Use a credit card refund receipt template to ensure accurate and professional documentation of transactions. This template helps businesses provide customers with clear proof of refunds while maintaining financial records. A well-structured receipt includes key details such as the refund amount, transaction date, payment method, and business information.

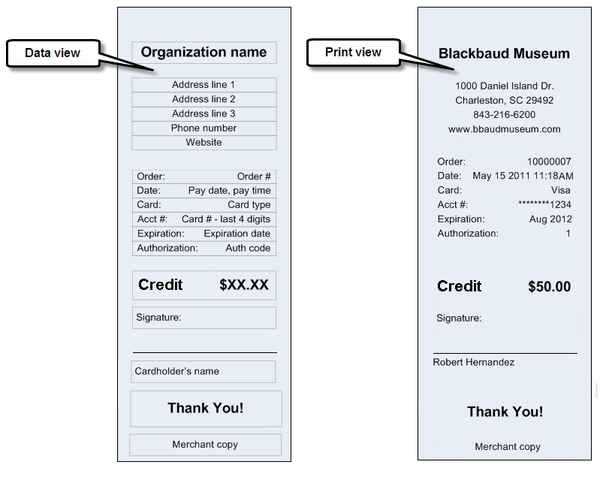

A standard refund receipt should contain the merchant’s name, address, and contact details. It must also include the last four digits of the refunded card, a unique transaction ID, and a brief reason for the refund. Clear formatting and legibility are essential to avoid disputes or confusion.

For businesses handling frequent refunds, using a digital template can streamline the process. Automated receipts generated through point-of-sale (POS) systems or accounting software ensure consistency and compliance with financial regulations. If a manual template is needed, a simple structured layout in PDF or Word format allows for easy printing and record-keeping.

Providing a well-documented refund receipt reassures customers and enhances transparency. Whether operating a small business or managing corporate finances, keeping detailed refund records helps prevent chargeback disputes and ensures smooth financial operations.

Here’s the optimized version with redundancy removed:

To create a clean and straightforward credit card refund receipt, focus on the key details: transaction information, refund amount, and date. Avoid repeating unnecessary information and ensure clarity with each section.

- Transaction Details: Include the date of the original transaction, the merchant’s name, and the original amount.

- Refund Amount: Clearly state the refund total and specify any fees, if applicable.

- Refund Date: Mention the exact date the refund was processed for transparency.

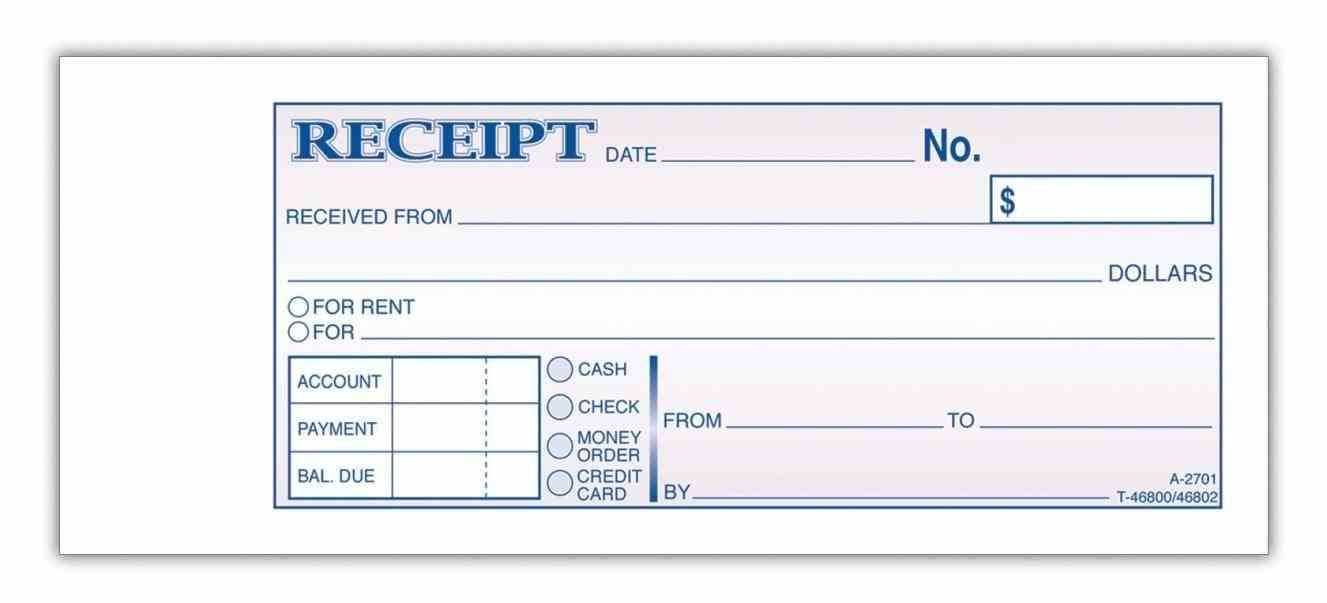

- Payment Method: Indicate the payment method used for the original transaction, as well as the method of refund, if different.

