A well-structured personal loan payment receipt helps both the lender and the borrower keep accurate financial records. Whether you’re lending money to a friend or managing a small business, having a clear, professional receipt ensures transparency and avoids disputes.

Include key details such as the borrower’s name, lender’s name, payment date, amount paid, and remaining balance. A receipt should also specify the payment method, whether cash, bank transfer, or another form, to eliminate any confusion about how the transaction was settled.

For added security, both parties should sign the document. Digital receipts can include an electronic signature or a verification code. If the loan involves multiple payments, numbering each receipt helps maintain an organized record of the repayment process.

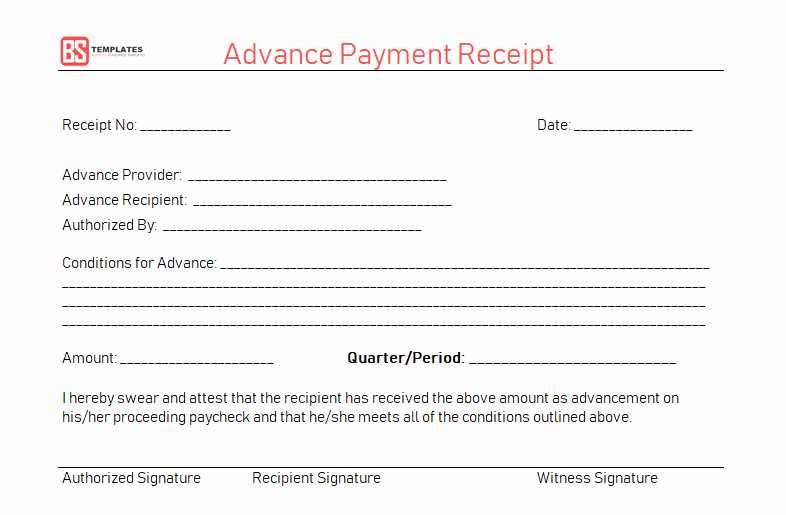

Using a structured template saves time and ensures consistency. A simple format with clear sections makes the receipt easy to read and reference when needed. Below is a breakdown of the essential elements to include in a personal loan payment receipt template.

Here’s a version with reduced repetition of words while maintaining meaning and correctness:

When creating a personal loan payment receipt, focus on the key details. Start by including the borrower’s and lender’s names, loan amount, and payment date. Be sure to state the payment amount received and any outstanding balance, if applicable. Clearly note any applicable interest or fees associated with the loan.

Structure of the Receipt

The receipt should begin with the basic transaction information, followed by the payment method and date. Always specify whether the payment was partial or full. If applicable, outline the next due date and the remaining balance. This helps ensure both parties are clear on the loan’s status.

Accuracy is Key

To avoid misunderstandings, double-check all figures, including the loan amount, payment, and balance. Provide a clear breakdown of fees or adjustments. The receipt should be concise yet informative, serving as a formal acknowledgment of the transaction.

- Personal Loan Payment Receipt Format

The format of a personal loan payment receipt should be simple yet thorough. Include these details to ensure clarity:

- Receipt Number: Assign a unique identifier to each receipt for tracking purposes.

- Borrower’s Information: Full name, address, and contact details of the borrower.

- Lender’s Information: Full name, address, and contact details of the lender.

- Payment Date: Clearly state the date the payment was received.

- Amount Paid: Specify the payment amount, both numerically and in words.

- Payment Method: Indicate the payment method used (e.g., bank transfer, cash, cheque).

- Loan Account Number: Reference the loan account associated with the payment.

- Remaining Balance: Provide the remaining balance after this payment.

- Signatures: Include the borrower’s and lender’s signatures for verification.

By maintaining this format, you ensure both parties have a clear record of the payment transaction for future reference.

