Ensure smooth financial tracking and reimbursement with a fillable child care receipt template. Whether you are a daycare provider or a parent claiming tax deductions, a well-structured receipt documents payments clearly and professionally. This template eliminates manual calculations and formatting, making the process faster and more reliable.

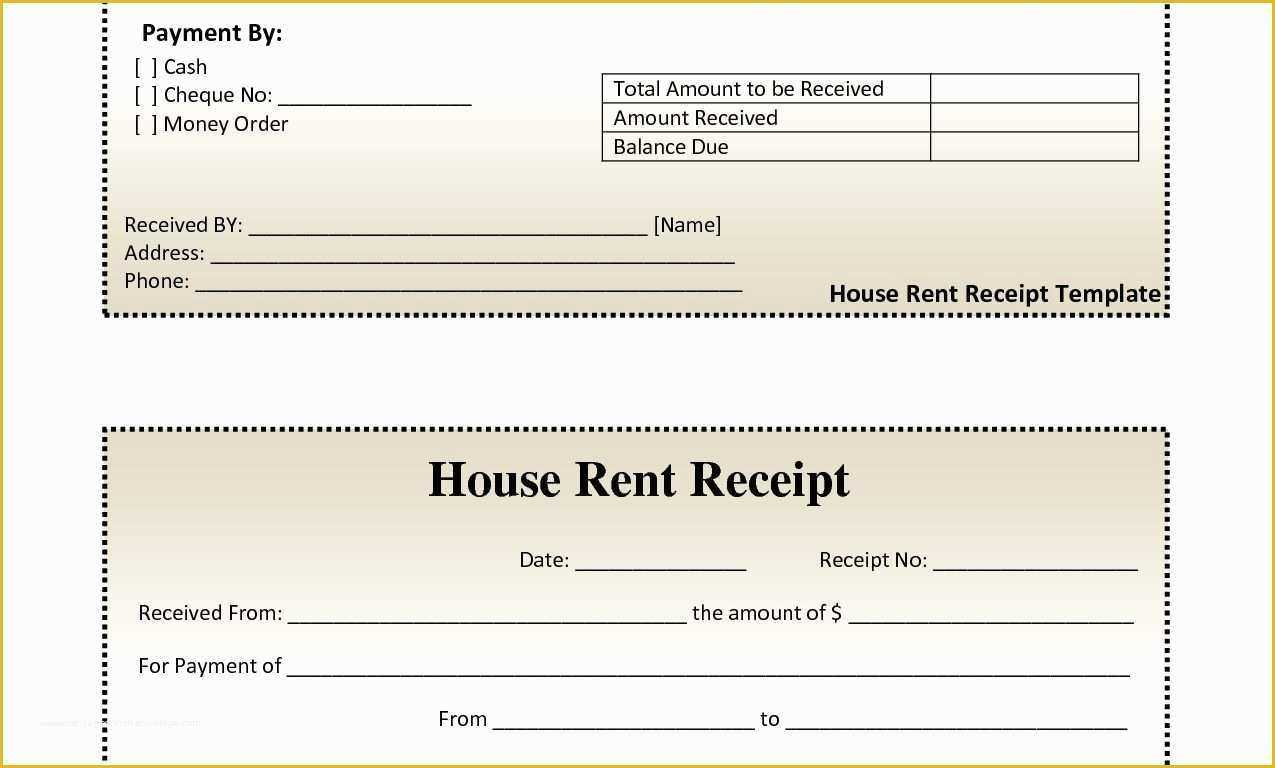

