Provide a clear and structured document confirming the initial payment for an order. This receipt serves as proof of transaction, ensuring transparency between the buyer and seller.

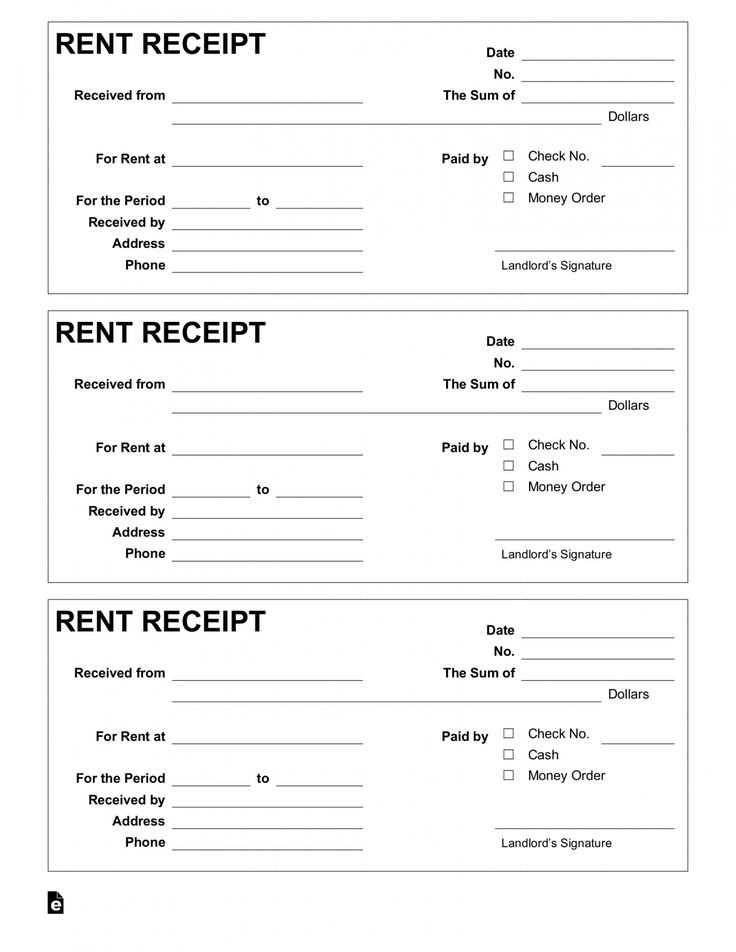

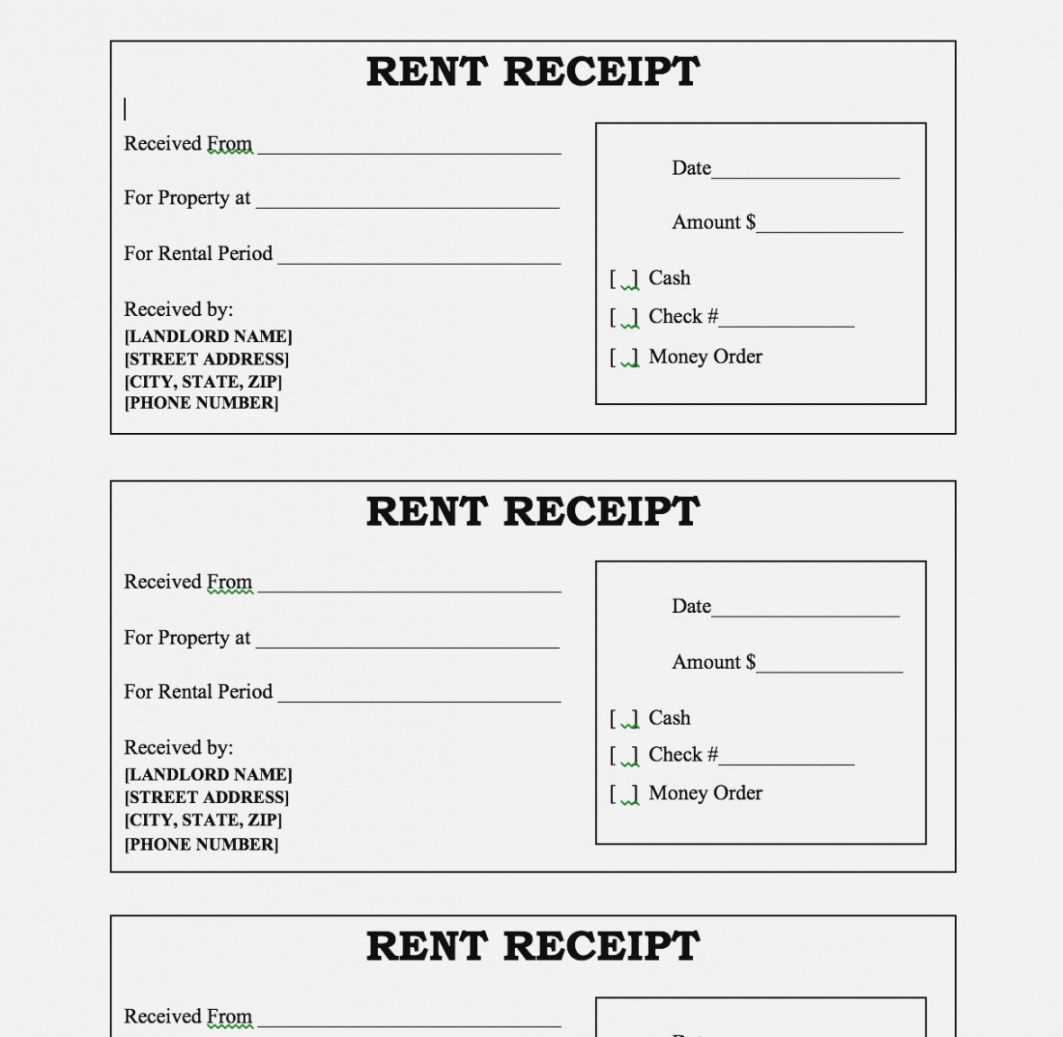

Include key details such as the payer’s name, payment date, amount received, and method of payment. Specify what the deposit covers and whether it is refundable or non-refundable.

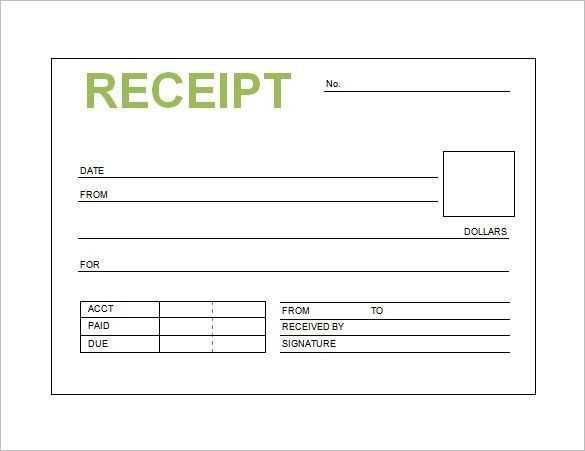

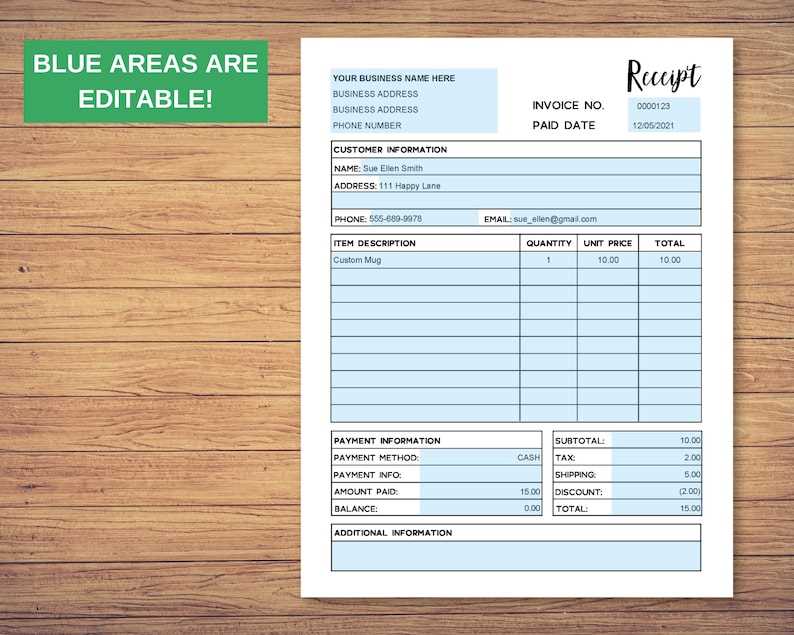

Use a professional format with a company logo, contact information, and a unique reference number. A well-organized template helps avoid misunderstandings and streamlines record-keeping.

For added security, include a signature section or an electronic confirmation. This strengthens the document’s credibility and protects both parties in case of disputes.

Template for Receipt of Order Deposit

Ensure clarity by including the date, payment amount, and transaction method. Specify the payer’s and recipient’s details, including names and contact information. A unique receipt number simplifies record-keeping and future reference.

Describe the purchased item or service, mentioning key details such as quantity, specifications, or expected delivery time. Clearly state whether the deposit is refundable or non-refundable to avoid misunderstandings.

