Essential Details for a Clear and Accurate Receipt

A well-structured receipt ensures transparency for both parents and after-school care providers. Include the following key details:

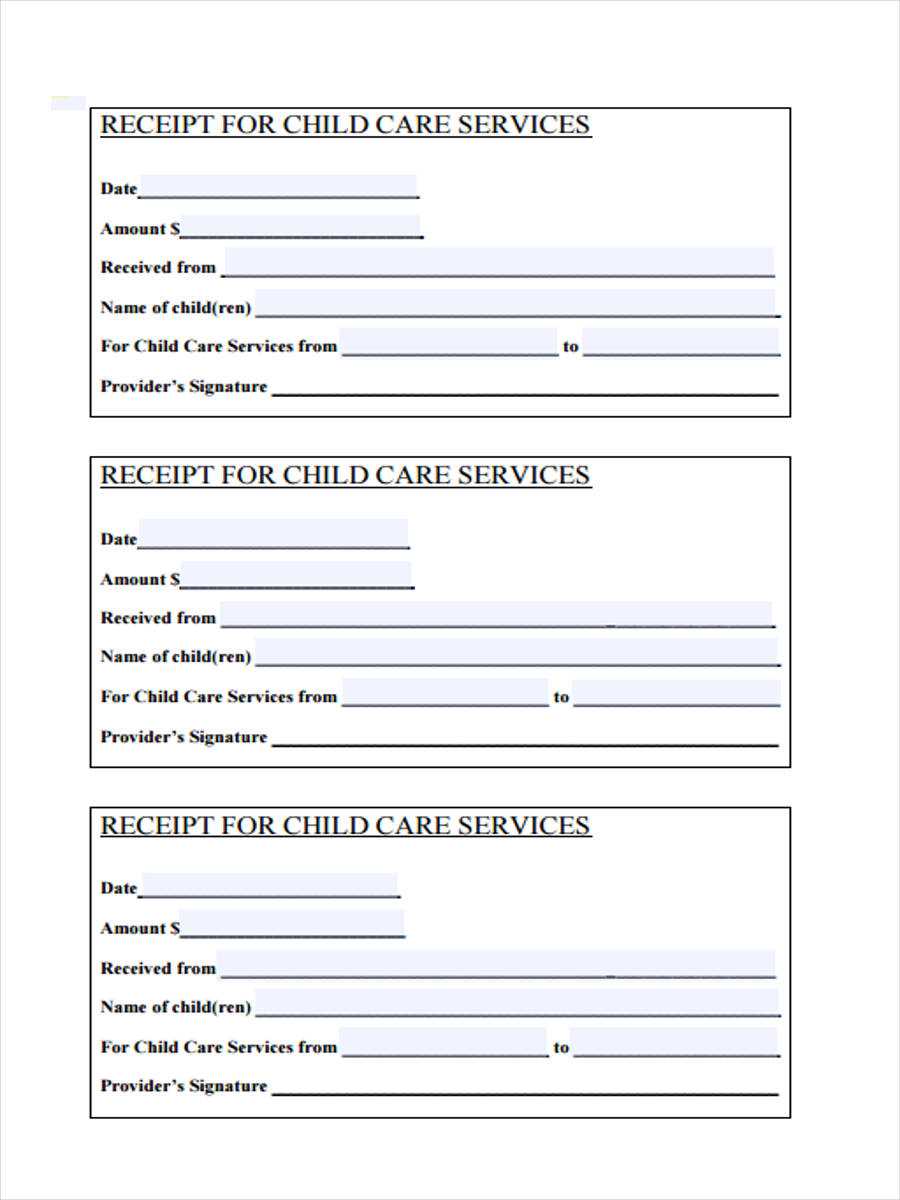

- Date of Service: Clearly state the date when care was provided.

- Child’s Name: Specify the full name of the child receiving care.

- Parent/Guardian Name: Include the responsible party’s name for record-keeping.

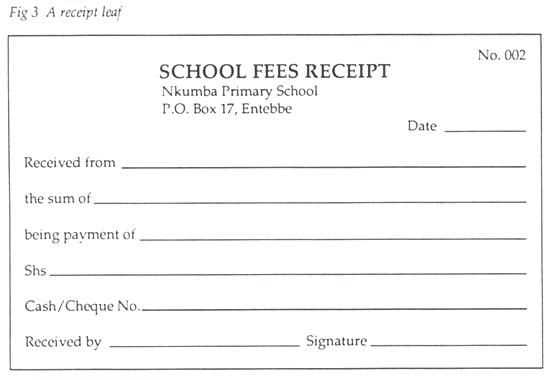

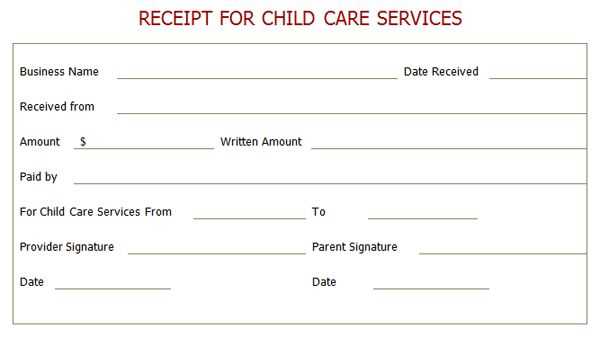

- Provider Information: List the business name, address, contact details, and tax ID (if applicable).

- Service Description: Outline the care provided, such as hours attended or activities included.

- Amount Paid: Specify the total payment received, along with the method (cash, check, or digital transfer).

- Signature: The provider or an authorized person should sign to confirm receipt.