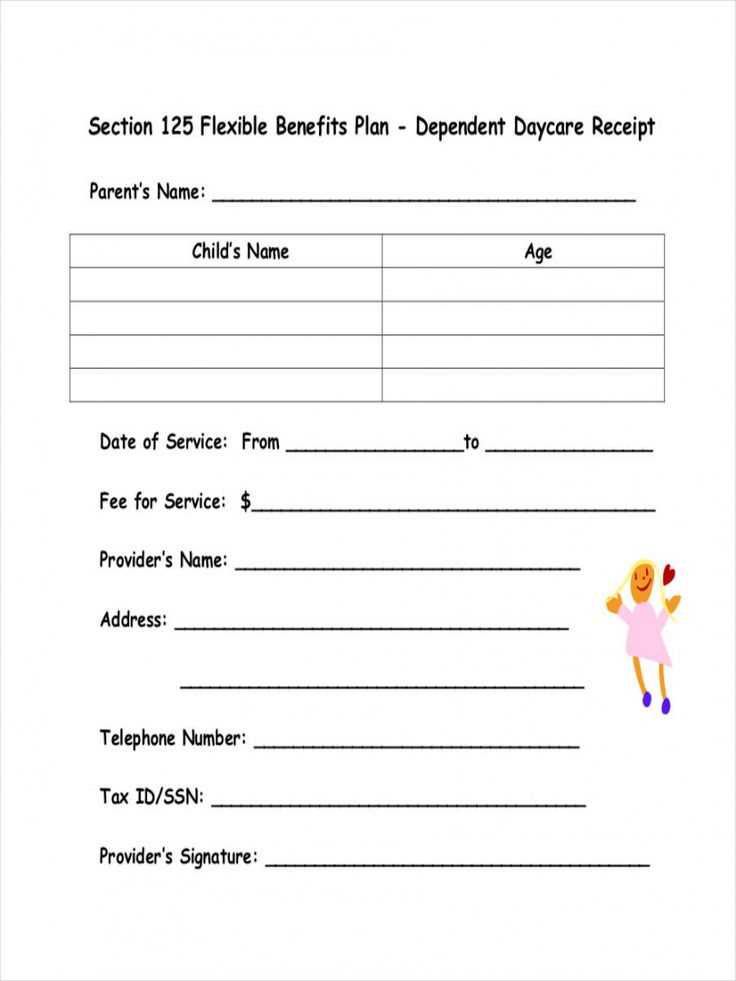

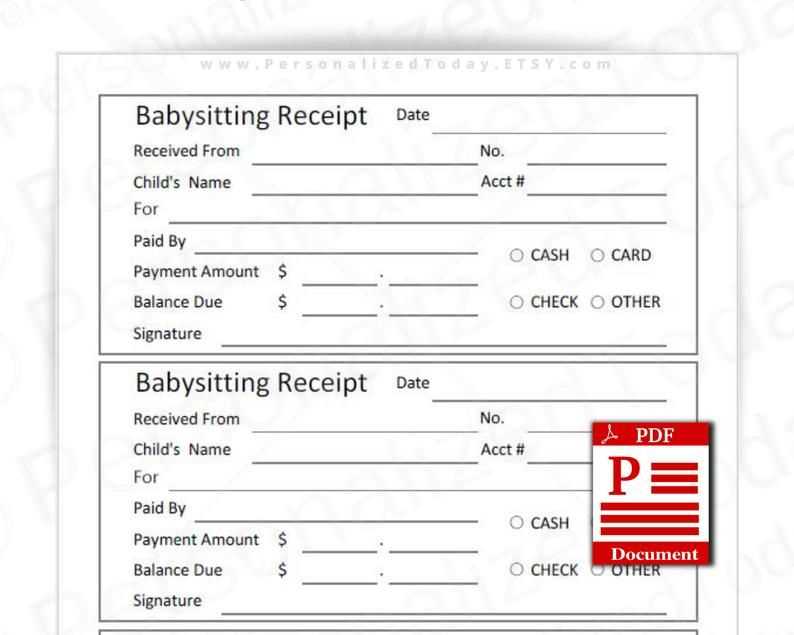

A detailed receipt should include the provider’s name, contact information, date of service, child’s name, payment amount, and method of payment. Many templates also feature an area for additional notes, such as late fees or discounts. Using a standardized format simplifies record-keeping and ensures compliance with tax regulations.

