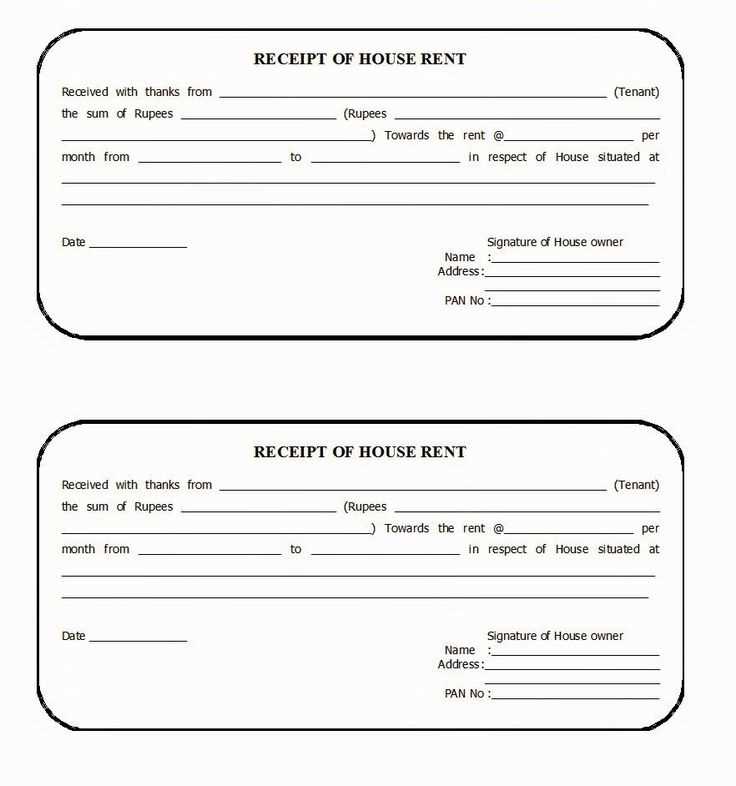

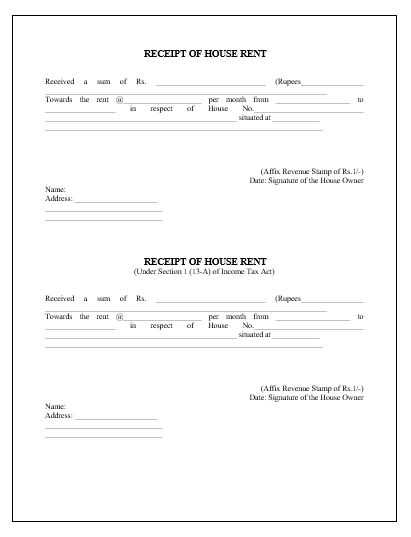

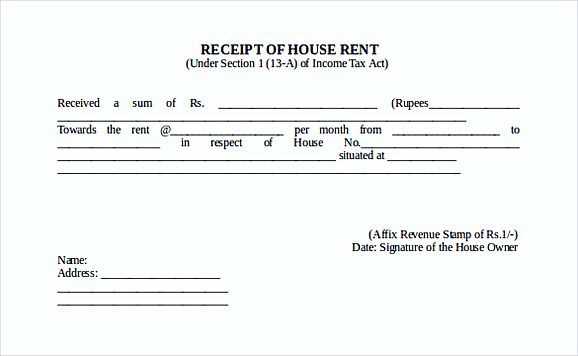

If you need a simple and professional way to create a house rent receipt in India, a DOC template can help streamline the process. A well-structured receipt provides a clear record of rental payments for both tenants and landlords, ensuring transparency. You can easily generate and print a template that includes all necessary details, such as tenant and landlord names, rental amount, payment dates, and rental period.

Start by selecting a template that covers the required legal details. Include the tenant’s full name, address of the rented property, rent amount, and payment method. Make sure to specify the payment date and the month for which the rent is being paid. Adding a space for both parties’ signatures can make the receipt more official and reduce any potential disputes.

