Provide a clear and concise statement for daycare services at the close of the year. This receipt serves as a formal summary for tax reporting or reimbursement purposes. Ensure all the key details are included: the provider’s name, address, and contact information, as well as the child’s name and dates of service. Always check for accuracy, as these statements are essential for maintaining organized records and claiming eligible deductions.

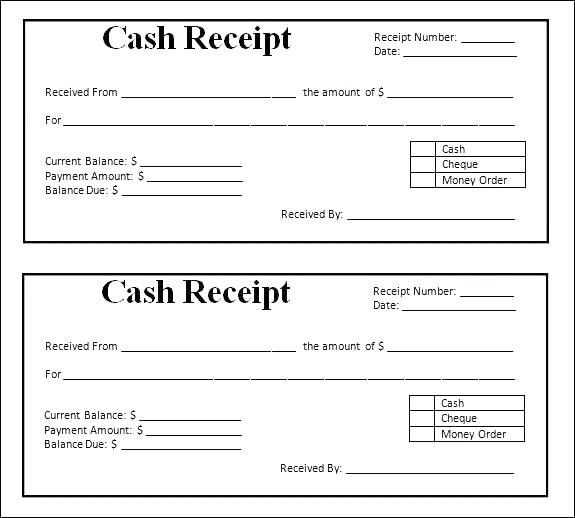

Make the statement easy to understand by listing the total fees paid over the year. Break down charges by month or session if necessary, and specify any additional costs, such as late fees or materials. Include the payment method used, whether it’s cash, check, or digital transfer. If applicable, add a note for tax purposes, such as the daycare provider’s tax identification number.

For convenience, keep a template that you can quickly fill in at year-end. This ensures that all required information is present without any missed details. Regularly update the template throughout the year to save time when the statement is needed, and maintain a system for both electronic and paper records for easy access at tax time.

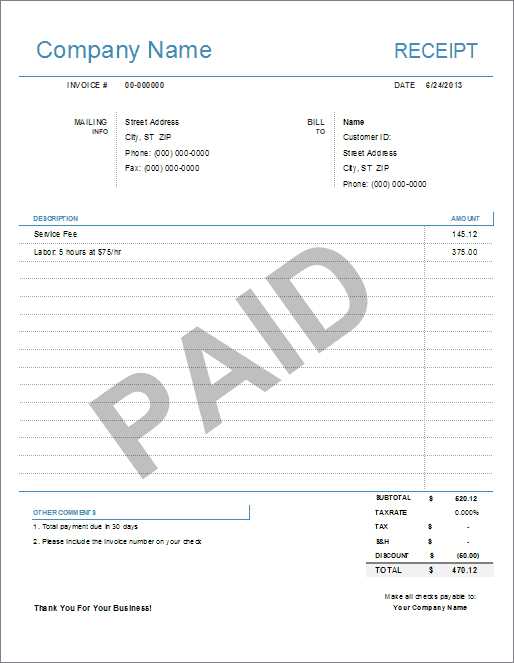

Receipt for Daycare Services Year-End Statement Template

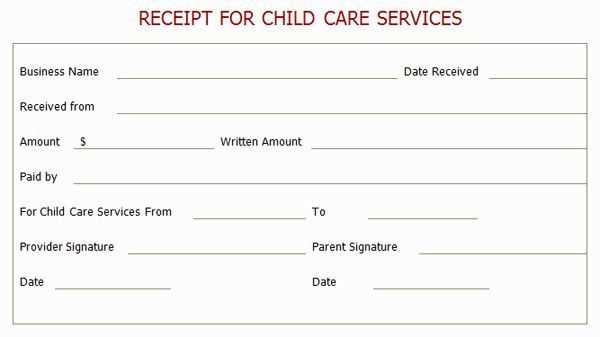

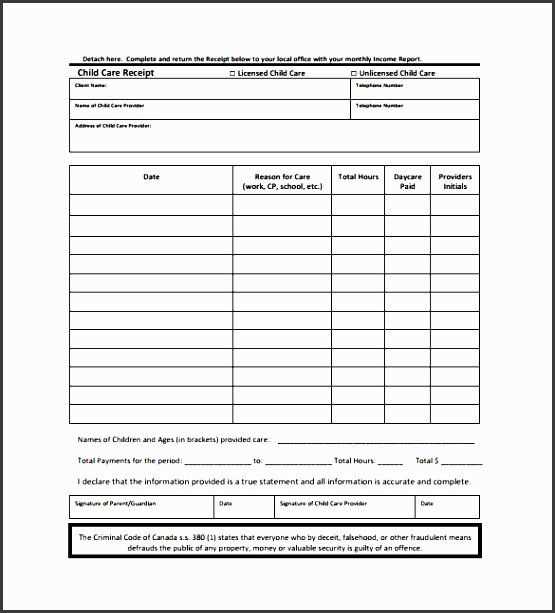

For daycare providers, creating a year-end statement can streamline tax filing for parents and maintain clear financial records. Use a simple, clear format that highlights important service details and financial totals. Here’s what your year-end statement should include:

Required Information

- Provider Details: Full name, business name (if applicable), and contact information.