Include a confirmation statement acknowledging the deposit received. If applicable, add terms regarding balance payment, due dates, or conditions for cancellation.

End with the recipient’s signature or official stamp to validate the receipt, ensuring both parties have a reliable record of the transaction.

Key Elements to Include in the Document

Specify the amount received, clearly stating the currency and payment method. Include a reference number for tracking and link it to the original order.

Detail the payer’s information, such as name, contact details, and, if applicable, company name. Ensure accuracy to avoid disputes.

Outline the payment breakdown. If partial payment applies, mention the remaining balance and due date.

| Element | Details |

|---|---|

| Received Amount | Exact sum with currency |

| Payment Method | Cash, card, bank transfer, etc. |

| Payer Information | Name, contact details |

| Reference Number | Unique identifier for tracking |

| Payment Breakdown | Full or partial payment details |

State the purpose of the payment and any applicable terms, such as refund policies or conditions for order fulfillment.

Provide the issuer’s details, including business name and contact information. Signatures or official stamps enhance credibility.

Legal Considerations and Compliance

Specify the payment terms clearly, including the amount, due date, and refund conditions. This prevents disputes and ensures that both parties understand their obligations.

Regulatory Requirements

Verify that the receipt complies with tax regulations. Include necessary details such as the payer’s name, transaction date, and a unique reference number. If applicable, add sales tax or VAT information as required by local authorities.

Data Protection

Protect customer information by following data privacy laws. Store payment records securely and limit access to authorized personnel. If sharing data with third parties, obtain explicit consent to avoid legal complications.

Regularly review applicable laws to ensure that your receipt format remains valid. Non-compliance can lead to fines or legal challenges, making it essential to stay informed about updates in financial and consumer protection laws.

Formatting Guidelines for Clarity

Use consistent alignment. Keep all text aligned to the left or centered, depending on the document’s purpose. Left alignment improves readability, while centered text suits headings.

Limit font variations. Stick to one or two typefaces, using bold or italics sparingly for emphasis. Overuse of styles makes information harder to scan.

Organize information logically

Group related details. Separate sections using blank spaces or horizontal rules. Ensure item descriptions, prices, and totals follow a clear order.

Use tables for structured data. Align numbers properly in columns to improve readability. Ensure totals stand out with bold formatting.

Enhance readability

Choose a legible font size. Keep text large enough to read comfortably. Small print reduces clarity and increases the risk of misinterpretation.

Maintain sufficient contrast. Dark text on a light background works best. Avoid color combinations that strain the eyes or reduce visibility.

Payment Terms and Conditions

Ensure that all payments are completed within the specified timeframe to avoid delays in processing. Late payments may result in additional fees or order cancellation. The accepted payment methods include bank transfers, credit cards, and secure online payment platforms.

Deposit Requirements

A minimum deposit is required to confirm the order. The remaining balance must be settled before shipment. Failure to pay the deposit within the agreed period may lead to order suspension.

Refund and Chargeback Policy

Deposits are generally non-refundable unless stated otherwise in the agreement. Chargebacks without prior communication may result in service suspension or legal action. If a refund is approved, processing times may vary depending on the payment method.

Signature and Authorization Requirements

Require a clear and legible signature from the payer to confirm acceptance of the transaction. Use black or blue ink for handwritten signatures to ensure readability on copies.

Specify the authorized signatory based on the payer’s role or legal standing. If dealing with businesses, request signatures from individuals with financial authority, such as a manager or director.

Include a printed name and date alongside the signature. This prevents disputes by verifying who approved the transaction and when it was authorized.

Use electronic signatures where applicable by ensuring compliance with regional e-signature laws. Require multi-factor authentication or a timestamp to enhance security.

Store signed documents securely in digital or physical formats. Keep records for the required retention period to resolve potential disputes or audits.

Common Mistakes and How to Avoid Them

- Missing Payment Details – Ensure the receipt clearly states the amount, date, and payment method. Without this information, disputes become harder to resolve.

- Ambiguous Terms – Clearly define whether the deposit is refundable or non-refundable. Specify conditions for refunds to prevent misunderstandings.

- Omitting Contact Information – Include the full name, address, and contact details of both parties. This avoids confusion and provides a point of reference.

- Inconsistent Formatting – Use a uniform structure for all receipts. A disorganized layout makes records difficult to verify and process.

- Lack of Signatures – Always require a signature from both parties. This confirms agreement on the deposit terms and strengthens legal validity.

- Failing to Provide Copies – Issue at least two copies–one for the customer and one for recordkeeping. Digital copies also help in case of lost documents.

By ensuring clarity, consistency, and completeness, businesses can minimize disputes and maintain trust with customers.