If you’re looking to create a realistic and accurate StockX receipt template, you must ensure it includes specific details commonly found in authentic receipts from the platform. Here’s a breakdown of what should be included and how to structure the template.

Key Components of a StockX Receipt

- Transaction Number: A unique identifier for the transaction.

- Date and Time: Clearly display when the transaction occurred.

- Item Details: Include the product name, model number, and size.

- Price: Show the purchase price, taxes, and shipping fees.

- Seller Information: The name and location of the seller.

- Buyer Information: Buyer’s name, address, and contact info.

- StockX Authentication: Proof that the item has passed StockX’s verification process.

- StockX Fees: Breakdown of any service fees charged by StockX.

Designing the Template

When designing your receipt, the layout should be clear and easy to read. Avoid cluttering the document with unnecessary information. Keep it professional and aligned with StockX’s branding, if you are making a mock-up.

Creating a Template in Excel or Word

Both Excel and Word are great options for creating a StockX receipt template. Use a table format in Excel to organize the data neatly, or use a Word document with clear headings for each section. Add logos and other visual elements to give the receipt a more authentic appearance.

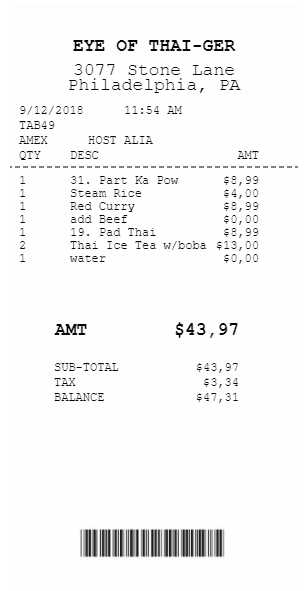

StockX Receipt Format Example

Here’s a basic structure for a StockX receipt:

Transaction Number: 1234567890 Date: January 15, 2025 Time: 2:45 PM Item: Nike Air Max 90 Size: 10 Price: $120.00 Taxes: $10.80 Shipping: $15.00 Seller: John Doe Buyer: Jane Smith Location: New York, NY StockX Authentication: Verified StockX Fee: $15.00

By following these steps and using the listed components, you can create a realistic and accurate StockX receipt template that closely mirrors the official documents issued by the platform.

StockX Receipt Template: A Detailed Guide

Understanding the Key Elements of a StockX Receipt

How to Create a Custom StockX Receipt for Personal Use

Verifying StockX Receipts: Authenticity and Security Measures

How to Use a StockX Receipt for Reselling Purposes

Common Issues with StockX Templates and How to Solve Them

Legal Considerations When Modifying or Sharing StockX Receipts

To create a StockX receipt template, ensure it includes specific elements that define its authenticity. A proper receipt should feature details such as the order number, transaction date, item description, condition (new or used), price, and any associated taxes or fees. These components provide a clear record of the transaction.

Creating a Custom StockX Receipt

For personal use, designing a custom StockX receipt requires attention to detail. Start by including the order number and seller’s information, followed by a clear description of the product, including size and color. Ensure that the price matches the transaction details. Adding a professional touch, such as a logo or watermark, can enhance the document’s appearance, but be mindful not to infringe on StockX’s intellectual property.

Verifying the Authenticity of StockX Receipts

Verifying a StockX receipt is straightforward. Look for security features such as a unique order number, which can be cross-checked on the StockX platform. Verify the item’s serial number or SKU to confirm it matches the product listed on the receipt. Additionally, check for inconsistencies in format or printing that might indicate a counterfeit receipt.

When using StockX receipts for reselling, be transparent about the origin of the product and its condition. Include a copy of the original receipt to build trust with buyers. Misleading information can result in legal issues or penalties. If issues arise with StockX templates, check the alignment and ensure the printed version matches the digital copy to avoid discrepancies.

Lastly, modifying or sharing StockX receipts comes with legal considerations. Avoid altering details that could mislead others, as this can lead to legal consequences. Sharing receipts for reselling purposes should only involve legitimate transactions. Unauthorized alterations or distribution of counterfeit documents can result in significant legal repercussions.