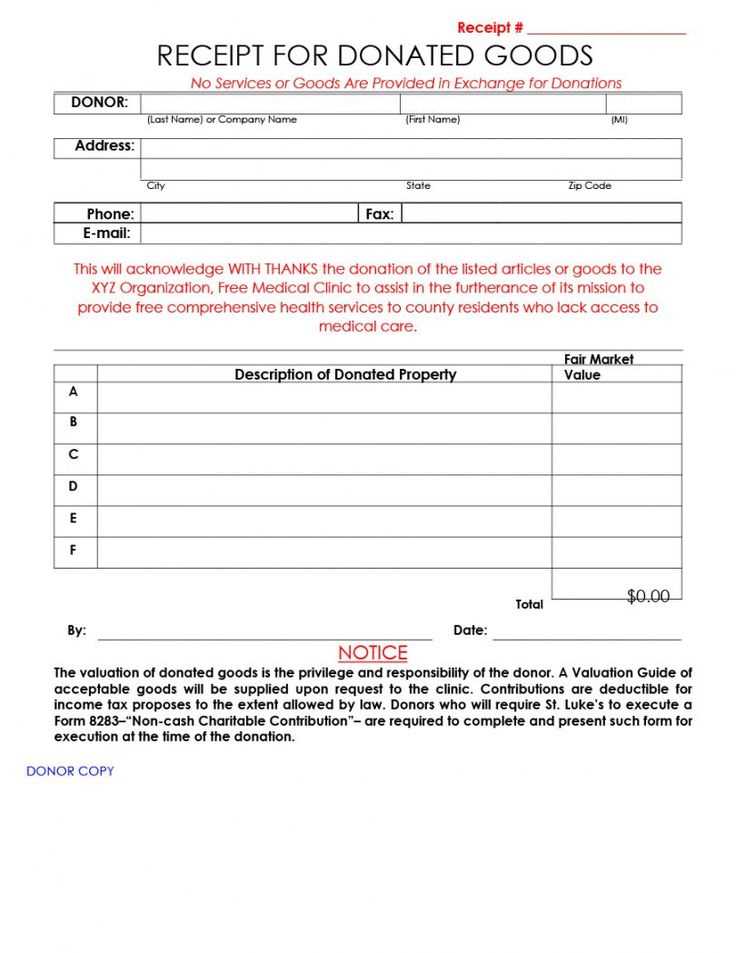

Essential Elements of a Tax-Deductible Receipt

To ensure compliance with tax regulations, a tax-deductible receipt must include specific details. Missing information can lead to issues during tax filing, so double-check the following elements:

- Organization Name: Clearly state the name of the nonprofit or business issuing the receipt.

- Date of Donation or Purchase: Specify when the transaction took place.

- Donor or Customer Details: Include the full name and contact information.

- Contribution Description: Describe the donation or purchased item, including its value.

- Statement of No Goods or Services: If applicable, confirm that no goods or services were exchanged.

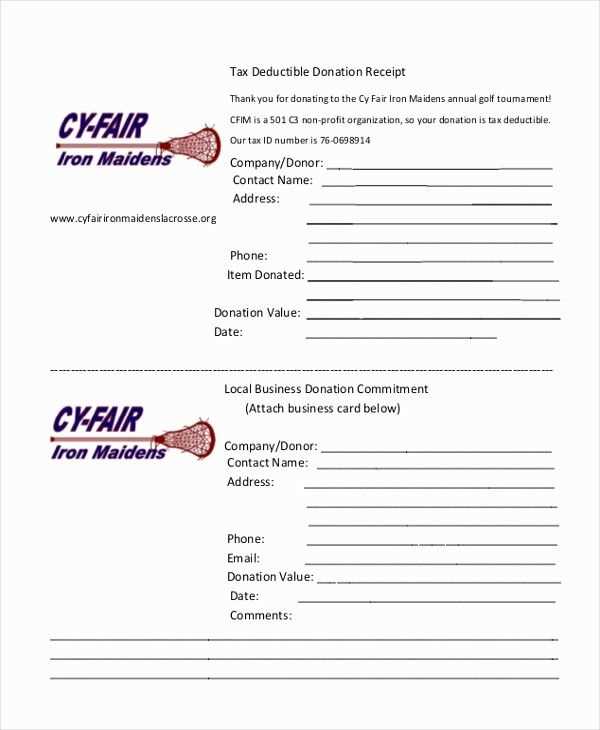

- Tax Identification Number: Add the organization’s tax ID for verification purposes.

- Signature or Digital Confirmation: Authenticate the receipt with an authorized signature or digital validation.