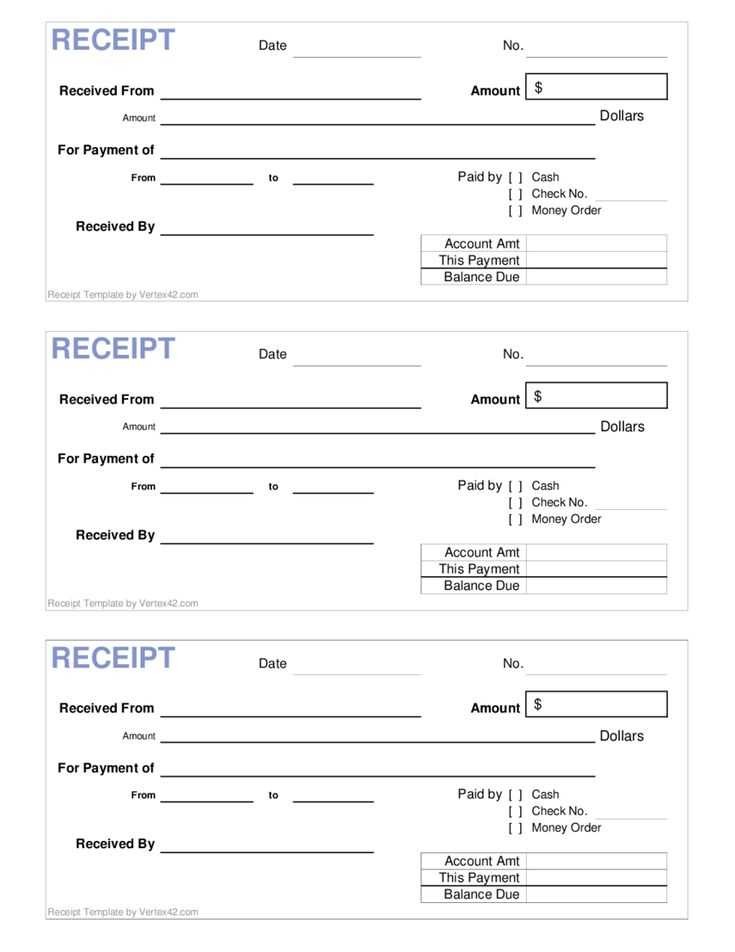

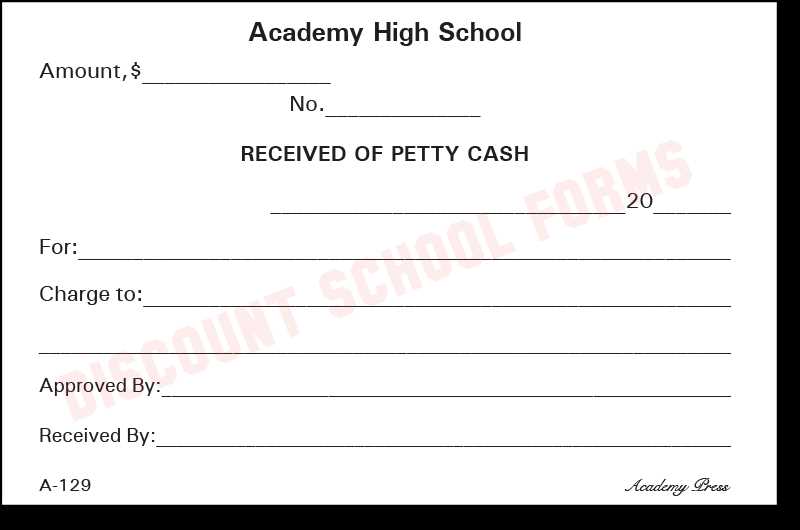

Example Template

Use this format for consistency and clarity:

AFTER SCHOOL CARE RECEIPT Date: [MM/DD/YYYY] Receipt No.: [Unique Number] Child’s Name: [Full Name] Parent/Guardian: [Full Name] Provider Name: [Business/Individual Name] Address: [Provider’s Address] Phone: [Provider’s Contact] Tax ID (if applicable): [Tax ID] Service Provided: After School Care Dates Covered: [MM/DD/YYYY – MM/DD/YYYY] Total Hours: [Number of Hours] Rate per Hour/Day: [$Amount] Total Amount Paid: [$Amount] Payment Method: [Cash/Check/Bank Transfer] Signature: ________________________

Why a Receipt is Important

Maintaining records benefits both parties. Parents may need receipts for tax deductions or reimbursement programs, while providers ensure accurate accounting. A standardized template simplifies this process and reduces disputes.

For best results, issue receipts immediately after payment and retain copies for future reference.

After School Care Receipt Template

Key Information to Include in a Receipt for After School Care

Legal and Tax Considerations for These Receipts

Best Formats and Layouts for Clear, Professional Documents

Digital vs. Paper: Choosing the Right Receipt Option

Common Mistakes to Avoid When Creating These Receipts

Free and Paid Resources for Generating Them

Key Information to Include in a Receipt for After School Care

Ensure each receipt includes the caregiver’s name, business address, and contact details. Clearly state the child’s name, service dates, and the amount paid. Specify payment method and include a unique receipt number. If applicable, add tax ID or EIN for tax deductions.

Legal and Tax Considerations for These Receipts

Receipts should comply with local tax regulations. Parents may need them for dependent care credits, so accuracy is essential. Retain copies for record-keeping. If operating as a business, check whether sales tax applies to your services.

Opt for structured templates to ensure clarity. Use tables for service breakdowns and bold headers for easy navigation. Digital receipts provide automatic backups, while paper copies offer immediate access without technical barriers. Avoid missing key details, as incomplete receipts may cause issues for parents and tax reporting.