Need a simple and reliable way to issue receipts? Download a free cash receipt template designed for UK businesses. It helps you document transactions, ensuring both parties have a clear record of payments received.

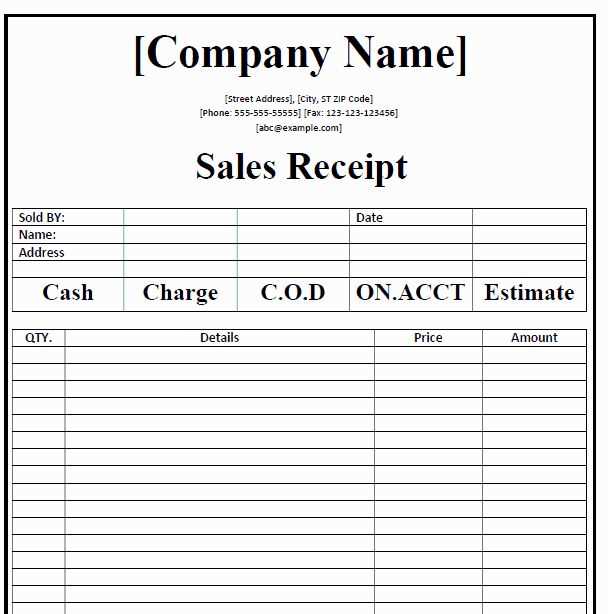

A well-structured receipt should include date, payer and payee details, amount, payment method, and a unique reference number. Using a template saves time and maintains consistency, whether you run a small business, rent property, or provide freelance services.

Customisation is key. A flexible template allows you to add VAT details, company branding, or payment terms. Many formats, such as PDF, Word, and Excel, offer easy editing and professional presentation. Choose the format that suits your needs and ensure your receipts meet legal requirements.

Here’s a refined version with fewer word repetitions, maintaining clarity:

Choose a free cash receipt template that includes essential fields like date, amount, payment method, and recipient details. Ensure the format aligns with UK standards by specifying VAT if applicable. PDF and Word templates offer flexibility, while Excel versions automate calculations. Customize the design with a business logo and unique reference numbers for better tracking. Before issuing, verify all entries to prevent errors. Store copies digitally for easy access and compliance with tax regulations. Many reputable sources provide ready-made templates, ensuring a professional appearance and seamless record-keeping.

- Free Cash Receipt Template UK

Choose a free cash receipt template that includes essential fields like date, payer details, payment amount, and method. A structured format ensures clarity and accuracy for both parties. Use a PDF or Excel template for easy customization and professional presentation.

Ensure the template complies with UK accounting standards. It should display VAT details if applicable, along with a unique receipt number for tracking. Consistent formatting improves record-keeping and simplifies tax reporting.

Opt for a template with an automatic calculation feature to avoid errors. Digital versions save time and allow quick modifications. Whether printed or emailed, a well-designed receipt enhances transparency and professionalism.

The quickest way to get a free payment receipt template in the UK is through official and reputable sources. Below are some of the best platforms offering downloadable templates in various formats.

Government and Business Support Websites

- GOV.UK – While the UK government does not provide specific receipt templates, it offers guidance on legal requirements for invoicing and receipts.

- Federation of Small Businesses (FSB) – Membership includes access to business templates, including payment receipts.

Online Template Libraries

- Microsoft Office Templates – Free receipt templates for Word and Excel are available for download.

- Canva – Offers editable receipt templates with a professional layout.

- Template.net – A collection of free and premium receipt templates in various formats.

For the most flexibility, use platforms that allow you to edit and save templates in different file types. Checking user reviews and template previews helps ensure the format meets your needs.

Ensure the receipt contains the business name, address, and contact details. This establishes authenticity and provides customers with a reference for future inquiries.

Transaction Details

List the date, time, and a unique receipt number. Specify the payment method and the last four digits of the card used, if applicable. These details help in tracking and reconciling payments.

