Keeping track of expenses is easier with a well-structured receipts template. A clear and simple format ensures that every transaction is documented properly, helping with reimbursements, tax deductions, and financial planning. Use a template that includes essential details such as date, amount, vendor, and payment method.

A good receipts template should be easy to fill out and store. Digital formats like Excel, Google Sheets, and PDF provide flexibility, while printed versions work well for quick entries. Adding an auto-calculating function in spreadsheets can simplify calculations and reduce errors.

For businesses, a standardized template helps maintain consistency across records. Including a section for notes allows additional details, such as purpose or client-related expenses. Using a cloud-based solution can also improve accessibility and ensure that receipts are not lost.

Choose a template that fits your needs, whether for personal use, employee reimbursements, or business expenses. Keeping all receipts well-documented will make financial management smoother and more transparent.

Here’s a version without unnecessary repetition:

Focus on clear, concise details. Avoid redundant information that doesn’t add value. Make sure each line serves a specific purpose and cuts straight to the point. For instance, include only necessary data such as the date, amount, and vendor. Keep descriptions brief but descriptive enough to explain what the expense was for.

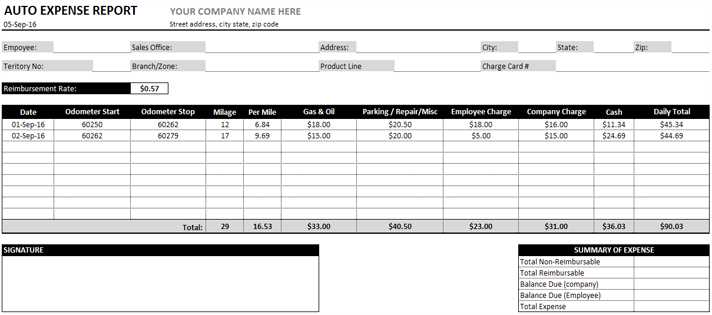

Template Example

The template should list the essential elements: Date, Item or Service, Amount, and Payment Method. These categories make it easy to track your expenses and maintain clarity.

Tips for Accuracy

Ensure the data is accurate and consistently formatted. Regularly update the template to reflect any new expense categories you may encounter. This will help maintain a clear record without the need for revisions later.

