Every donation deserves a clear and professional receipt. A well-structured template ensures transparency, simplifies record-keeping, and provides donors with the documentation they need for tax purposes. Whether you manage a nonprofit, charity, or fundraising campaign, having a ready-to-use receipt format saves time and keeps financial records organized.

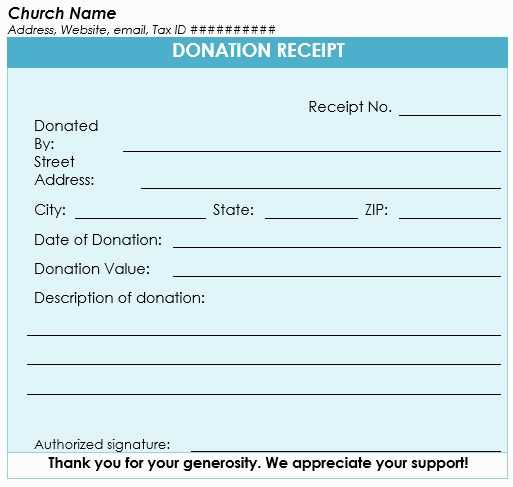

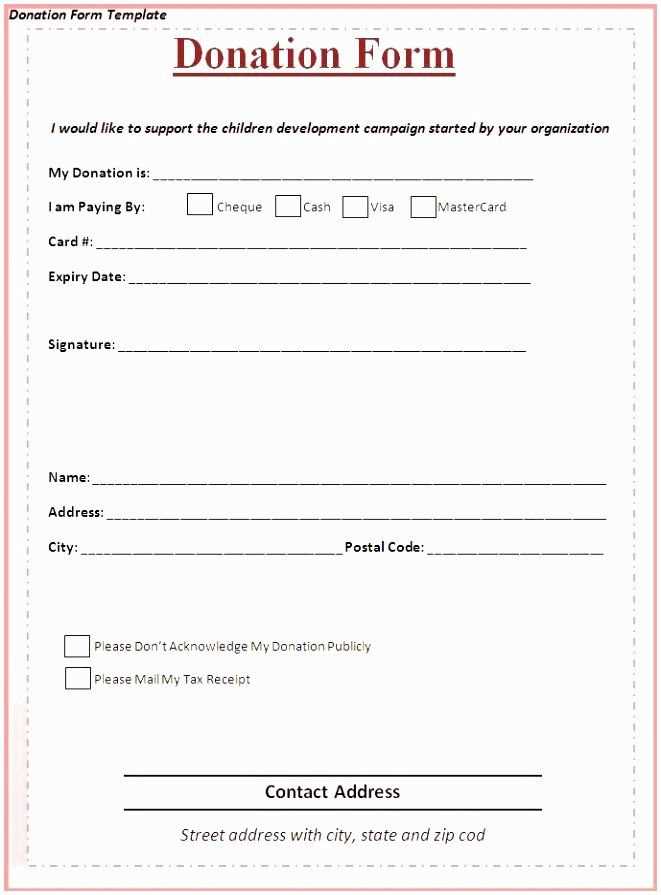

A complete receipt should include the donor’s name, contribution amount, date, and payment method. Adding a brief acknowledgment message strengthens donor relationships and encourages future support. For tax-deductible donations, include a statement confirming the organization’s eligibility and whether goods or services were provided in return.

Standardizing your receipt format reduces errors and maintains consistency. Digital templates allow for quick customization, while printable versions offer a professional touch for mailed acknowledgments. Using clear, concise language ensures that donors understand the details at a glance.

To create an effective receipt, keep the layout simple. Use bold headings for key details and avoid unnecessary design elements that could distract from the information. A structured, easy-to-read template enhances credibility and reinforces trust between donors and your organization.

Donation Form Receipt Template

Ensure clarity and compliance by structuring your donation receipt with key details: donor’s name, contribution amount, date, and a confirmation statement. If the donation is tax-deductible, include a note specifying whether goods or services were provided in return.

Use a simple layout with clearly labeled sections. A concise header stating “Donation Receipt” followed by the organization’s name, address, and contact information sets the foundation for credibility. A short thank-you message reinforces donor appreciation.

Provide multiple formats to accommodate different needs. Offer receipts in both digital and printed versions, ensuring donors can access their records conveniently. If sending by email, use a PDF format to maintain consistency across devices.

Automate where possible to streamline processing. Online donation platforms often generate receipts automatically, reducing administrative workload. Ensure templates are adaptable, allowing for quick edits while maintaining accuracy.