For added convenience, a digital fillable template allows quick edits, automatic calculations, and easy printing. Choose a PDF or Excel format for better customization and compatibility across devices. Download a ready-to-use template today to streamline your child care payment records with minimal effort.

Here’s the corrected version without excessive repetition, while maintaining the meaning:

For a child care receipt template, make sure to include these key components:

- Provider Information: Full name, address, and contact details.

- Parent/Guardian Information: Name and contact details of the individual making the payment.

- Service Details: Date(s) of care, hours of service, and the rate charged.

- Total Amount: The total amount due, including any applicable taxes.

- Payment Confirmation: A section to acknowledge payment, including the method (cash, check, etc.).

Make sure each field is clearly labeled for ease of understanding. Avoid clutter and ensure the layout is clean and easy to fill out. Always double-check that all the required information is included for accurate documentation.

- Fillable Child Care Receipt Template

A fillable child care receipt template allows parents and guardians to track payments made for child care services easily. By filling out the details directly into the template, you can save time and ensure accuracy. Below are key elements you should include in a fillable template:

- Provider Information: Include the child care provider’s name, address, phone number, and email. This ensures clear communication and record-keeping.

- Parent/Guardian Information: Make sure to input the name and contact details of the person making the payment.

- Child’s Information: Add the child’s name and age to specify which child the payment applies to.

- Service Dates: Clearly state the dates of the child care services provided. This ensures both the provider and parent are aligned on the period being billed.

