A well-organized sales receipt template is a must for any appliance store. It not only ensures that customers have a clear record of their purchase but also helps you maintain accurate financial records. Creating a template that includes all necessary details can save time and reduce errors in processing sales transactions.

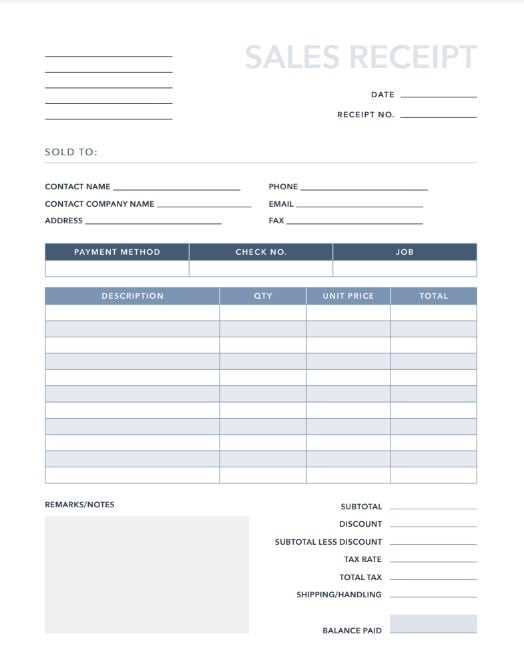

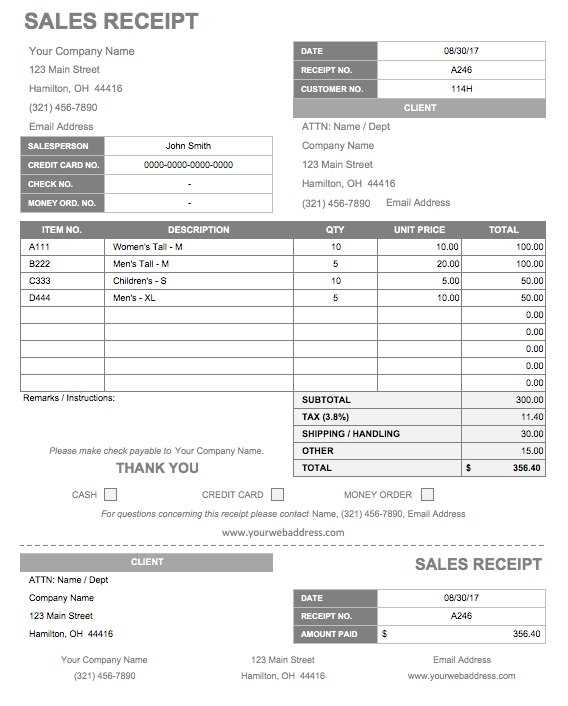

The template should include sections for the store’s name, address, and contact information at the top. These details provide a professional touch and make it easier for customers to reach you if there’s a need for returns or inquiries. Additionally, the itemized list of purchased appliances should show product names, quantities, prices, and any applicable discounts or promotions.

To enhance the customer experience, include a clear breakdown of taxes, warranties, and total amounts. Including a space for payment method (e.g., credit card, cash, or online payment) is also crucial for accurate record-keeping. Lastly, don’t forget to add your store’s return policy or a note for further assistance to encourage customer satisfaction.

Here is an improved version of the text with minimized repetition:

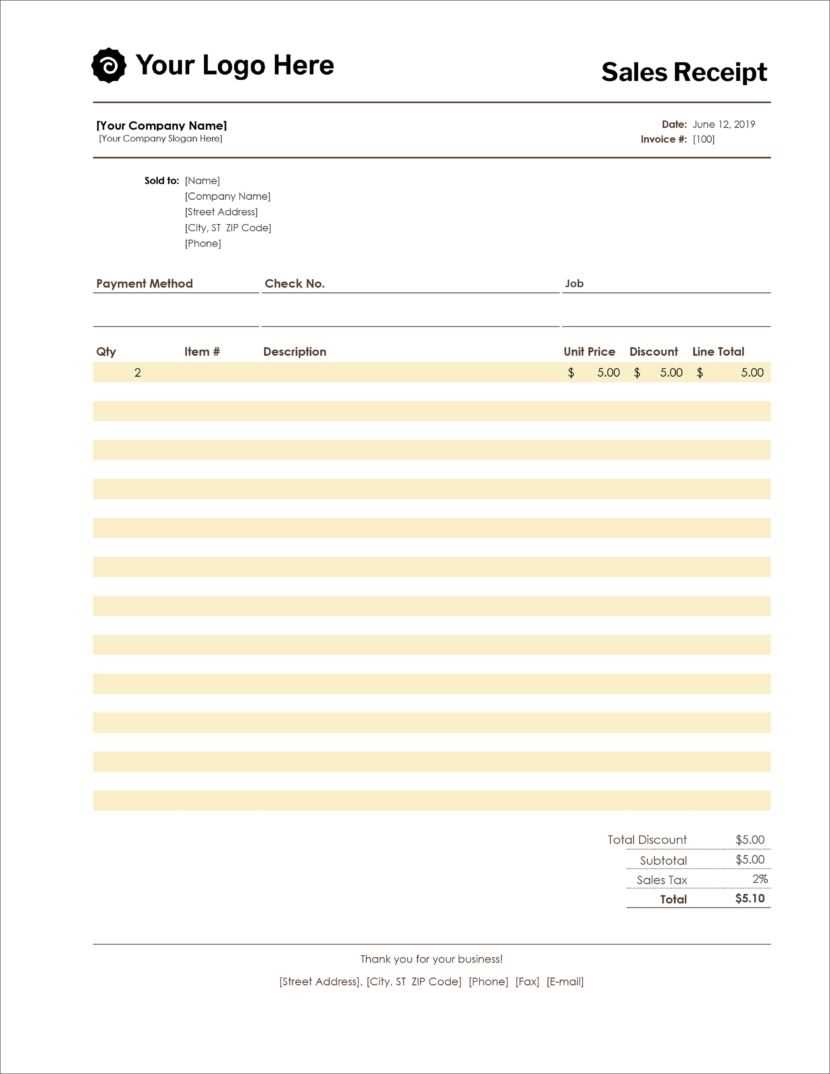

To create a sales receipt template for an appliance store, focus on clarity and simplicity. Include the store’s name, address, and contact information at the top. Clearly state the transaction date and the customer’s name, if necessary. Itemize each product purchased with details such as model number, quantity, unit price, and total price. Ensure the subtotal, applicable taxes, and final amount are displayed prominently. Add a section for any applicable warranties or return policies to provide customers with all necessary information. Conclude with payment method details and a thank-you message. Make the template visually clean and organized, using easy-to-read fonts and spacing to avoid clutter. This will enhance the customer experience and keep everything transparent and accessible.

- Sales Receipt Template for Appliance Store

A well-designed sales receipt helps maintain transparency and professionalism in any transaction. For an appliance store, it should include specific details that protect both the customer and the store.

Key Elements of a Sales Receipt

Include the following essential information:

- Store Name and Contact Information: Clearly display the store’s name, address, phone number, and email at the top of the receipt.

- Receipt Number: Assign a unique receipt number to help with future reference or potential returns.

- Date and Time of Purchase: Document the exact date and time of the transaction for accuracy.

- Customer Information: If applicable, include the customer’s name, address, and contact details.

- Itemized List of Purchases: List each appliance or accessory purchased, including model numbers, descriptions, and prices.

- Payment Method: Specify how the customer paid (credit card, cash, etc.), and include any relevant transaction details, such as card number or payment reference number.

- Total Amount: Ensure the final amount is clearly visible, including taxes and any discounts.

- Warranty Information: Provide information about the product’s warranty, including its duration and terms.

- Return/Exchange Policy: Briefly outline the store’s return and exchange policy to prevent confusion later.

Design Tips for Clarity

Keep the layout clean and easy to read. Use different sections with clear headings to make the receipt easy to scan. Choose a legible font and maintain consistent spacing between items to avoid clutter.

By organizing the receipt with these details, you’ll ensure both the store and the customer have all necessary information for a smooth transaction.

To create a practical and professional receipt template for an appliance store, focus on clarity and organization. A receipt should offer all the necessary details without overwhelming the customer.

