Using a well-structured template for typed receipts saves time and ensures accurate documentation of transactions. A clear format helps both businesses and customers keep track of payments, reducing misunderstandings and disputes.

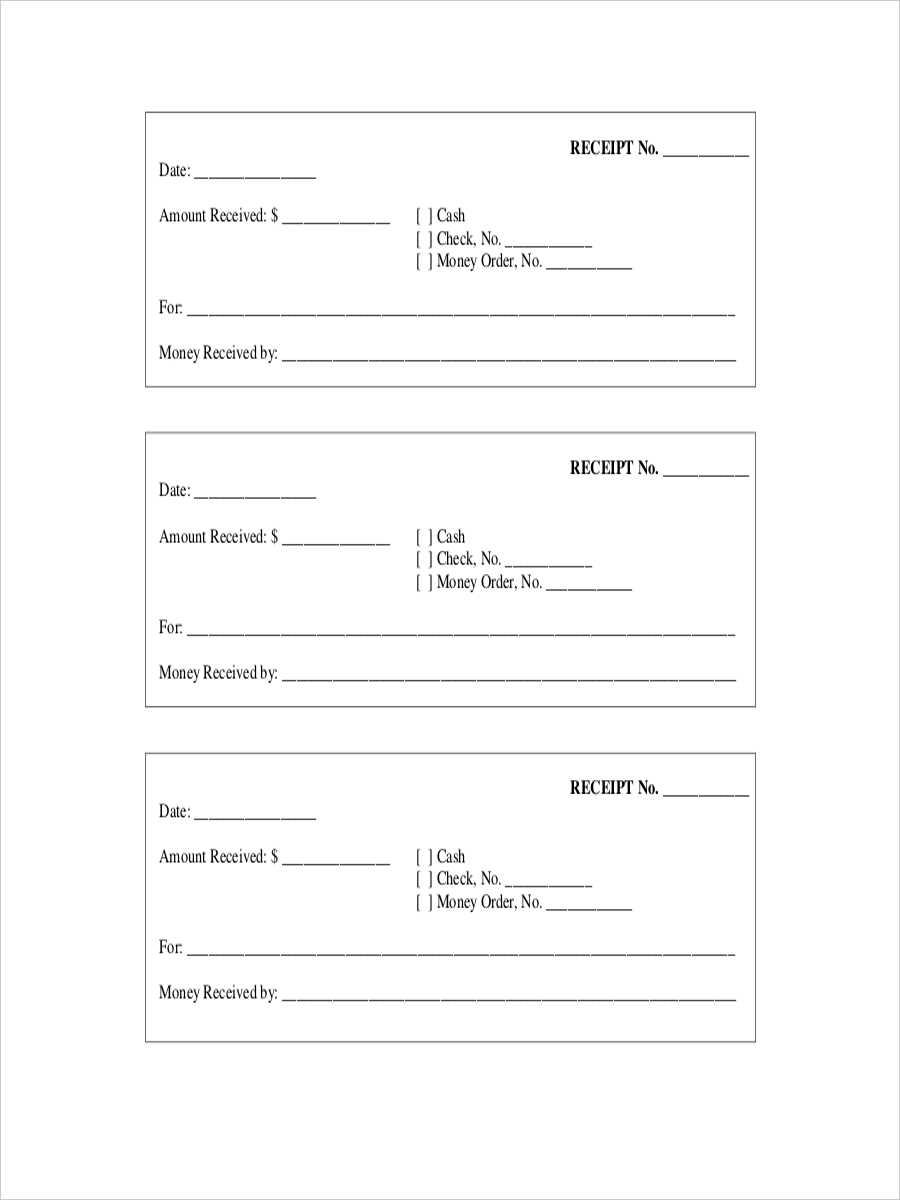

At a minimum, a receipt template should include the date, transaction number, payment details, and contact information for the issuing party. Ensure that each section is easy to read and logically arranged for quick reference.

Adding optional fields such as a thank-you note, tax breakdown, and payment method enhances professionalism and transparency. Consider using bold text for essential information like total amounts and due dates to improve readability.

Finally, standardize your receipt format across all transactions to maintain consistency. This practice not only reinforces brand identity but also builds trust with customers by providing them with reliable and predictable documentation.

