A well-structured cash receipt ensures transparency in transactions and provides essential documentation for both service providers and clients. To create a clear and professional receipt, include key details such as the service description, payment amount, date, and payer information. Using a standardized template helps maintain consistency and prevents disputes.

Essential Elements of a Cash Receipt:

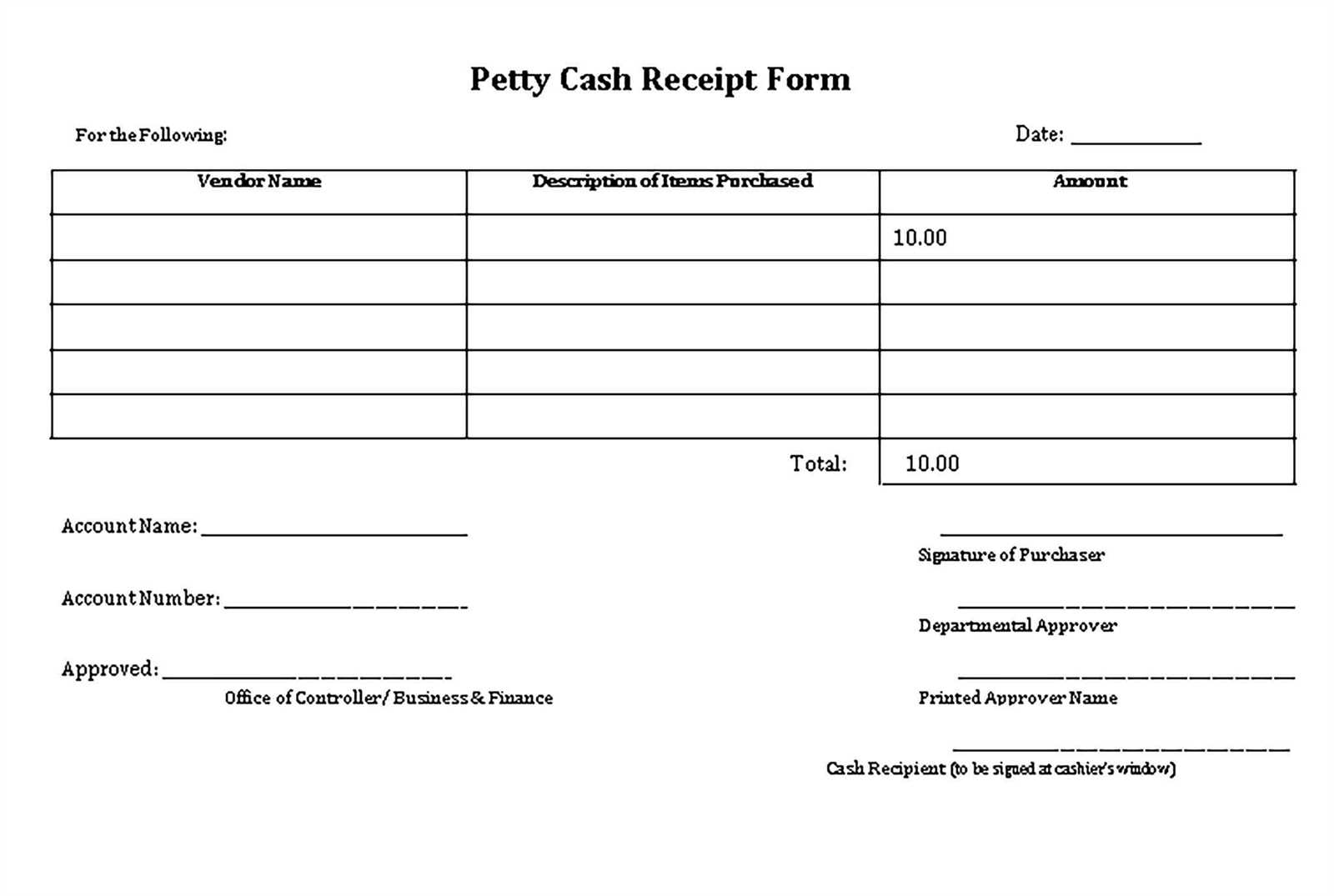

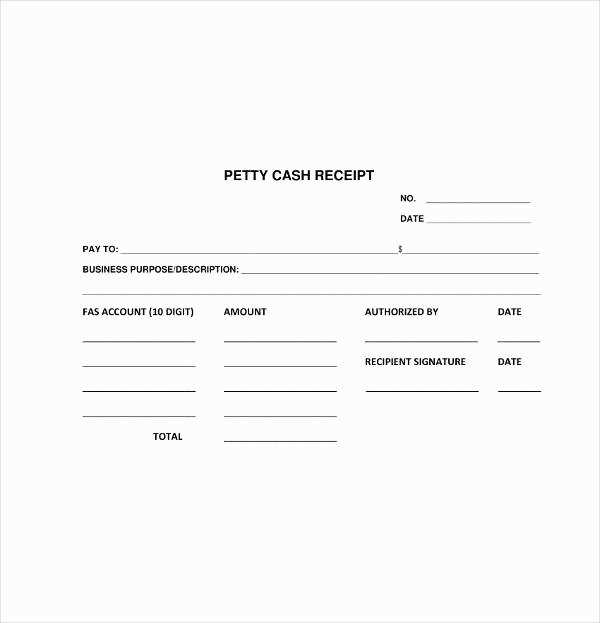

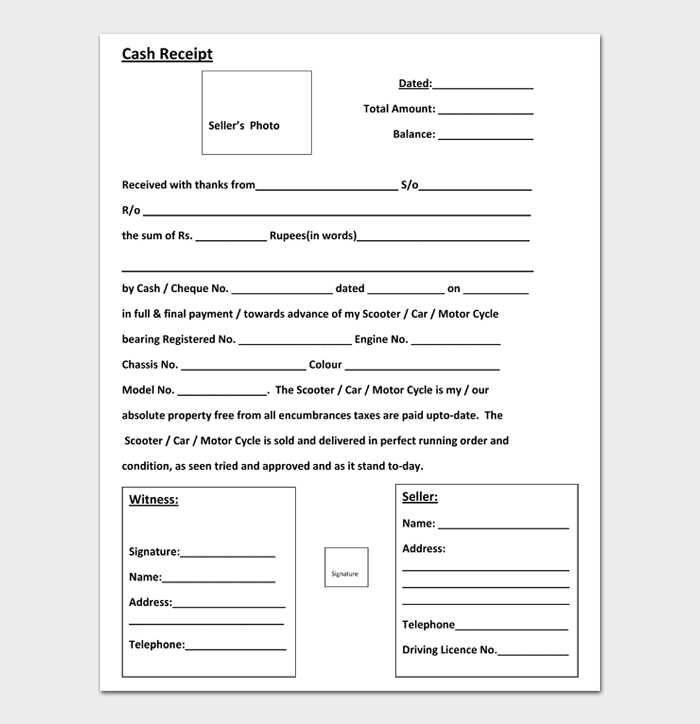

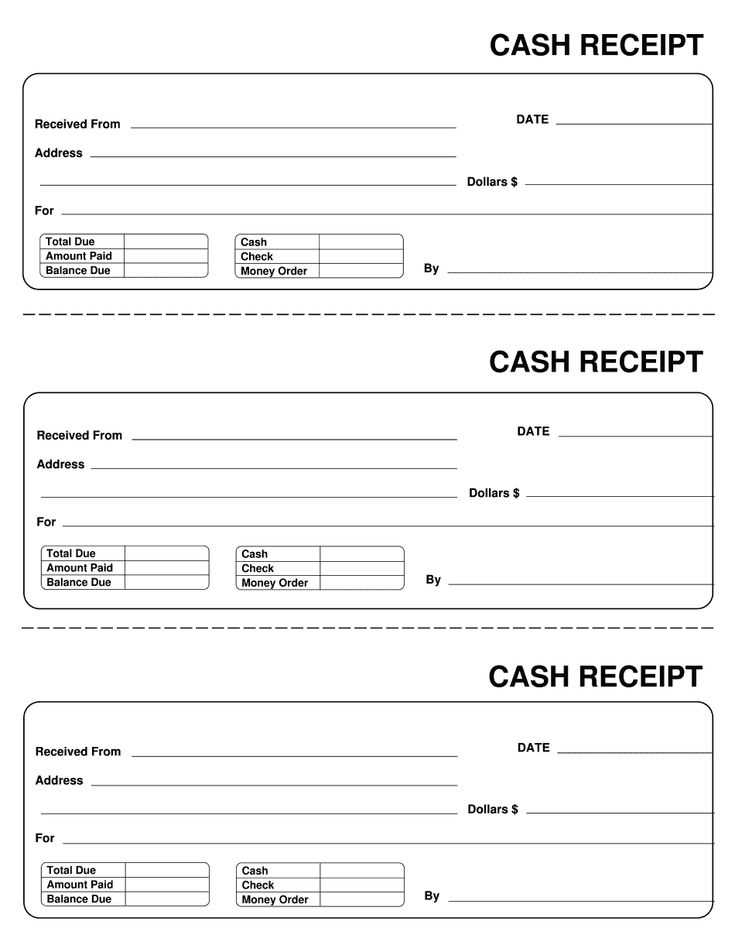

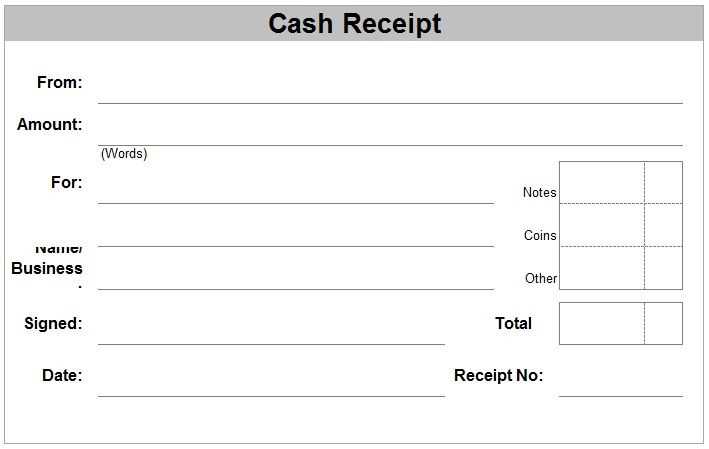

Every cash receipt should contain the business or service provider’s name, contact details, and a unique receipt number for tracking. Clearly outline the service provided, specifying the quantity, rate, and total amount. The receipt should also include the payment method–whether cash, check, or electronic transfer–and the name of the person making the payment.

