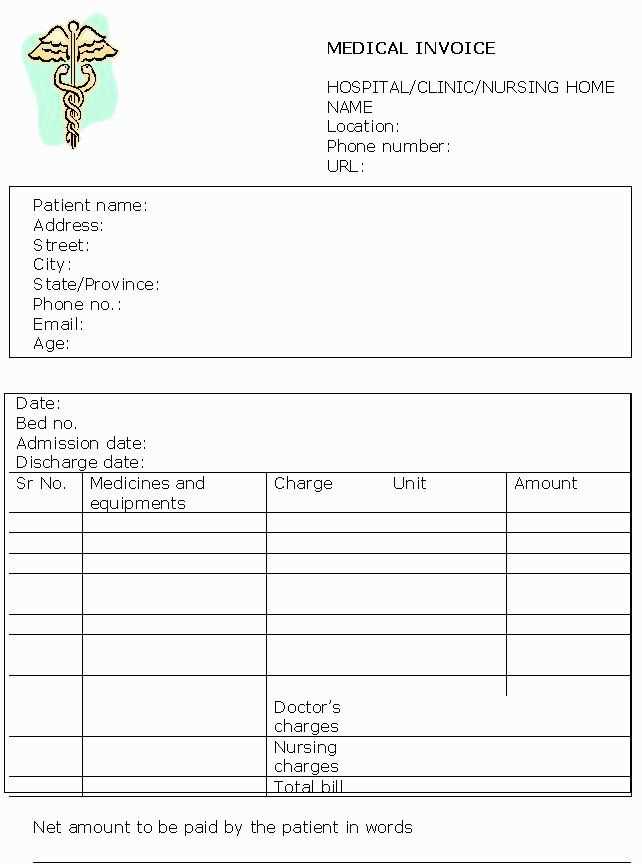

Every medical visit requires clear financial documentation. A well-structured copay receipt ensures patients have a record of their payments, while clinics maintain accurate financial records. Using a standardized template saves time and minimizes errors.

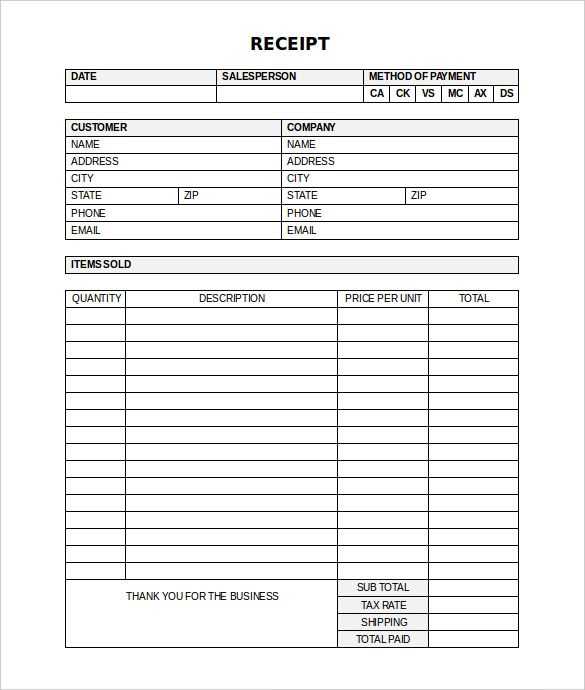

A proper copay receipt should include essential details: patient name, date of service, provider information, payment amount, and method of payment. Adding a unique receipt number simplifies future reference. For extra clarity, including the reason for the visit or procedure type can be helpful.