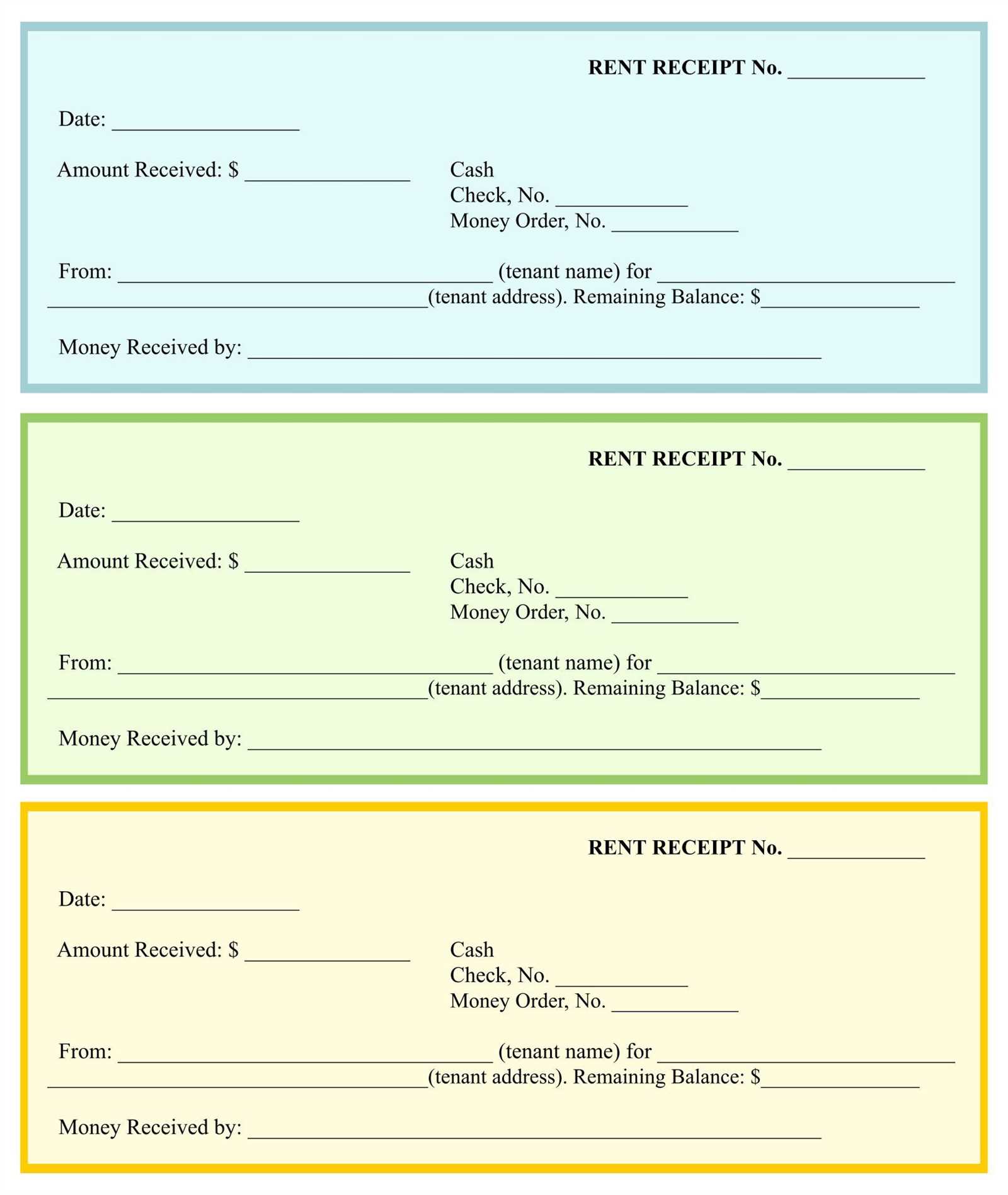

A payment proof document should provide clear, accurate information that can be easily verified. To ensure this, include the following details:

- Recipient’s Information: Include the name of the individual or organization receiving the payment, along with their contact details.

- Payer’s Information: Clearly state the payer’s full name, address, and any relevant account details.

- Amount Paid: Specify the exact amount of money paid, along with the currency used.

- Date of Payment: The exact date on which the payment was made should be listed to avoid confusion.

- Payment Method: Mention the method used for the transaction, such as bank transfer, credit card, check, or cash.

- Transaction Reference Number: If applicable, include any reference numbers or transaction IDs related to the payment for tracking purposes.