Key Elements to Include in a Receipt

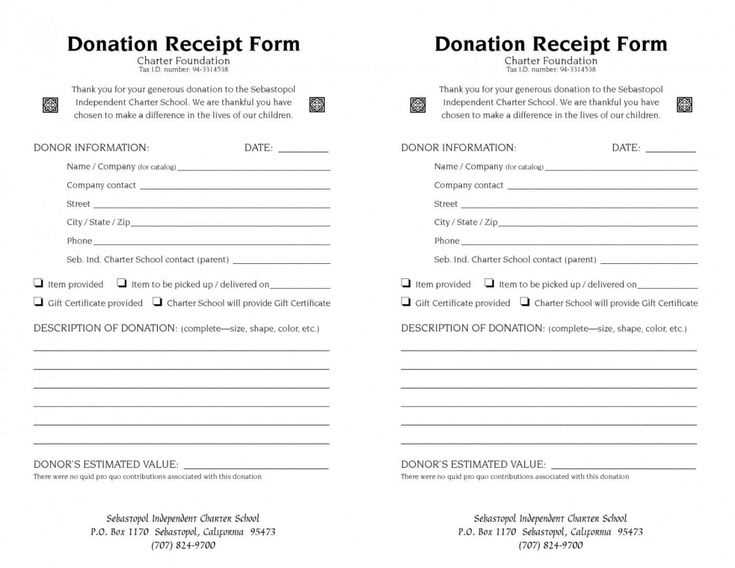

Include the donor’s full name and contact details to ensure proper record-keeping. Add the organization’s name, address, and tax identification number for verification purposes.

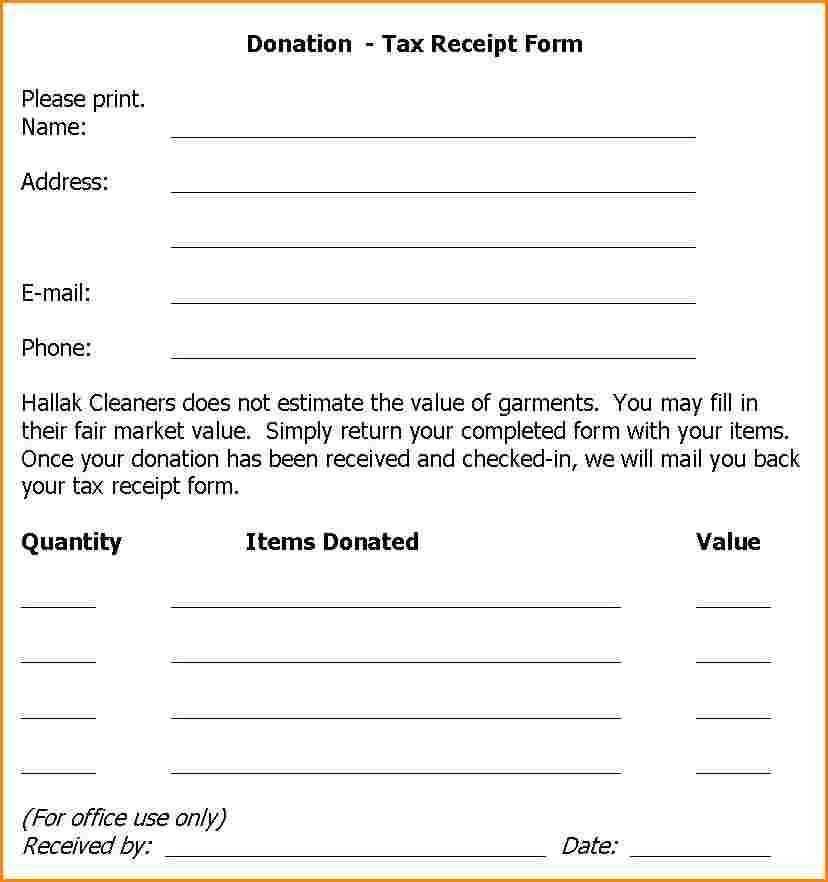

Specify the donation date and amount. If the contribution was non-monetary, describe the item or service provided, including its estimated value.

