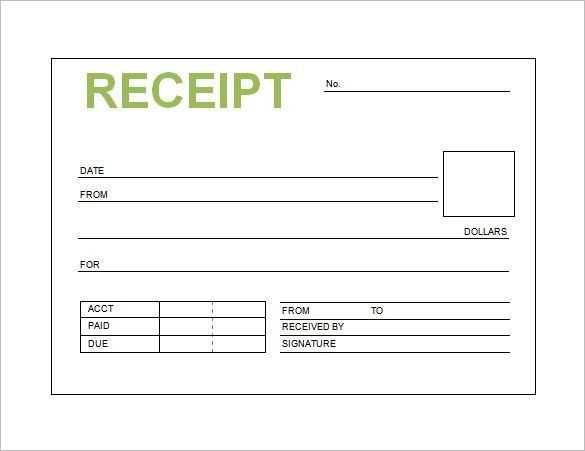

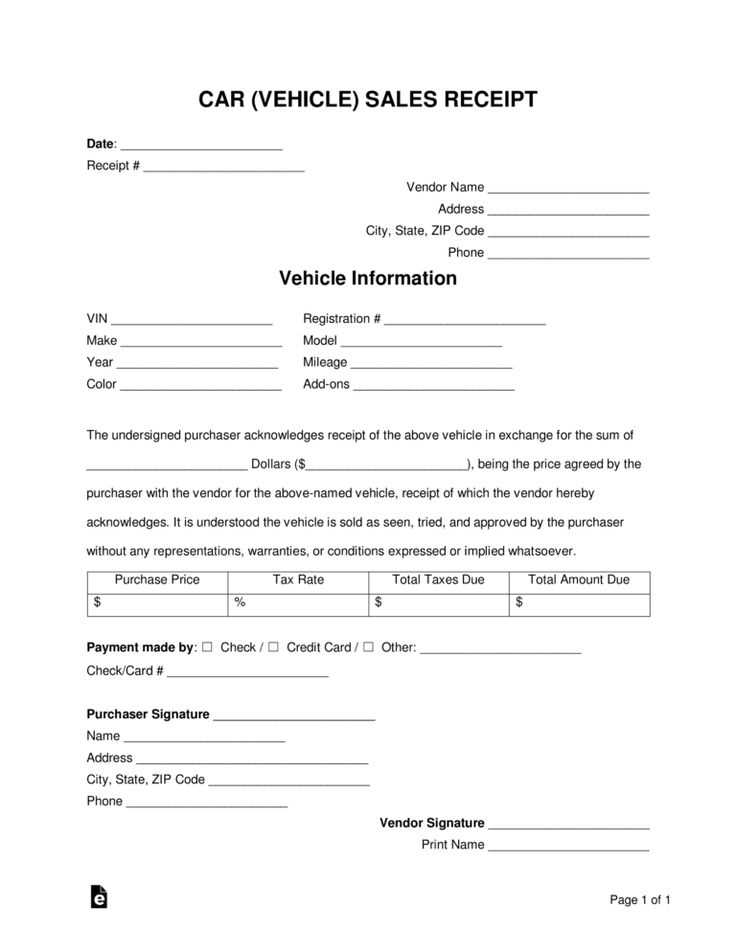

Always provide a detailed receipt when selling a vehicle. A well-structured document protects both buyer and seller by confirming the transaction details and ensuring transparency. The receipt should include essential information such as names, contact details, vehicle description, sale price, and date of sale.