Key Elements to Include

- Store Information: Include the name, address, and contact details of the store. This helps customers reach out for returns or support if needed.

- Transaction Details: Clearly display the transaction date, time, and receipt number for easy reference.

- Itemized List: List each appliance purchased along with the quantity, price, and any discounts applied. This breakdown helps customers track what they’ve bought and ensures transparency.

- Taxes and Total: Show the applicable tax rate and the final total clearly, so the customer can see how the final price is calculated.

- Payment Method: Mention whether the transaction was paid by cash, card, or other methods. This builds trust and helps with future queries regarding payments.

Design Tips for a Clean and Professional Look

- Readable Font: Use a clean, legible font. Avoid overly stylized fonts that may make important details harder to read.

- Consistent Layout: Maintain a consistent structure for each receipt. This will help customers quickly find the information they need and establish a professional brand image.

- Whitespace: Incorporate enough whitespace between sections. Crowded receipts can make important information hard to distinguish.

- Logo Placement: Place the store logo at the top for branding purposes. It gives the receipt a polished look while reinforcing the store’s identity.

By incorporating these components, you’ll provide customers with an easy-to-read receipt that reflects professionalism and attention to detail.

Include the store name and contact details at the top. This should include the full address, phone number, and email. Customers need this information for follow-up inquiries or warranty claims.

Clearly display the date and time of purchase. This helps track the transaction and verify any claims related to returns or defects.

List the item(s) purchased, with detailed descriptions. Include the model numbers, serial numbers, and quantities to avoid confusion during returns or exchanges.

Show the total amount paid, including taxes and any discounts. Break down the subtotal, tax amount, and final total clearly for transparency.

Include the payment method (e.g., credit card, cash). This helps confirm the transaction and provides proof of payment.

If applicable, include warranty details. This includes the duration and what’s covered, offering peace of mind to the customer.

Include any store policies regarding returns, exchanges, or refunds. These guidelines ensure customers know what to expect if they need to return or exchange an item.

Selecting the right format for your receipt directly impacts both customer satisfaction and your store’s efficiency. A simple, clean layout ensures customers easily understand their purchase details, while an organized format speeds up your internal processing.

Clear and Concise Information

Include only the necessary information on your receipt. Display the item names, quantities, unit prices, total amounts, taxes, and payment method. Avoid clutter, as too many details may confuse the customer. If your store offers warranties or return policies, consider adding this information in a separate section, such as a footer, for easy reference.

Incorporate Branding Elements

Integrating your store’s logo and contact information adds a professional touch and reinforces your brand identity. Ensure these elements are placed where they won’t overpower the rest of the receipt’s content, keeping the focus on the transaction details. Use your store’s colors and fonts to create a cohesive and recognizable look.

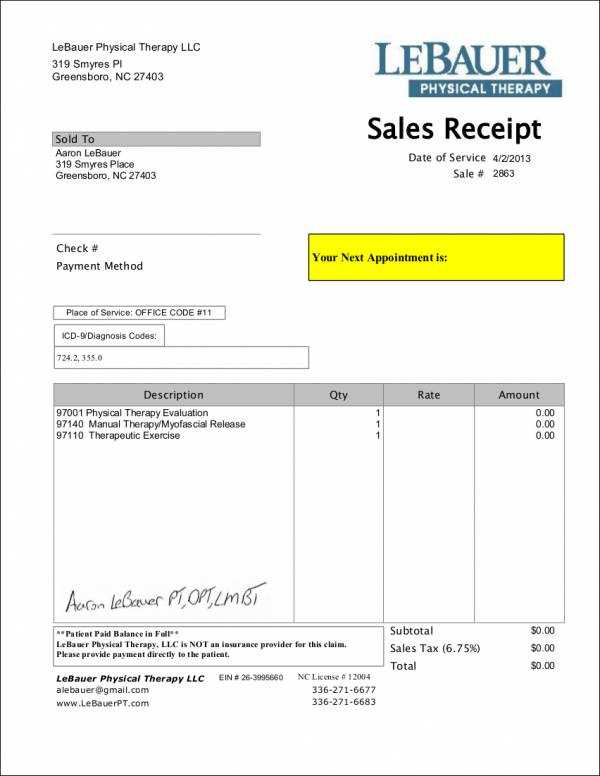

Adapt the receipt template based on appliance categories to offer clear, category-specific information. For large appliances like refrigerators or washing machines, include extra details such as installation fees, warranty periods, and maintenance instructions. This helps customers understand the long-term value of their purchase.