Consider including a clause about late payment charges or other relevant terms that may apply. This ensures both parties are aware of the agreed-upon conditions. The template should be easy to edit so that you can adjust the details as needed, whether for a one-time transaction or recurring payments.

Sure, here’s the updated version with reduced repetition:

For a cleaner, more concise house rent receipt template in India, focus on the key details that make the document complete and legally sound. Include the following elements:

Essential Information

- Landlord’s Name and Address – Clearly list the landlord’s full name, address, and contact details.

- Tenant’s Name and Address – Provide the tenant’s full name and current address.

- Rental Property Address – Mention the exact address of the rented property.

- Payment Details – Specify the amount paid, the payment date, and the rental period.

- Signature and Date – Include spaces for both parties to sign and date the receipt.

Formatting Tips

Keep the language clear and straightforward. Avoid complex terms or unnecessary jargon. Use a simple layout that is easy to follow, and make sure the important sections stand out, such as payment amount and dates. This way, both the tenant and landlord can easily refer to the document when needed.

By focusing on these components, the receipt will serve its purpose efficiently, without unnecessary details or redundancy.

- House Rent Receipt Template DOC India

For a simple and clear house rent receipt in India, it’s helpful to use a DOC template. Here’s how you can structure your receipt:

1. Tenant and Landlord Details

- Tenant’s Full Name: Include the name of the person paying rent.

- Landlord’s Full Name: Provide the name of the property owner.

- Property Address: Mention the complete address where the tenant resides.

- Phone Numbers: Both parties’ contact numbers for easy communication.

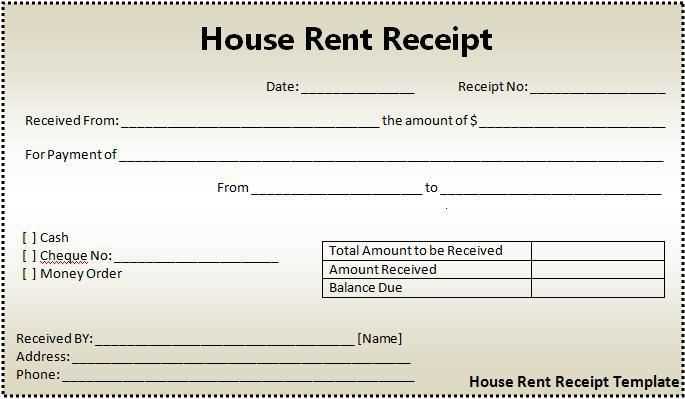

2. Rent Payment Information

- Rent Amount: Specify the monthly rent agreed upon.

- Payment Period: Mention the exact duration (e.g., January 1, 2025, to January 31, 2025).

- Payment Mode: Indicate if the payment was made by cheque, cash, bank transfer, etc.

3. Additional Terms and Conditions

- Security Deposit: Mention if any advance deposit is paid and its amount.

- Late Payment Charges: If applicable, state the penalty for late payments.

By following this format, you ensure clarity in the documentation of rent payments, which can be useful for both legal purposes and record-keeping.

For a rent receipt to be legally valid in India, it must contain key details that confirm the transaction. Ensure your rent receipt includes the following:

Basic Details

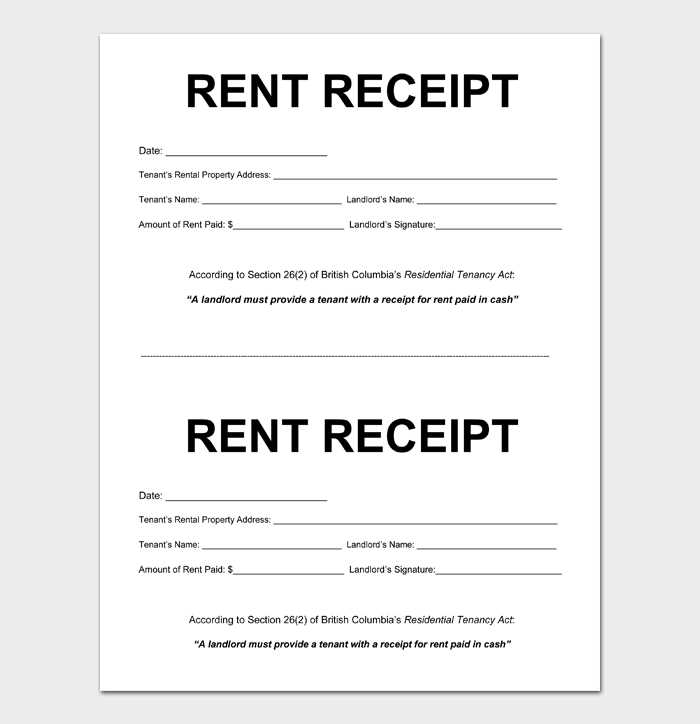

The receipt should include the name and address of both the landlord and tenant. This confirms who is involved in the transaction. Clearly state the rental property’s address to avoid confusion.

Payment Information

Include the amount paid, the period for which the rent is applicable (e.g., monthly), and the date of payment. Also, mention whether the payment was made via cheque, cash, or bank transfer. This helps in tracking payments and prevents future disputes.

Signature and Acknowledgment

Both parties should sign the receipt. The landlord’s signature is particularly important to confirm the receipt of payment, while the tenant’s signature acts as an acknowledgment of the transaction. A landlord’s stamp may also add an extra layer of authenticity.

Ensure the format used is easy to understand and does not leave any room for ambiguity. Consider creating a template that includes these components, making the process smoother for both parties.

A rent receipt must include specific details to ensure both parties have a clear record of the transaction. The following elements are necessary:

| Element | Description |

|---|---|

| Date | The date when the rent payment was made must be clearly mentioned. |

| Tenant’s Name | Include the full name of the person making the payment. |

| Landlord’s Name | The name of the landlord or property owner should be included for verification. |

| Amount Paid | The exact amount of rent paid should be stated in both numeric and written form. |

| Payment Mode | Specify the mode of payment, such as cash, cheque, or online transfer. |

| Rental Period | Clearly mention the period for which the rent is being paid (e.g., monthly, quarterly). |

| Property Address | State the full address of the rented property for reference. |

| Signature | Include a space for both the tenant and landlord’s signatures to acknowledge the transaction. |

Including these details guarantees that the rent receipt serves as a legally valid document for both parties. Each element helps avoid misunderstandings or disputes regarding payments and the rental arrangement.

To tailor a receipt for a specific rental agreement, focus on the key elements that differentiate each rental situation. Start by ensuring that the rental details are clearly outlined, such as the duration of the rental, monthly rent amount, and any special terms like utilities included or additional services. These specific details help distinguish one rental agreement from another.

1. Include Payment Terms

Specify the payment schedule–whether it’s monthly, quarterly, or annually. If there are late payment penalties or discounts for early payments, make sure these terms are visibly included in the receipt. This avoids confusion and ensures both parties are aware of their obligations.

2. Specify Property and Tenant Information

List the exact property address and the name of the tenant renting it. Customizing these fields makes the receipt more precise and relevant to the specific rental agreement.

Finally, if there are any special conditions, such as security deposits or agreements for lease renewal, mention them on the receipt. This helps create a clear record for both parties and reduces disputes over rental terms.

In India, landlords are required to provide rent receipts to tenants for every rental payment made. A rent receipt serves as proof of payment, which can be useful for both tenants and landlords in the event of disputes or tax-related matters. It is crucial that these receipts contain specific details to be considered legally valid.

Key Details to Include in a Rent Receipt

A legally valid rent receipt must contain the following details:

- Tenant’s and landlord’s names and addresses

- Amount paid

- Date of payment

- Period for which rent is paid (e.g., monthly, quarterly)

- Signature of the landlord

Legal Implications for Rent Receipts

Rent receipts are not just a formality. Tenants can use these receipts to claim rent deductions under Section 80GG of the Income Tax Act if they meet specific criteria. Landlords must issue rent receipts to maintain transparency and avoid disputes with tenants, especially during tax assessments. Failure to issue receipts may result in complications for both parties.