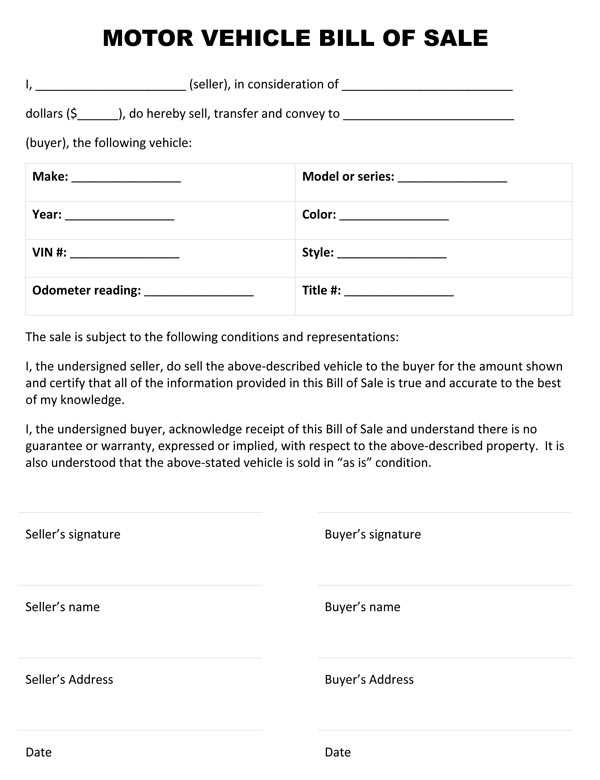

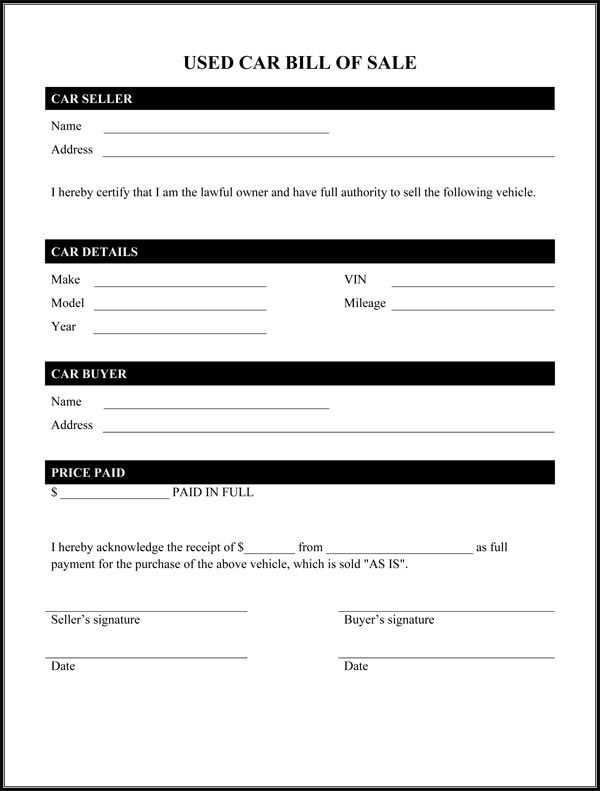

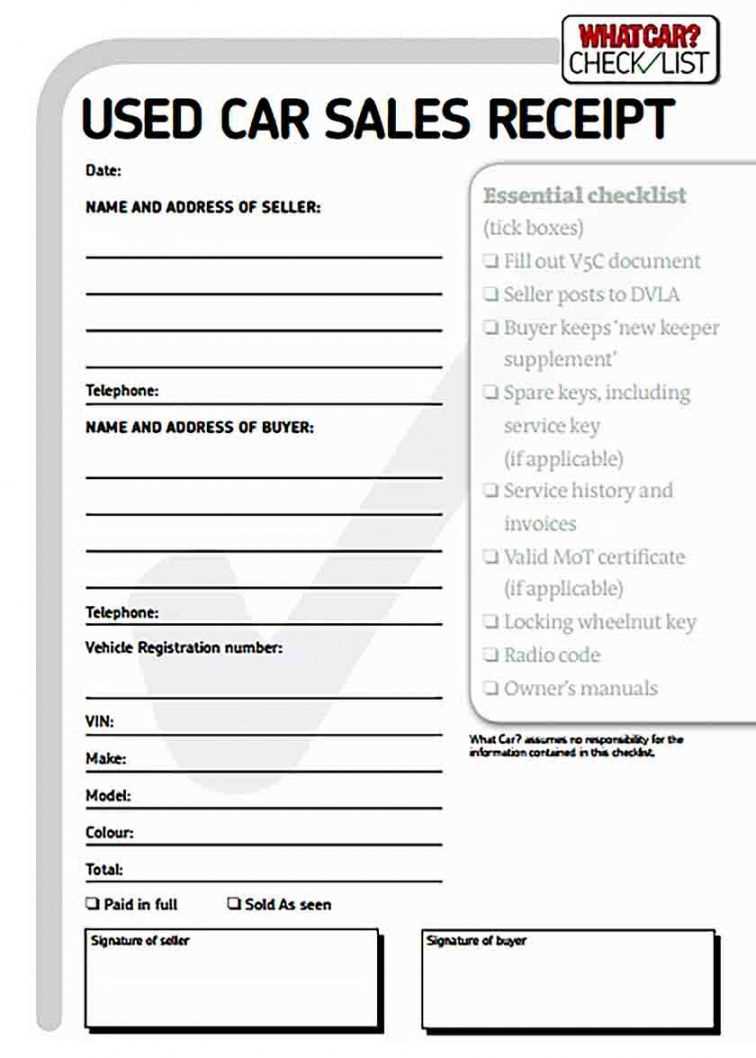

Vehicle details must be clear and specific. Include the make, model, year, VIN (Vehicle Identification Number), mileage, and any notable features or conditions. This prevents future disputes regarding the condition of the car at the time of sale.

Payment confirmation is crucial. Indicate the agreed price, payment method, and whether it was paid in full or through installments. If a deposit was made, specify the amount and balance due. A signature from both parties further validates the agreement.

Legal disclosures may be required depending on local regulations. Some regions mandate the inclusion of an “as-is” clause, stating that the buyer accepts the vehicle in its current condition without warranties. Always check local laws to ensure compliance.

A simple yet comprehensive vehicle sale receipt provides clarity and security for both parties. Keep a copy for your records, and if necessary, have the document notarized for added legal assurance.

Here’s the corrected version with reduced word repetitions:

For vehicle sale receipts, use clear language and concise information. Specify the vehicle details, including make, model, year, and VIN. List the sale price and payment method, and provide the buyer’s name and address. Be sure to include the transaction date and signatures from both parties.

For added clarity, you may include the terms of the sale, such as warranty details or return conditions. Ensure all required fields are present to avoid misunderstandings. Double-check all information for accuracy before finalizing the document.

- Vehicle Sale Receipt Template

A vehicle sale receipt should clearly document the transaction between the buyer and seller. Include the following key details:

Transaction Information

Start with the sale date, followed by the full names and contact information of both the buyer and seller. Add the vehicle’s make, model, year, and VIN (Vehicle Identification Number). Specify the agreed-upon sale price and the payment method used, whether it’s cash, check, or financing.

Condition and Terms

Note the condition of the vehicle at the time of sale, including any warranties, promises, or exclusions regarding the car’s condition. Also, mention whether the vehicle is sold as-is or with any guarantees. Include signatures from both parties to validate the sale.