For added credibility, include a signature field or digital authentication. This not only validates the transaction but also reassures clients of the legitimacy of the receipt. If applicable, add tax details and a note about refund policies to prevent misunderstandings.

Benefits of Using a Template:

A ready-made template saves time and minimizes errors. Whether using a printable PDF, an Excel sheet with automatic calculations, or a digital receipt generator, a well-formatted template streamlines record-keeping. It also improves professionalism by presenting a consistent format that clients can easily recognize and verify.

Choose a template that suits your business needs, ensuring it aligns with legal and accounting requirements. A simple yet detailed receipt serves as a reliable proof of payment and reinforces trust between service providers and clients.

Here’s the revised version with reduced repetition of “Cash Receipt” while maintaining the meaning:

To make the document clearer and more concise, we can minimize the repeated use of “Cash Receipt” by using alternative phrases or rewording sentences. Below is a revised template where the key information is retained but repetition is minimized:

Receipt Template for Services Rendered

| Field | Description |

|---|---|

| Receipt Number | Unique identifier for the transaction |

| Date | Specific date of the service payment |

| Received From | Name of the client who made the payment |

| Service Provided | Description of the service rendered |

| Amount | Total payment received for the service |

| Payment Method | Cash, check, or other payment form |

| Issued By | Name or company issuing the receipt |

Note on Receipt Usage

It’s recommended to use clear, descriptive terms rather than overloading the template with “Cash Receipt” to keep the document professional and readable. This version emphasizes clarity without redundancy, making it easier for both the issuer and the recipient to understand the transaction details.