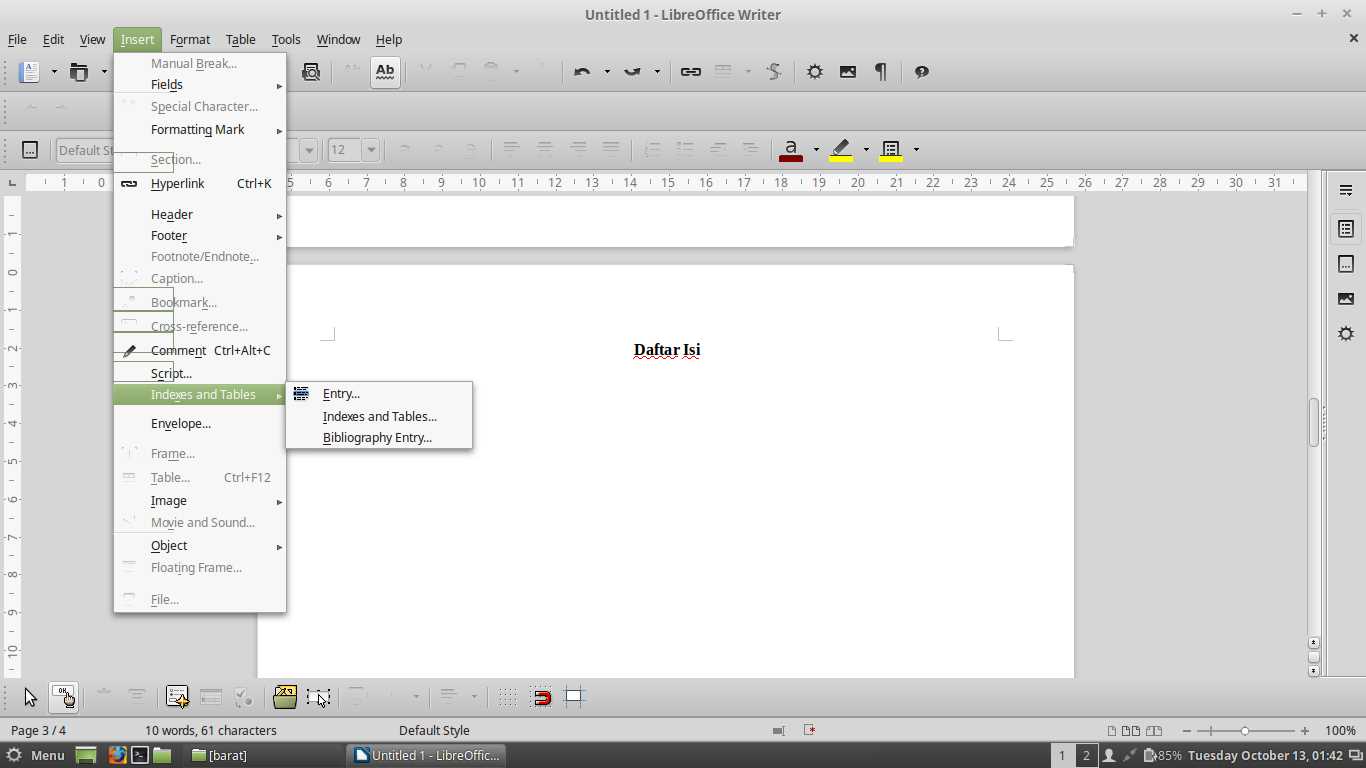

To streamline processing, clinics often use digital templates compatible with their billing systems. A structured format with predefined fields eliminates manual entry mistakes and speeds up administrative work. Whether printed or emailed, a clear receipt reassures patients and supports transparent financial transactions.

Here’s the corrected version without excessive repetition:

Make sure to list the copay amount clearly on the receipt. Start by including the patient’s name and date of the visit. Then, specify the amount paid for the copay, along with the services rendered during that visit. Provide a detailed breakdown of the charges, ensuring transparency.

Key Elements to Include:

- Patient Name

- Date of Service

- Amount Paid for Copay

- List of Services Rendered

- Provider Information

How to Format the Receipt:

- Clearly label each section to avoid confusion.

- Provide a total at the bottom that matches the paid amount.

- Include any relevant reference numbers or account numbers for follow-up.

This format ensures clarity and helps both the provider and the patient track payments efficiently.