Make sure to include these specific details for clarity and accuracy:

- Transaction Date: Clearly state the date of the transaction to avoid confusion regarding the sale’s timing.

- Seller’s Information: Include the seller’s full name or business name, address, and contact information for identification purposes.

- Buyer’s Information: The buyer’s full name or contact details are useful, particularly in case of returns or disputes.

- Item Description: Provide a detailed description of the vehicle sold, including make, model, year, color, and VIN (Vehicle Identification Number).

- Sale Price: Specify the agreed-upon price for the vehicle, along with any applicable taxes or fees.

- Payment Method: Indicate whether the payment was made in cash, by check, credit card, or through any other method.

- Transaction ID: If possible, include a unique transaction ID or receipt number for easy reference in future inquiries.

- Signatures: Both the seller and buyer should sign the receipt to validate the transaction.

Optional Details to Add

- Warranties or Guarantees: If applicable, mention any warranties or guarantees offered with the sale of the vehicle.

- Odometer Reading: Recording the vehicle’s mileage can help both parties avoid discrepancies later on.

- Vehicle Condition: Briefly note the condition of the vehicle at the time of sale, including any issues that were disclosed.

Ensure that the vehicle sale receipt includes all required legal information for validity. Depending on the jurisdiction, specific details must be included to comply with consumer protection laws and tax regulations. Typically, this includes the full name and contact information of both the buyer and the seller, the vehicle’s identification number (VIN), sale price, and any warranties or disclaimers.

Tax and Regulatory Compliance

Check local tax regulations to confirm that the receipt reflects the correct tax rate and provides the necessary documentation for tax purposes. Sales taxes must be correctly calculated and reported, and failure to do so may result in penalties. Some regions may also require specific forms or electronic submissions when selling a vehicle.

Warranty and Return Policy Disclosure

If offering a warranty or return policy, the receipt should outline these terms clearly. Indicate the duration of the warranty, what is covered, and the process for returns or claims. Without this information, the transaction could lack legal protection for the buyer, which may lead to disputes.