- Expenses Receipts Template

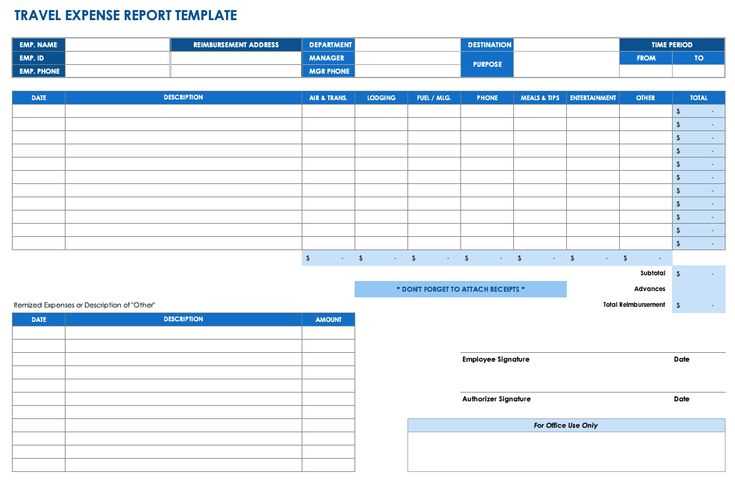

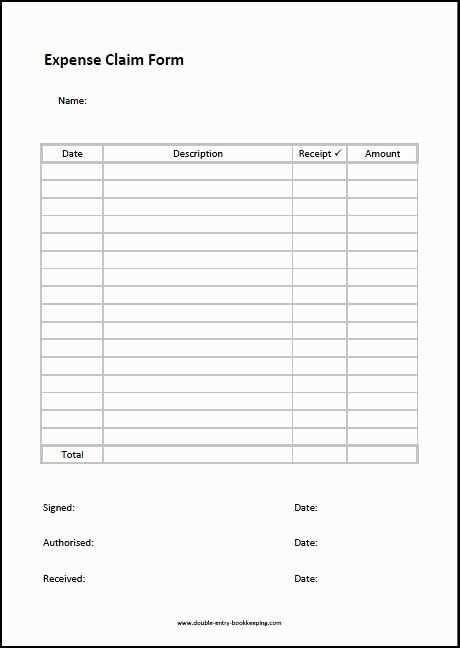

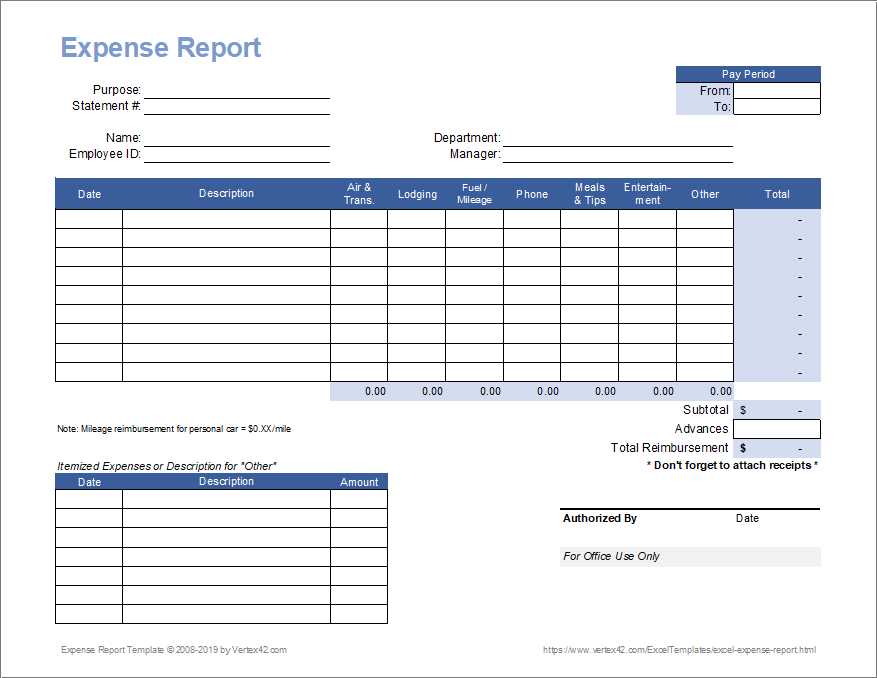

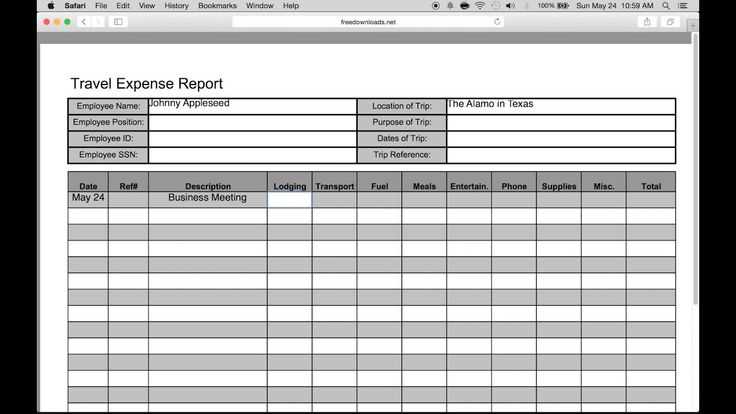

An effective expense receipt template helps track purchases and maintain accurate records for reimbursement or tax purposes. Use the following guidelines to create a functional and straightforward template:

Key Elements of a Template

Include the date, item or service description, the amount spent, and payment method. The template should also allow space for vendor information and a receipt number to maintain a well-organized system. If possible, add a section for business or project references to ensure clarity when reviewing multiple expenses.

