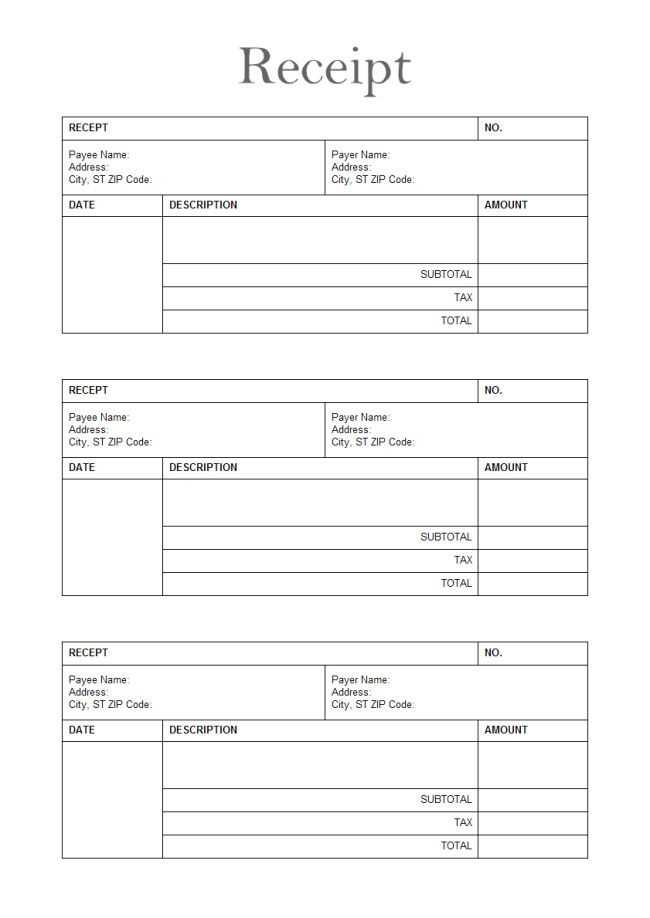

An electrician receipt template helps create clear and accurate records for services rendered. Ensure the template includes the following key elements for completeness:

- Business Name and Contact Information: Include the electrician’s business name, phone number, email, and address for easy communication.

- Customer Details: List the customer’s name, address, and contact details.

- Service Description: Specify the work completed, including any repairs, installations, or inspections, along with the materials used.

- Dates: Record the date when the service was performed and the date the payment is due.

- Payment Information: Mention the total amount due, any discounts applied, taxes, and the payment method.

- Invoice Number: Assign a unique invoice number for easy tracking.

Design the template with clear sections and labels to avoid confusion. Keep it simple yet informative, ensuring both the electrician and customer have a thorough record of the transaction.

Key Elements to Include in an Electrician Receipt

Clearly label the receipt with the business name and contact information. This ensures the customer knows who provided the service and how to reach you if needed.

Itemized List of Services and Products

Break down the charges for labor, materials, and any additional services performed. List the materials used, along with their quantities and costs, to provide transparency.

Payment Details

Include the payment method (cash, card, check, etc.) and the amount received. If any deposits or prepayments were made, note them along with the remaining balance.

How to Structure an Itemized Billing Section

Clearly list each item or service, along with its corresponding cost, for easy reference. This transparency prevents confusion and helps clients understand exactly what they’re paying for.

Step 1: Categorize the Services

Group similar items together. For instance, divide electrical repairs, materials, and labor into separate sections. This makes the invoice easier to follow and provides clarity on what each charge covers.

Step 2: Use Descriptive Item Names

For each service or product, provide a detailed description. Include specifics like the type of material used, the time spent, or the scope of the job. Instead of just listing “wiring,” say “replacing faulty wiring in kitchen area (10 feet).”

Step 3: Include Quantities and Rates

For every item, clearly indicate the quantity (if applicable) and the unit rate. For example, “2 outlets installed at $50 each” or “10 feet of copper wire at $1 per foot.” This adds precision to the billing and ensures there are no misunderstandings.