- Cash Receipt Template for Services Rendered

Use a straightforward format when creating a cash receipt for services rendered. Ensure the following details are included:

- Receipt Number: Assign a unique identifier to each receipt for tracking purposes.

- Date: Record the exact date the payment was made.

- Service Description: Clearly outline the service provided, including any relevant details like hours worked or specific tasks completed.

- Amount Paid: State the exact amount received, using the appropriate currency symbol.

- Payment Method: Specify whether the payment was made in cash, by check, or another method.

- Receiver Information: Include the name and contact details of the individual or business receiving the payment.

- Issuer Information: List your name, business name, and contact information.

For a clean presentation, align the information neatly in rows or columns. Ensure all entries are legible and easy to read. If possible, provide a space for both parties to sign, acknowledging the transaction. Keep a copy of each receipt for your records and offer a duplicate to your client.

When drafting a payment receipt for services rendered, make sure to include these key details to ensure clarity and proper documentation:

1. Business Information

Clearly display the name, address, phone number, and email of your business. If you have a website or registration number, include that as well. This provides a point of contact for future inquiries.

2. Client Information

Include the full name of the client or the company receiving the service. Also, include their address, email, and phone number, ensuring the receipt is properly linked to the customer.

3. Invoice Number and Date

Each payment receipt should have a unique invoice number for easy reference. The date of the payment transaction is also important for tracking the timeline of services provided.

4. Description of Services

Describe the services rendered in detail. Include the type of service, the date of completion, and any other relevant details that clarify what the payment covers.

5. Payment Details

List the payment method (e.g., cash, credit card, bank transfer), the amount paid, and any applicable taxes or discounts. This ensures transparency regarding the total amount paid.

6. Signature

Signatures from both parties–either physical or digital–serve as confirmation of the transaction and make the receipt legally binding.

7. Terms and Conditions

Optionally, you can include a brief section on terms, such as return policies, future payment expectations, or additional charges. This prevents any future disputes regarding the transaction.

Include key details at the top of the receipt, such as your business name, address, and contact information. Make sure the receipt has a unique identification number for easy reference in case of any disputes.

List the date of the transaction and the specific services rendered, with a brief description for clarity. Include the quantity of hours or units, if applicable, and the price per unit or service. Provide a clear total amount, specifying taxes if required by local regulations.

Ensure that the payment method is clearly indicated (e.g., cash, credit card, check). If applicable, note any deposits or partial payments made beforehand.

Finally, provide space for both the recipient’s and payer’s signatures, if necessary, to acknowledge the transaction. This helps ensure accountability and verification of the agreement.

Ensure the payment receipt clearly identifies the service provider and the recipient. Include names, addresses, and contact details for both parties. This helps avoid any confusion in the event of a dispute or audit.

List the amount received, the date of the transaction, and the method of payment. If possible, include the invoice or reference number to tie the receipt to a specific transaction. This makes tracking payments straightforward for both parties.

State the purpose of the payment. A generic “payment received” statement may not be sufficient in certain legal contexts. Specify whether it is for goods, services rendered, or other contractual obligations.

Ensure the receipt is signed or electronically verified by the provider to validate the document. An unsigned or unverified receipt could lead to challenges in proving the authenticity of the payment.

Keep copies of all receipts issued for your records. This is necessary for tax and legal purposes. Maintaining accurate records can protect you in case of an audit or other legal matters.

If the payment pertains to a contract, include a clause or reference to the agreement under which the payment was made. This adds an extra layer of clarity and helps prevent misunderstandings between parties.

