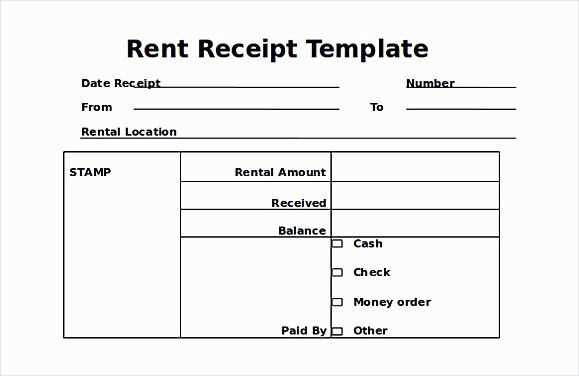

Use a straightforward rent receipt template to clearly document each payment made. This template should include details such as the tenant’s name, the rental property address, payment amount, and the date of payment. Having this information in a concise format helps both parties track the transaction history with ease.

Tenant’s Name: Always include the full name of the tenant. This ensures there is no confusion about who made the payment.

Rental Property Address: Clearly state the property address to avoid any misunderstanding about which rental unit the payment pertains to.

Payment Amount and Date: Indicate the exact payment made and the date it was received. This provides a clear record for both the landlord and tenant.

Signature: A signature from the landlord or authorized agent can further confirm the transaction and prevent disputes later on.

Make sure the template is simple and free from unnecessary details. Keep the structure consistent, and update the information as needed for each transaction.

Here’s the corrected version without redundant word repetitions, maintaining the meaning:

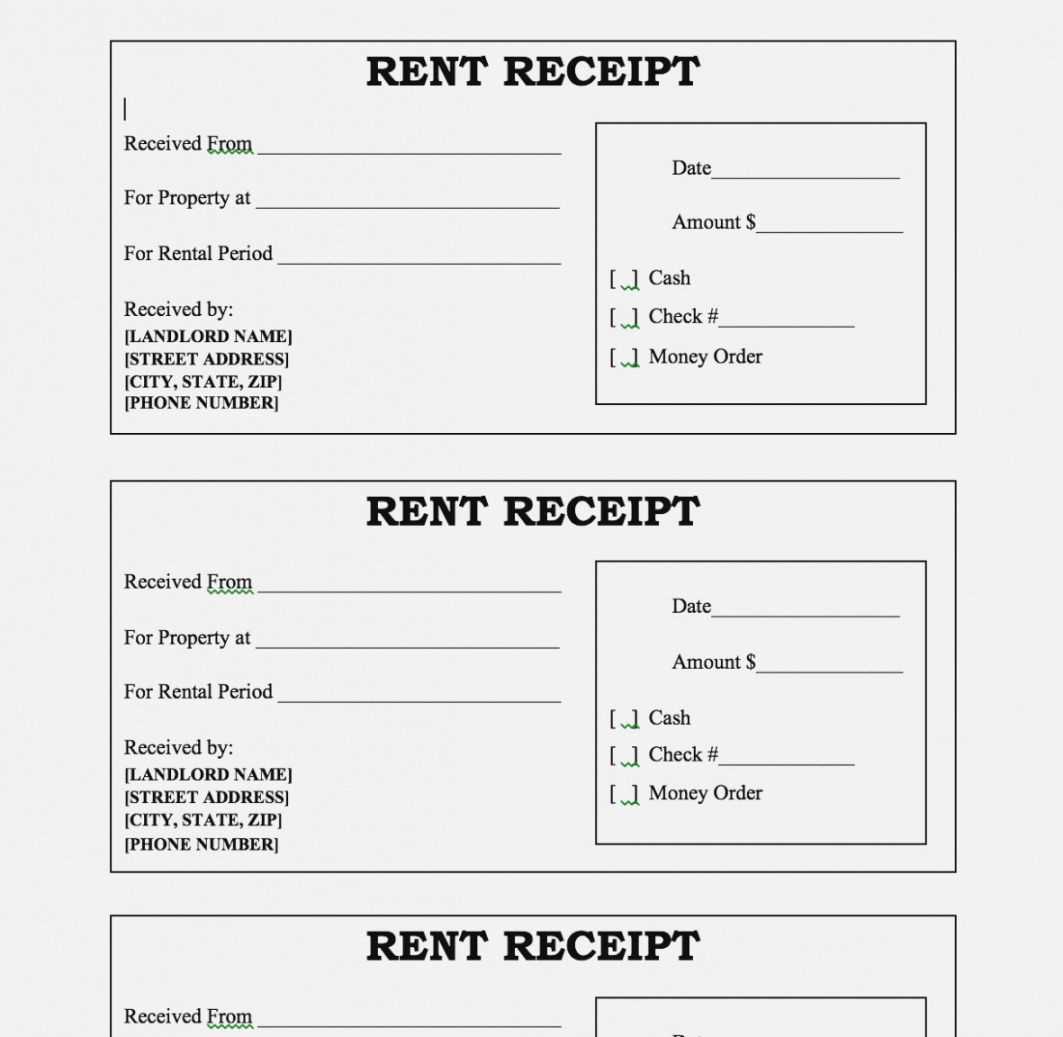

For a rent receipt template, ensure clarity by including all necessary details concisely. Specify the tenant’s name, property address, and the exact rental period. Include the amount paid, the payment method, and the date the payment was made. It’s crucial to mention if the payment covers any additional services or fees. The landlord’s contact information should also be clear, and you can add a brief statement about the agreement, confirming the payment receipt.