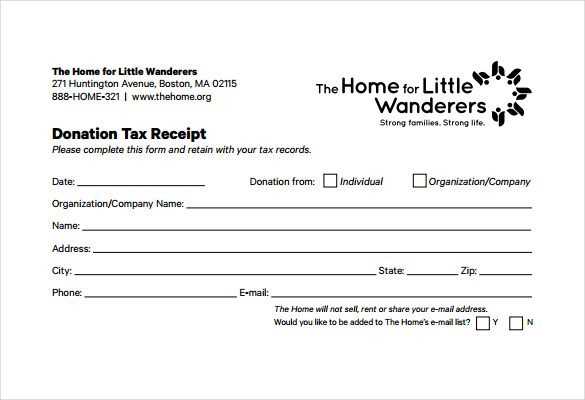

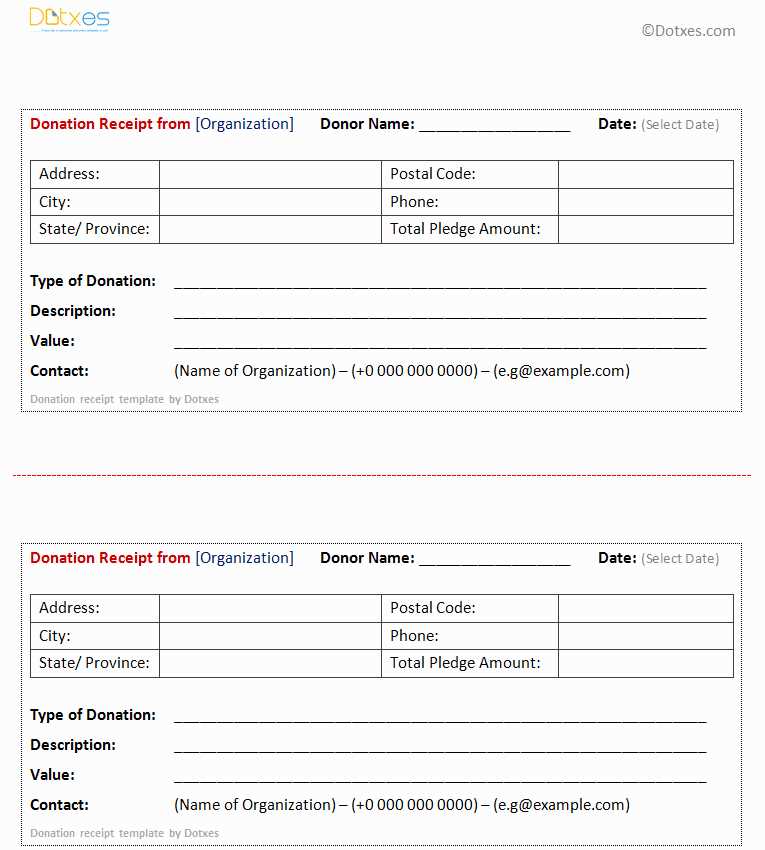

Template for a Tax-Deductible Receipt

Use this template to create a tax-compliant receipt for donations or qualifying transactions:

[Organization Name]

[Street Address]

[City, State, ZIP Code]

[Email Address or Phone Number]

Receipt Number: [Unique Identifier]

Date of Transaction: [MM/DD/YYYY]

Donor/Customer Information:

Name: [Full Name]

Address: [Street Address, City, State, ZIP Code]

Contact: [Email or Phone]

Donation/Purchase Details:

Description: [Goods, Services, or Donation Details]

Amount: [$XXX.XX]

“No goods or services were provided in exchange for this contribution.” (Include this statement if applicable.)

Tax Identification Number: [EIN or Registration Number]

Authorized Signature: ________________________

Best Practices for Issuing Receipts

Maintain clear and organized records to simplify tax reporting. Store copies of issued receipts, ensure donors receive them promptly, and verify all details before distribution. Using digital templates can improve accuracy and efficiency.

Tax Deductible Receipt Template

Key Elements to Include in Documents

Each receipt must clearly state the donor’s name, the organization’s legal name, and the date of the transaction. Include a detailed description of the donation, specifying whether it was cash or non-cash. If goods or services were provided in return, disclose their fair market value. Clearly indicate the organization’s tax-exempt status and provide an authorized signature.

Legal Requirements for Tax-Exempt Records

Tax authorities mandate that receipts include a statement confirming whether any benefits were received by the donor. For contributions above specific thresholds, additional documentation may be required. Nonprofit organizations should ensure compliance with regional tax laws by reviewing government regulations annually.

Formatting for Different Tax Jurisdictions

Different regions impose varying rules on receipt content. In the U.S., IRS-compliant receipts must exclude estimated donor valuations and specify whether goods or services were exchanged. In Canada, official receipts require a unique serial number and a statement of the organization’s registration. The European Union has distinct country-specific rules, often requiring donor identification numbers.

Common Mistakes in Templates to Avoid

Omitting a clear statement of tax deductibility leads to rejected claims. Inconsistent formatting or missing key details, such as the date and organization’s contact information, raises compliance risks. Avoid vague descriptions–each receipt should specify the exact nature of the contribution. Digital receipts must match paper copies in content and format.

Best Practices for Digital and Paper Records

Organizations should generate digital copies for every receipt, ensuring secure storage and easy retrieval. Paper records must be kept in fireproof storage, while digital files should be backed up regularly. Standardized templates with auto-filled fields reduce errors and maintain uniformity.

How to Verify and Store for Audits

Audit-ready records must be accessible for at least five to seven years, depending on jurisdiction. Cross-check each receipt with bank statements or donation logs to confirm accuracy. Implementing an automated tracking system enhances reliability and minimizes manual errors. Always ensure encrypted storage for digital receipts to prevent unauthorized access.