Organizing your receipts doesn’t have to be complicated. A simple, well-structured receipt filing template can save you time and effort when managing your expenses. Create a system that works for you by designing a template that captures all necessary details in one place. This will streamline tracking and ensure no receipt goes unnoticed.

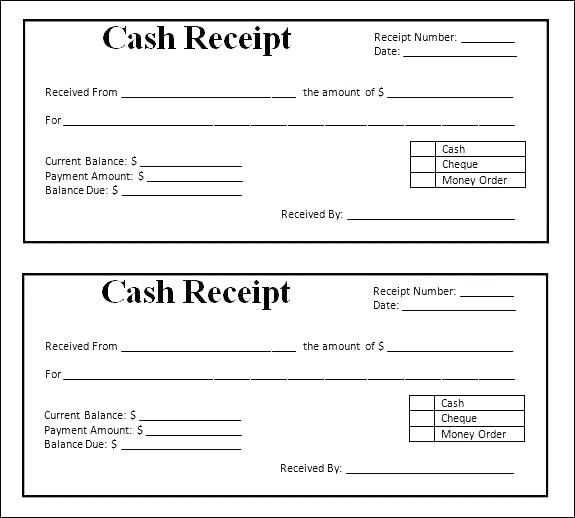

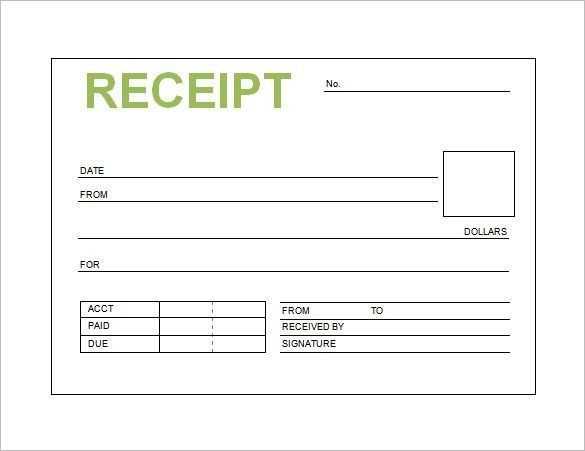

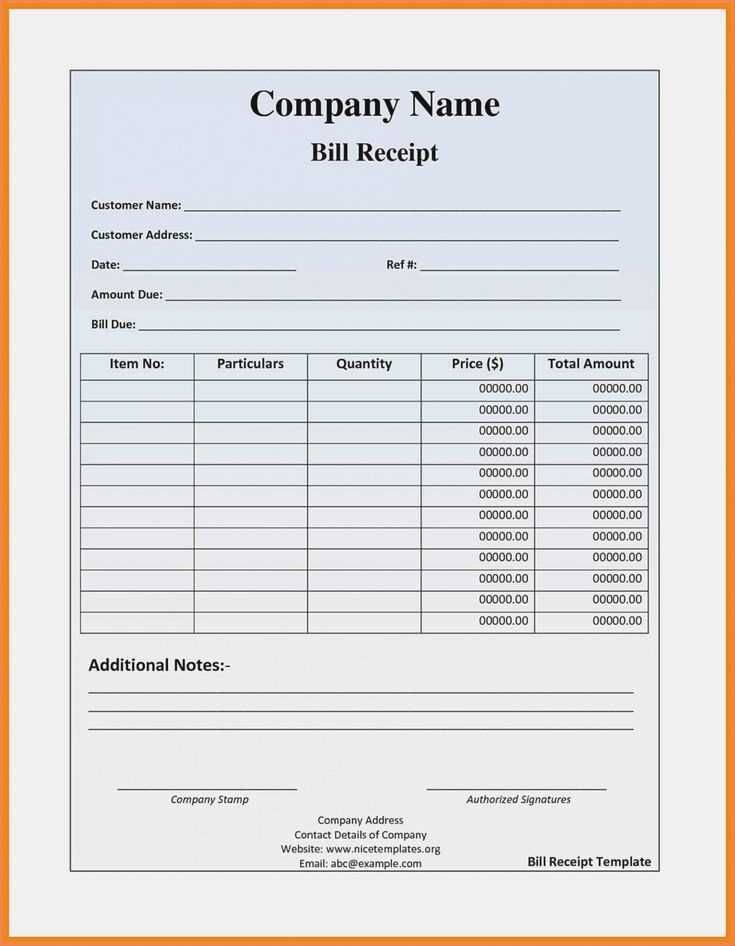

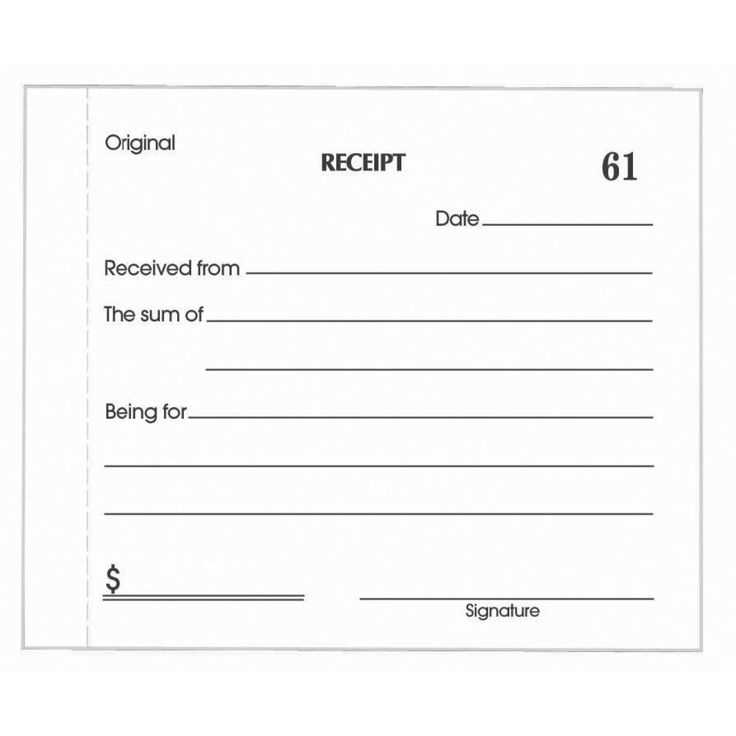

Include fields for the date of the purchase, vendor name, item description, amount spent, and payment method. Make sure to allocate a spot for categorizing each purchase, whether it’s for personal, business, or other expenses. This way, you’ll quickly identify trends and keep your finances in check.

With a digital template, you can easily store and search your receipts. Whether you prefer spreadsheets or a custom form in a document editor, the goal is to keep everything uniform and accessible. A filing system like this minimizes the risk of losing receipts and makes it easy to retrieve them during audits or tax season.

Here is the corrected text according to your requirements:

To streamline the receipt filing process, follow these clear steps:

1. Categorize Your Receipts

- Group receipts by type: food, office supplies, transportation, etc.

