Key Elements of a Cash Sale Receipt

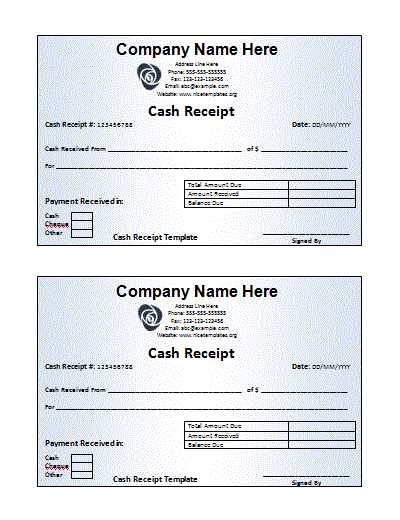

Creating a private cash sale receipt ensures both parties have a clear record of the transaction. This is especially important for informal agreements where no third-party oversight is involved. A receipt should include the following details:

- Date – The exact date of the transaction.

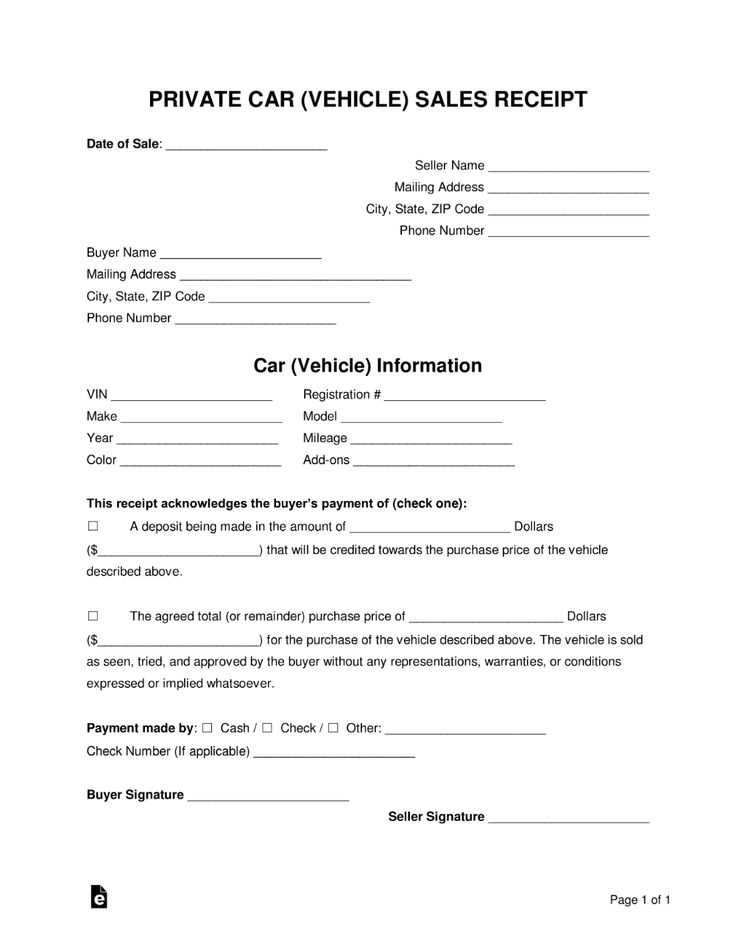

- Seller and Buyer Information – Full names, addresses, and contact details of both parties.

- Description of Goods or Services – A brief but clear description of what is being sold, including any relevant details (e.g., model, color, serial number).

- Amount Paid – The total amount of money exchanged for the goods or services.

- Payment Method – Specify that payment was made in cash. If there were any specific terms (e.g., partial payments), note them.

- Signatures – Both buyer and seller should sign the receipt to confirm the transaction.

How to Structure Your Template

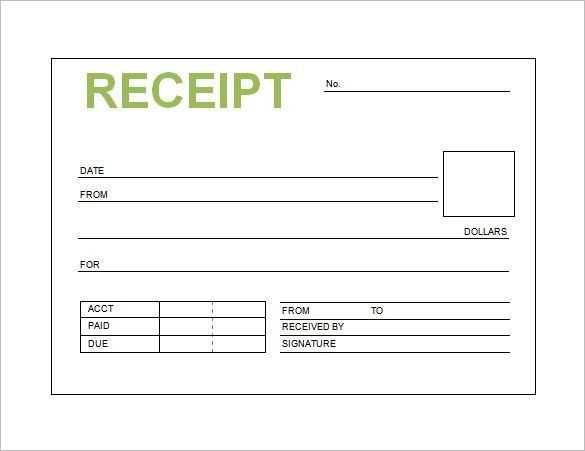

When creating a private cash sale receipt template, follow this structure to ensure clarity and completeness:

- Header: Include a title such as “Private Cash Sale Receipt” at the top.