Here’s a Text Version Without Repeated Words in Lines:

Typed receipts should clearly display essential transaction details without redundant terms. Each row must convey unique information, ensuring readability and data accuracy. Focus on item descriptions, quantities, prices, and tax rates, avoiding repetitive phrases or headers in line entries.

Effective Tips for Streamlined Content:

1. Ensure item descriptions are concise yet informative. Use distinct wording for similar products.

2. Group related charges logically, reducing unnecessary duplication.

3. Avoid reusing terms within the same row, enhancing clarity for readers.

4. Maintain consistent column labels at the top without repeating them in individual lines.

By optimizing language and structure, your typed receipts will become more reader-friendly and professionally organized.

- Template for Typed Receipts: Practical Guide

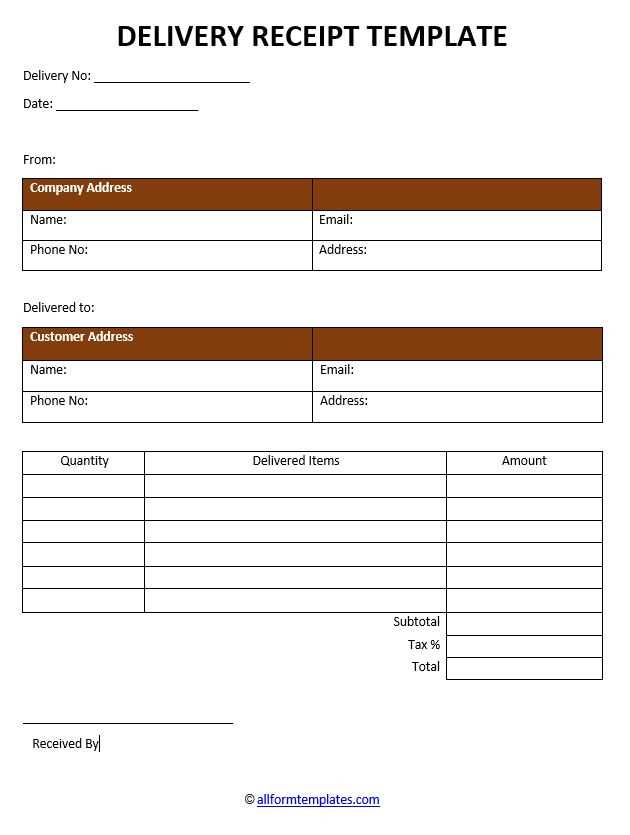

Ensure that every receipt includes essential information such as the business name, address, contact details, and tax identification number. Clearly state the date of issue and a unique receipt number to keep records well-organized and traceable.

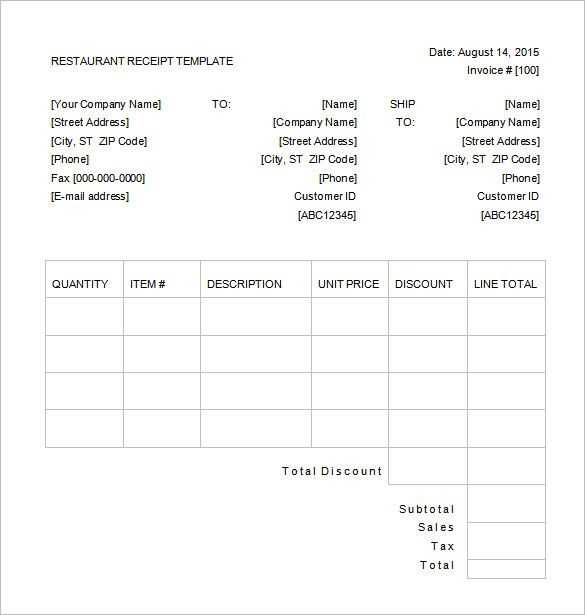

List the purchased items or services with specific descriptions, quantities, and unit prices. Provide a clear breakdown of subtotals, applicable taxes, and the final total amount. This helps avoid disputes and ensures transparency for both parties.

