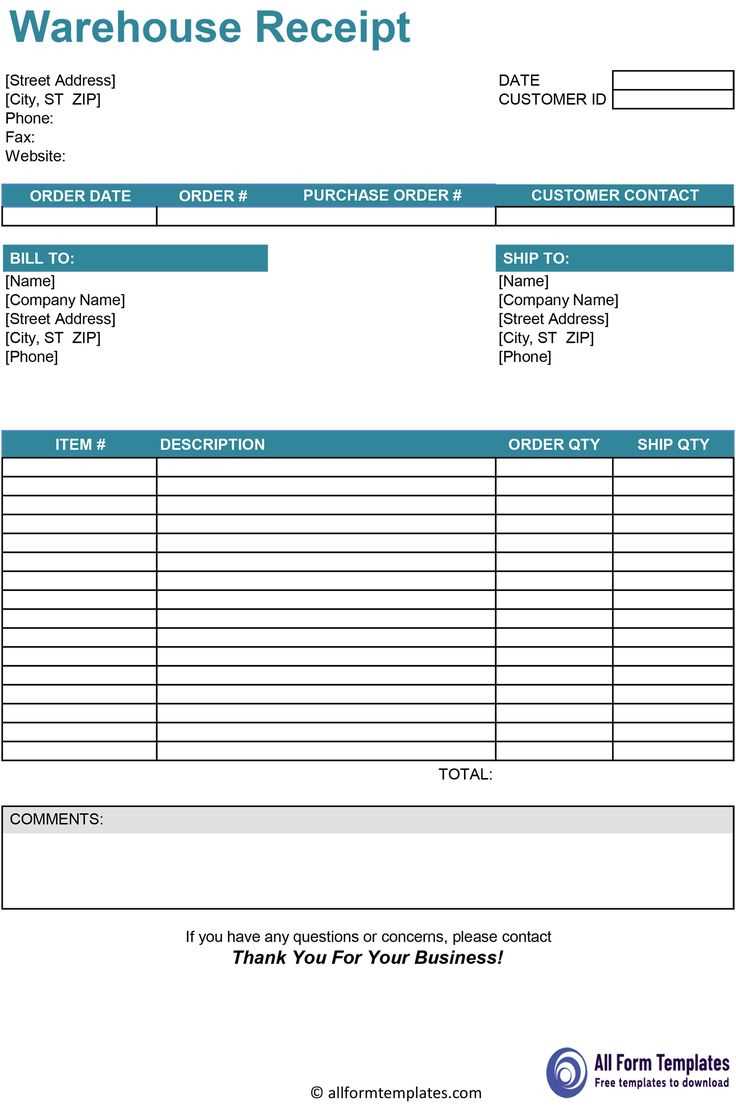

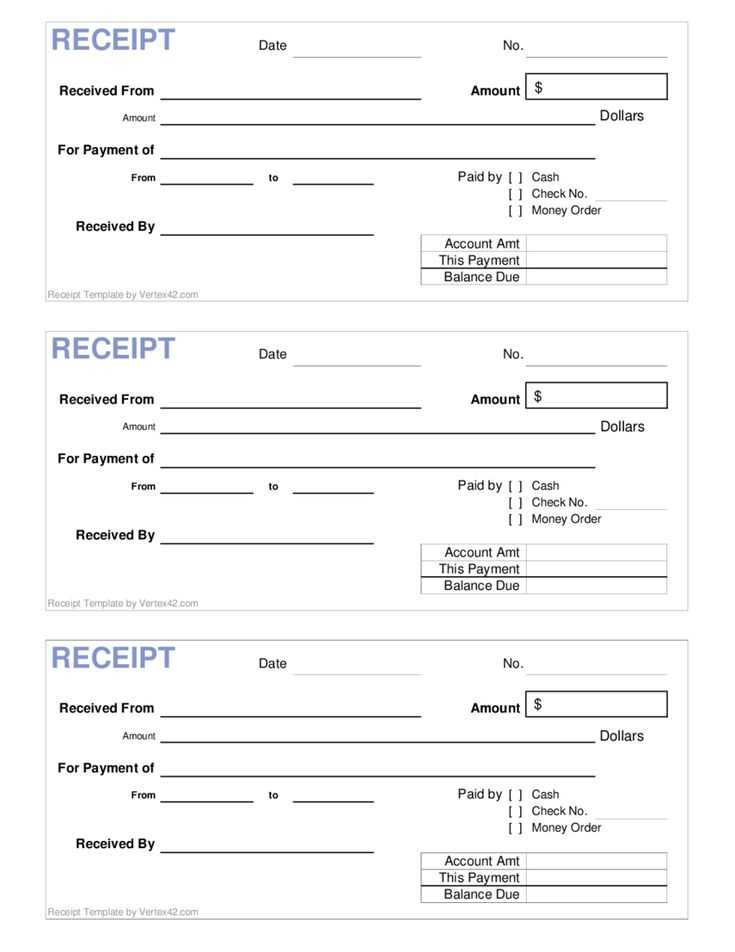

Key Components of a Gross Receipt Form

A well-structured gross receipt form ensures accurate financial tracking and simplifies tax reporting. Include these essential sections:

- Business Information: Name, address, contact details, and tax identification number.