- Seller’s Details: List the seller’s full name, address, and contact number.

- Buyer’s Details: Include the buyer’s name, address, and contact information.

- Transaction Details: Describe the goods or services sold, including the agreed price and payment method.

- Date of Transaction: Clearly state the date on which the transaction occurred.

- Signatures: Provide space for both parties to sign, confirming the sale.

Sample Template

Here’s a simple template you can use for a private cash sale receipt:

PRIVATE CASH SALE RECEIPT Seller’s Name: ________________________ Seller’s Address: ________________________ Seller’s Phone: ________________________ Buyer’s Name: ________________________ Buyer’s Address: ________________________ Buyer’s Phone: ________________________ Date of Sale: ________________________ Description of Goods/Services: ________________________________________ ________________________________________ Total Amount Paid: ______________________ Payment Method: Cash Seller’s Signature: _______________________ Buyer’s Signature: ________________________

Always make sure both parties have a copy of the signed receipt. This ensures both are protected in case any disputes arise.

Private Cash Sale Receipt Template

Key Elements of a Private Cash Receipt

Legal Aspects of Private Cash Transactions

How to Draft a Clear and Detailed Receipt

Printable vs. Digital Templates: Pros and Cons

Common Errors to Avoid in Receipt Drafting

Best Practices for Storing and Verifying Documents

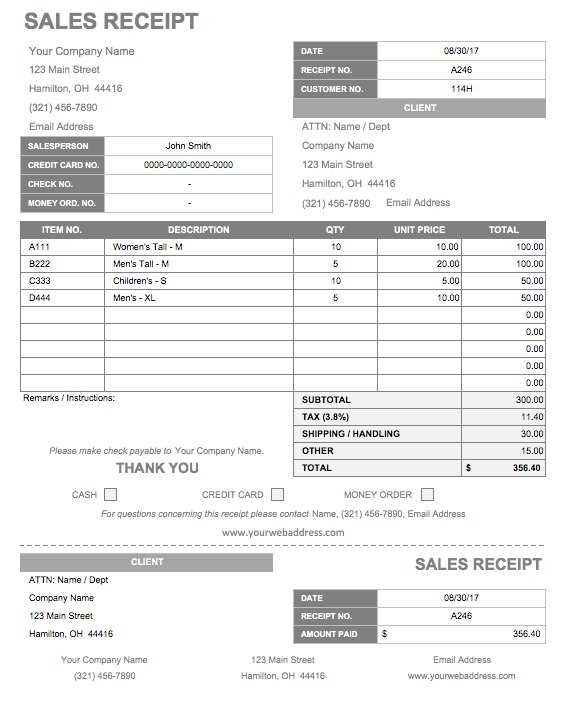

When drafting a private cash sale receipt, focus on clarity and accuracy. Include the names of both buyer and seller, the date of the transaction, a detailed description of the item or service, and the total amount paid. Also, ensure that both parties sign the document to acknowledge the transaction.

Legally, private cash transactions are binding once both parties agree on the terms and sign the receipt. A receipt can serve as evidence in disputes, but it must be clear and include all necessary details. Always be sure to state that the transaction was made in cash and specify the currency used.

To create a clear receipt, include specific information such as item condition (if applicable), any warranties or guarantees, and whether the transaction was final or subject to future conditions. Make sure to detail any taxes, discounts, or fees involved, to avoid confusion later.

Both printable and digital templates are available, and each has advantages. Printable receipts offer a physical copy, which may be useful for record-keeping or if either party prefers tangible documentation. Digital receipts, on the other hand, are more convenient for sharing and storing electronically but require reliable backup methods to avoid losing data.

Avoid common mistakes like omitting important details, such as the transaction’s total amount, or providing unclear descriptions of items. Never forget to include both parties’ contact information for follow-up if necessary.

When storing receipts, consider keeping both physical and digital copies. For digital storage, back up the receipts in multiple locations, like cloud storage or external drives. Verify receipts by comparing them with bank records or other payment confirmations to ensure the transaction occurred as outlined.