- Description of the Transaction: Provide a brief note explaining the purpose of the payment, such as a loan repayment, purchase, or service fee.

- Signature: A signature from the payer or an authorized representative confirms the authenticity of the payment.

Including these key details ensures that the payment proof is clear and can be used effectively for record-keeping and verification purposes.

Begin by clearly labeling each section with specific headings. This makes it easier for anyone reviewing the document to understand its structure and locate information quickly. For example, use headings like “Loan Amount” or “Payment History” to clearly indicate the contents of each section.

Provide Accurate and Detailed Information

Always include complete details. Ensure that the recipient’s name, loan amount, payment date, and any additional charges are listed clearly. Avoid vague terms–be specific with dates and amounts. A payment receipt should reflect the exact amount paid, the payment method, and any remaining balance.

Use Simple and Clear Formatting

Organize your document in a way that allows for easy scanning. Use bullet points or numbered lists to break down complex information. Leave sufficient space between sections to avoid clutter. A clean layout increases readability and reduces the risk of mistakes.

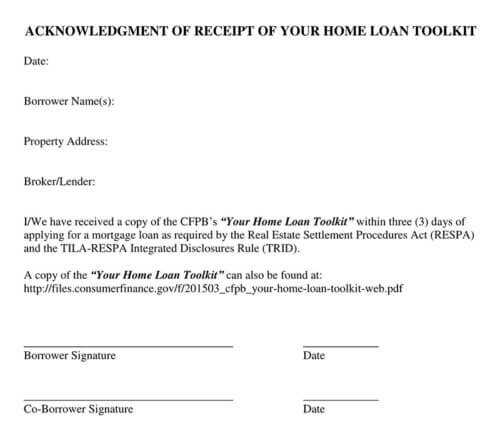

Ensure that all loan payment records include essential information for legal compliance. The records must clearly show the payment amount, date, and method. Both the lender and borrower should retain copies to avoid disputes.

Contractual Obligations

The loan agreement outlines the terms for payments. Payment records serve as evidence of adherence to those terms. If the loan contract includes a repayment schedule, the records should match the agreed-upon milestones. This helps avoid any misunderstandings in case of legal action.

Proof of Payment

Maintain detailed payment receipts to provide proof in case of claims or lawsuits. A payment record must reflect the exact amount transferred, payment method, and both parties’ signatures (if required). This documentation can protect the borrower from any false claims regarding non-payment.

Impact of Inaccurate Records

Inaccurate or missing records can lead to legal disputes. They may cause unnecessary complications if a borrower is unable to demonstrate their payment history. Always cross-check records with bank statements or other verified documents to ensure accuracy.

Regulatory Requirements

Some regions have specific rules for keeping loan payment records. Be sure to consult local laws about how long these records must be kept and in what format. Failure to comply with such regulations may lead to penalties or challenges in case of disputes.

Check the transaction details carefully before confirming payment. Ensure that all amounts, dates, and the recipient’s details match the agreed-upon terms. Compare the provided information with your initial loan agreement to spot any discrepancies.

Use secure methods of payment verification, such as two-factor authentication (2FA), which adds an additional layer of security. This can involve a secondary verification method, like a one-time code sent to your mobile device or email.

Monitor your account for any unusual activities after the transaction. If you notice any unauthorized charges or discrepancies, contact the financial institution immediately. Many services offer real-time alerts to notify you of new transactions, which can help you stay on top of any changes.

Double-check any receipt or confirmation number provided after the transaction. These numbers act as proof of the payment and can be used to verify the transaction with the lender or payment service if needed.

| Verification Step | Action |

|---|---|

| Transaction Details | Compare amount, recipient, and date with your agreement |

| Two-Factor Authentication | Enable 2FA for extra security |

| Monitor Account | Check for any unauthorized transactions |

| Receipt/Confirmation Number | Keep as proof of payment for verification |

Lastly, always ensure that your internet connection is secure when performing transactions. Avoid using public Wi-Fi networks for financial operations as they can be vulnerable to hacking. Using a trusted, encrypted connection reduces the risk of fraud or data theft.

Ensure all required information is included. Omitting key details like the loan amount, interest rate, and payment dates can create confusion or legal issues. Double-check that the name of the lender and borrower is spelled correctly and consistently throughout the document.