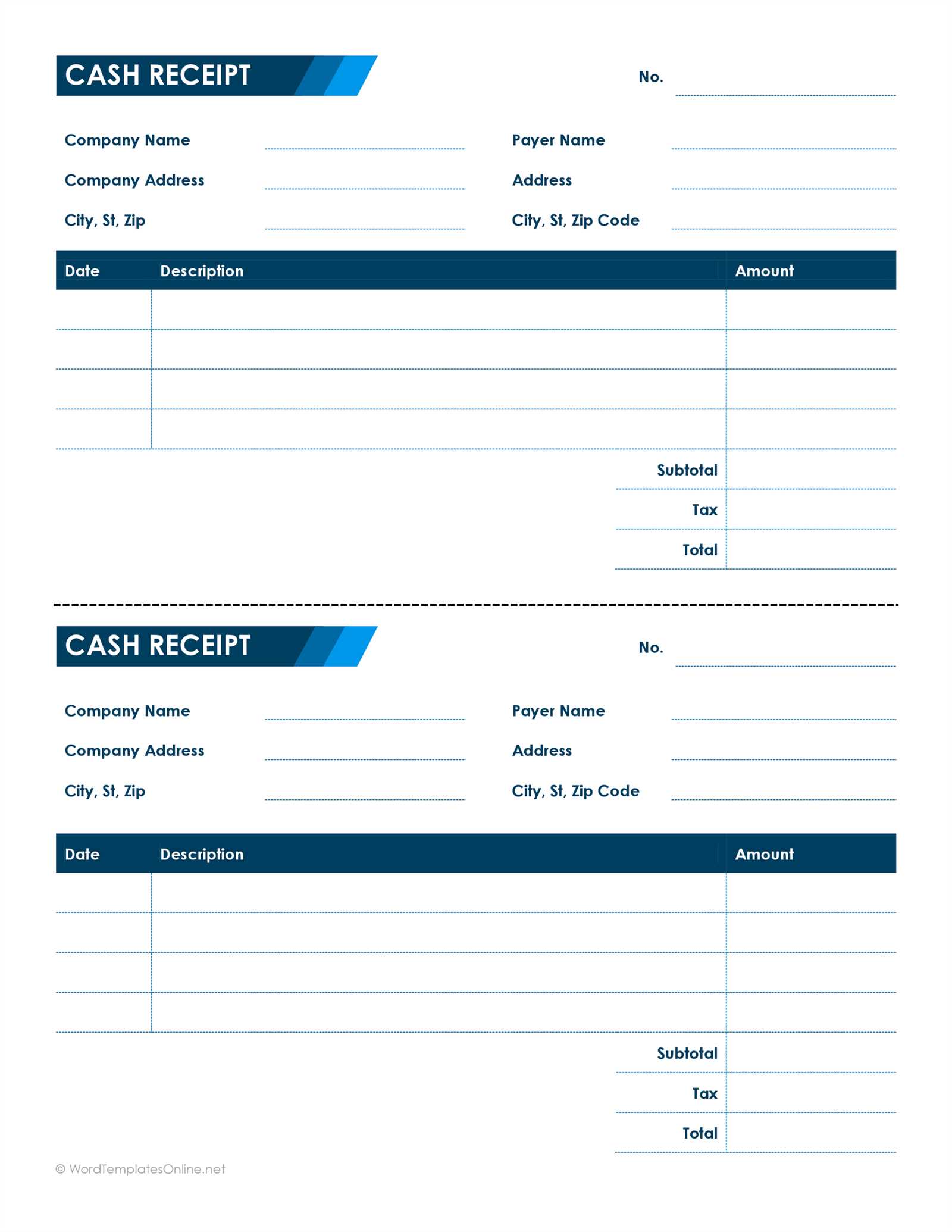

- Payment Details: Record the total amount paid, including hourly rates, the number of hours, and any additional charges. It’s useful to list the payment method as well.

- Signature Fields: Include spaces for both the provider’s and parent’s signatures to confirm the transaction. This adds legitimacy to the receipt.

- Notes Section: Add a place for additional comments or special instructions, which can help clarify billing or special agreements.

Why Use a Fillable Template?

Using a fillable template speeds up the receipt generation process and reduces the chances of mistakes. It also helps create a professional appearance and ensures that both parties have a record of the transaction.

Customization Tips

Ensure the template fits your needs by customizing it with your branding, such as logos or specific payment instructions. You can also set it up to automatically calculate totals based on the hourly rate and hours worked, streamlining the process even more.

Make sure the receipt clearly shows the name of the child care provider, including their business name, if applicable. Include their contact details such as phone number and address.

Clearly state the date(s) of the child care services provided, with specific attention to the days and times for which the care was given.

The total amount paid for the service should be listed, along with a breakdown of any additional fees, such as late charges or extra services.

For tax or reimbursement purposes, include a description of the services, including the type of care provided (e.g., daily care, after-school care, or full-time care).

It’s helpful to also provide a receipt number or unique identifier for record-keeping purposes, especially if multiple payments are made over time.

Lastly, include a signature from the child care provider or an authorized representative to validate the transaction.

Adjust the template by adding specific fields that reflect the details you need to track. Ensure you include the child’s name, dates of service, and the total amount paid. These fields should be easily editable, so make them fillable or leave them as editable text areas.

Modify the layout to match your style and include any other relevant information, such as the caregiver’s contact information or the service description. You can also adjust the font size and style to make the document more readable and professional.

For better clarity, add checkboxes or dropdown menus for recurring items, like payment methods or additional charges (e.g., late fees). This simplifies filling out the receipt, especially when you use the same structure repeatedly.

Ensure consistency by aligning fields neatly and maintaining a clean design. A well-organized template reflects professionalism and helps avoid confusion.

Consider adding a signature section at the bottom of the receipt for verification purposes. This small addition can help provide authenticity to the document.

Finally, save the template as a fillable PDF so it can be easily shared and completed on any device. This format ensures both you and your clients can quickly fill out, sign, and store receipts securely.

Include the child’s full name on the receipt. This ensures there is no confusion about which child the care pertains to. Next, specify the dates and times of service. Clearly state the start and end dates for the child care period, as well as the hours or days the child was under care. These details are often required for tax purposes and proof of services rendered.

Another key component is the provider’s information. The receipt must contain the child care provider’s full name or business name, along with their address and contact number. If applicable, include the provider’s tax ID number or employer identification number (EIN). This is necessary for tax reporting and compliance purposes.