- Parent Details: Parent’s full name, address, and child’s name.

- Service Period: Start and end dates of the service period for which the statement applies.

- Total Amount Paid: Total amount the parent paid for daycare services throughout the year.

- Payments Summary: A breakdown of monthly or weekly charges, along with any adjustments or discounts applied.

Additional Recommendations

- Tax Identification Number: Include your tax ID or EIN number for tax reporting purposes.

- Service Categories: List any specialized services provided, such as extended care or extracurricular activities, if applicable.

- Late Fees and Discounts: Clearly state any late fees charged or discounts applied to the total amount paid.

Ensure that the statement is clear, concise, and accurate, providing parents with a straightforward summary of the payments made for daycare services. This helps to avoid confusion and facilitates tax preparation on both ends.

Understanding the Importance of a Year-End Statement

A year-end statement for daycare services plays a key role in both tax filing and budgeting. It serves as a concise summary of the payments made throughout the year, providing clarity and transparency for parents and caregivers alike. This document is not only helpful for personal records but also simplifies the process of claiming deductions or credits during tax season.

Clarity in Financial Tracking

The statement clearly lists all charges, payments, and any discounts, allowing parents to track their daycare expenses with ease. It can highlight any overpayments or underpayments, helping to ensure that all financial matters are settled accurately. This transparency reduces confusion and prevents any potential disputes regarding fees.

Tax Reporting and Benefits

Parents can use the year-end statement to claim applicable tax deductions for dependent care expenses. The statement typically includes the daycare provider’s details, which are required for filing. Keeping this record ensures that parents don’t miss out on potential savings during tax season.

Key Information to Include in the Template

The year-end statement for daycare services should be clear and straightforward. Here are the key details to ensure the template is complete:

- Child’s Full Name: Include the full name of the child receiving care to avoid confusion.

- Provider’s Details: Clearly state the daycare provider’s name, address, and contact information.

- Service Period: Specify the exact period the daycare services were provided (e.g., January to December). This helps in tracking payments and services rendered.

- Payment Summary: Include a detailed breakdown of payments made, along with the payment dates and amounts. Highlight any outstanding balances, if applicable.

- Tax Identification Number: The daycare’s tax ID number should be listed for tax filing purposes.

- Service Hours: Include the total number of hours the child attended daycare over the year, if relevant to the fee structure.

- Discounts and Additional Charges: Mention any discounts given or additional charges incurred, such as late fees or extra care hours.

- Signature Section: Allow space for both the daycare provider and the parent to sign and acknowledge the statement.

Make sure all entries are accurate and well-organized, which will simplify the review process for parents and tax preparation.

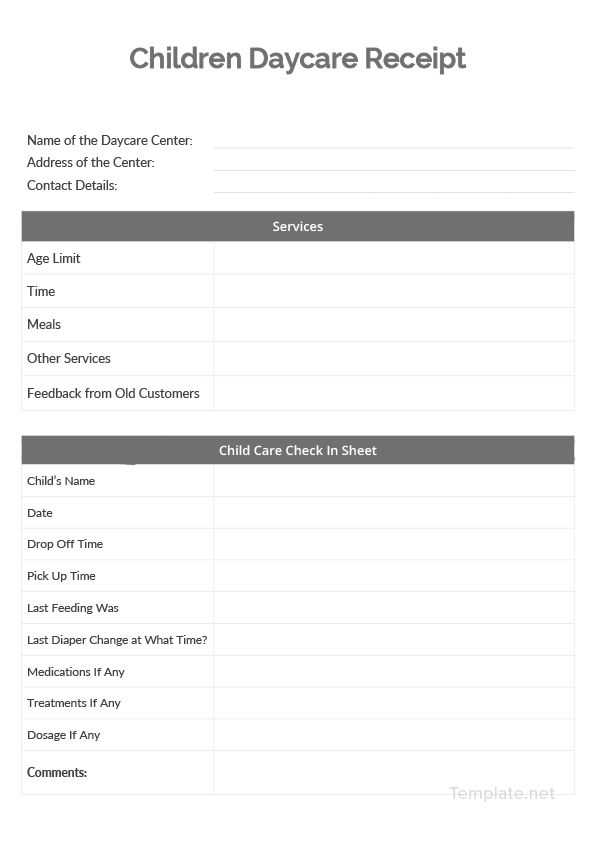

How to Create a Simple and Clear Template

Focus on clarity and structure. Begin with a header that clearly states the purpose of the receipt, such as “Daycare Service Receipt.” Include sections for key information like the provider’s name, address, and contact details at the top. This makes the template easy to read and instantly identifies the service provider.