Itemized Breakdown

Include a clear list of purchased items or services with individual prices, applied taxes, and the total amount paid. A transparent breakdown minimizes disputes and enhances customer trust.

For added clarity, consider a brief note on return policies or warranty information. This prevents misunderstandings and streamlines post-purchase support.

Modify a payment template by adjusting key fields such as payer details, transaction date, amount, and payment method. Open the template in a spreadsheet or word processor and replace placeholders with actual data. Ensure the format remains clear and professional.

Adjust Layout and Branding

Enhance the template by adding a company logo, changing fonts, or adjusting column widths for readability. Use consistent colors and align text properly. If using a digital format, save it as a PDF to prevent unauthorized edits.

Include Additional Fields

Tailor the template by adding reference numbers, tax details, or payment terms. Ensure legal compliance by checking if any specific information is required for documentation. Regularly review and update the template for accuracy.

Businesses in the UK must issue receipts for transactions involving taxable goods or services if the customer requests one. While not mandatory for all sales, providing a receipt ensures compliance with tax regulations and enhances transparency.

Mandatory Information on Receipts

Receipts must include specific details to meet legal standards. A properly formatted receipt should contain the following elements:

| Required Information | Description |

|---|---|

| Business Name & Address | Full registered details of the seller |

| Transaction Date | Exact date of the purchase |

| Goods/Services Provided | Clear description of items or services |

| Total Amount | Breakdown including VAT, if applicable |

| VAT Registration Number | Required if the business is VAT-registered |

VAT Receipts and Thresholds

If a business is VAT-registered and the transaction exceeds £250, a full VAT invoice must be provided. For lower amounts, a simplified VAT receipt is acceptable, displaying VAT-inclusive pricing and the registration number.

Maintaining accurate records of receipts supports tax compliance and dispute resolution. Digital and paper formats are both acceptable, provided they meet legal requirements.

For high-quality printing, use PDF or TIFF. PDFs ensure a consistent layout across devices, while TIFF files offer lossless compression for sharp details. Set the resolution to at least 300 DPI to avoid pixelation.

Recommended File Types

- PDF: Ideal for invoices and receipts, preserving formatting and fonts.

- TIFF: Best for professional printing with high detail retention.

- PNG: Suitable for digital receipts with transparent backgrounds.

Optimal Settings for Digital Use

For email attachments or online storage, PDFs with embedded fonts work best. Compress images to reduce file size without sacrificing readability. If using PNG or JPEG, keep the resolution at 150 DPI for clear on-screen display.

- JPEG: Good for web previews but may lose quality with compression.

- CSV: Useful for data storage and integration with accounting software.

Skipping essential details leads to errors. Always include the date, receipt number, payer’s name, and a clear description of the transaction. Missing any of these can cause confusion or disputes.

Ignoring Customization

Pre-made templates provide structure, but leaving default placeholders or irrelevant fields can make receipts look unprofessional. Adjust headings, tax sections, and payment methods to match your business needs.

Incorrect Tax Calculations

Manually entering VAT or other taxes increases the risk of miscalculations. Use formulas in editable fields to automate tax calculations and ensure accuracy.

Failing to keep copies results in lost records. Always save digital or printed copies for reference, audits, or customer inquiries. Cloud storage or accounting software helps maintain organized records.

A well-structured receipt template should include key details such as the date, transaction amount, payment method, and recipient information. Missing or unclear fields can lead to disputes, so ensure all sections are easy to read and complete.

Essential Receipt Elements

- Date: Clearly indicate when the transaction took place.

- Business Name and Contact: Include a registered name, address, and phone number.

- Description of Goods or Services: Provide a concise list with individual prices.

- Total Amount: Ensure VAT (if applicable) is separated from the subtotal.

- Payment Method: Specify whether it was paid by cash, card, or bank transfer.

- Unique Receipt Number: Helps track transactions and simplifies accounting.

Ensuring Compliance

UK businesses must retain receipts for at least six years for tax purposes. Templates should align with HMRC guidelines, ensuring all required details are present. A simple, professional layout reduces errors and enhances record-keeping.