Accurate Receipt Details

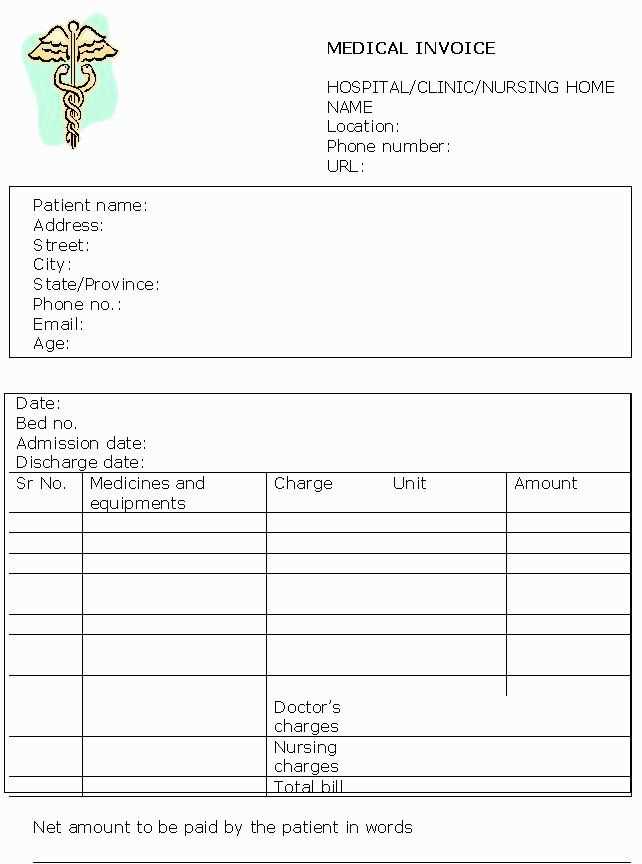

Ensure your nanny receipt includes key elements. Start with the nanny’s full name and address. Specify the date(s) of service and the hours worked. The payment amount for each day or week must be clearly listed. Include the total paid, along with a detailed breakdown of services rendered, such as childcare hours and any additional duties performed. This ensures clarity and avoids any confusion during reimbursement submission.

