Key Elements to Include

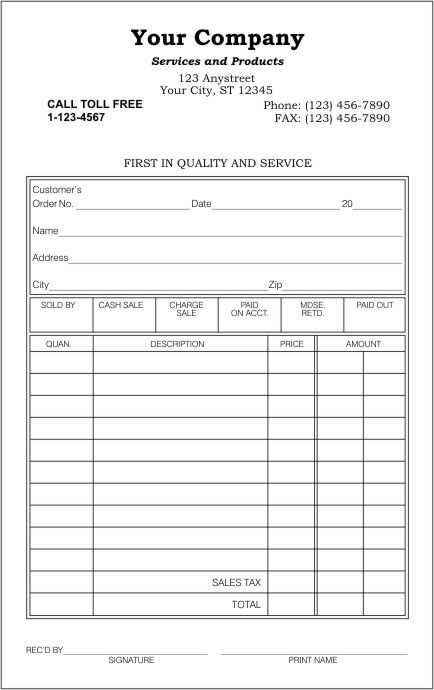

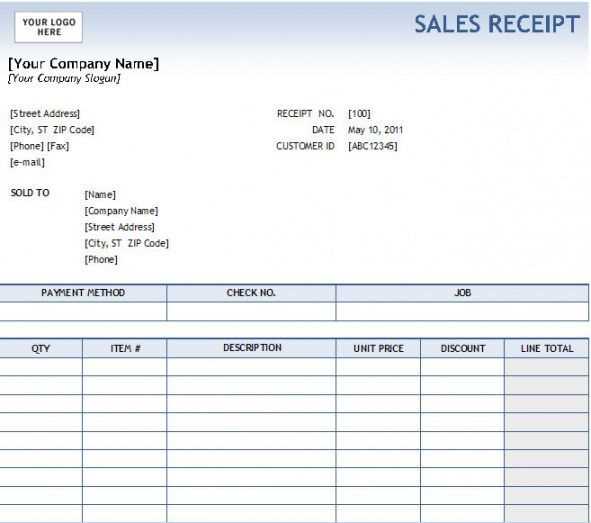

Creating a well-structured sales receipt helps maintain clear records for both your business and customers. Ensure your template includes the following essential sections:

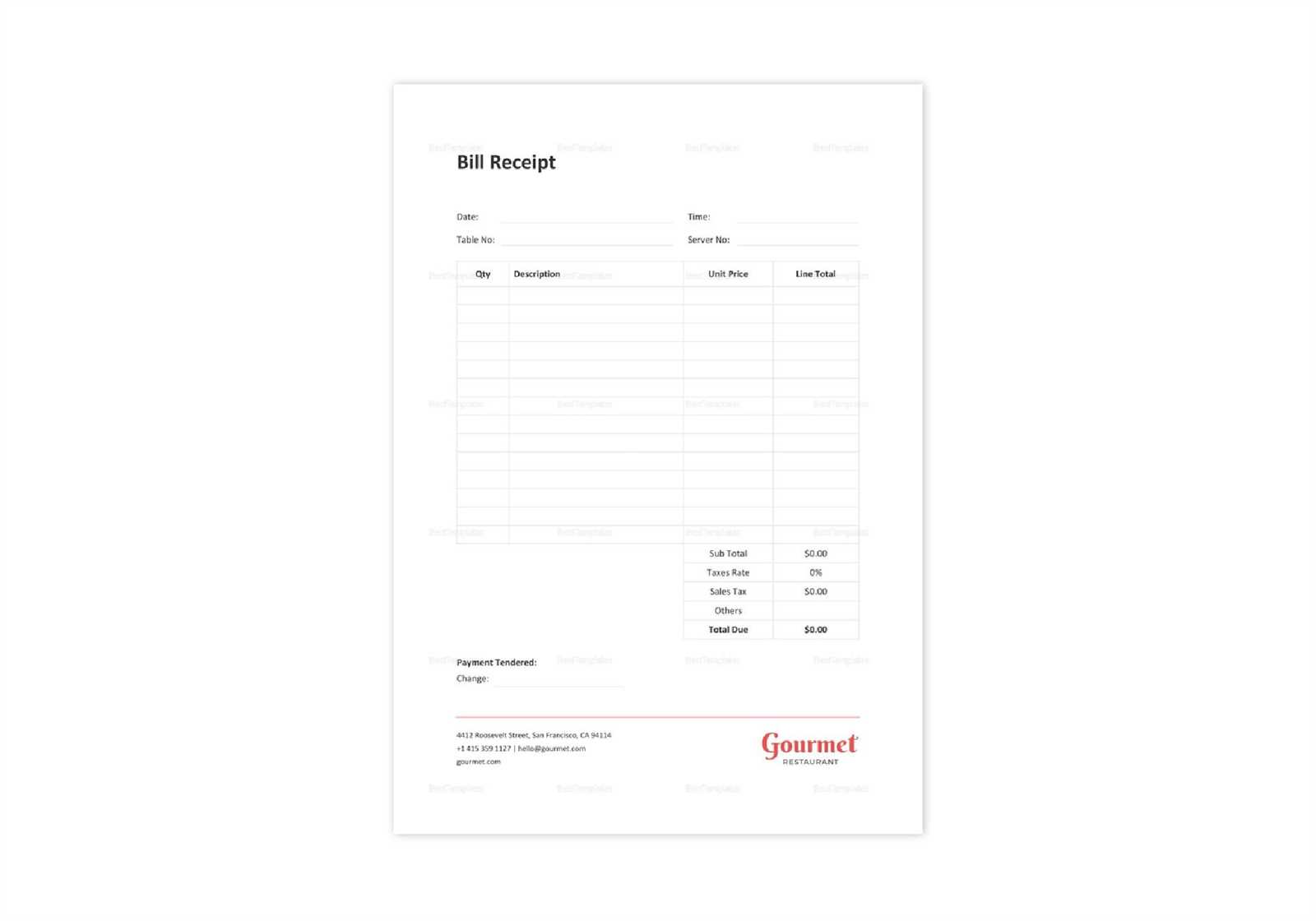

- Company Details: Include the business name, logo, address, phone number, and email.

- Receipt Number: Assign a unique identifier to each receipt for tracking purposes.

- Transaction Date: Clearly state the date when the transaction occurred.

- Customer Information: Provide fields for customer name and contact details if necessary.

- Itemized List: Include descriptions, quantities, unit prices, and total amounts for each item sold.

- Subtotal, Taxes, and Total: Display the subtotal, any applicable taxes, and the final total.

- Payment Method: Indicate how the payment was made, such as by credit card, cash, or bank transfer.

- Terms and Conditions: Provide any relevant refund or return policies.

Tips for an Effective Layout

A clean and organized format improves readability and professionalism. Use a simple table structure to align columns neatly and avoid visual clutter. Bold key figures, such as totals, to make them stand out.

Digital and Printable Options

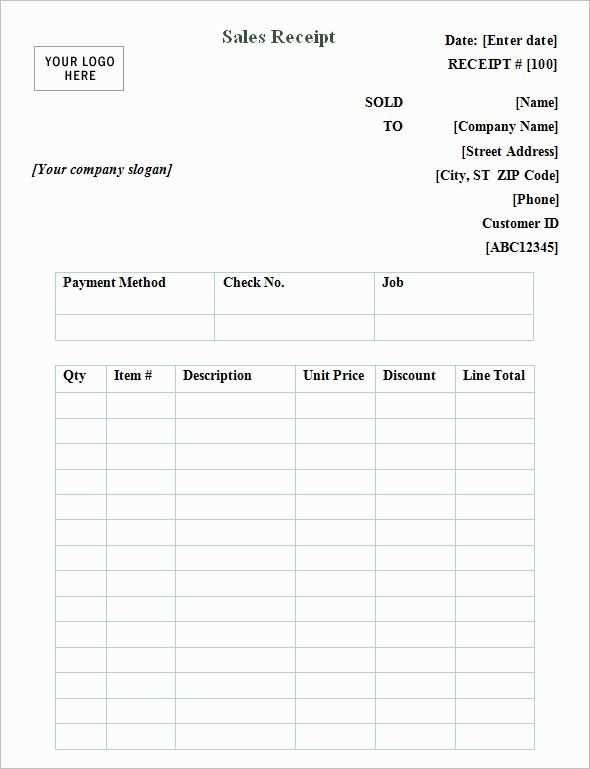

Consider offering your receipt template in both digital and printable formats. PDF is ideal for secure sharing, while editable formats like DOC or Google Docs allow for flexibility when making changes.

With a well-prepared blank template, your company can streamline transactions, improve record-keeping, and provide customers with a professional experience.

Blank Template for Company Sales Receipts

Designing a Professional and Clear Receipt Template

Key Information to Include in a Sales Receipt

Customizing Receipts for Various Business Needs

Legal and Tax Compliance for Business Receipts

Digital vs. Printed Receipts: Practical Tips

Tips for Streamlining Receipt Creation Processes

A well-structured sales receipt should be easy to read and include essential transaction details. Begin by clearly displaying the company name, address, and contact information at the top. This provides immediate context for both customers and accounting purposes.

Key Elements to Include

Ensure the receipt features a unique transaction number to help organize sales records. Include the date of purchase, detailed descriptions of products or services, unit prices, quantities, and the total amount paid. Specify payment methods, whether by credit card, bank transfer, or cash.

Customization and Compliance

Tailor receipts to your specific industry by incorporating logos or branding elements for professionalism. Additionally, consider any legal requirements such as tax breakdowns or compliance codes specific to your region. Digital templates can help save time, offering automated fields and calculations to minimize manual input errors.

Whether printed or digital, prioritize clarity and accuracy to ensure receipts effectively meet both customer and business needs.