Avoid repeating phrases like “payment for rent” or “received payment” multiple times. Keep it brief, focusing only on the key points: the amount, tenant, property details, and payment confirmation. Using simple, clear language makes the receipt easy to understand.

- Template for a Lease Receipt

Creating a lease receipt requires clarity and precision. Below is a simple yet complete template that includes the most important details for both the tenant and landlord.

- Tenant Information: Include the full name, address, and contact details of the tenant.

- Landlord Information: Specify the landlord’s name and address for official records.

- Lease Period: Clearly state the duration of the lease (start date and end date).

- Rent Amount: Mention the exact amount of rent paid, along with the payment method.

- Payment Date: Specify the date the payment was received.

- Payment Details: Include any additional details such as late fees, if applicable, and the total amount paid.

- Signature: Both tenant and landlord should sign the receipt for verification.

Make sure to include all necessary details to avoid any misunderstandings later. This template will serve as a clear record for both parties involved.

Include the full names of both the tenant and the landlord. This ensures there’s no confusion about who is involved in the rental agreement. Provide the rental property’s address, including the street, city, and postal code. Clearly state the rental period, noting the start and end dates. Mention the rental amount and payment frequency, whether it’s weekly, monthly, or otherwise. Always specify the payment method, such as bank transfer or check. If applicable, include any security deposits paid or other financial details relevant to the lease. Finally, sign the document with both parties’ signatures to validate the proof.

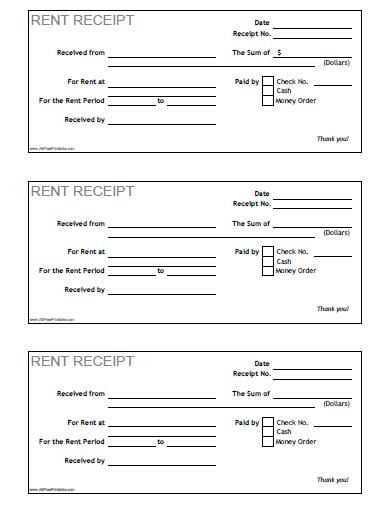

Choose a clean, readable font such as Arial, Helvetica, or Times New Roman. Ensure the font size is between 10pt and 12pt for easy readability.

Use Consistent Spacing

Maintain consistent margins, usually 1 inch on all sides, to provide a balanced look. Line spacing should be set at 1.5 or double to prevent the text from appearing crowded. This improves readability and enhances document structure.

Align and Structure Information Clearly

Align text to the left for easy reading, and avoid justified text that may create awkward gaps. Use bullet points or numbered lists for organized sections. Keep the layout simple, ensuring there’s enough white space between each section for clarity.