Ensure that the vehicle sale receipt is easy to read and understand. A clean format with clear divisions between key sections helps prevent confusion. Use headings, bullet points, and tables to clearly separate information.

Header Organization

Start with a bold header that includes the receipt title and vehicle details, followed by sections like buyer and seller information, itemized costs, and payment method. This makes each part of the receipt identifiable at a glance.

Use of Tables

Tables help organize itemized charges in a neat and structured way. Each column should clearly label the type of cost, quantity, and total amount. This reduces the risk of missing or misinterpreted details.

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Vehicle Sale | 1 | $10,000 | $10,000 |

| Tax | 1 | $800 | $800 |

| Registration Fee | 1 | $100 | $100 |

| Total | $10,900 |

Align text neatly and avoid long paragraphs. Each item or section should be easy to locate with consistent margins and spacing.

Specify the payment methods accepted for the vehicle purchase, such as bank transfer, credit card, or check. Clearly mention if any down payment is required and the exact amount or percentage expected at the time of sale. Provide a detailed breakdown of any applicable taxes, fees, or additional charges that will be added to the total price. Include the payment due dates and the schedule if the payment is to be made in installments. It’s important to outline any penalties for late payments and clarify whether the sale is contingent upon payment clearance. Also, be transparent about any refund policies or conditions for returns if applicable.

Both the buyer and seller should sign the vehicle sale receipt to confirm the transaction and ensure legal protection for both parties. Each signature serves as an acknowledgment of the terms and conditions outlined in the document. This simple step helps prevent misunderstandings and disputes in the future.

Buyer’s Signature

The buyer’s signature confirms their acceptance of the vehicle’s condition as described in the receipt. This includes acknowledging any existing issues, modifications, or damages that were disclosed during the transaction. Ensure that the buyer clearly understands the terms before signing.

Seller’s Signature

The seller’s signature verifies that the vehicle has been transferred to the buyer, and that all details, including the sale price and vehicle identification, are accurate. It also serves as proof that the seller has received payment for the vehicle and has completed their part of the transaction.

Both signatures should be made in ink and be legible to avoid any confusion. Always keep a copy of the signed receipt for future reference, and if necessary, have a witness present during the signing process.

Digital receipts offer greater convenience for storage and retrieval. Users can access them easily via email or apps, reducing the risk of misplacing them. Additionally, digital receipts can be stored in cloud services, allowing quick searches for specific transactions.

However, they may require a stable internet connection to access, and some people prefer physical copies for easier reference in situations with limited access to devices. Also, digital receipts may be vulnerable to technical issues like email glitches or app malfunctions.

Advantages of Digital Receipts

- Environmentally friendly, reducing paper waste.

- Organized storage, reducing clutter and easy retrieval from various devices.

- Can be integrated with expense tracking or tax filing apps for added convenience.

- Provide clear digital timestamps and transaction details.

Drawbacks of Digital Receipts

- May not be accepted for all types of returns or warranty claims.

- Privacy concerns about sharing personal data with third-party services.

- Possible difficulties for individuals who are not comfortable with technology.

Paper receipts, on the other hand, offer tangible proof of purchase and can be kept easily for returns or record-keeping purposes. They do not depend on digital devices or the internet, ensuring they remain accessible regardless of technology issues.

Despite these benefits, paper receipts take up physical space and can deteriorate over time, making it harder to store large volumes of receipts effectively. Paper can also contribute to waste, especially if receipts are printed unnecessarily.

When creating a vehicle sale receipt template, make sure to clearly outline the transaction details. This includes the vehicle make, model, VIN (Vehicle Identification Number), and the sale price. Accurately listing these specifics avoids any potential misunderstandings between the buyer and seller.

Details to Include

In addition to vehicle information, include both the seller’s and buyer’s contact details, along with the date of the transaction. A clear payment method section is necessary, whether it’s cash, check, or finance. Including signatures from both parties adds an extra layer of validation to the receipt.

Legal Considerations

Ensure that the receipt specifies whether the sale is “as-is” or includes any warranties. For “as-is” sales, it’s helpful to add a disclaimer that protects the seller from future claims. Keep in mind, different states or countries may have unique requirements for vehicle sales receipts, so research local regulations.