Step 4: Add Subtotals

Break down the charges into subtotals per category, such as labor, materials, and other services. This allows clients to see how much they are paying for each component of the job.

Step 5: Summarize with a Total

After listing all the items and their respective costs, include a final total. This should be the sum of all the subtotals, with taxes or additional fees applied, clearly stated at the bottom of the invoice.

- Be sure to indicate any discounts or promotions, if applicable.

- Provide payment instructions, such as accepted methods or payment deadlines.

Choosing the Right Format for Digital and Paper Receipts

Digital receipts are a practical solution for many businesses. Choose a format like PDF or JPEG for simplicity and compatibility. PDFs are easy to share and store, while JPEGs are compact and work well for image-based receipts.

For paper receipts, ensure the layout is clear and easy to read. Avoid cluttering the document with excessive information. A basic, structured format should include the date, itemized list of services, total amount, and company contact details.

| Receipt Format | Advantages | Disadvantages |

|---|---|---|

| Compatible with various devices, professional appearance, easy to store | File size may increase with images or detailed layouts | |

| JPEG | Compact, easy to share via email or message | Less customizable, may lose quality with resizing |

| Paper | Traditional, tangible proof of transaction | Not environmentally friendly, easy to lose or damage |

Decide on a format based on your customer’s preference and the nature of the transaction. Combining both digital and paper options can offer convenience while maintaining professionalism.

Legal Requirements and Tax Considerations

Make sure to keep detailed records of all transactions. When preparing receipts, include clear information such as the date, services rendered, and total amount charged. This will not only ensure transparency but also help you comply with local laws regarding invoicing and accounting.

Tax Obligations

When charging for electrical services, be aware of the local tax rates applicable to your work. Ensure that you correctly apply any sales tax or value-added tax (VAT) required by law. If your total revenue exceeds a certain threshold, you might need to register for tax collection purposes. Always consult with a tax professional to ensure you’re meeting your obligations.

Licensing and Permits

Verify whether you need specific licenses or permits to perform electrical work in your area. These are often required to ensure that your work meets safety and quality standards. If you’re self-employed, confirm whether your business needs to be registered with the relevant local authorities.

Lastly, ensure that your receipts comply with any regional requirements, such as including business registration numbers or specific wording mandated by tax authorities. This will help avoid legal issues down the line and ensure your records are complete and accurate.

Customizing Templates for Different Electrical Services

Tailor your receipt templates to suit specific electrical services by adjusting key sections. Highlighting the type of work performed is important. For example, include fields like “Wiring Installation,” “Rewiring,” or “Panel Upgrade.” These categories help clarify the scope of the job and provide clients with clear details about the service they received.

Include Detailed Labor and Material Costs

Break down labor costs by hours worked and the rate charged. This adds transparency for customers, making them aware of how their bill is calculated. Similarly, list materials used with their respective costs. Be specific about parts such as circuit breakers, wiring, or outlets to avoid confusion.

Add Payment Terms and Warranty Information

Make sure to include payment terms like due dates, deposit requirements, or installment options. Also, specify any warranty terms related to the work done or materials provided. This ensures both parties are clear about expectations after the service is completed.

Personalizing these aspects of your receipt templates can help you present a professional and organized service while offering clients clear and accurate information.

Best Practices for Record-Keeping and Client Communication

Keep detailed, accurate records of all transactions, including the date, scope of work, materials used, and hours worked. This transparency builds trust and avoids future disputes. Store receipts and invoices digitally for quick access and easy organization. Consider using cloud storage solutions that allow real-time sharing and access.

Clear Communication with Clients

Always provide a clear breakdown of pricing before starting any project. Offer clients an itemized invoice that includes labor, materials, and taxes. Keep clients informed at each step of the project. If any issues arise, address them immediately, and keep the lines of communication open throughout the process.

Follow-Up and Feedback

After completing the job, follow up with clients to ensure satisfaction and address any concerns. Encourage feedback to improve your service and build long-term relationships. This ensures clients feel valued and confident in your work.