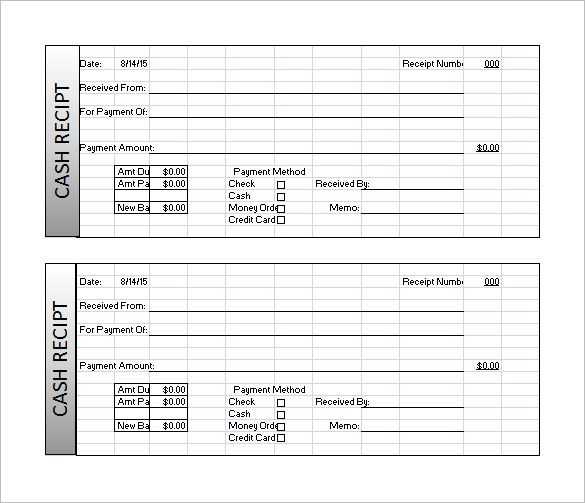

Include payment details, specifying whether the amount was paid in cash, by card, or through other methods. If applicable, mention any partial payments and the remaining balance. Always indicate whether the transaction is final or pending further payment.

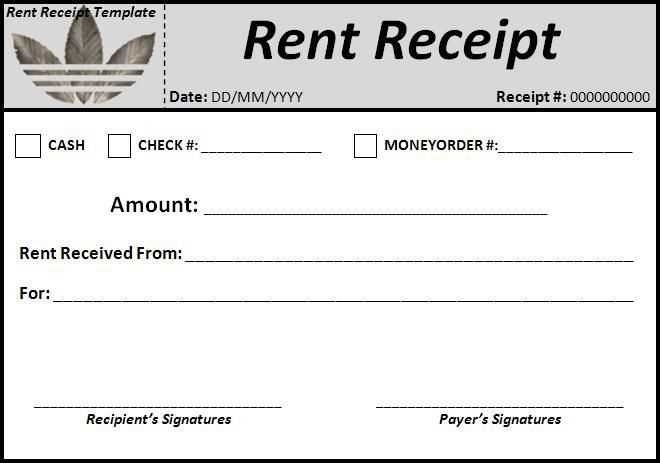

Provide a designated space for the customer’s signature if the receipt serves as a contractual document or proof of delivery. Digital receipts should offer secure signature fields or acknowledgment options.

Save templates in editable formats to streamline future transactions and ensure consistency. Regularly review and update your template to meet any legal or business requirements, making your operations more efficient and professional.

A well-structured receipt must provide essential transaction details to ensure transparency and compliance. The following elements are indispensable for creating clear and accurate receipts:

1. Seller and Buyer Information

Include the full name, address, and contact details of both parties. For businesses, add the registered business name and tax identification number (if applicable).

2. Transaction Details

Specify the date and time of the transaction, the payment method used (e.g., credit card, cash, or bank transfer), and a unique receipt number for easy tracking.

Below is a table summarizing key receipt components for quick reference:

| Element | Description |

|---|---|

| Itemized List | Break down purchased goods or services, including quantity and individual prices. |

| Total Amount | Include subtotals, taxes, discounts, and the final payable amount. |

| Terms and Conditions | Outline refund policies or any special notes relevant to the transaction. |

| Payment Confirmation | Provide a confirmation note if payment has been successfully completed. |

By consistently including these elements, you ensure that your receipts are informative, professional, and fully compliant with financial documentation standards.

- Use Clear and Consistent Fonts: Select readable fonts such as Arial, Verdana, or Calibri. Maintain a consistent font size for body text and headers.

- Align Content Properly: Use left alignment for most text elements to ensure better readability. Right-align numerical data like prices or totals for clarity.

- Include Logical Sections: Organize information into sections with clear headers. Common categories include product details, payment information, and terms.

- Incorporate White Space: Avoid cluttered layouts by spacing out elements to improve visual flow. This helps readers quickly identify key information.

- Highlight Key Information: Use bold or slightly larger text for important details like total amounts, due dates, and customer information.

- Use Tables for Data Presentation: Structure item lists, pricing details, and tax breakdowns in tables. This format ensures alignment and improves clarity.

- Ensure Compatibility for Printing: Set standard page margins and avoid color backgrounds to ensure templates print correctly on different printers.

- Incorporate Branding Elements: Add your logo and consistent brand colors to reinforce your identity while maintaining a professional appearance.

- Double-Check Formatting for Errors: Review spacing, alignment, and line breaks before finalizing the template to ensure a polished and professional look.

Businesses in the United States must include specific elements such as the date of purchase, business name and address, item descriptions, and total payment amount to comply with IRS regulations. Electronic receipts must also be accessible and printable if requested by the customer.

European Union Requirements

EU member states often require Value-Added Tax (VAT) details on receipts, including the seller’s VAT identification number and a clear breakdown of the VAT amount per tax rate category. Receipts must also be stored digitally for up to ten years in some jurisdictions to comply with tax audits.