Avoid unnecessary repetition of terms such as “refund” and “payment” in different sections. Stick to the facts and make the document easy to read by grouping related information together. This layout ensures that recipients clearly understand the refund details without feeling overwhelmed by excessive text.

- Credit Card Refund Receipt Template

A credit card refund receipt should clearly reflect the transaction details, ensuring both parties are on the same page. Include the refund amount, the reason for the refund, and any relevant transaction identifiers. This will serve as proof for both the customer and the business.

Key Information to Include

Each refund receipt should list the following key details:

- Refund Amount: The exact sum refunded to the customer’s card.

- Transaction ID: A unique identifier for the original purchase, helping track the transaction.

- Refund Date: The date the refund was processed.

- Merchant Name: The name of the business issuing the refund.

- Customer Information: The customer’s name and card type (e.g., Visa, MasterCard).

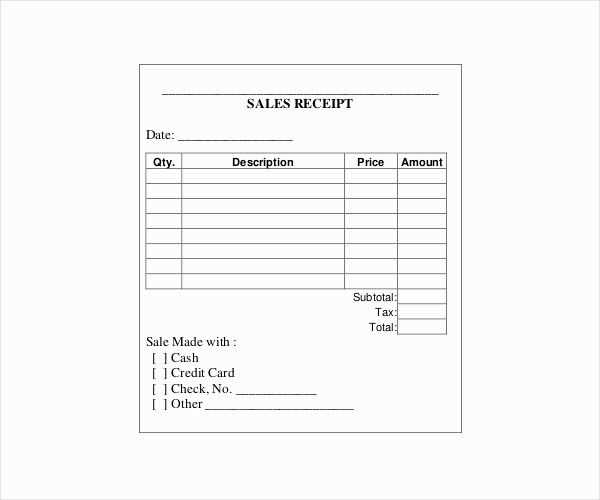

How to Format the Refund Receipt

Use clear and simple formatting to ensure the information is easy to read. Start with the business’s name and contact details, followed by the transaction details. The refund amount and reason should be highlighted, and include any applicable refund policies. Ensure the receipt is signed or digitally authorized to validate the transaction.

Ensure the refund receipt includes these critical components to avoid confusion and keep everything transparent:

Transaction Details

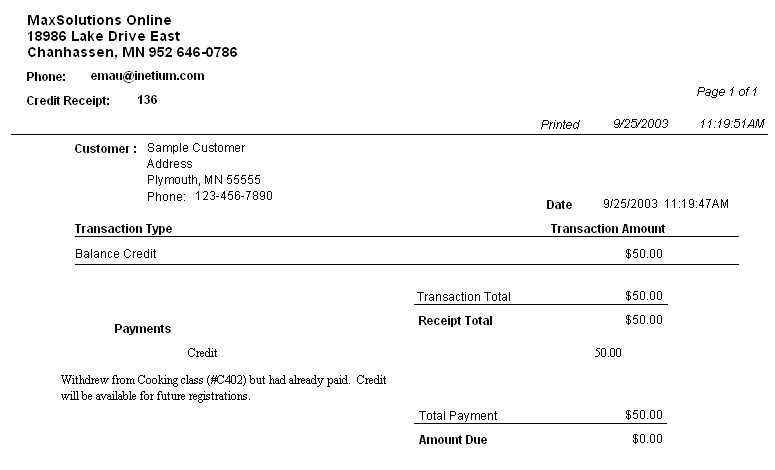

Clearly state the transaction date, original payment method, and any reference numbers. This ensures the receipt matches the corresponding purchase or order.

Refund Amount

Specify the exact amount refunded, including any adjustments made (e.g., taxes, discounts, or restocking fees). This prevents any discrepancies regarding the refund value.

Refund Reason

Include a brief explanation for the refund to maintain transparency. Common reasons include item defects, buyer’s remorse, or shipping errors.

Business Information

Provide the business name, contact details, and any relevant account information for further inquiries or follow-up. This adds credibility and helps customers reach out if necessary.

Customer Information

Optionally, include the customer’s name or order number for reference, especially in cases where multiple transactions need to be tracked.

| Element | Description |

|---|---|

| Transaction Details | Date, payment method, reference numbers |

| Refund Amount | Exact refunded amount with adjustments |

| Refund Reason | Brief explanation of the reason |

| Business Information | Name, contact details, account info |

| Customer Information | Customer’s name or order number (optional) |

To ensure your credit card refund receipt is clear and accurate, structure the information logically. Begin with the title “Refund Receipt” in a prominent position. Include the merchant’s name, contact details, and business address at the top, followed by the customer’s name and contact information. Clearly list the items refunded, showing the original price and the refunded amount. Provide the refund date and any relevant transaction numbers for easy tracking.