Printable templates are best when you need something tangible or need to share a physical copy with clients. You can easily hand over the receipt during meetings or keep a printed record for filing. However, they take up physical storage space and require paper and ink, which can add up over time. The process of printing and distributing also consumes more time compared to digital alternatives.

On the other hand, digital templates offer convenience and quick access. You can store, edit, and send them instantly via email or other platforms, reducing time and paper waste. With cloud storage, your receipts are safely backed up and accessible from any device. The downside is that you need an internet connection or device to access them, and there may be compatibility issues with different software versions or file formats.

Printable templates suit those who prefer physical documentation, while digital templates provide efficiency and sustainability for modern workflows. Consider the specific needs of your business and clients to choose the best option for your cash receipt system.

Customizing a Receipt Template for Your Business Needs

Adjust your receipt template to match your specific business operations and customer expectations. Begin by including key details such as your company’s name, contact information, and logo. This ensures consistency across all transactions and helps with brand recognition.

- Logo and Branding: Add your business logo to the header. Customize the font and colors to reflect your brand’s identity. This makes receipts look professional and personalized.

- Service Description: Be specific about the services rendered. Include a breakdown of each service or product provided. This can be helpful for both you and your clients in case of future inquiries or disputes.

- Payment Method: Indicate how the payment was made (e.g., credit card, cash, bank transfer). This clears up any confusion and keeps a record for accounting purposes.

- Tax Information: Clearly state the applicable tax rate and amount. This helps your clients understand the final price and ensures you comply with local tax laws.

- Terms and Conditions: If applicable, include terms related to refunds, warranties, or any service agreements. It’s useful to set expectations up front and reduce misunderstandings later on.

Adjusting these sections to your business needs helps you maintain clear communication with clients and ensures you’re keeping track of important details. Customizing a receipt template will give you more control over your financial documentation and provide a polished, professional image to your customers.

Store payment records in a secure, centralized location. Cloud storage solutions offer encryption options to protect sensitive data, and they allow easy access from multiple devices. Make sure to back up all records regularly to prevent loss due to hardware failures.

Label each record with clear, specific information. Include payment dates, amounts, client names, and services rendered. This makes it easier to retrieve and verify information when needed. Use consistent naming conventions for files to stay organized.

Maintain a filing system that categorizes payments by date, client, or service type. This method ensures fast retrieval during audits, tax season, or whenever you need to reference past transactions.

Use digital tools for tracking payments and generating reports. Many accounting software programs allow you to upload and store invoices, receipts, and payment confirmations, automating the process of recordkeeping and minimizing human error.

Establish a retention policy for your payment records. Determine how long to keep each type of record based on legal or business requirements, and securely delete or archive older files to avoid unnecessary clutter.

Keep records organized with password protection and user access restrictions. Only authorized individuals should have the ability to view or modify payment records to prevent unauthorized access or data breaches.

Now, the term “Cash Receipt” is not overused, but the meaning remains clear.

To create a clear and concise cash receipt template for services rendered, focus on key components without repeating the phrase “Cash Receipt” unnecessarily. A straightforward layout will help ensure both clarity and professionalism.

Structure the Template Efficiently

- Header: Include the service provider’s name, business address, and contact information. Add the title “Receipt for Services Rendered” or something similar at the top.

- Recipient Details: Clearly state the client’s name and contact information. This helps track transactions and identify parties involved.

- Service Description: List the services provided along with a brief description, quantity, and price for each. Avoid unnecessary repetition while being clear on what was delivered.

- Payment Information: Include the amount paid, payment method (e.g., cash, check, or bank transfer), and any reference numbers if applicable.

- Date and Time: The date of the transaction should be clearly visible. If services were rendered over multiple days, list the range of dates.

- Signatures: Add space for both the service provider’s and the recipient’s signatures for verification purposes.

Review and Finalize

Before finalizing the template, double-check that the layout is logical and all necessary details are included without excess wording. A well-organized document helps to maintain professionalism while avoiding redundancy.