- Use separate envelopes or folders for each category to keep things organized.

2. Organize by Date

- Sort receipts by the date of purchase to make it easier to track expenses over time.

- Consider using monthly or quarterly dividers for long-term storage.

For digital receipts, store them in a dedicated folder on your computer or cloud storage, ensuring each file is named with the purchase date and category for easy access.

Regularly review and dispose of receipts you no longer need, keeping only those that are necessary for taxes, warranties, or other important purposes.

- Receipt Filing Template

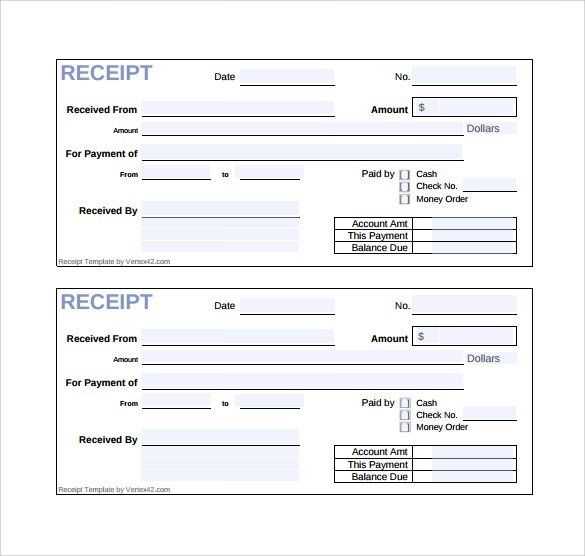

To keep your receipts organized, use a structured template. The key is simplicity and easy access when needed. Here’s a basic template you can adapt:

| Date | Vendor | Amount | Payment Method | Category | Description |

|---|---|---|---|---|---|

| MM/DD/YYYY | Store Name | $XX.XX | Credit Card / Cash | Food, Travel, Office Supplies | Item(s) purchased or service received |

This template organizes the necessary details for each receipt. Consider sorting receipts by categories like office supplies, travel, or meals for quick reference. Make sure to keep your file updated regularly and store receipts in a safe place, whether digitally or physically. It’s a simple method that saves time during tax season or expense reporting.