Next, list the date and service period covered by the receipt. Ensure that the start and end dates are clearly visible. This section allows the recipient to know exactly what time frame the payment pertains to.

Under the service details, itemize the charges. Break down the services provided, such as daily care, special activities, or meals, and list their individual costs. This transparency eliminates confusion and shows the exact breakdown of the payment.

Finally, include a total amount section, summarizing the total payment. A simple “Total Due” line makes this straightforward. Ensure the amount is highlighted or bolded for easy visibility.

Keep fonts consistent and use simple formatting. Avoid excessive decoration or unnecessary information that might distract from the essential details. A clean, professional layout will ensure the template is functional and user-friendly.

Best Practices for Organizing Payment Records

Keep all payment information in one central location. Create folders or digital files for each month or quarter to ensure easy access and retrieval when needed.

Use clear labeling for every document. Label payment receipts with the date, amount, and service details. This helps to quickly track payments and avoid confusion later.

Maintain separate files for each client or child, if applicable. Organize payments by name or account number to streamline the process when reconciling accounts.

| Record Type | Details | File Format |

|---|---|---|

| Payment Receipt | Date, Amount, Service Description | PDF or Image |

| Year-End Summary | Total Payments, Summary of Services | Excel or PDF |

| Payment Schedule | Dates of Future Payments, Amounts | Spreadsheet |

Review payment records regularly to ensure everything is up-to-date. This will help you identify any missed payments or discrepancies before they become an issue.

Use accounting software to streamline the process. Such tools can track payments, generate reports, and send reminders for upcoming fees, making organization much easier.

Common Errors to Avoid When Preparing the Statement

Ensure all details are accurate and up-to-date. Double-check the dates, amounts, and names to prevent errors that could lead to confusion or delays. Mistakes in basic information can cause issues when submitting the statement or processing tax deductions.

Don’t forget to include all services provided. Even small services that might seem insignificant at the time should be accounted for. Missing items can lead to discrepancies and affect the overall accuracy of the statement.

Avoid using generic categories for expenses. Specificity in describing services provided can help avoid misunderstandings or questions from the recipients. Clearly identify each type of care or additional service rendered.

Keep track of all payments received. Sometimes payments may have been missed or not documented correctly. Make sure to confirm that all payments are reflected and that refunds or adjustments are properly listed.

Ensure that deductions or subsidies are properly accounted for. Miscalculating these can result in an incorrect final amount. Double-check any applicable discounts or reductions that should be applied to the total cost.

Don’t skip the verification process. Taking a final look through the statement before submission can help catch overlooked errors. Whether it’s missing signatures or incorrect totals, this step can prevent common mistakes from slipping through.

Provide clear breakdowns for parents. It’s important to make the statement easy to understand. Avoid clutter or excessive detail, but ensure each item is sufficiently detailed for transparency.

Tips for Distributing the Statement to Parents

Use Email for Convenience – Sending the statement via email ensures that parents receive it quickly and securely. Include a clear subject line, such as “Year-End Statement for Daycare Services,” so they know what the email contains. Attach the statement as a PDF file to maintain its formatting and prevent accidental edits.

Offer Multiple Formats – Some parents may prefer a printed version or a different file format. Provide the option to receive the statement in PDF, Word, or even as a printed copy, if requested, ensuring all parents have access to the statement in a format that suits them.

Set a Clear Deadline – Be transparent about the timeframe for distributing and receiving the statements. This gives parents a clear expectation of when they can expect to receive the document and helps ensure that all are accounted for.

Provide Contact Information – In case parents have questions or need clarification, include your contact details (email or phone number) in the statement or email. This creates an opportunity for prompt communication and allows any issues to be resolved efficiently.

Consider an Online Portal – If your daycare has an online system or parent portal, upload the statements there as well. This allows parents to access the document at any time, giving them more flexibility.

Send a Reminder – If necessary, send a gentle reminder after a week or two to those who haven’t acknowledged receipt of the statement. This will help avoid any confusion and ensure that all parents receive the information in a timely manner.