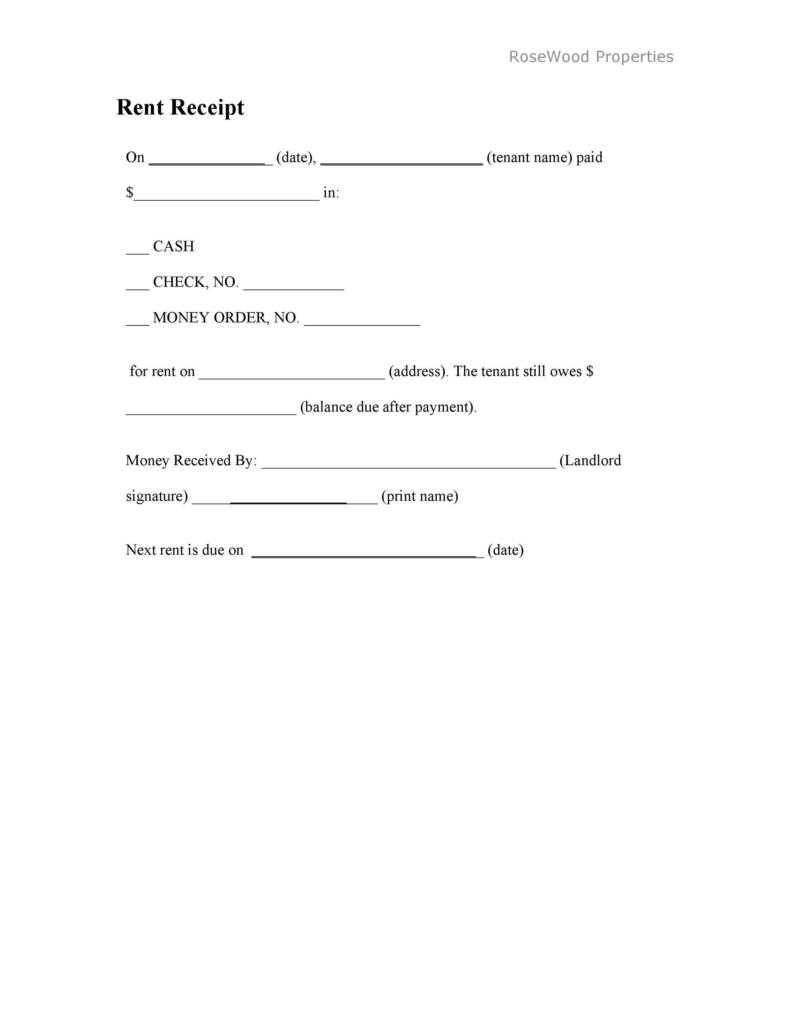

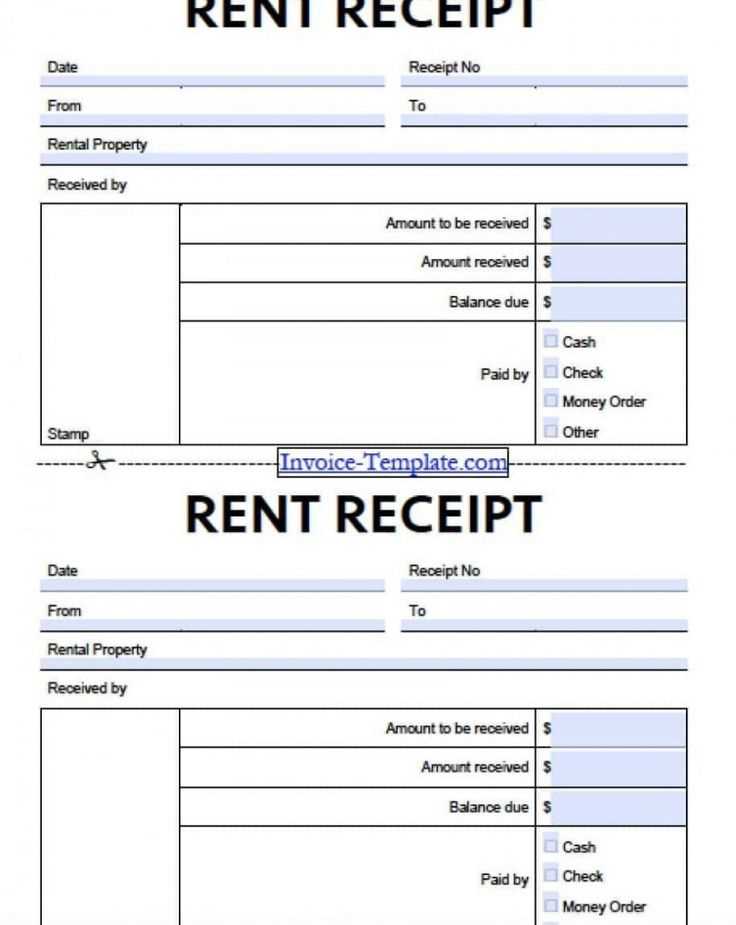

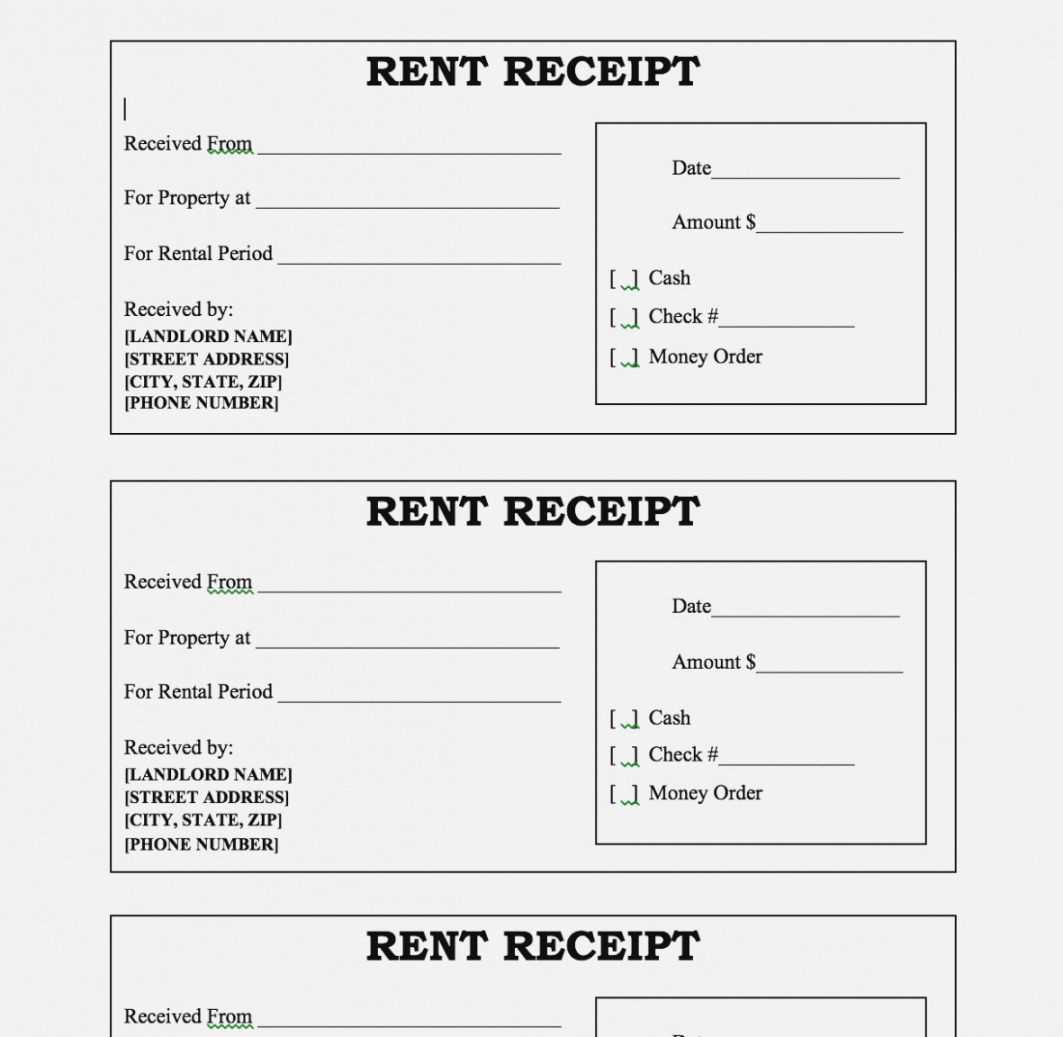

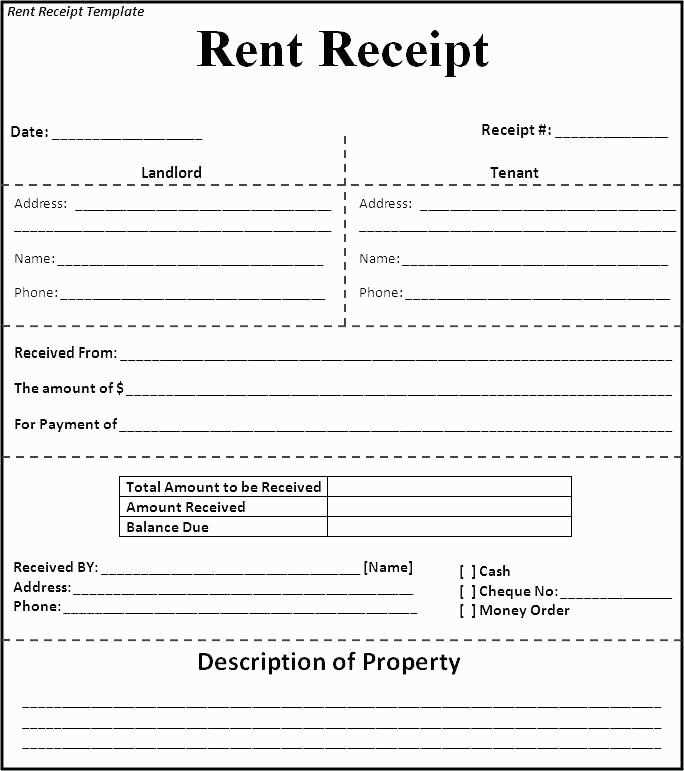

If you need a simple way to document rental payments, using a rent receipt template can save you time. A ready-made template helps create clear and professional records for both landlords and tenants. These templates are available in Word and PDF formats, ensuring easy editing and sharing.

The Wonder.legal platform offers an easy-to-use rent receipt template that you can download for free. Whether you’re a tenant or a landlord, this tool simplifies the process. All the necessary information, such as tenant details, rental amount, and payment date, are clearly organized in the template.

By using a ready-made template, you avoid having to create one from scratch. This can help you maintain proper records for accounting or tax purposes. The clear layout ensures both parties understand the payment history, making it easy to refer back to previous transactions if needed.

Get your free template today and start managing rental payments more smoothly!

Here are the revised lines with minimal repetition:

Focus on clarity and brevity when drafting rental receipts. Remove unnecessary details to keep it concise. Ensure all key information such as tenant name, rental amount, and payment dates are included clearly.

Example: “Received from [Tenant Name] the sum of $[Amount] for rent covering the period from [Start Date] to [End Date].” Avoid repeating similar phrases in the document.