How to Create a Structured Template for Storing Receipts

To create a structured template for storing receipts, first determine the categories that best organize your receipts. This helps quickly locate and manage them when needed. Start with basic categories such as:

- Store Name

- Purchase Date

- Amount

- Payment Method

- Category (e.g., Office Supplies, Groceries, Travel)

- Tax Information

Once the categories are set, choose the format for storing the data. An organized file or spreadsheet is ideal for easy tracking and searching. Consider using a simple table format like this:

| Store Name | Purchase Date | Amount | Payment Method | Category | Tax Information |

|---|---|---|---|---|---|

| Store XYZ | 02/05/2025 | $25.50 | Credit Card | Office Supplies | Yes |

For better organization, add labels to your physical receipts or digital folders. Use consistent naming conventions for digital files, such as “StoreName_YYYYMMDD_Amount.” Keep receipts sorted by date or category, depending on your needs.

Lastly, back up your receipts regularly. If using digital storage, use cloud services to ensure access from any device and prevent loss of data.

Opt for a format that suits the volume and type of receipts you handle. If you have a high volume of receipts, a digital system using folders and subfolders by category works well. Categorize receipts by type (e.g., office supplies, meals, travel) to simplify retrieval. For paper receipts, use a filing cabinet with labeled folders and tabs for easy access.

Consider the frequency with which you access your files. If you need quick access, alphabetical or chronological systems may work best. For long-term storage, a more structured system, like grouping by month or year, offers easier organization and future reference. A hybrid system–storing older receipts digitally and keeping current ones on paper–might be most effective.

Think about how you need to share or submit receipts. If you frequently need to share or claim expenses, a digital system allows you to scan and upload receipts directly. A cloud-based system gives you access from anywhere, streamlining the process of expense tracking.

Lastly, consistency in format is key. Stick to one method for labeling and organizing receipts. This ensures that, whether physical or digital, you can quickly locate and identify what you need without confusion.

Organizing Receipts by Date, Category, or Amount

To streamline your receipt filing system, sort receipts based on the most useful criteria: date, category, or amount. Each method has distinct benefits depending on your needs, making it easy to track expenses, prepare for tax season, or analyze spending patterns.

Organizing by Date

Start with sorting receipts by date to follow your spending over time. This helps to quickly reference recent purchases or compare month-to-month expenses. Use folders or digital tools with date filters to group receipts into weekly or monthly sections. This method is especially helpful for expense reports or preparing for financial reviews.

Organizing by Category

For those who want to track specific types of spending, organizing receipts by category is effective. Create categories like “Groceries,” “Transportation,” “Entertainment,” or “Business Expenses.” This will give you a clearer view of where your money is going, making it easier to spot trends or manage budgets.

Organizing by Amount

If you need to focus on larger purchases, sort receipts by amount. This approach helps when reviewing high-value transactions, whether for reimbursement purposes or keeping track of large expenses. Keep receipts of higher amounts in a separate folder to ensure they’re easy to find for tax deductions or future reference.

For seamless template management, consider using tools like Microsoft Word and Google Docs. Both platforms allow you to create, store, and edit templates easily. Microsoft Word offers a variety of pre-made templates, while Google Docs gives the advantage of cloud storage and real-time collaboration, making it a great option for teams.

Canva is another popular tool for creating custom templates, especially for marketing and social media purposes. With its drag-and-drop functionality, you can design professional-looking templates quickly, and its library is constantly updated with new assets.

If you need more structure, try Template.net. This platform offers templates for everything from business documents to legal forms, with options for both free and premium users. You can customize these templates to fit specific needs and download them in various formats.

Adobe InDesign is a powerful tool for advanced users, especially those in creative industries. It provides an extensive set of design features, including sophisticated typography, color management, and vector graphics, perfect for creating high-quality templates for print and digital media.

For simple project management alongside template management, Trello can help. By using boards and cards, you can store and organize your templates in an easily accessible way, and you can share them with your team or track template-related tasks.

Lastly, Notion combines note-taking with database functionality, offering a flexible way to create and organize templates in one place. It’s particularly useful for those who like to keep everything interconnected within a single workspace.

Organize digital receipts by creating a designated folder structure in your system. Separate receipts by category, such as purchases, subscriptions, or travel expenses. This allows for quick retrieval and keeps your records organized.