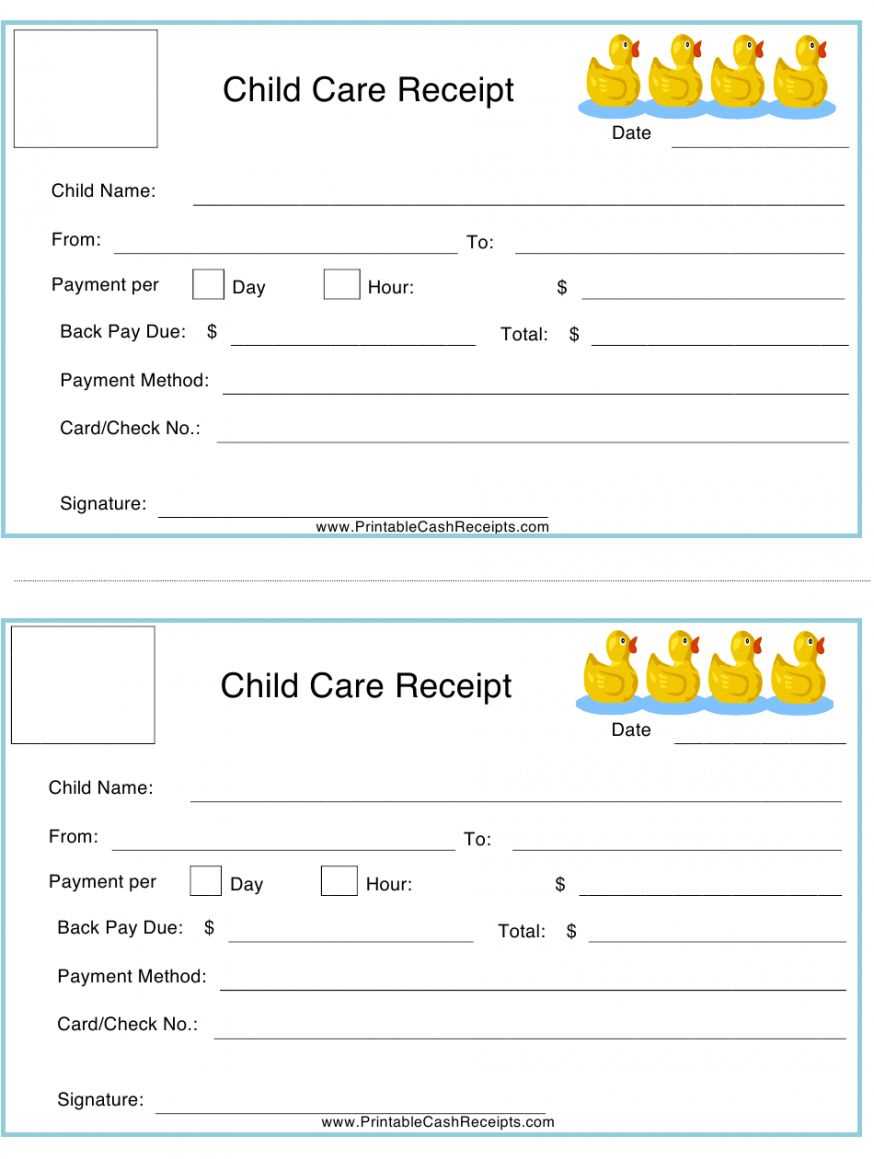

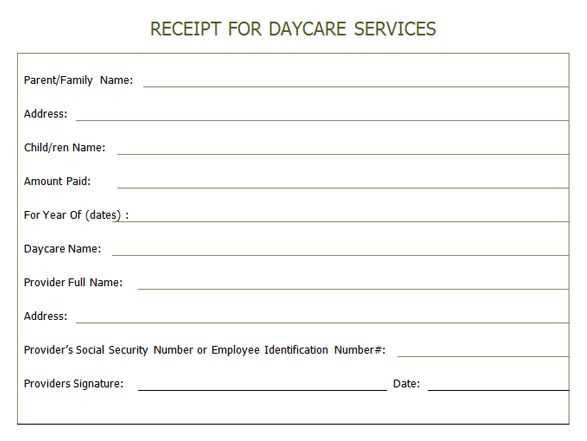

Sample Receipt Template

Here’s a simple format to follow when creating a receipt for your nanny:

- Nanny’s Name: [Full Name]

- Address: [Full Address]

- Service Dates: [Date Range]

- Hourly Rate: $[Rate] per hour

- Hours Worked: [Total Hours]

- Total Payment: $[Amount Paid]

- Services Provided: [Describe duties, e.g., Childcare, Light Housekeeping, etc.]

- Signature: [Nanny’s Signature]

- Payment Method: [Cash, Check, Bank Transfer, etc.]