- Doctors Office Copay Receipt Template

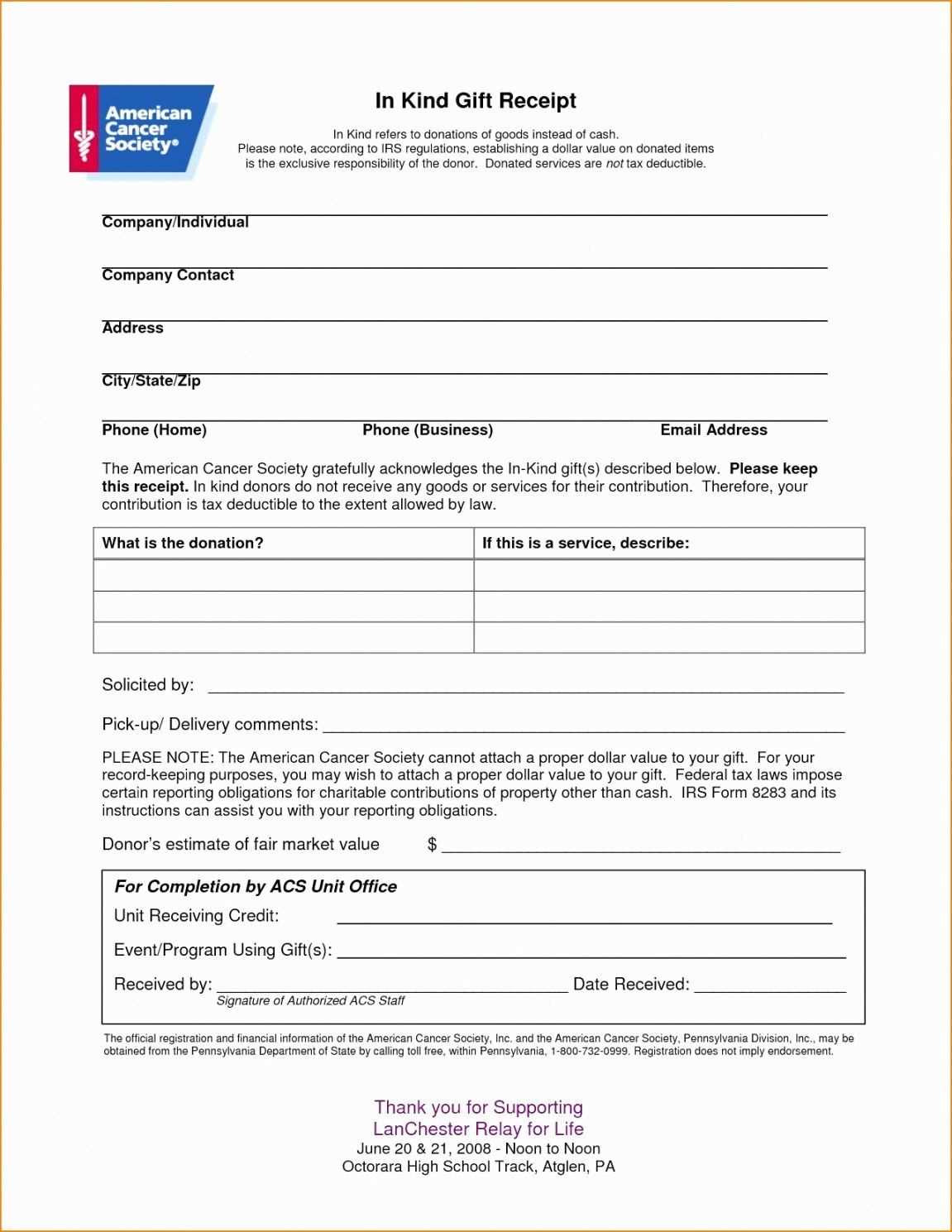

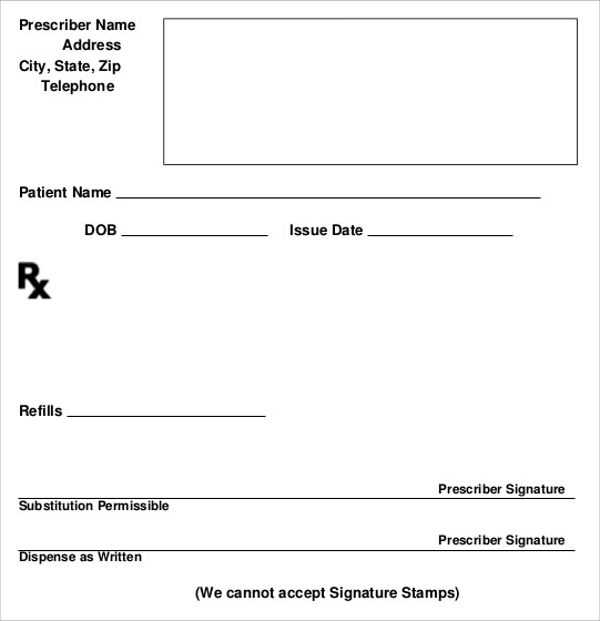

A copay receipt from a doctor’s office is a document confirming the payment made for medical services. It typically includes specific details about the visit and payment. The following elements should be included in the receipt template:

Required Information

The template should capture all necessary details to ensure accuracy. Key components include:

- Patient’s full name

- Date of service

- Doctor’s name or practice name

- Amount paid as copay

- Method of payment (cash, card, etc.)

- Receipt number for tracking purposes

- Practice address and contact details

Sample Template

| Field | Details |

|---|---|

| Patient Name | [Patient’s Full Name] |

| Date of Service | [Date] |

| Doctor/Practice Name | [Doctor’s Name or Practice Name] |

| Copay Amount | $[Amount] |

| Payment Method | [Cash/Card/Other] |

| Receipt Number | [Receipt Number] |

| Practice Contact | [Address/Phone Number] |

Ensure the copay receipt is easy to understand and includes all essential payment information for your patients. This template provides a clear structure for tracking payments and can be customized based on specific office needs.

Begin with the patient’s full name and date of service. This ensures that both the individual and the exact time of the visit are clearly identified. List the amount paid, specifying the copay amount for transparency. Include the method of payment used, such as credit card, check, or cash. Add a unique receipt number to easily track and reference the transaction. Mention the healthcare provider’s name and contact information, along with their tax ID number for billing purposes. Finally, include a brief description of the services provided, including any specific treatments or consultations covered by the payment. This provides a clear record of what was paid for, leaving no ambiguity about the transaction.