Ensure you accurately record the rent amount in both words and figures to avoid confusion. Double-check the numerical values to prevent errors in the payment details.

1. Incorrect Date

Verify that the date reflects the exact day the payment was made. A common mistake is listing the wrong date, which can lead to disputes over payment periods.

2. Missing or Incorrect Property Details

Clearly mention the full address of the property for which the rent receipt is issued. Failing to include this information or listing it incorrectly could cause problems during audits or legal proceedings.

3. Missing Tenant or Landlord Information

Both parties’ full names and contact details should be included. This detail ensures that both the tenant and landlord are easily identifiable in case of any discrepancies.

4. Not Including the Payment Mode

Specify how the rent was paid: whether it was through cash, cheque, or bank transfer. Leaving this out can cause confusion in future references.

5. Absence of Signature

It’s crucial to sign the receipt. A signature serves as proof of acknowledgment for both parties, solidifying the validity of the document.

6. Lack of Payment Period

Be specific about the rental period the payment covers, whether it’s monthly, quarterly, or yearly. Failing to mention the payment period can lead to confusion or disputes about the amount being paid.

7. Incomplete or Vague Descriptions

Avoid vague terms when describing the rental agreement. Make sure the receipt clearly mentions the purpose of the payment and any additional details, such as utilities included or advance payments.

8. Not Using a Standardized Format

Using an inconsistent or unclear format can make it difficult to track receipts. Stick to a professional, easy-to-read template for all receipts.

9. Leaving Out Tax Information

If applicable, include GST or any other taxes charged on the rent. Omitting tax details may complicate financial reporting or legal issues later on.

10. Failing to Keep Copies

Always retain a copy of the receipt for both parties involved. This ensures that both the landlord and tenant have a record for future reference.

| Common Mistakes | How to Avoid Them |

|---|---|

| Incorrect Date | Double-check the date before issuing the receipt. |

| Missing Property Details | List the full property address clearly. |

| Missing Tenant/Landlord Info | Include full names and contact details. |

| No Payment Mode | Indicate whether the rent was paid by cheque, cash, or transfer. |

| Absent Signature | Ensure both parties sign the receipt. |

To digitally sign and share house rent receipts in India, you can use digital signatures that comply with Indian laws. Here’s a step-by-step process:

1. Get a Digital Signature Certificate (DSC)

- Obtain a DSC from a certified Registration Authority (RA) recognized by the Controller of Certifying Authorities (CCA), Government of India.

- Choose between Class 2 or Class 3 DSC based on your needs. For rental receipts, a Class 2 DSC is typically sufficient.

2. Use Digital Signature Software

- Install digital signature software compatible with your DSC. Many providers offer simple software for signing PDF documents.

- Open your rent receipt document and select the option to apply a digital signature.

3. Apply the Signature

- Click on the designated area within the receipt to insert the signature.

- Authenticate using your DSC token or USB device, and your signature will be applied securely.

4. Share the Signed Receipt

- After signing, save the document and send it via email or through any secure messaging service to the tenant or landlord.

- You can also upload the signed receipt to cloud storage or a secure document-sharing platform.

Following this process ensures that your rent receipts are legally binding and securely shared with recipients in India.

When creating a house rent receipt template in a DOC format for India, it is important to ensure the document covers all necessary details clearly and correctly. Start by including the name and address of both the landlord and the tenant. These details should be listed at the top of the receipt for easy reference.

Key Information to Include

- Date of Payment: Make sure to mention the specific date when the rent was paid.

- Amount Paid: Clearly state the exact rent amount and the mode of payment (cash, bank transfer, cheque, etc.).

- Rental Period: Mention the period for which the rent payment covers (e.g., January 2025).

- Landlord’s Signature: A signature from the landlord confirms the receipt of payment.

- Tenant’s Acknowledgment: A statement confirming the tenant’s acknowledgment of the payment made.

Formatting Tips

- Clarity: Use clear, easy-to-read fonts like Arial or Times New Roman.

- Spacing: Maintain proper spacing between sections for readability.

- Language: Keep the language simple and to the point, avoiding unnecessary wording.