Clear Structure for Accurate Records

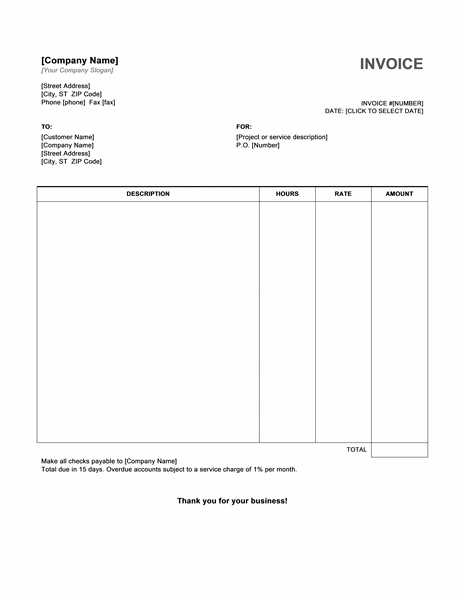

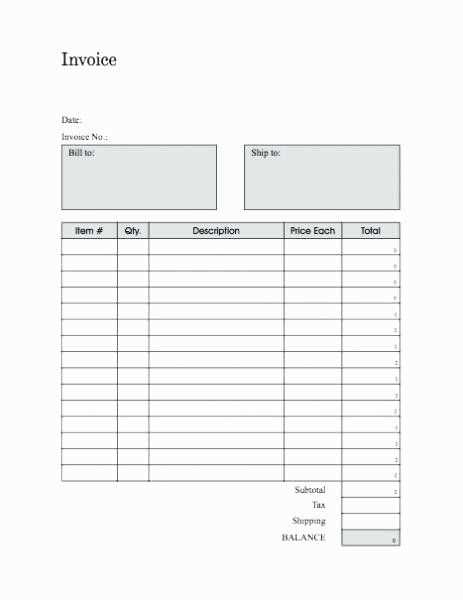

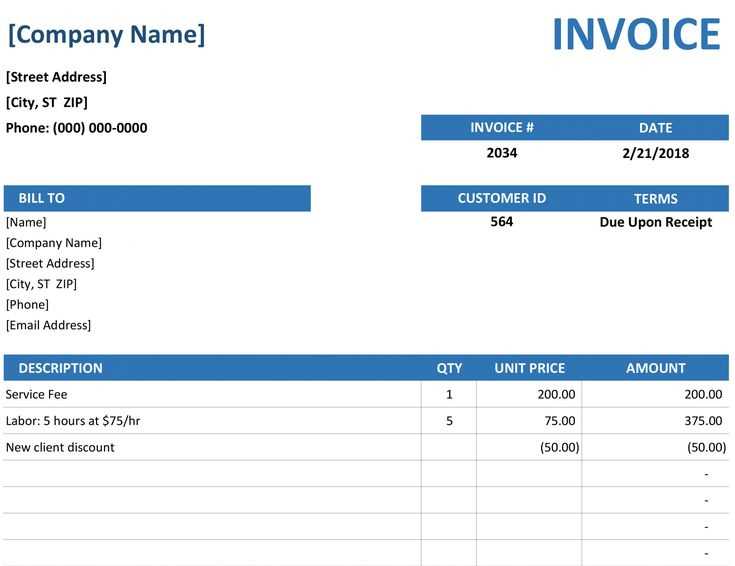

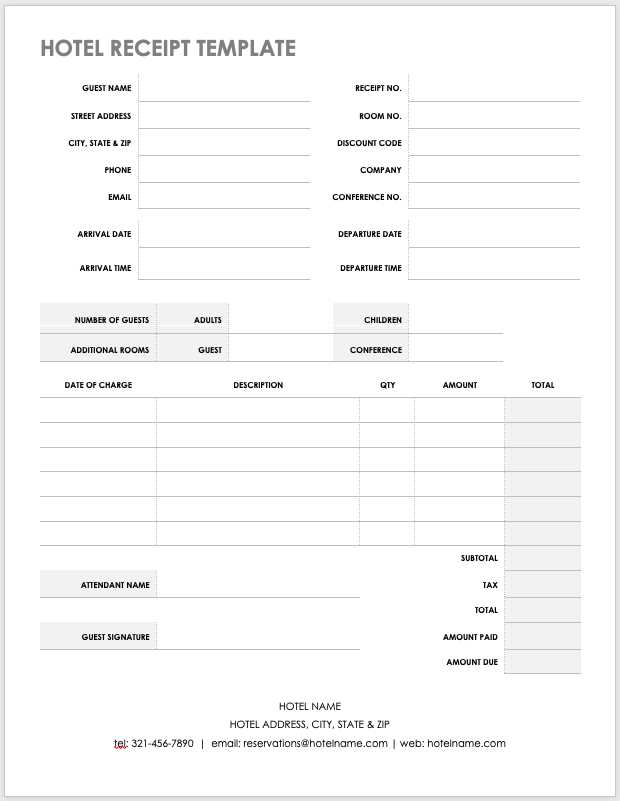

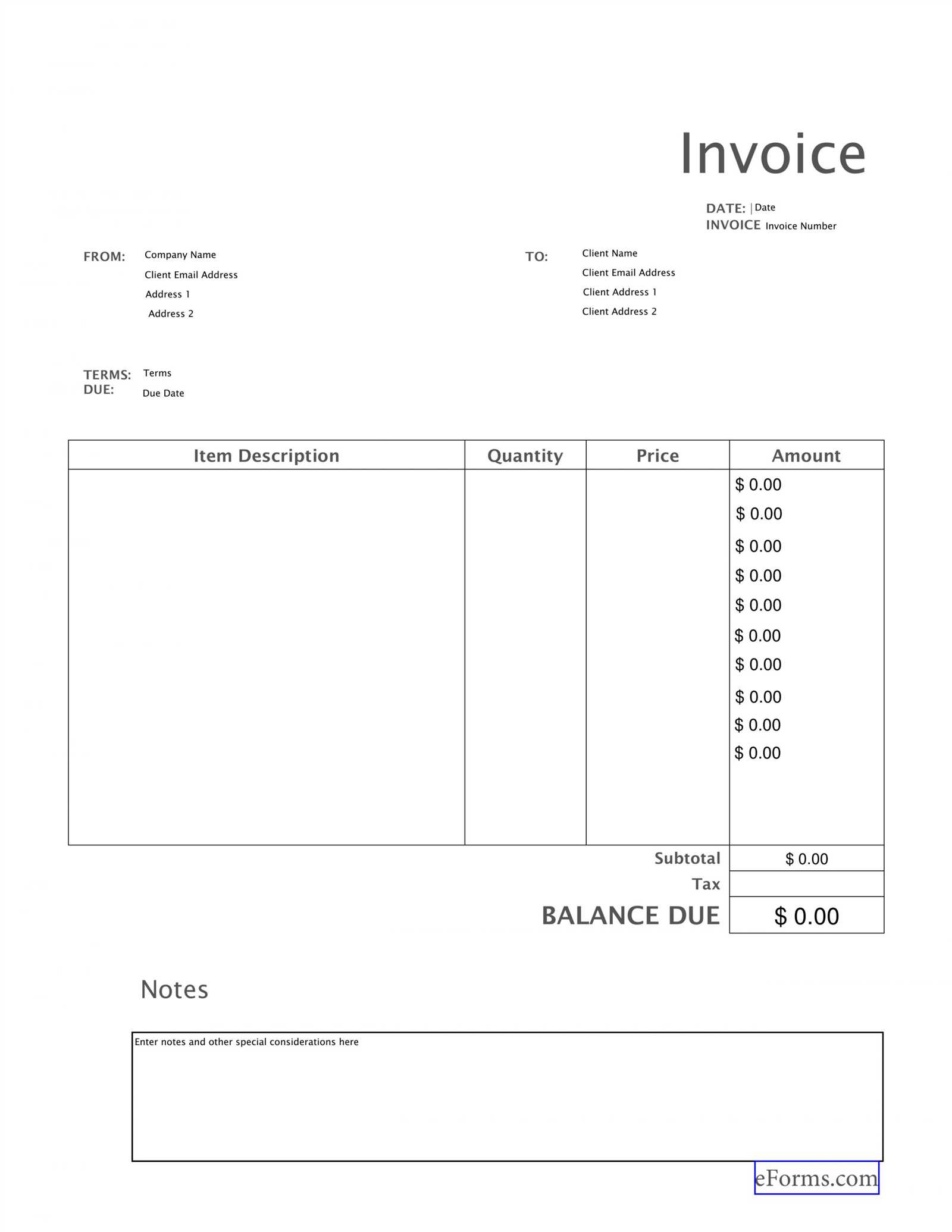

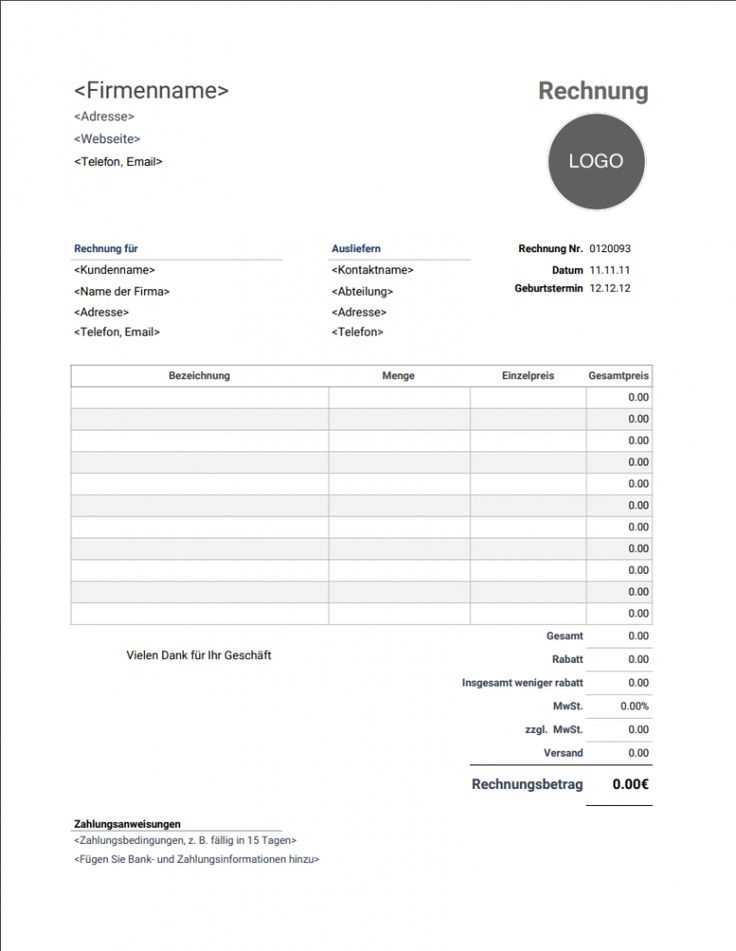

Use a structured format to ensure every invoice includes key details. List the seller’s name, address, and contact information at the top. Below that, include the buyer’s details for clarity. The invoice number should be unique to prevent duplication.

Essential Details

- Date: The exact issue date.

- Itemized List: Each product or service with descriptions, quantities, and prices.

- Subtotal: Sum before taxes and fees.

- Taxes and Fees: Breakdown of applicable charges.

- Total Amount: The final amount due.