Align the text consistently throughout the receipt. Use a clean, legible font like Arial or Times New Roman. Maintain a font size of 10-12 points to ensure readability without overcrowding the page.

Include sufficient white space around each section. This creates clarity and prevents the receipt from appearing too cramped.

Clearly distinguish between different sections of the receipt, such as payment details, service descriptions, and doctor information. Use bold or slightly larger text for headings to separate each area.

- Payment information: Include the amount paid, payment method, and date. Bold the total amount for emphasis.

- Service details: List each service with a brief description, the date of service, and the corresponding charge.

- Doctor’s contact details: Ensure the doctor’s name, office number, and address are easy to locate.

Align monetary values to the right for consistency. This improves the clarity of financial data and makes it easier for clients to review the receipt quickly.

Use consistent punctuation and formatting for clarity. If using a period after one item, apply it to all items within the same section. This helps maintain a uniform appearance throughout the document.

Lastly, ensure that the receipt includes a footer with any necessary legal disclaimers or additional information, such as office hours or patient rights.

Keep detailed and accurate records of copayments for legal and tax purposes. These receipts serve as proof of medical expenses, which may be tax-deductible. For individuals itemizing deductions, medical expenses that exceed a certain percentage of income could qualify for a tax break.

Ensure that the documentation includes the provider’s name, the date of service, the amount paid, and the specific services rendered. This level of detail supports claims for deductions or reimbursement requests. Additionally, having a clear receipt helps avoid issues in the event of an audit or dispute with insurance companies.