Implement Automatic Categorization

Set up rules or filters within your email or document management system to automatically tag and categorize receipts based on keywords or senders. This minimizes manual sorting and reduces the risk of losing important documents.

Use OCR Technology for Scanning

If receipts are sent in image formats, leverage Optical Character Recognition (OCR) software to extract relevant data (like purchase amount, date, and vendor). This allows for easy indexing and searching within your system without having to manually input information.

- Ensure OCR software integrates seamlessly with your document management system for smoother workflow.

- Double-check OCR results to avoid errors in critical data like total amount or date.

Set Retention Periods

Determine how long digital receipts should be kept before being archived or deleted. For tax or warranty purposes, retain receipts for a specified period, such as 3 to 7 years. This helps manage storage while complying with legal requirements.

Ensure Data Security

Store receipts in encrypted folders or systems that offer secure access. Implement multi-factor authentication (MFA) to safeguard sensitive data, especially for receipts containing financial details.

- Regularly back up your receipts to a secure cloud storage or external drive.

- Review access permissions and limit receipt access to authorized personnel only.

Common Mistakes to Avoid When Designing a Filing Template

Start by organizing your categories clearly. Many people fail to make a straightforward distinction between types of receipts, making it difficult to retrieve information quickly. Ensure each category has a unique label, and use clear, concise titles.

1. Overcomplicating the Structure

A common mistake is overcomplicating the template with too many subcategories. While it might seem helpful to break things down into tiny details, it often leads to confusion and longer filing times. Stick to high-level categories that make sense for the majority of users.

2. Inconsistent Formatting

Mixing different fonts, font sizes, and styles across the template can make it harder to read and less professional. Choose a clean, consistent format that stays uniform throughout. Use bold for headings and standard font size for descriptions.

3. Lack of Flexibility

Designing a filing template that is too rigid can create issues as new types of receipts or records arise. Make sure you leave room for additional fields or categories, allowing the template to adapt to future needs without requiring a complete redesign.

4. Ignoring User Preferences

Design with the user in mind. Some people prefer digital filing systems, while others may need physical space for handwritten notes. Offering both options will ensure your filing template suits a variety of preferences.

5. Overlooking Sorting and Search Features

Without a proper method to sort or search through receipts, the filing system becomes inefficient. Ensure your template allows for easy sorting by date, category, or amount, and consider adding a simple search function if it’s digital.

6. Inadequate Backup or Redundancy

Relying solely on one method of storage, whether physical or digital, is risky. Ensure your filing system has backups. For digital templates, cloud storage can help protect against data loss, while physical templates should be backed up by scanning or keeping digital copies.

7. Forgetting to Label Files Properly

Proper labeling is crucial for easy access. Include essential details like the date, the merchant’s name, and the total amount. Avoid vague labels like “miscellaneous” and instead use specific terms for better organization.

| Mistake | Impact | Solution |

|---|---|---|

| Overcomplicating the Structure | Leads to confusion and time lost | Use simple categories and high-level sections |

| Inconsistent Formatting | Hard to read and unprofessional | Keep a uniform font and style |

| Lack of Flexibility | Limits future adaptability | Design for scalability and flexibility |

| Ignoring User Preferences | Disrupts ease of use | Offer multiple formats (digital and physical) |

| Overlooking Sorting and Search Features | Slows down the retrieval process | Implement sorting and search functionality |

| Inadequate Backup or Redundancy | Risk of losing important data | Use cloud or multiple backup options |

| Forgetting to Label Files Properly | Causes difficulty in finding receipts | Ensure detailed and consistent labeling |

In this case, repetition is minimized, while the meaning and structure of the text are preserved.

To create an efficient receipt filing system, organize receipts into clear categories: by type of expense, date, or project. Label each receipt with a brief description and the corresponding amount. This simplifies the filing process and makes retrieval faster.

Organizing by Date

Arrange receipts chronologically, either by month or by fiscal year. This method ensures easy tracking of financial transactions and provides an accurate timeline for reference during audits or tax preparation.

Using Digital Tools

Consider using scanning apps or software to digitize your receipts. This reduces clutter and provides a backup in case of lost physical receipts. Make sure to name each digital file clearly, including details such as the merchant’s name and date of purchase.

Consistency is key. Develop a routine for regularly filing receipts, whether weekly or monthly, to avoid backlog. A clean, organized filing system saves time and ensures you have the right documents at hand when needed.