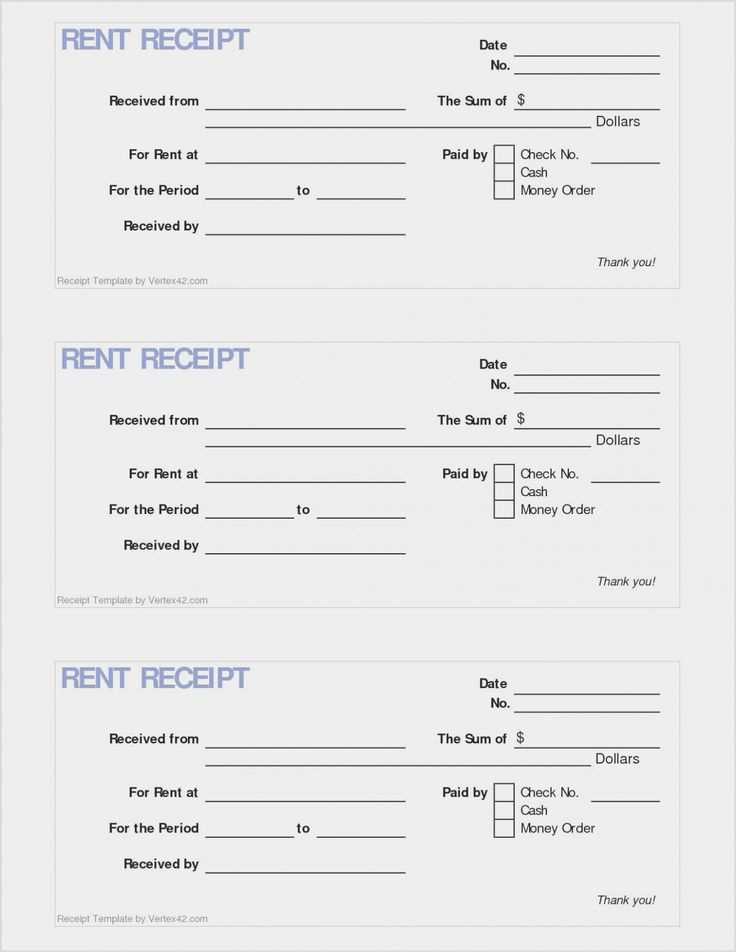

Make sure the rent receipt includes the full names of both the landlord and tenant. Clearly state the rental property address, as well as the rental period and the total amount paid. These details protect both parties in case of disputes or future reference.

Adhere to local tax laws by specifying the payment method, whether by cash, check, or bank transfer. Some regions require landlords to issue receipts for payments above certain amounts or in specific intervals, so familiarize yourself with these regulations to stay compliant.

Include a unique receipt number and date of issuance. This helps track payments and ensures that each transaction is properly documented. Both parties should keep a copy of the receipt for their records, as it serves as evidence in any potential legal matters related to the rental agreement.

Be aware of rental laws in your jurisdiction. Some areas have specific regulations that mandate what information must be included in rent receipts. Stay informed about these rules to ensure your receipts are legally valid and avoid penalties.

Ensure you include the full names of both parties involved–landlord and tenant. Missing or incorrect names can cause confusion or legal disputes. Double-check the spelling and ensure all information matches official documents.

Incorrect Dates and Payment Details

Provide accurate start and end dates for the rental period. Errors in these dates may lead to misunderstandings about the lease term. Similarly, clearly outline the rent amount, payment frequency, and due dates. Missing this information can create confusion about payment obligations.

Omitting Property Description

Clearly describe the rented property, including the address and specific details such as the unit number, floor, and any included amenities. Vague descriptions may result in disputes about what exactly is being rented.

Digital vs. Paper: Advantages and Drawbacks

Choose wisely between digital and paper receipts based on convenience, security, and long-term accessibility.

- Digital Receipts:

- Pros:

- Store easily on your device, reducing clutter.

- Quick retrieval with simple search options.

- Can be accessed anywhere, eliminating the need for physical storage.

- Environmental benefits, saving paper and reducing waste.

- Cons:

- Risk of losing access if the device malfunctions or data is lost.

- Requires internet access for cloud storage or backup recovery.

- Not everyone is comfortable with digital systems or prefers tangible proof.

- Paper Receipts:

- Pros:

- Simple, no technology needed to store or access.

- More trusted by individuals who prefer physical records.

- No dependency on electricity or internet connection.

- Cons:

- Can easily be lost, damaged, or faded over time.

- Requires physical storage space, leading to potential clutter.

- Not environmentally friendly due to paper waste.

Each lease agreement carries its own unique terms and conditions, so tailoring a receipt to reflect the specifics of the agreement is crucial. For residential leases, include the tenant’s name, the rental period, and the payment amount. For commercial leases, ensure the receipt mentions the lease type (e.g., gross, net, or modified gross), and clarify the payment structure, such as rent plus additional charges like utilities or maintenance fees.

Adjusting the receipt for different payment frequencies is another key aspect. For monthly leases, specify the rent amount due each month. For annual leases, break down the total rent into monthly installments to give a clear view of the payment schedule. For lease agreements with late fees or penalties, include a section showing these additional charges if applicable.

To provide clarity and transparency, consider the following table layout to structure the information:

| Item | Description |

|---|---|

| Tenant Name | [Tenant’s Full Name] |

| Lease Type | [Residential/Commercial] |

| Payment Due Date | [Due Date] |

| Rent Amount | [Amount] |

| Late Fees (if applicable) | [Late Fee Amount] |

| Total Paid | [Total Amount Paid] |

By customizing the receipt to match the details of each lease agreement, landlords and tenants both maintain a clear and accurate record of transactions. This helps avoid confusion and ensures all terms are properly documented for future reference.

Ensure the rent receipt includes clear and concise information. Start with the tenant’s and landlord’s names, the rental property’s address, and the date of payment. List the amount received in full and specify the payment method–whether it was cash, check, or electronic transfer. If applicable, mention any partial payments made prior to the receipt. Include the rental period covered by the payment. If taxes are part of the transaction, clearly outline those amounts as well.

Details for a Complete Rent Receipt

The receipt should clearly state the full rental amount, breaking it down if necessary. For example, if there are separate charges for utilities, repairs, or other fees, list them separately for transparency. It’s also a good idea to note the next payment due date if it’s part of a recurring agreement.

Additional Considerations

To avoid confusion, ensure that any discounts or late fees are also clearly outlined. Providing a brief summary of the payment terms or any agreement updates can prevent misunderstandings. Always include a statement confirming the payment was received in full to avoid disputes later.