For smaller appliances, such as blenders or coffee makers, focus on highlighting product specifications, any promotional discounts, and return policies. Including a section on care instructions can also enhance the customer experience, ensuring they get the most out of their purchase.

For electronics, ensure that details about energy efficiency ratings, manufacturer support, and compatibility with other devices are clearly listed. This adds clarity and builds customer confidence in their purchase decisions.

Tailor the layout of each category’s receipt to reflect its unique attributes, from listing power consumption for electronics to including additional safety tips for home appliances. This small customization goes a long way in improving the customer’s post-purchase experience.

To ensure that a receipt is legally compliant and meets tax requirements, include the following details:

- Business Information: Clearly state your business name, address, phone number, and tax identification number (TIN). This helps customers contact you if necessary and verifies your business for tax purposes.

- Transaction Date: Include the date of the sale to establish a timeline for both the customer and for accounting purposes.

- Itemized List of Purchases: List each item purchased, including quantity, description, and price. This ensures transparency and helps with tax calculations.

- Sales Tax: Display the applicable sales tax rate and the total amount charged for tax. This is critical for both business reporting and customer understanding of their charges.

- Total Purchase Amount: Show the final total amount, including all taxes and discounts applied. This confirms the total cost of the transaction.

- Payment Method: Indicate how the transaction was paid (e.g., cash, credit card, digital payment), which is necessary for both customer records and accounting accuracy.

- Return Policy: Include a brief note or reference to your store’s return policy. This informs customers about the conditions for returning or exchanging items.

- Refund and Exchange Rights: In some jurisdictions, businesses must mention customers’ legal rights regarding refunds or exchanges. Check local laws to ensure compliance.

- Invoice Number: Assign a unique number to each receipt for tracking purposes. This is important for record-keeping and in case of disputes.

- Warranties or Guarantees: If a warranty or guarantee is provided with any item, include the terms or a reference to the documentation in the receipt.

Including these details will ensure that receipts meet legal and tax standards, offering both protection for your business and clarity for your customers.

To implement a digital sales receipt system, integrate a reliable point-of-sale (POS) software that supports digital receipts. This system should be capable of generating and sending receipts directly to customers via email or SMS after every transaction.

Choosing the Right Software

Select POS software that fits your store’s needs and is compatible with your existing hardware. Ensure it allows for easy customization of receipts, including your store’s logo, transaction details, and return policies. Check if the software provides analytics to track receipt delivery and customer engagement.

Customer Consent and Data Security

Before sending digital receipts, ask customers for their consent to receive the receipt electronically. Ensure that their personal data, such as email addresses or phone numbers, is stored securely and complies with relevant privacy regulations like GDPR or CCPA.

Test the system to confirm it works smoothly and that customers receive their receipts promptly. An effective system reduces paper waste and enhances the customer experience, offering easy access to their purchase records anytime.

Include a clean and simple layout for the sales receipt to avoid confusion. Use a consistent font and clear alignment for each section. The customer should easily find key details like product names, quantities, prices, and totals. Also, remember to add tax rates, any discounts, and total savings. Clear demarcation between sections enhances readability.

Ensure the date and time of the purchase are placed at the top, followed by customer and store information. Include the payment method, such as credit card or cash, to make the transaction traceable. An itemized list of purchased products should come next, with the description of each item and its price. This list should be concise yet detailed enough for any future reference.

| Product Name | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Washing Machine | 1 | $400.00 | $400.00 |

| Dryer | 1 | $350.00 | $350.00 |

| Subtotal | $750.00 | ||

| Tax (8%) | $60.00 | ||

| Total | $810.00 | ||

Finish with a thank you note and a reminder of any return or warranty policies. Having a separate section for the terms and conditions helps to clarify any questions that may arise later.