Incorrect Formatting

Formatting errors can make the receipt hard to read. Use a consistent font size and style, and make sure there is enough space between different sections. Clear headers and bullet points help in organizing the information logically.

Missing Payment Details

Including vague or incomplete payment information can lead to misunderstandings. Always include the exact payment date, amount, and method. Indicate whether the payment is partial or full, especially if there are multiple payments involved.

Double-check the receipt before finalizing it. A receipt with errors can be a hassle to correct later and may not be valid for reference.

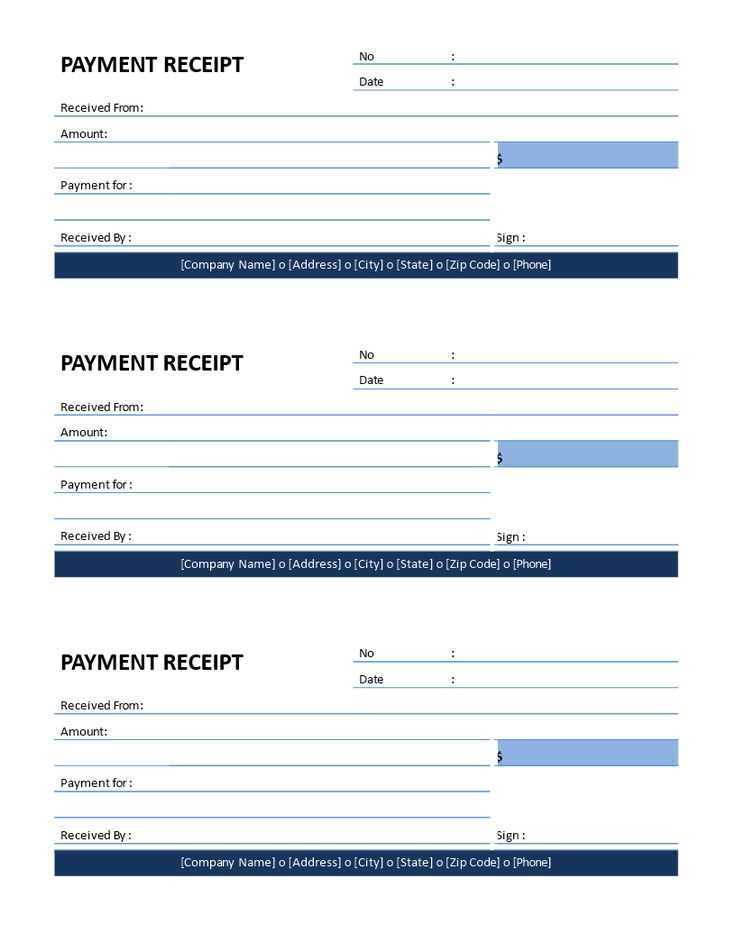

For convenience and flexibility, both printable and digital templates are available for personal loan payment receipts. Printable templates can be easily downloaded and printed for physical records. These are perfect if you prefer keeping hard copies for your personal files or need to provide a printed receipt to the lender.

Digital templates offer the advantage of being stored on your device, allowing for quick access and easy sharing through email or cloud storage. Many digital templates are editable, letting you customize details like the amount paid, payment date, and loan balance.

Both options provide the same level of detail and formality, with the only difference being the medium used for storage and sharing. Choose printable templates if you need a physical copy, or opt for digital templates for easy access and management on your devices.

Creating a Personal Loan Payment Receipt

To create a personal loan payment receipt, include the key details of the transaction. Start with the borrower’s name, lender’s name, and the amount paid. Specify the payment method, such as cash, check, or bank transfer, and include the payment date. This makes it clear and easy to verify the transaction.

Important Information to Include

Along with basic details, add a unique receipt number for easy reference. If the loan has an outstanding balance, indicate the remaining amount after the payment. This helps both parties track the loan’s progress and ensures accuracy in future transactions.

Record Keeping Tips

Store these receipts in an organized manner, either digitally or physically, to avoid confusion later. This will serve as proof of payment if any disputes arise. It’s also a good idea to keep a copy of the loan agreement for full context.