Always specify payment method and any relevant details about deposits. Reiterate only the necessary facts to avoid clutter.

Tip: Use a straightforward template for faster document preparation and less repetition.

- Rent Receipt Free Sample Template Word & PDF Wonder.Legal

To create a rent receipt using Wonder.Legal’s free sample template, follow these steps:

- Download the template in Word or PDF format directly from Wonder.Legal.

- Fill in your tenant’s name, address, and the rental property details.

- Specify the rental period and amount received, including payment method and any additional fees if applicable.

- Ensure the receipt includes the landlord’s name and signature for authenticity.

- Review the information for accuracy before saving or printing the receipt.

Additional Tips

- Customize the template to suit specific rental agreements, including the frequency of payments or any unique clauses.

- Store receipts digitally for easier access and tracking.

- Include contact information in case any discrepancies arise regarding payments.

A rent receipt must clearly display key details to ensure transparency and avoid misunderstandings. Include the landlord’s and tenant’s full names to identify both parties. Specify the address of the rental property to avoid confusion with other locations.

List the exact date the payment was made, as well as the amount received. This is necessary for proper record-keeping and to confirm the payment history. If applicable, note the payment method–whether it’s cash, check, or bank transfer.

Provide a breakdown of the payment if it covers multiple periods or services. For example, indicate the rent for the current month, along with any additional charges like late fees or utilities. Include a statement confirming the payment is in full and no further balance is due.

Finally, include a section for the landlord’s signature. This serves as proof that the payment has been acknowledged. With all these elements in place, the rent receipt will serve its purpose as a clear and reliable document.

How to Customize Your Receipt Template for Specific Needs

Adjusting your receipt template to suit particular needs involves modifying key sections. Begin by updating the header with your company name, address, and contact details. Make sure these are clearly visible to ensure easy identification.

Key Sections to Modify

Focus on these areas when personalizing your template:

- Date and Time: Ensure the date and time fields are clearly formatted. You may want to add a field for rental duration, especially for recurring services.

- Rental Details: Include descriptions of rented items or services. You can add a section for specific terms, such as the rental period, price per day, or special offers.

- Payment Method: Tailor this section to capture payment method (credit card, cash, bank transfer) to provide more accurate records for both you and your client.

Additional Features to Include

Consider these elements to enhance the template:

- Security Deposit: If applicable, include a field for deposit amounts and specify whether they are refundable or non-refundable.