Structure and Format

The template should be clear and easy to fill out. Use a table format with columns for each required detail (date, item, amount, etc.). Make sure to provide adequate space for each entry and ensure the font is readable. You can also include a signature or confirmation section if necessary, especially for internal documentation.

A well-organized receipt template should clearly display all key transaction details to avoid confusion. Include the business name, address, and contact details at the top for easy identification.

Date and time are crucial for tracking the transaction. This provides a reference point for both parties involved and serves as proof of purchase.

Itemized list of goods or services with clear descriptions, quantities, and prices makes it easy to verify the transaction. Ensure each item is listed separately to prevent errors or misunderstandings.

Show the total amount paid, including taxes, fees, or discounts. This ensures transparency and helps to avoid any disputes related to the final price.

Indicate the payment method, such as cash, credit card, or online transfer. This adds an extra layer of clarity for both parties.

Don’t forget to include a unique transaction or receipt number. This reference number helps track the purchase for future inquiries or returns.

Finally, adding return or refund policy information ensures that customers know their rights regarding any potential issues with the purchase.

Tailor receipts to match the specifics of your business by adding details that matter most to your clients and your accounting practices. Begin by including your business name, address, and contact information prominently at the top. This ensures that customers can easily reach you if needed, while also keeping your receipts professional.

Adjusting for Product Type

For retail businesses, incorporate a breakdown of the items purchased, quantities, and unit prices. This transparency helps customers verify what they bought. For services, you might want to include a description of the service, date of completion, and hourly rates. If your business deals with subscriptions, adding subscription periods or renewal dates can avoid confusion.

Including Taxes and Discounts

For businesses that deal with variable tax rates or promotions, make sure your receipt clearly shows tax amounts and any applicable discounts. This not only helps customers understand their final price but also keeps your records accurate for tax purposes. Always ensure that discounts are clearly marked and subtotaled before tax.

Additionally, adding a unique receipt number and date can help in tracking transactions, making returns smoother, and maintaining organized financial records.

Accuracy is key when creating expense records. One common mistake is not recording expenses immediately, leading to forgotten details or incorrect amounts. Avoid this by documenting expenses as soon as they occur.

- Failing to categorize expenses correctly is another frequent error. Use clear and consistent categories to make reviewing and analyzing the records easier.

- Ignoring receipts or not keeping copies can cause problems during audits or reimbursements. Always retain physical or digital receipts for each expense.

- Not verifying amounts before finalizing records can lead to errors. Double-check your receipts and ensure the recorded amounts match the receipts.

- Mixing personal and business expenses can create confusion. Keep separate records for business-related and personal expenses to avoid complications during tax season or financial reporting.

- Using vague descriptions for expenses can cause ambiguity. Provide clear and specific descriptions, so it’s easy to understand the nature of the expense.

- Not tracking recurring expenses is another pitfall. Make sure to note any subscriptions or regular payments, as they can be easy to overlook but still significant over time.

- Relying solely on automated tools without cross-checking the data can introduce errors. Regularly review automated entries for accuracy.

Digital receipts offer immediate storage and easy access. You can retrieve them instantly from your email or mobile app, reducing physical clutter and the need for filing cabinets. They are also more secure, as they can be backed up and stored safely in cloud systems. They take up no physical space, making them ideal for people who want to go paperless.

However, digital receipts may pose issues for those who are not as tech-savvy or lack consistent internet access. Additionally, some apps may not offer seamless integration across multiple devices, leading to difficulty in organizing receipts. The data associated with digital receipts can sometimes be vulnerable to breaches if not properly protected.

Paper receipts, on the other hand, are tangible and often easier to manage for people who prefer physical documentation. They can be directly handed to customers, and there’s no need for technology to access them. Paper receipts are also immediately available at the point of purchase, which can be useful for tracking expenses right away.

However, paper receipts come with downsides. They are prone to fading or getting damaged over time. Storing large numbers of paper receipts can take up significant space and result in disorganization. Additionally, paper receipts are more vulnerable to theft or loss and lack the instant backup capability that digital receipts offer.