- Transaction Details: Date, invoice number, and payment method.

- Itemized Sales: Description, quantity, unit price, and total amount.

- Taxes and Discounts: Breakdown of applicable taxes, discounts, and surcharges.

- Total Amount: Sum of all charges, including taxes.

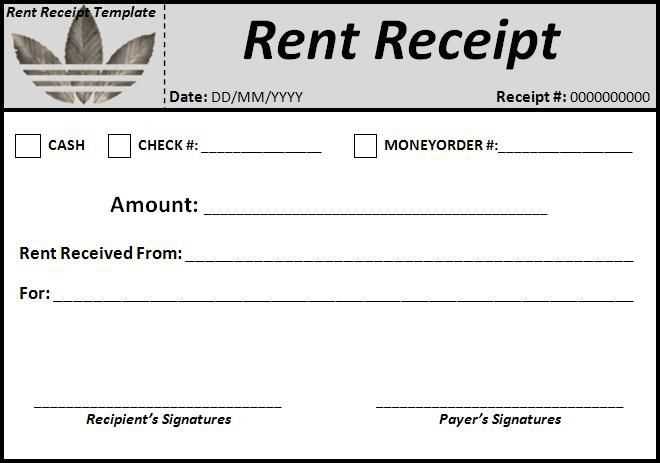

- Signature and Approval: Space for signatures if required for validation.

How to Use a Gross Receipt Form

Recording Transactions

Fill out the form immediately after each sale to maintain accurate records. Ensure all fields are completed to avoid discrepancies.

Organizing and Storing Receipts

Store digital and paper copies securely for easy access during audits or financial reviews. Categorize receipts by date or transaction type.

Generating Reports

Summarize gross receipts periodically to monitor revenue trends and prepare for tax filings. Use accounting software for automated tracking.

A detailed gross receipt form streamlines financial management, reduces errors, and ensures compliance with tax regulations.