Consult a tax professional or accountant for guidance on how to properly account for these expenses in your filings. They can help determine if any other medical costs might be eligible for tax benefits. Keep receipts for at least three years, as this is the typical timeframe for the IRS to request documentation for tax returns.

Ensure that all patient information is accurate. A common mistake is missing or incorrect details, like the name, date of service, or insurance information. Double-check these elements before finalizing the receipt.

Include the exact amounts charged for each service. Vague descriptions or rounding amounts can cause confusion. Be specific about what was provided and how much it costs.

Don’t forget to mention payment methods. Clearly indicate whether the payment was made by credit card, cash, or insurance. Omitting this can lead to disputes over payment.

Make sure the receipt includes the date of payment, not just the service date. This helps patients confirm when the payment was made and prevents issues with billing cycles.

Use consistent formatting throughout the receipt. Inconsistent fonts, spacing, or layout can make it difficult to read and verify the details. Keep the design clean and standardized.

Remember to provide any necessary disclaimers about refunds or future services. Leaving this out can lead to misunderstandings or frustration from patients later.

Medical practices can tailor receipts to meet their specific needs and requirements. By customizing a copay receipt template, practices can include specific details such as office visit type, diagnosis codes, and payment method. This allows for clearer communication with patients regarding the services they received and the charges incurred.

For example, optometry clinics may want to add fields for vision exams, glasses, or contacts, while dermatology offices could include skin procedures or treatments. These customizations ensure that receipts accurately reflect the type of service provided and help patients understand their financial obligations.

Another important option is adding a practice logo or branding to enhance the professional look of the receipt. This gives a personalized touch while promoting the practice’s identity. Practices can also include payment due dates or instructions for insurance claim submissions to streamline the payment process.

Some medical offices also choose to list detailed descriptions of services to reduce confusion or potential disputes. Custom fields for insurance adjustments, discounts, or payment plans can be added, making it easier for both the office and the patient to track payments and remaining balances.

Ultimately, customizing receipts based on the nature of the practice improves transparency and helps both patients and providers manage expectations regarding financial transactions.

Choosing between digital and paper formats for doctor’s office copay receipts depends on your priorities like convenience, storage, and accessibility. Both options have their strengths, and understanding these can help you decide which works best for your needs.

Digital Format: Convenience and Accessibility

Digital receipts are easy to store and access. With just a few clicks, you can retrieve them anytime from your phone, tablet, or computer. They take up no physical space and can be backed up to avoid loss. However, keep in mind that you need reliable internet access and device compatibility to view or store them. Additionally, some digital formats may lack the clarity or necessary detail that physical copies provide in specific situations.

Paper Format: Tangible and Reliable

Paper receipts offer a tangible record you can hold and review. They’re useful for those who prefer hard copies or are not comfortable with digital storage. Paper can also be more straightforward during in-person appointments, where it can be immediately handed over for reference. However, paper can be easily misplaced, damaged, or lost, and requires physical space for storage. It’s also not as easily shareable or accessible when you need it remotely.

Each format has clear advantages depending on your priorities. Digital receipts excel in convenience and accessibility, while paper receipts remain a reliable, tangible choice for those who prefer physical records. Consider your preferences for storage and retrieval when deciding which format to use for your receipts.

Ensure that your copay receipt includes accurate details, such as the date of service, doctor’s name, and the amount paid. Make sure to check that your copay amount matches the terms of your insurance plan. Include a description of the service provided and any applicable diagnostic codes. This will help you maintain organized records for both insurance claims and tax purposes.

If you paid by card, request a copy of the payment transaction. This can assist in resolving any discrepancies or disputes. Keep all receipts in a secure place for easy access during your next doctor’s visit or insurance filing.

For clarity, ask your doctor’s office for an itemized list of services if it’s not included. This breakdown is helpful when cross-checking with your insurance coverage and for better understanding your copay costs.