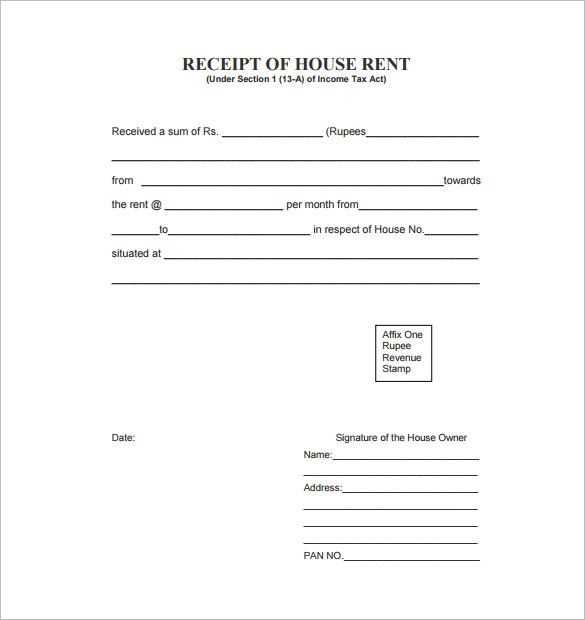

Key Details to Include

A clear and structured receipt protects both the payer and the recipient. Make sure to include the following:

- Date of Transaction: The exact date when the deposit is received.

- Names and Contact Information: Full names, addresses, and phone numbers of both parties.

- Property Address: The full address of the house in question.

- Deposit Amount: The exact amount paid, written in numbers and words.

- Payment Method: Specify if the payment was made via cash, check, or transfer.

- Terms and Conditions: Clearly state if the deposit is refundable or non-refundable.

- Signatures: Both parties should sign the document for confirmation.