- Terms and Conditions: Add a summary of your rental policies, late fees, or other important terms at the bottom of the receipt to ensure transparency.

Example Customization Table

| Field | Customization Tips |

|---|---|

| Rental Item | Include clear descriptions of items or services rented. Use bullet points for clarity. |

| Payment Method | Specify the method used to complete the transaction, including card type or reference number. |

| Additional Charges | List any additional charges like taxes, delivery, or extra services provided. |

Once you’ve made these adjustments, save the template for future use. Tailoring it as needed ensures your receipts are not only professional but also meet specific requirements, making them more effective in your business operations.

Ensure the template includes clear sections for both tenant and landlord details. The tenant’s name, address, and rental period should be easily identifiable. Similarly, include the landlord’s name, contact information, and address for clarity.

- Payment Details: Include fields for the exact payment amount, the date it was received, and the payment method (e.g., cash, check, bank transfer).

- Receipt Number: A unique receipt number helps with organization and future reference. It adds a layer of accountability for both parties.

- Property Information: Mention the property address or unit number for which the rent payment applies, reducing any ambiguity.

- Signature Fields: Both parties should have space to sign and date the document, ensuring mutual acknowledgment of the payment.

- Clear Formatting: The template should use easy-to-read fonts and logical organization, making it simple for both the tenant and landlord to understand the details at a glance.

These features create a professional and transparent receipt that benefits both tenant and landlord, ensuring clear records of all transactions.

Ensure that the receipt template accurately reflects the transaction details, including both parties’ names, the payment amount, and the services rendered. Any discrepancies in the document can lead to misunderstandings or legal disputes. Double-check the dates, and make sure the format aligns with local legal requirements for financial records.

Verify that the receipt includes a clear statement that confirms the payment has been made or received. This helps prevent any future claims of unpaid dues. Keep in mind that in some jurisdictions, using templates for receipts might require specific wording or additional clauses, especially for larger transactions or specific business types.

Ensure both parties involved in the transaction retain a copy of the receipt for their records. This is not only good practice but may also be necessary for tax purposes. Distribute receipts promptly after a transaction to prevent issues related to lost or missing documents.

For certain types of transactions, such as rent or large purchases, you may need to include more detailed information, such as rental terms, a breakdown of payments, or any agreed-upon conditions. Tailor the template accordingly to avoid leaving out necessary details that might affect future legal claims.

Ensure you include the correct rental period. Omitting this information can create confusion for both the tenant and the landlord. Specify the exact start and end dates of the payment made.

Inaccurate Payment Details

Double-check the payment amount. Mistakes in the rent amount, such as rounding errors or failing to include the correct amount paid, can lead to disputes. Confirm the amount written on the receipt matches the actual payment received.

Failure to Include the Tenant’s Information

Always include the tenant’s full name and address on the rent receipt. Missing these details may lead to misunderstandings about the validity of the document. It is a simple yet necessary step to verify the receipt’s authenticity.

Signing the Receipt

For the receipt to be official, ensure it is signed by the landlord or the property manager. Leaving this part incomplete makes the receipt ineffective as proof of payment.

Use a password-protected cloud service for storing receipts. Platforms like Google Drive or Dropbox offer encryption, ensuring your files remain safe from unauthorized access. Make sure to enable two-factor authentication to add an extra layer of security.

Organize Receipts in Folders

Create a specific folder structure for different categories of receipts, such as rent, utilities, and purchases. This makes retrieval easier and reduces the risk of mixing up documents. Label each file clearly with the receipt date and a brief description of the transaction.

Share with Caution

When sharing receipts, always use secure channels. If you need to send a receipt via email, ensure it’s encrypted. Avoid sharing receipts over unsecured platforms, and never share sensitive financial details in plain text. If possible, use file-sharing services that offer encrypted links for access.

Use a simple and clear format for your rent receipt to ensure it’s easily understood and legally valid. Begin with a clear title, such as “Rent Receipt” or “Receipt for Rent Payment.” Then, include the tenant’s full name and address, as well as the property address where the payment applies.

Next, list the payment details, including the amount paid, the date it was received, and the payment method. Be sure to indicate whether the payment covers a specific month or a different time period. It’s also helpful to note any outstanding balance or late fees if applicable.

Details to Include:

- Tenant’s full name and contact information

- Landlord or property management’s details

- Amount paid, payment method (e.g., check, cash, bank transfer)

- Date of payment

- Lease period covered by payment

- Signature of landlord or authorized agent

Conclude with a statement acknowledging receipt, such as “Received by” followed by the landlord’s or property manager’s signature. This confirms that both parties agree on the transaction. Make sure to keep a copy for your records.