State whether the donor received any goods or services in return. If none were provided, include a statement confirming the donation is tax-deductible.

| Element | Details |

|---|---|

| Donor Information | Full name, address, and contact details |

| Organization Information | Name, address, and tax ID |

| Donation Date | Exact date of the contribution |

| Donation Amount | Precise monetary value or description of goods |

| Tax Deduction Statement | Confirmation of tax-deductibility |

Conclude with a signature or digital authorization from the organization to validate the receipt.

Formatting Guidelines for a Clear Layout

Align all text and elements consistently to improve readability. Use left alignment for descriptions and right alignment for numerical values to enhance clarity.

Font and Spacing

- Choose a sans-serif font for better legibility.

- Set the font size to at least 12pt for body text and slightly larger for headings.

- Ensure line spacing is at least 1.5 for easy reading.

- Use bold text only for emphasis, avoiding excessive formatting.

Information Structure

- Group related details with clear section breaks.

- Use tables for structured data such as donation amounts and dates.

- Ensure headings and labels are concise and self-explanatory.

- Include sufficient white space to separate sections without clutter.

Keep the layout simple, avoiding unnecessary graphics or decorative elements. A well-structured receipt enhances readability and ensures all key details are easily accessible.

Legal Considerations and Compliance

Ensure your donation receipt includes the full legal name and address of the organization, along with its tax-exempt status. Clearly state whether the donor received any goods or services in exchange for the contribution, and if so, provide their estimated value. Omitting this information may lead to compliance issues with tax authorities.

Required Disclosure Statements

Include a disclosure statement if required by local regulations. Some jurisdictions mandate specific wording to confirm tax-deductibility. Verify legal requirements based on your organization’s location to avoid penalties.

Record-Keeping and Data Protection

Maintain accurate records for audit purposes and donor inquiries. Secure sensitive information to comply with data protection laws, ensuring receipts do not expose personal financial details. Regularly review policies to align with current legal standards.

Customization Options for Different Needs

Adapt donation receipts to suit various purposes by adjusting key elements like layout, branding, and content. Whether for tax documentation, corporate sponsorships, or recurring contributions, a flexible template ensures clarity and professionalism.

- Brand Identity: Add a logo, organization name, and contact details. Maintain consistent fonts and colors for a polished appearance.

- Payment Details: Display transaction methods, confirmation numbers, and timestamps. Specify if the contribution was one-time or recurring.

- Tax Compliance: Include necessary disclaimers, tax-deductible status, and nonprofit registration numbers based on jurisdiction.

- Personalized Messages: Express gratitude with customized thank-you notes. For large donations, add a signature from leadership.

- Multi-Format Options: Offer printable PDFs, email-friendly versions, and downloadable digital copies for accessibility.

- Donation Purpose: Indicate fund allocation, such as education, medical aid, or community support, to reinforce donor impact.

Optimize receipts for mobile viewing, ensuring text remains readable and formatting stays intact. Test different layouts to find the most user-friendly option.

Digital vs. Printed Receipts: Pros and Cons

Choose digital receipts to reduce paper waste and simplify record-keeping. They are easy to store, searchable, and accessible from any device. No risk of losing a slip, and they integrate seamlessly with accounting software.

Printed receipts work best when customers need immediate proof of purchase. They don’t require internet access and are universally accepted, making them reliable in all situations. However, they fade over time and clutter wallets.

For businesses, digital receipts cut printing costs and streamline customer interactions. Printed versions remain useful in locations where digital access is limited or customer preferences vary.

A hybrid approach ensures flexibility. Offer both options and let customers decide what works best for them.

Common Mistakes to Avoid in Receipt Design

Focus on clarity and simplicity. Avoid cluttering the receipt with unnecessary details. Keep the layout clean, ensuring the donor’s name, donation amount, and date are prominently displayed. Too many elements can distract from the key information.

Do not overlook legibility. Use a readable font size and style. Small or overly decorative fonts make the text difficult to read, especially on smaller devices or printed copies. Always prioritize clear communication.

Don’t forget to include the organization’s branding. Leaving out your logo or name can make the receipt look impersonal. Consistent branding helps build trust with donors and reinforces your organization’s identity.

Avoid vague descriptions. Be specific about the type of donation, whether it’s monetary or goods, and clarify any other relevant details. This prevents confusion and ensures the receipt can serve as accurate documentation for tax purposes.

Ensure proper alignment and spacing. Misaligned text or crowded fields can create a disorganized appearance. Maintain consistent margins and spacing between sections to create a professional look.

Don’t skip adding contact information. Include your organization’s phone number, email address, or website in case the donor needs to reach out for any inquiries or further details about their donation.