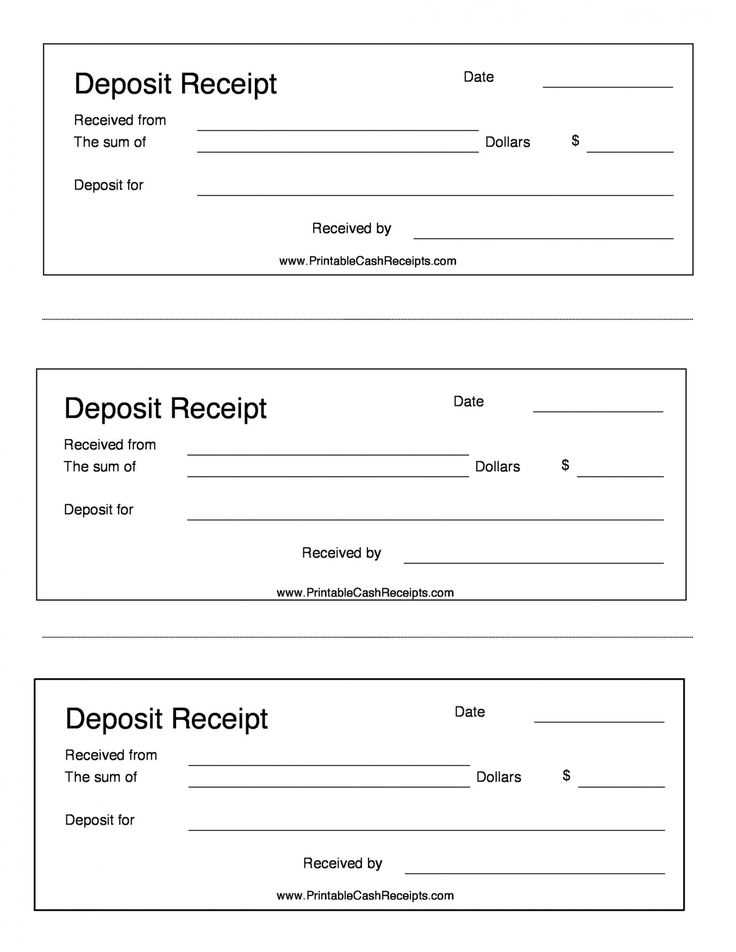

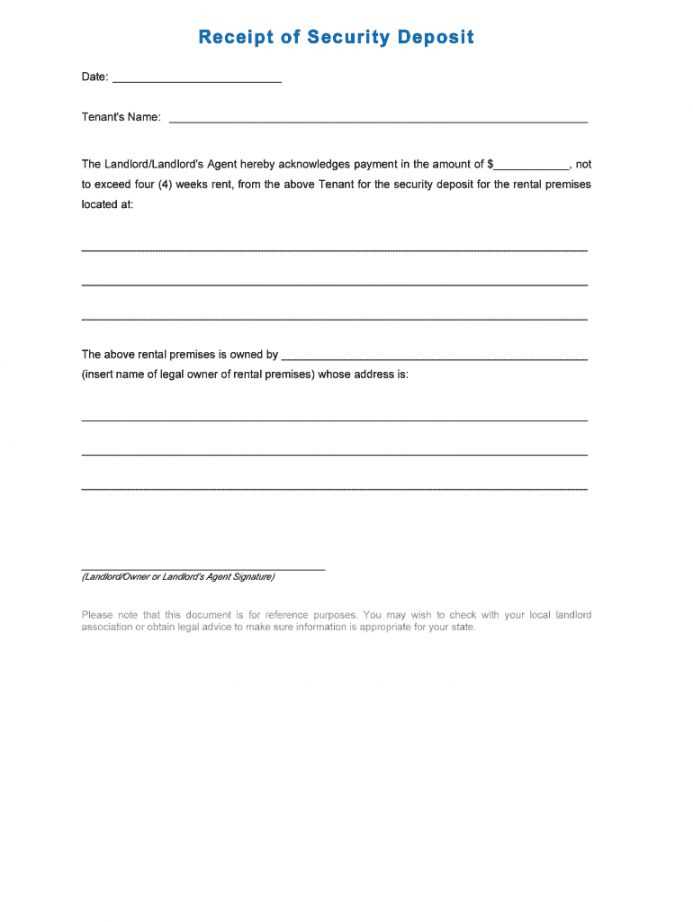

Sample Receipt Template

Use this template as a guide:

House Deposit Receipt

Date: [Insert Date]

Received From: [Payer’s Full Name]

Address: [Payer’s Address]

Contact Number: [Payer’s Phone Number]

Received By: [Recipient’s Full Name]

Address: [Recipient’s Address]

Contact Number: [Recipient’s Phone Number]

Property Address: [Full Property Address]

Deposit Amount: $[Amount] ([Amount in Words])

Payment Method: [Cash/Check/Bank Transfer]

Deposit Terms: [Refundable/Non-Refundable]

Additional Notes: [Any Other Relevant Information]

Signatures:

______________________ (Payer) ______________________ (Recipient)

Final Check

Ensure all details are correct before signing. Keep a copy for reference, and provide one to the other party.

Receipt Template for House Deposit

Key Elements to Include in the Document

Organizing Payment Information Clearly

Legal Aspects of Drafting a Receipt

Steps to Verify and Sign the Deposit Form

Frequent Errors in House Deposit Documents

Effective Methods for Storing and Sharing

Key Elements to Include in the Document

Specify the names and contact details of both parties. Include the property address, deposit amount, payment date, and method used. Mention any conditions tied to the deposit, such as refund terms or transfer deadlines. A clear statement confirming receipt of funds prevents disputes.