Important Notes

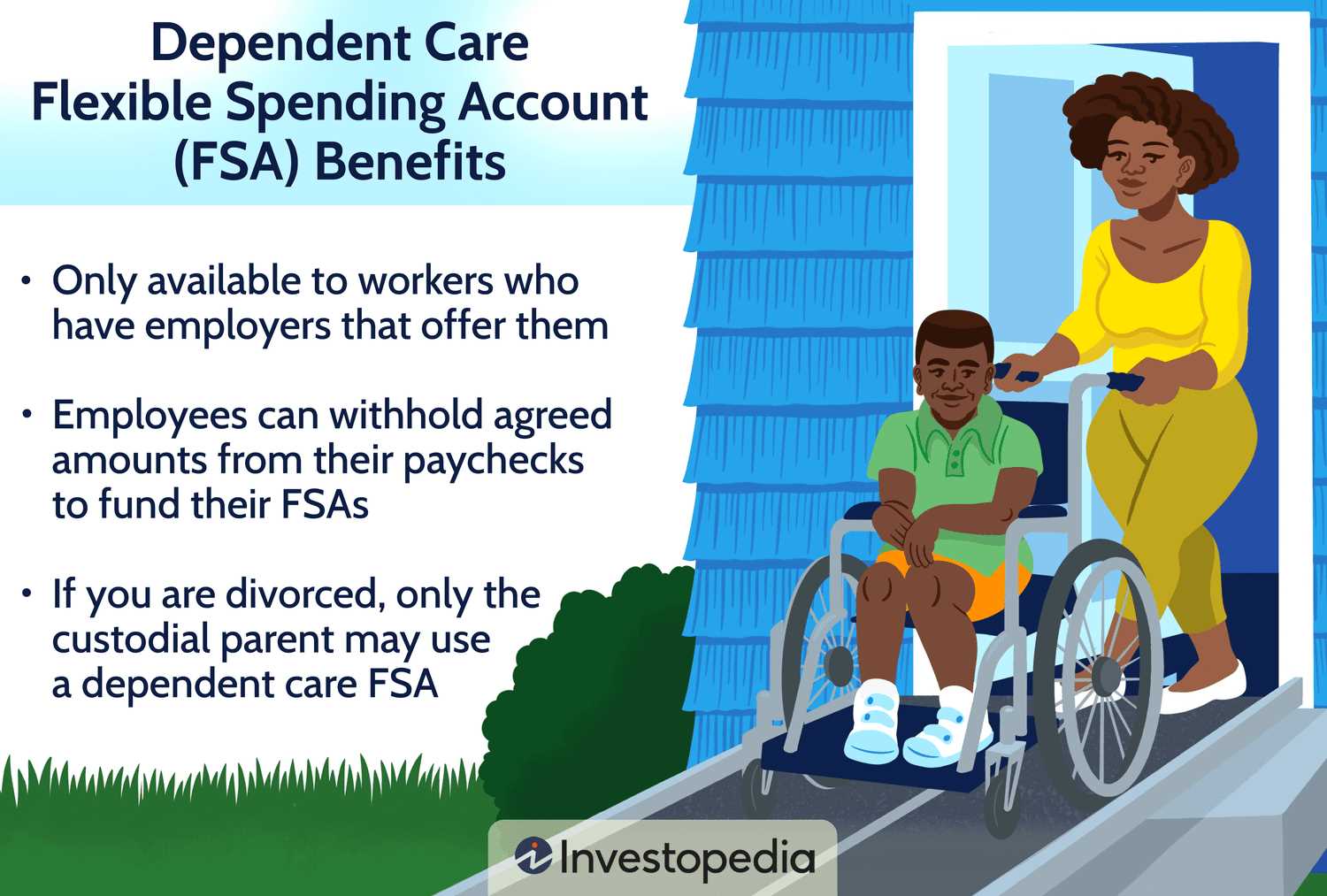

Ensure the receipt is signed by both parties: the nanny and the employer. This will authenticate the receipt and prevent any discrepancies. Also, the nanny should provide their Tax Identification Number (TIN) if requested. Keep a copy of the receipt for both personal records and for submission to the FSA plan administrator.

Additional Tips

Always store receipts for a minimum of three years to be in line with IRS guidelines. If your nanny is providing services on a regular basis, it’s useful to keep receipts organized by month for easier tracking. This will streamline any future reimbursements from your Dependent Care FSA account.