Make sure to outline the total amount paid for the child care services provided. This should cover the entire billing period and reflect any agreed-upon rates. If the service includes multiple payments or fee structures, clearly break down each charge. This transparency is vital for both legal and tax reasons.

Lastly, include a statement confirming the receipt of payment. This can be a simple note like “Paid in full,” along with the date the payment was received. This ensures the receipt serves as an official record of the transaction.

PDF and Excel are the most commonly recommended formats for fillable child care receipt templates. These file types are widely accessible, easy to edit, and offer excellent compatibility across various devices and platforms.

PDF is the preferred format for its universal compatibility and security features. With tools like Adobe Acrobat, users can easily create and fill out forms. PDFs maintain their formatting, regardless of the device or operating system used, ensuring consistency. Additionally, you can password-protect the document for extra security.

Excel

Excel is another popular choice due to its flexibility with formulas and automatic calculations. For templates requiring complex calculations, such as hourly rates or totals, Excel is a great option. The fillable fields can be customized to suit various needs, and users can also save the templates in other formats, such as CSV or PDF, depending on their requirements.

Creating a digital receipt for child care services is straightforward. Follow these steps to ensure clarity and accuracy.

1. Choose Your Template

Select a fillable template for child care receipts that suits your needs. Many online platforms offer customizable forms where you can input specific information. Make sure the template includes fields for the child’s name, care dates, total hours, and payment details.

2. Fill in Relevant Information

Input the details of the transaction. Include the name of the caregiver, child’s name, period of care, and the amount paid. If applicable, break down the total cost into hourly or daily rates for transparency. This ensures both parties are clear on the terms.

For added clarity, include the method of payment (e.g., cash, check, or digital payment), and specify if any deposits or discounts apply. Ensure the receipt is dated accurately, as this helps in tracking future payments.

3. Add Tax Information (If Needed)

If taxes are applicable, list the tax rate and the total amount. This is essential if the child care provider is required to report income or if the family is entitled to tax credits. Clearly state whether the payment includes tax or if tax is calculated separately.

4. Save and Share the Receipt

Once all information is filled out, save the receipt in a secure, accessible format, such as PDF. You can then email the receipt directly to the family or print it out for their records. For ease of access, ensure the file is named clearly, such as “ChildCare_Receipt_ChildName_Date.pdf”.

5. Keep Records

For both the caregiver and the family, it’s important to keep a record of all receipts. Store them securely for future reference, especially if they’re needed for tax purposes or financial planning.

Double-check all information before finalizing your receipt. A common mistake is missing or incorrect dates. Ensure the date reflects the actual service or transaction date.

Incorrect Amounts

Double-check the amount listed. An error in the total or hourly rate can lead to confusion or disputes later. Ensure the calculations are accurate and match your records.

Missing Details

Make sure to fill in all required fields, such as the child care provider’s contact details, services rendered, and payment method. Incomplete receipts may not be accepted for reimbursement or tax purposes.

Avoid vague descriptions. Be specific about the service provided, whether it’s for daily care, after-school activities, or special programs.

Finally, ensure that both the recipient’s and the provider’s names are spelled correctly. Inaccurate or missing names may cause the receipt to be invalid for any official purposes.

Now the term “Child Care Receipt” is used less frequently, but the meaning of each line remains accurate.

The structure of a child care receipt typically includes several key elements that remain unchanged, regardless of how it’s formatted. Here’s what you should expect to see:

| Field | Description |

|---|---|

| Provider Name | The name of the child care provider or facility |

| Address | The provider’s address, including city, state, and zip code |

| Phone Number | Contact number for the provider |

| Dates of Service | Specific dates child care services were provided |

| Amount Paid | The total amount paid for the services rendered |

| Payment Method | The method used to make the payment (e.g., check, cash, credit card) |

Although the term may not be used as often, the receipt still serves the same function for tax and reimbursement purposes. It offers all necessary details, such as dates and payment information, making it valid documentation. Make sure to keep these receipts organized for easy reference during tax season.