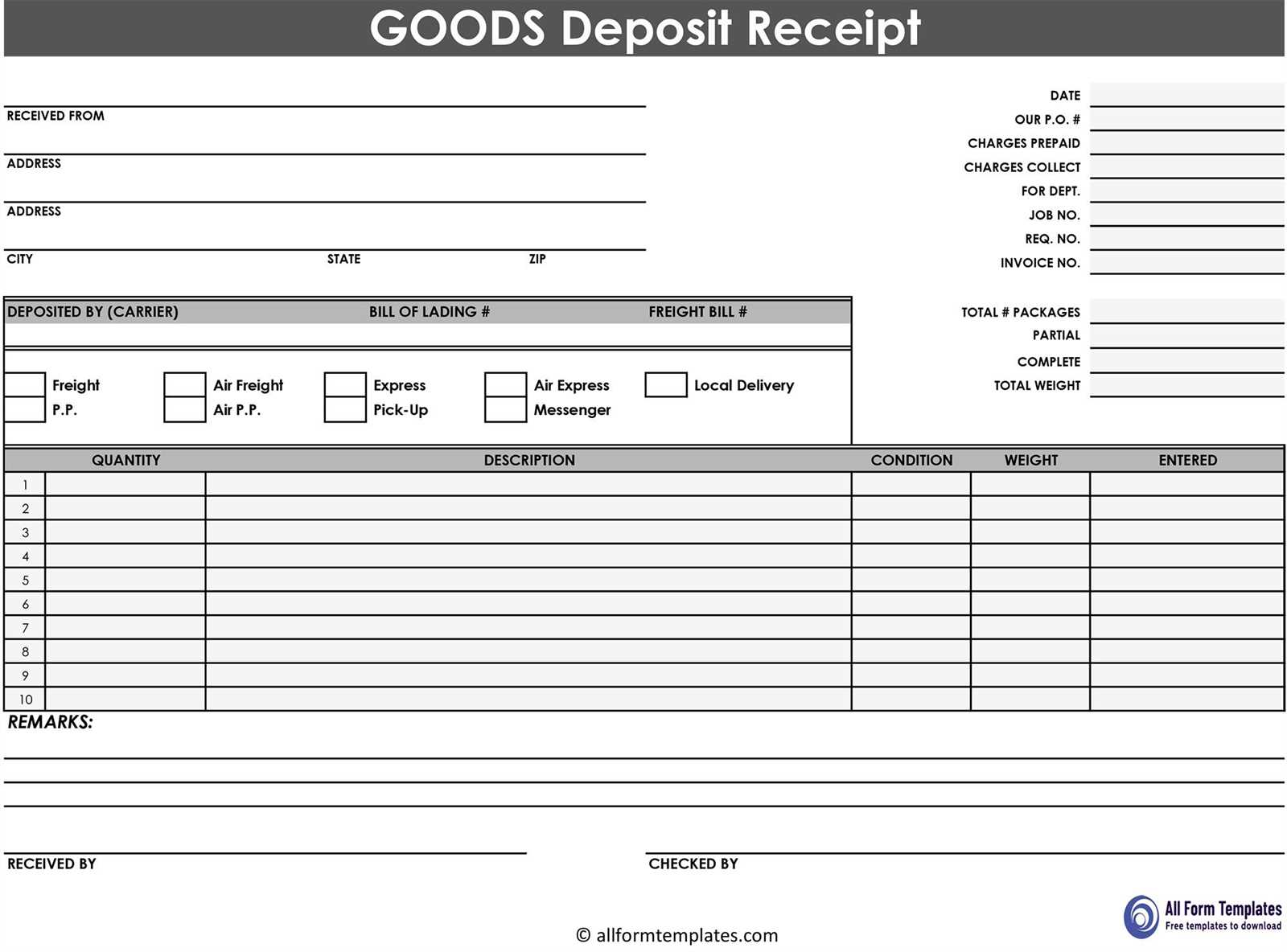

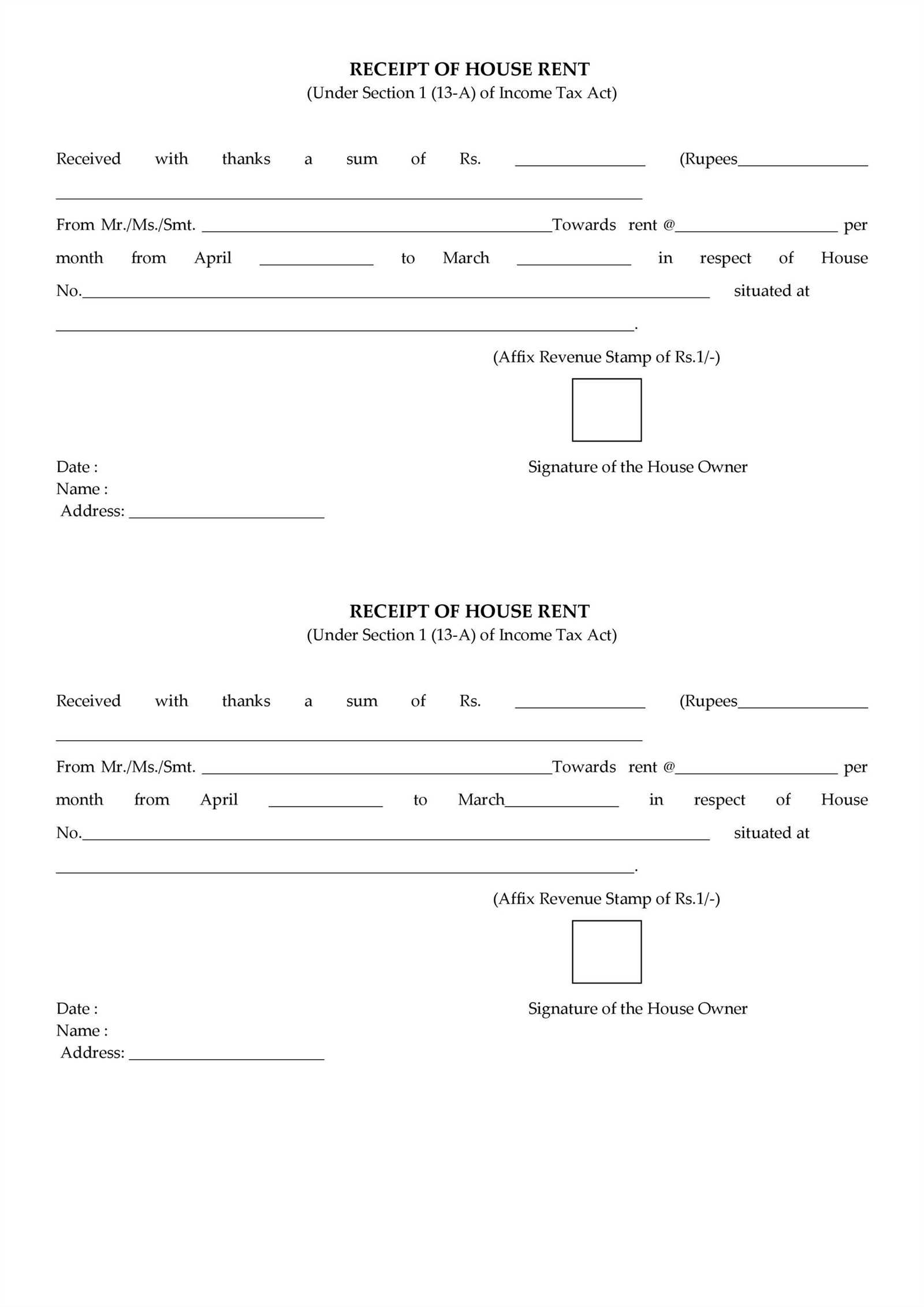

Organizing Payment Information Clearly

Break down the amount into sections: total sum, partial payments (if any), and balance due. Use a structured layout with tables or bullet points to separate transaction details. Listing payment method (e.g., bank transfer, check) ensures traceability.

Include unique identifiers like a receipt number and reference codes from financial institutions. If paid via check, note the check number and bank name. If using online transfer, include a transaction ID.

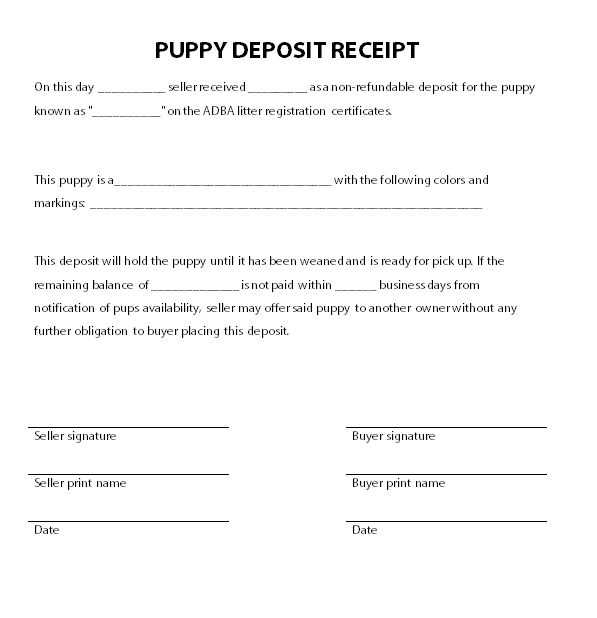

Legal Aspects of Drafting a Receipt

Ensure compliance with local property laws by stating whether the deposit is refundable. If conditions apply, list them explicitly. Mention governing regulations to strengthen the document’s validity. Always use precise language to avoid ambiguity.

Steps to Verify and Sign the Deposit Form

Confirm that all information matches payment records before signing. Both parties should sign and date the receipt, ensuring agreement on terms. If possible, use a witness or notary for additional legal security.

Frequent Errors in House Deposit Documents

Avoid missing signatures, incorrect amounts, and unclear refund terms. Spelling errors in names or addresses may lead to complications. Inconsistent formatting can make details hard to read, so keep everything aligned and organized.

Effective Methods for Storing and Sharing

Store digital copies in multiple secure locations, such as encrypted cloud storage and external drives. Physical copies should be kept in a fireproof document safe. When sharing, use email with encrypted attachments or secure document-sharing platforms.