Dependent Care FSA Nanny Receipt Template

Key Information to Include in a Childcare Payment Record

Formatting Guidelines for a Clear and Acceptable Document

How to Verify and Validate Payment Details for a Caregiver

Common Mistakes That Can Lead to Rejection

Digital vs. Paper Records: Pros and Cons

Steps to Submit a Caregiver Receipt for Reimbursement

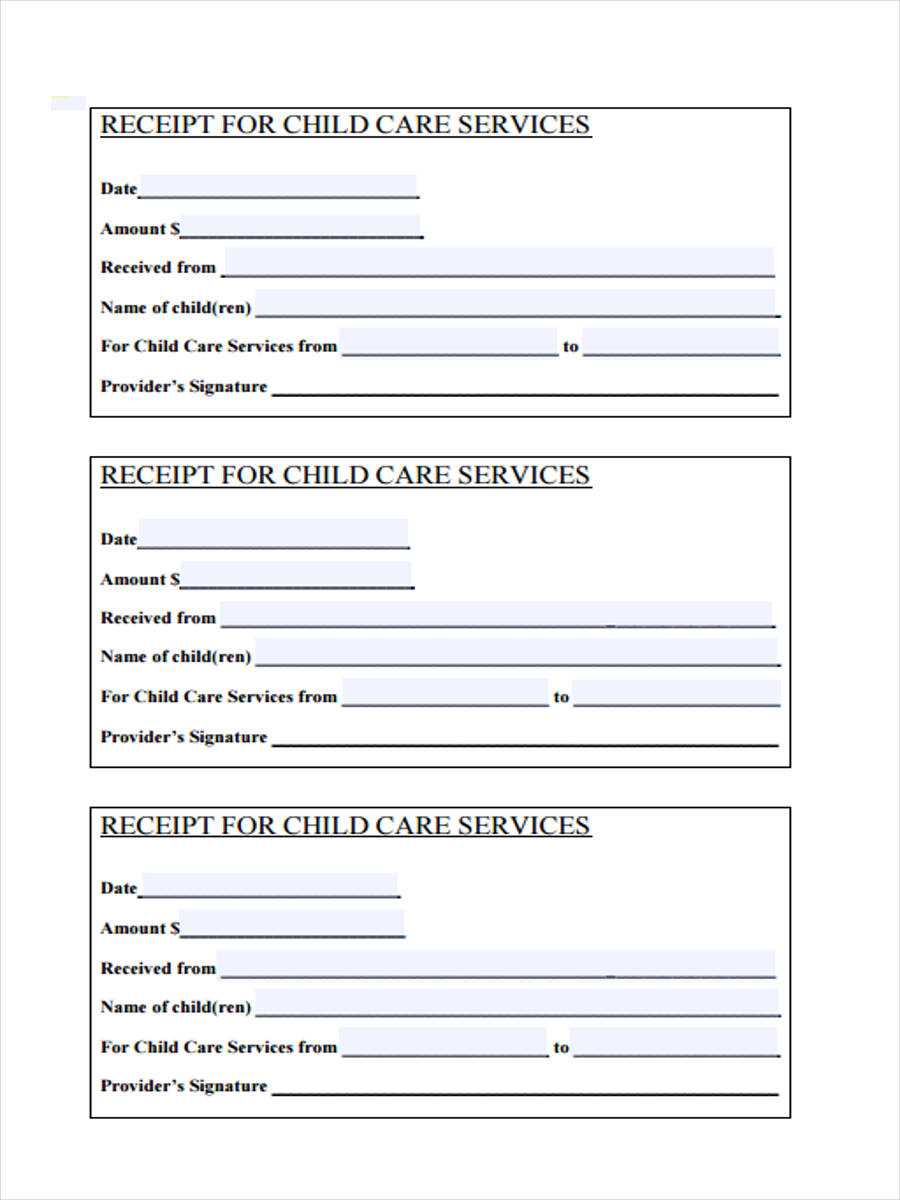

Ensure that the nanny receipt includes the caregiver’s full name, address, and tax identification number (TIN) or Social Security number. Specify the dates of service, hourly rate, and total amount paid. Also, include the child’s name and the period covered by the payment. Each entry should have a clear breakdown of the hours worked and the corresponding payment.

To meet FSA standards, format the receipt neatly with a clear distinction between the service details and the payment summary. Use bold text for headings and ensure that totals stand out. Double-check for legibility and clarity, avoiding complex language or unclear abbreviations.

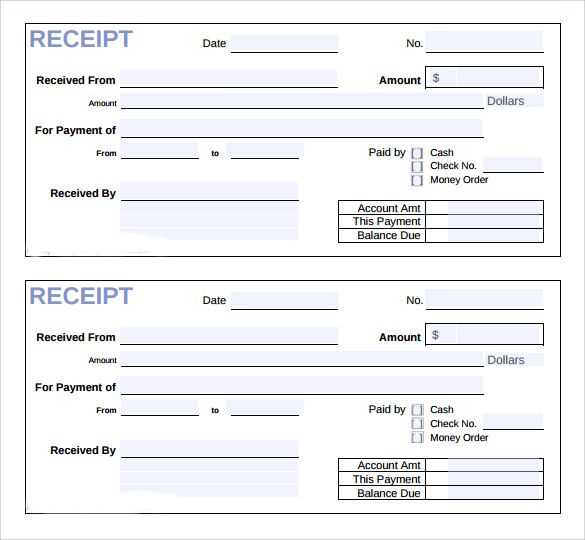

Verify the payment details by cross-checking the caregiver’s hourly rate and the number of hours worked with your personal records. Ensure that the total payment matches the amount listed in the receipt. If any discrepancies arise, address them immediately before submission.

A common mistake is missing the provider’s TIN or SSN, which may cause the receipt to be rejected. Also, ensure that the service dates and payment amounts are accurate. Incorrect or incomplete information can delay reimbursement.

Digital records are convenient for storage and easy to submit, but they may require extra attention to file formatting. Paper records provide a tangible proof of payment but can be harder to store and organize. Choose the method that best suits your preference, but ensure it meets FSA submission guidelines.

To submit the caregiver receipt for reimbursement, scan or photograph the receipt if it’s paper, or use a digital version for online submission. Include any required forms and verify the receipt matches the FSA plan requirements before submitting it.