Asia and Oceania Standards

In Japan, businesses must provide a tax-compliant receipt with the company’s registered invoice number and tax breakdown as part of the Consumption Tax System. Australia mandates that receipts exceeding AUD 75 include the Australian Business Number (ABN) and a GST breakdown to comply with tax laws.

Understanding and implementing these legal requirements ensures that businesses operate within the boundaries of jurisdictional laws, minimizing potential penalties and enhancing transparency in financial transactions.

To create a template for typed receipts, begin by defining the essential sections you want to include. This will typically cover the company name, address, date, items purchased, total amount, payment method, and any other relevant information. Keep it simple and structured for easy readability.

1. Set Up the Layout

Start by choosing the right layout for your template. Use tables or grid structures to neatly arrange the information. Ensure there is enough space between each section so that the text doesn’t look cluttered. Use clear headings for each section, like “Items Purchased” or “Total Amount”, for easy identification.

2. Customize Fonts and Styles

Customize the font size and style for each section to highlight important information. For example, the company name can be in a larger font, while the individual items can have a standard font size. Avoid using too many different styles, as this can make the template look chaotic.

Finally, review your template to ensure all sections are included and the layout is consistent. Test the template by inputting sample data to make sure everything aligns correctly. This will help you spot any issues before using it in actual transactions.

Focus on clarity and accuracy. Misplacing important details or using illegible fonts creates confusion. Customers rely on receipts to verify purchases, so make sure every piece of information is easy to read and understand.

1. Inconsistent Layout

Inconsistent alignment or placement of information can disrupt readability. Make sure the transaction details, such as date, amount, and items, are organized in a structured way. Group related information together and leave adequate space between sections.

2. Failing to Include Key Information

- Don’t omit the business name, address, or contact details.

- Ensure the transaction total, taxes, and payment method are clearly displayed.

- Always include a unique receipt number for easy tracking.

3. Overcrowding the Receipt

A cluttered receipt will overwhelm the customer. Avoid cramming too much information into a small space. Use bullet points or short, concise descriptions for each item. Keep promotional or additional messages minimal to prevent distraction.

4. Using Inappropriate Fonts

- Avoid decorative fonts that are hard to read.

- Stick with simple, clean fonts like Arial or Helvetica, especially for key details.

- Ensure the font size is large enough for easy reading.

5. Not Testing the Design for Different Devices

If receipts are generated digitally, test them on various screen sizes to ensure the layout remains intact. A receipt that looks perfect on one device might become unreadable on another.

Recommended Software for Generating Templates

To create typed receipt templates quickly and easily, use reliable software that offers customization options, flexibility, and user-friendly interfaces. Here are some highly recommended tools:

1. Microsoft Word

Microsoft Word remains a solid choice for generating receipt templates. It provides a variety of customizable templates that can be edited for specific business needs. You can adjust fonts, tables, and margins easily, ensuring that the receipt matches your brand style. The built-in formatting tools allow for professional-looking results without requiring any design experience.

2. Canva

Canva is a powerful graphic design tool with a large selection of templates. It’s especially useful for creating visually appealing receipts with logos, unique fonts, and creative designs. Canva’s drag-and-drop interface makes it easy to tweak your template, and it allows exporting files in multiple formats, such as PDF or PNG, which is ideal for printing or emailing receipts.

Both these tools cater to different needs, whether you prioritize straightforward text-based receipts or ones that include custom graphics and branding elements. Choose the software that best fits your specific requirements for simplicity or creativity.

Removed Redundant “Receipt” and “Typed” Terms

To streamline text and avoid redundancy, replace unnecessary repetitions of the words “receipt” and “typed.” Instead of repeating these terms, focus on the context to make the meaning clear. For instance, you can use pronouns or adjust sentence structures to eliminate the need for restating the same concepts. Here are practical suggestions:

1. Use Contextual Clarity

Once the document is established as a receipt, there’s no need to repeat “receipt” throughout. Refer to it as “this document” or simply “it” in subsequent sentences. This approach keeps the writing concise and fluid.

2. Replace Overused “Typed” References

If you’ve already specified that the document is typed, avoid saying “typed receipt” multiple times. Instead, consider using “generated document” or “printed form” depending on the context. This will reduce clutter while maintaining clarity.