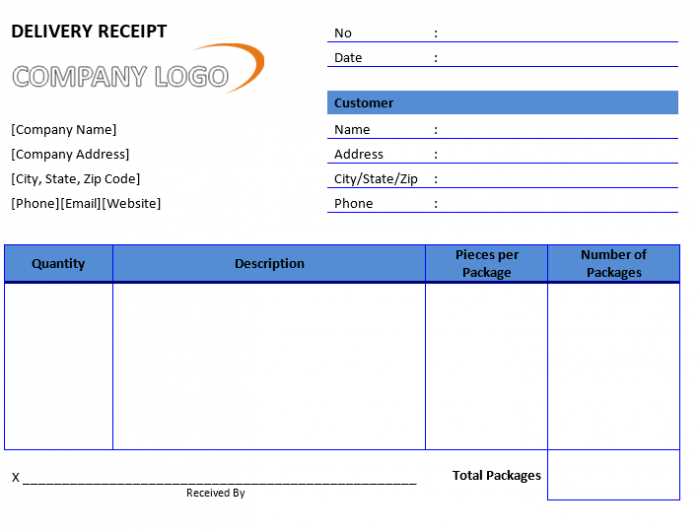

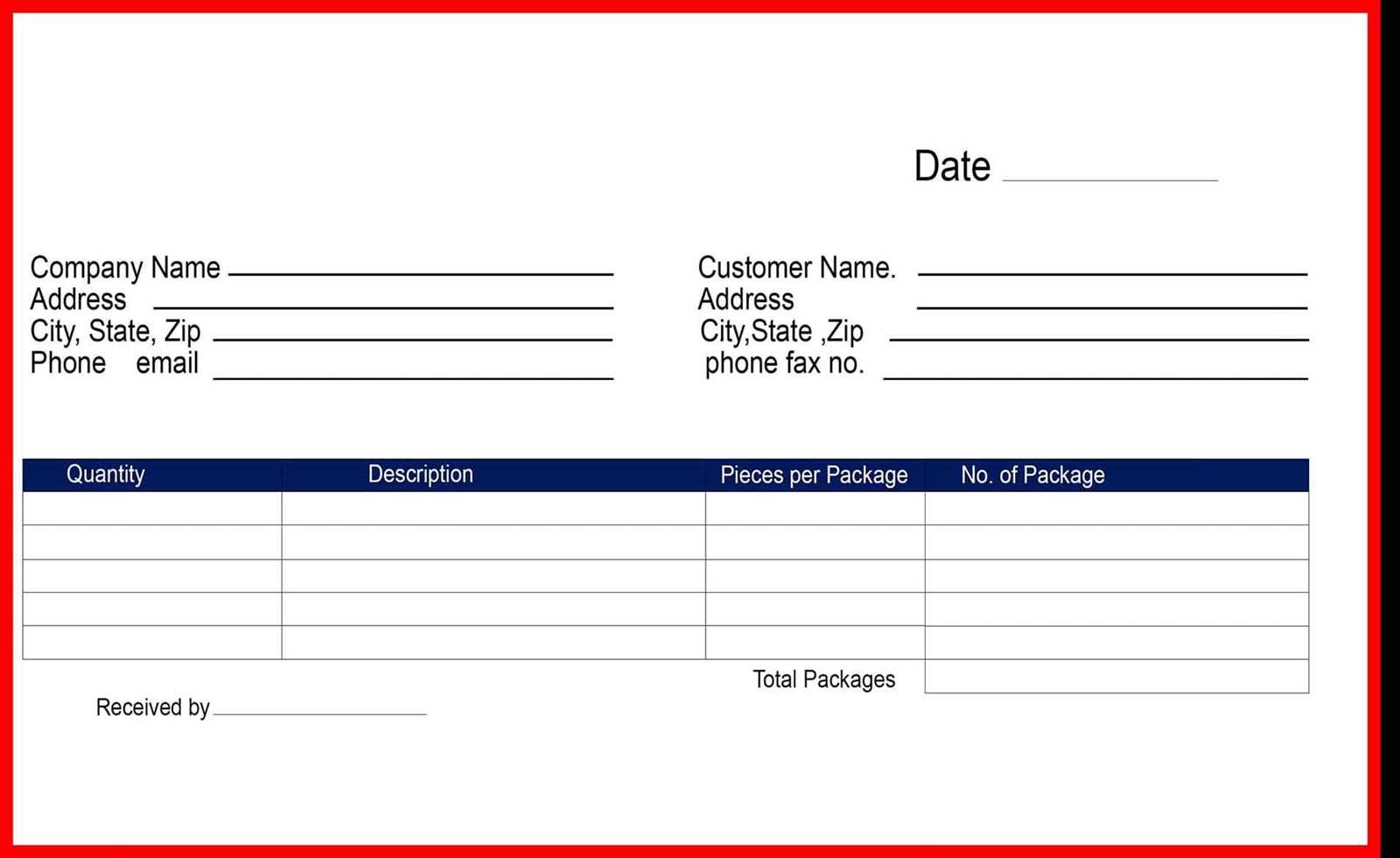

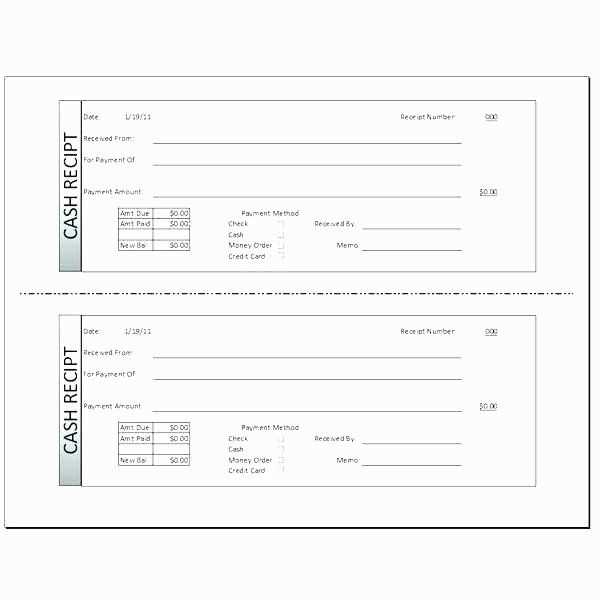

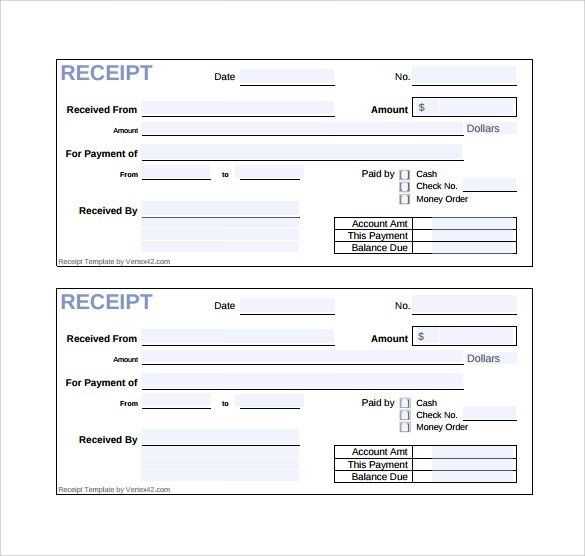

Template Gross Receipt Form

Key Elements of a Gross Receipt Document

A well-structured gross receipt form should include the business name, date of transaction, unique receipt number, payer details, and a breakdown of received amounts. Clearly separate taxable and non-taxable revenue to ensure compliance with tax regulations. Indicate the payment method and include a section for additional notes, such as discounts or refunds.

Structuring Revenue and Deduction Fields

Revenue should be itemized with descriptions, unit prices, and quantities. Deduction fields must specify applicable taxes, discounts, or allowances. Ensure each category is distinct to simplify bookkeeping and prevent calculation errors. A subtotal before deductions and a final total after deductions enhance clarity.

Legal and tax requirements vary, so align receipt details with local regulations. Store digital copies for audits and dispute resolution. Consistency in formatting helps standardize record-keeping and facilitates easier financial analysis.