Use a consistent font style and size throughout. This keeps the document easy to read and avoids confusion. Group related details together; for example, place the refund details (amount, date, and transaction number) in a separate section, distinct from the merchant’s details. Use bullet points or tables where appropriate for visual clarity.

Always include a short note or statement confirming that the refund has been processed successfully. If applicable, mention the method of refund, such as to the original credit card or an alternate method. Finally, ensure the receipt is free of spelling or formatting errors, as even small mistakes can cause confusion.

Choosing between printable and digital receipts depends on convenience and how you prefer to organize your transactions. Both options offer unique benefits that cater to different needs.

Printable Receipts

Printable receipts are reliable for those who prefer physical copies for easy reference. A printed receipt can be stored in folders or wallets for quick access during returns or warranty claims. They are also beneficial for business expense tracking where paper records are necessary. However, they take up physical space and can contribute to paper waste. Printing costs may add up if you’re handling a lot of transactions, and there’s always a risk of losing or misplacing the receipts.

Digital Receipts

Digital receipts provide a more streamlined and eco-friendly approach. They are easy to store on your phone or computer, reducing the clutter associated with paper storage. Searching for and organizing digital receipts is quick, and they can be backed up to avoid loss. However, digital receipts rely on technology, meaning you need a device with sufficient battery and storage. Some might also find it more challenging to manage large numbers of files without proper organization systems.

In short, printable receipts excel in accessibility for physical transactions, while digital receipts are perfect for keeping things organized in an environmentally friendly way.

Ensure that your credit card refund receipt aligns with the necessary legal standards. This includes providing accurate and clear information about the transaction, including the original purchase details, the refund amount, and the method of payment. Failure to do so may result in disputes or legal issues.

Data Privacy and Security

Protect your customers’ personal and financial information by adhering to relevant data protection laws, such as GDPR in the EU or CCPA in California. Use secure methods to process refunds and store receipt data, ensuring that sensitive customer data remains confidential and protected from unauthorized access.

Tax Reporting and Regulations

Understand and comply with tax laws that may affect refunds. In some regions, refunds may impact sales tax reporting or require specific documentation. Be sure to include all necessary details for tax purposes, such as the amount of sales tax refunded along with the total refund amount.

Failure to comply with these regulations can lead to penalties or disputes with both customers and regulatory bodies. Always verify that your refund receipt template meets local legal requirements and updates to financial regulations.

Tailoring a credit card refund receipt template for different types of businesses involves understanding their specific needs and adjusting the layout and fields accordingly. Each business might require distinct information on the receipt to comply with regulations or offer clarity to their customers.

Adjusting Template Fields

For retail businesses, focus on adding product details, such as item name, SKU, quantity, and price, alongside the refund total. A service-based business might prioritize fields like service description, technician name, and service date. Customize the template to reflect these needs, ensuring it is not overcrowded but still informative.

Design Considerations

The design should align with the branding of the business. Use specific colors, fonts, and logos that represent the company’s identity. A minimalist design works well for professional services, while vibrant, eye-catching designs may suit businesses in the entertainment or fashion industries.

Ensure your refund receipt is clear and concise. A common mistake is leaving out key information, such as the transaction date or the original purchase amount. Without these details, customers may not fully understand the refund process.

- Double-check the formatting of refund amounts. Using unclear symbols or inconsistent currency formats can confuse the recipient. Stick to one format and make sure it’s easy to read.

- Avoid vague descriptions. Be specific about the product or service being refunded. A simple “refund” without further explanation can lead to misunderstandings.

- Don’t forget the refund method. Whether the payment is returned to a credit card, PayPal, or another method, specifying it clearly helps avoid confusion.

- Ensure the refund receipt is free of spelling errors. A receipt with typos looks unprofessional and can raise doubts about its validity.

- Provide the correct refund reference number. Missing or incorrect reference numbers can create confusion for both the customer and your accounting team.

Taking care of these details will ensure that your refund receipt serves its purpose and creates a smooth experience for both parties involved.

Clarity Maintained, Redundancies Reduced, Readability Improved.

Focus on providing clear, concise details. Keep your refund receipt template simple and direct, with easy-to-understand language. Organize it logically so that users can quickly find necessary information.

Structure Your Template

A well-organized layout helps customers navigate through the details effortlessly. Include these key sections: refund amount, date of transaction, original purchase details, and a unique receipt number. Avoid overloading the template with unnecessary information.

Clear, Actionable Descriptions

Instead of generic terms like “refund processed,” describe the action specifically. For instance, use phrases such as “refund credited to card ending in 1234” to make the refund process crystal clear. Be precise with dates, amounts, and payment methods for greater transparency.

With these changes, your refund receipt will be more user-friendly, minimizing confusion and providing clear, actionable details at a glance.