Ultimately, the choice between digital and paper receipts comes down to personal preference and how you plan to organize your expenses. If you prioritize convenience and reducing paper waste, digital receipts are a solid choice. If you prefer physical records or need something instantly available without relying on technology, paper receipts may be a better fit.

Accurate expense documentation plays a significant role in ensuring compliance with tax laws and regulations. Maintaining proper records is not just a good practice but also a legal requirement for businesses and individuals seeking deductions or reimbursements.

- Ensure that all receipts are legible and include necessary details such as date, vendor, amount, and description of the item or service purchased.

- For tax purposes, receipts must align with local and federal regulations. For example, many tax authorities require receipts for any expense exceeding a certain threshold, which varies by country and jurisdiction.

- Use digital receipts or scans of paper receipts, making sure the documentation remains clear and accessible for auditing purposes.

- Be mindful of the types of expenses that qualify for deductions. Generally, business-related expenses are eligible, but personal expenses cannot be claimed.

- Store receipts for the required retention period, which typically spans between 3 to 7 years depending on the tax regulations in your area.

Failure to properly document expenses can lead to penalties, fines, or the loss of potential tax benefits. It’s advisable to review local tax codes and consult a tax professional to ensure your receipts meet legal standards and are organized correctly.

Best Tools and Software for Generating Receipts

For a smooth and accurate receipt creation process, consider using these tools and software. They provide user-friendly features, customization options, and help you maintain organized records.

1. QuickBooks

QuickBooks offers a wide range of receipt management features. It allows you to generate professional receipts and track your business expenses. You can customize templates, add logos, and email receipts directly from the software. Its seamless integration with accounting services helps maintain financial accuracy.

2. Zoho Invoice

Zoho Invoice is an excellent option for businesses of all sizes. This tool offers easy receipt generation with customizable templates, real-time currency conversion, and multi-language support. You can also automate recurring billing and receive detailed reports.

3. Wave Accounting

Wave Accounting is a free tool that provides a simple, yet effective way to create receipts. It allows you to generate receipts for both cash and credit transactions, store customer information, and customize receipts to match your branding.

4. Invoice Simple

Invoice Simple offers straightforward receipt creation with a mobile app, making it ideal for small businesses and freelancers. This tool is perfect for creating invoices and receipts quickly and includes basic customization options such as adding your company logo and details.

5. FreshBooks

FreshBooks is another strong contender for generating receipts. It features automatic receipt tracking, customizable templates, and integrations with various payment platforms. FreshBooks also helps with tax management by categorizing receipts for expense reporting.

| Tool | Key Features | Best For |

|---|---|---|

| QuickBooks | Customizable templates, integrations, expense tracking | Small to medium businesses |

| Zoho Invoice | Customizable templates, multi-currency, recurring billing | Growing businesses |

| Wave Accounting | Free, simple receipt generation, expense tracking | Freelancers and startups |

| Invoice Simple | Mobile app, quick invoicing, basic customization | Freelancers and small businesses |

| FreshBooks | Automatic receipt tracking, tax management | Service-based businesses |

For organizing expenses efficiently, you should create a structured and clear receipt template. Begin by including fields for the date, vendor, and a detailed description of the item or service purchased. A separate space for the total amount and taxes helps keep everything clear. Avoid cluttering the receipt with unnecessary information, focusing only on the essential details.

To enhance clarity, use bullet points or numbered lists for itemized purchases. This will allow anyone reviewing the receipts to easily identify individual expenses. If you plan to use this template digitally, ensure it is in a format that allows easy editing and saving, such as PDF or Excel. This way, it’s easy to make updates or adjustments to specific expenses.

Ensure that the template also includes an area for signatures if needed. Some businesses require proof of authorization or approval for certain purchases. Including this section helps maintain compliance with internal procedures and can simplify audits. A clear, organized receipt template will save time and prevent confusion down the line.