- Payment Details: Methods and deadlines.

Receipt Confirmation

A signed or stamped acknowledgment confirms payment. If using digital invoices, a confirmation email serves the same purpose. A clear statement, such as “Payment Received in Full,” removes ambiguity.

Templates for Quick Use

Avoid repetitive formatting by using a reusable template. A simple table layout improves readability. PDF formats ensure compatibility, while editable files in spreadsheet or word processing programs offer flexibility.

Receipted Invoice Template

Key Elements of a Billed Receipt

Legal Requirements for Such Documents

Formatting and Layout Guidelines

Common Errors and Ways to Prevent Them

Customizing Templates for Various Businesses

Digital vs. Paper-Based Receipts

Key Elements of a Billed Receipt

Ensure the document includes the seller’s name, address, and tax identification number. Clearly list purchased items with descriptions, unit prices, quantities, and total amounts. Include payment details, such as method used and transaction date. A unique invoice number helps with tracking and record-keeping. If taxes apply, specify the rate and amount separately. A signature or company stamp may be necessary for validation.

Common Errors and Ways to Prevent Them

Incorrect calculations, missing details, and inconsistent numbering cause disputes and processing delays. Automate calculations to avoid manual mistakes. Verify all mandatory fields before issuing the receipt. Use sequential numbering to maintain order and prevent duplicates. If offering refunds or adjustments, ensure clear documentation to align with financial records.